- This topic has 11,679 replies, 48 voices, and was last updated 4 months, 2 weeks ago by GVI Forex 2.

-

AuthorPosts

-

January 18, 2025 at 12:29 pm #18039

2 days and 5 hours to donald’s ascension

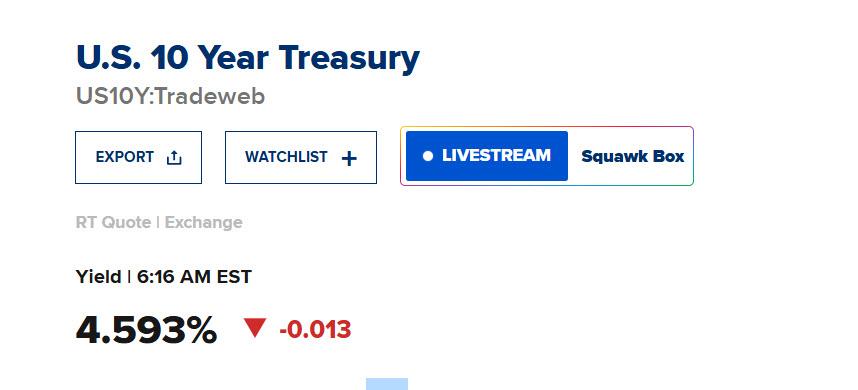

last 10-yr bond trade offered 4.623%

–

Day 1 is likely to see exec orders around the issue of the border and illegal migrantsWeek 1 is likely going to be a massive stack of executive orders donald made during his campaign

The Qtn is … will donald sign them all. It is his choosing and prerogative after all.

January 18, 2025 at 10:51 am #18038The main point in the case of salaried people is that treasuries provide another source of income for them.

Many countries in the world have the one job allowed only restrictions, and restrictions on what their employees can do after work mainly that they cannot take up a second job or freelance a job on the side or have a legal entity in their name as such matters are seen as the employee having a conflict of interest, having a legal entity conducting business in the same or even different industry serves as grounds for the employee facing immediate termination, no questions asked. Many countries also do not have effective welfare programs…

So what many salaried people in those countries do is to look for other streams of income such as fixed income securities, buying rental properties etc.

Their investing in fixed income government securities is the harmless way.

Treasury prices can also plateau for many years but then there is frequent cash turnover and reinvestment which when done long enough doubles their net worth.

Some people think rental property is the way but it is not, oh! the rental property will keep on growing in value. However, that is relevant if they plan to rent then sell the property in 10 years and not hold it for 50 years because at that time then who will be willing to pay market value with the hope saying oh! rental rates and property prices will keep on growing in the future… rental and property prices tend to plateau and stay flat for many years at a stretch. Now where is the appreciation in that?. The whole building gets older over time, and needs maintenance which costs $$$$$, The costs of building materials and a team of workers are justified only if the property is purchased for the owner to live in the property with his/her family.

Treasury yields nowadays are higher than property yields and will remain so in future times to come.

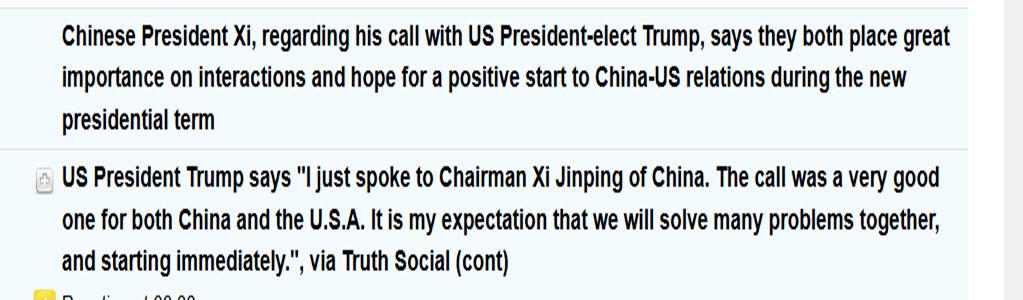

January 17, 2025 at 11:00 pm #18037January 17, 2025 at 8:18 pm #18024January 17, 2025 at 7:11 pm #18023January 17, 2025 at 6:55 pm #18022January 17, 2025 at 3:55 pm #18019January 17, 2025 at 3:41 pm #18018January 17, 2025 at 3:26 pm #18017January 17, 2025 at 3:10 pm #18016January 17, 2025 at 2:52 pm #18015Dollar coming off highs /slipping (except USDJPY (HIGHER AS BOND YIELDS TICK UP)) after concilatory remarks from Trump and Xi

Source:

January 17, 2025 at 2:03 pm #18010January 17, 2025 at 1:58 pm #18009January 17, 2025 at 1:09 pm #18001January 17, 2025 at 1:06 pm #18000January 17, 2025 at 11:46 am #17999A look at the day ahead in U.S. and global markets from Mike Dolan

Salvos from a Federal Reserve governor and the incoming Treasury Secretary helped nail down this week’s inflation-inspired retreat in worrisome U.S. Treasury yields before Donald Trump’s inauguration as president on Monday.

The reversal of the year’s rise in U.S. yields and the dollar coupled with news of an upbeat end to last year for China’s economy nudged world stocks up on Friday

Morning Bid: Waller and Bessent help peg back Treasury yields

January 17, 2025 at 11:23 am #17998NEWSQUAWK US OPEN

Stocks edge higher, JGBs lag on further BoJ sources, UK Retail sales weigh on GBP

Good morning USA traders, hope your day is off to a great start! Here are the top 4 things you need to know for today’s market.

4 Things You Need to Know

European bourses grind higher, US futures modestly in the green.USD marginally firmer, JPY softer and GBP knocked lower by disappointing retail sales.

JGBs lag slightly on further BoJ reports, Gilts gapped higher on Retail Sales.

Mixed trade in the base metal complex but crude stays firm.

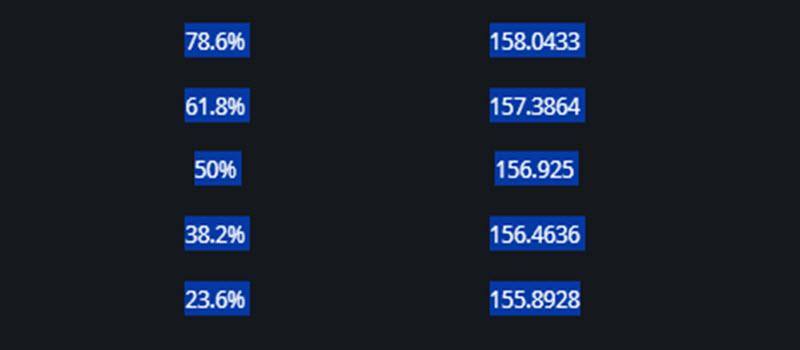

January 17, 2025 at 11:19 am #17997January 17, 2025 at 10:58 am #17996USDJPY 4 HOUR CHART – Tests 155

The main action remains in USDJPY and JPY crosses

155 remains the pivotal level on the downside (low 154.97) and a break of 156.35 would be needed to postpone the risk.

For FIBO lovers, here are retracement levels for 158/88-154.97 using our Fibonacci Calculator

January 17, 2025 at 10:46 am #17995

January 17, 2025 at 10:46 am #17995 -

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View