- This topic has 11,679 replies, 48 voices, and was last updated 4 months, 2 weeks ago by GVI Forex 2.

-

AuthorPosts

-

January 20, 2025 at 6:51 pm #18116January 20, 2025 at 5:59 pm #18115

Stanley Druckenmiller says ‘animal spirits’ are back in markets because of Trump with CEOs ‘giddy’ – cnbc

Druckenmiller believes Donald Trump’s re-election renewed a jolt of speculative enthusiasm in the markets and surging optimism within businesses.

“I’ve been doing this for 49 years, and we’re probably going from the most anti-business administration to the opposite,” Druckenmiller said on CNBC Monday. “We do a lot of talking to CEOs and companies on the ground. And I’d say CEOs are somewhere between relieved and giddy. So we’re a believer in animal spirits.” …

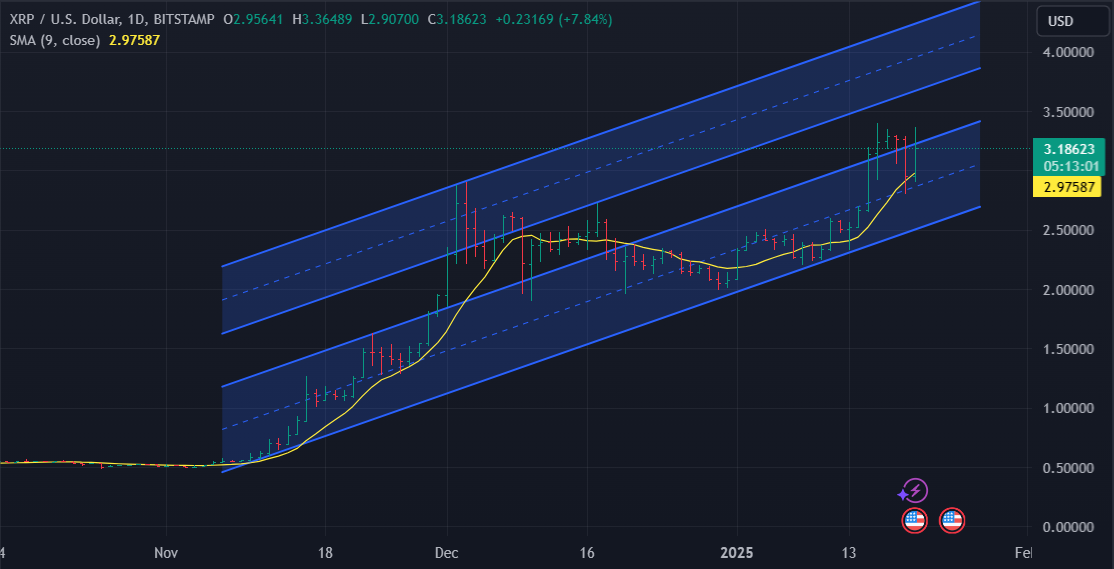

January 20, 2025 at 4:18 pm #18112January 20, 2025 at 4:03 pm #18111January 20, 2025 at 3:58 pm #18110BTCUSD

110 K – almost – 109.547…

110.850 is exact number of given target– BTC can pause for awhile below it, but if taken in next 24h – next target is around 123 K

Fact that the Channel trendline held firm and launch the Bitcoin straight to the new all time high , makes me believe so.

Only close tonight Below 103 K changes this picture and negates continuous Bullish sentiment.

January 20, 2025 at 3:44 pm #18109

January 20, 2025 at 3:44 pm #18109Euro 1.04 (HoD 1.0430 so far)

DLRx 1.08 (LoD 1.0775)I have not seen anything from donald that should change the rotation of plant

What I am looking at is … how stacked long dollar is the market

with the puppy below 108.90 market suggests, to me, some pricing correction is happeningDegenerate traders in a bit of teasing mode atm and imo.

Nothing tragic about the dollar just yet.January 20, 2025 at 2:36 pm #18100That’s the second time a tariff relief headline has whacked the market…As I noted earlier press reports were not talking about tariffs as part of the executive orders… reaction to news, as always, is what counts but … big moves today in thin liquidity and all this means so far is no tariff announcement on day one.

January 20, 2025 at 1:55 pm #18091January 20, 2025 at 1:05 pm #18089January 20, 2025 at 11:24 am #18084January 20, 2025 at 10:14 am #18083Using my platform as a HEATMAP shows

A market on hold waiting for the inauguration of President Trump and a slew of executive orders to follow.

For the FX market, the focus will be on anything related to tariffs but I have not seen any talk of it in the press.

The heatmap, meanwhile, shows the EURUSD as an outperformer with the GBP and JPY lagging out of respective EUR crosses.

The main action has been in cryptos with BTCUSD surging higher to a new record high (marginally so far). The $Trump memecoin has been the talk of the press but I will leave my opinion on something that has no intrinsic value for another time.

Otherwise US markets are closed today, liquidity is thin and it is now just a wait until the new Trump era begins.

January 19, 2025 at 10:34 pm #18066THIS WEEK’S MARKET-MOVING EVENTS (all days local)

The week begins with China’s loan prime rate decision for December, anticipated to remain unchanged at 3.10% for the 1-year lending rate and 3.60% for the 5-year. Germany’s producer price index is also due on Monday, with forecasts of a significant 1.0% annual increase, up from 0.1% in November. Tuesday brings Canada’s consumer price index, expected to show a 0.4% monthly decline due to a GST sales tax holiday, while annual CPI growth is forecasted to ease to 1.8%, reflecting slower food price inflation despite rising energy costs.

Midweek, the U.S. leading index for December is projected to decline by 0.1%, resuming its downward trend after a brief November uptick. Japan’s merchandise trade balance, due Thursday, is expected to narrow its deficit to ¥50 billion, with export values rising for the third consecutive month and import values increasing for the ninth. U.S. jobless claims are anticipated to remain steady at 218,000, though holiday season volatility could affect the numbers.

Friday features key economic updates from Japan, including consumer price index data and the Bank of Japan’s policy announcement. Inflation is expected to rise, with core CPI seen at 2.9% annually, driven by utility subsidies ending and persistent high food prices. The Bank of Japan is likely to raise its policy rate by 25 basis points to 0.5%. Meanwhile, U.S. existing home sales for December are forecast to hold steady at an annual rate of 4.16 million units, despite rising mortgage rates.

Econoday

January 19, 2025 at 10:24 pm #18065Reuters) – A look at the day ahead in Asian markets.

Signs of life being breathed back into China’s economy and a strong rally on Wall Street on Friday bode well for Asian markets on Monday, although nervousness around President-elect Donald Trump’s inauguration could temper the optimism.

January 19, 2025 at 10:24 pm #18064Reuters) – A look at the day ahead in Asian markets.

Signs of life being breathed back into China’s economy and a strong rally on Wall Street on Friday bode well for Asian markets on Monday, although nervousness around President-elect Donald Trump’s inauguration could temper the optimism.

January 19, 2025 at 3:42 pm #18061What a relief!

Trump’s inauguration to be moved indoors

President-elect Donald Trump’s inauguration will be moved indoors, he announced Friday, due to dangerously cold temperatures projected in the nation’s capital.

“I have ordered the Inauguration Address, in addition to prayers and other speeches, to be delivered in the United States Capitol Rotunda, as was used by Ronald Reagan in 1985, also because of very cold weather,” Trump posted on Truth Social.

“We will open Capital One Arena on Monday for LIVE viewing of this Historic event, and to host the Presidential Parade. I will join the crowd at Capital One, after my Swearing In,” Trump added.

https://edition.cnn.com/2025/01/17/politics/inauguration-moving-indoors-cold-weather/index.html

January 18, 2025 at 5:42 pm #18044January 18, 2025 at 3:52 pm #18043Newsquawk Week Ahead – 20-24th January

Highlights include BoJ, PBoC, PMI data, UK jobs, Inflation data from Canada, Japan and

January 18, 2025 at 3:38 pm #18042Countries around the world are bracing for an economic bruising on Monday. And few have more at stake than Canada.

Bracing for impact: 5 things to watch with Trump’s upcoming tariffs

January 18, 2025 at 1:43 pm #18041compensation of the different kind

Goldman CEO gets big pay boost, plus $80 million bonus for another five years at helm

January 18, 2025 at 12:44 pm #18040I want to see every legal entity/company investing some of their profits into government treasuries, which are just a way to loan money to the government at a cost, a higher yield means the government is paying more for every dollar loaned to them. Treasuries are one of the risk less ways for companies to generate to additional source of income for the balance sheet. If they don’t want to keep that yield then they can distribute it to their shareholders which translates into more people buying that stock because it gives them a higher dividend… which is a win-win-win for the company, government and investor.

Will the dividends be higher for stock dividends or higher for treasury yields? It’s higher from companies which do invest into treasuries also.

Nowadays large companies/HNI’s all over the world are gonna be looking to buy into treasuries or into listed companies which pay dividends over stocks which generate wealth, because in which company will they reinvest that wealth? They would reinvest it in treasuries or companies paying dividends… The drivers for the global stock market trends are not only in generating wealth but preserving wealth and getting it repaid to the investor from the company by way of dividends, and the investment is benefiting from capital growth over a period of time.

Nowadays the investors who buy stocks to generate wealth end up getting trapped into buying at unsustainable valuations, so it’s better to choose from a bucket of stocks which pay dividends comparable to treasuries or simply exclude stocks and focus on treasuries. Hold the cash until opportunities in dividend paying stocks come about then start buying into them. Equity valuations are still far too high (for model traders like me) and need to correct much more and to a very large extent, however a very positive trend I also observe is that companies which have done splits, bonuses etc have already corrected and considered close but still too far from my model prints but ripe for investment nevertheless, because the model points and also the macroeconomic variables are working in the favor of those specific types of companies, and much more so if they are paying dividends comparable to, if not higher than treasury yields with a lot of room for them to make future growth. The yields can be increased if they do invest in treasuries.

Me thinks fundamentally that we can now ask the government for a cut in tax rates across the board… but….

-

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View