- This topic has 11,679 replies, 48 voices, and was last updated 4 months, 2 weeks ago by GVI Forex 2.

-

AuthorPosts

-

January 21, 2025 at 11:54 am #18146

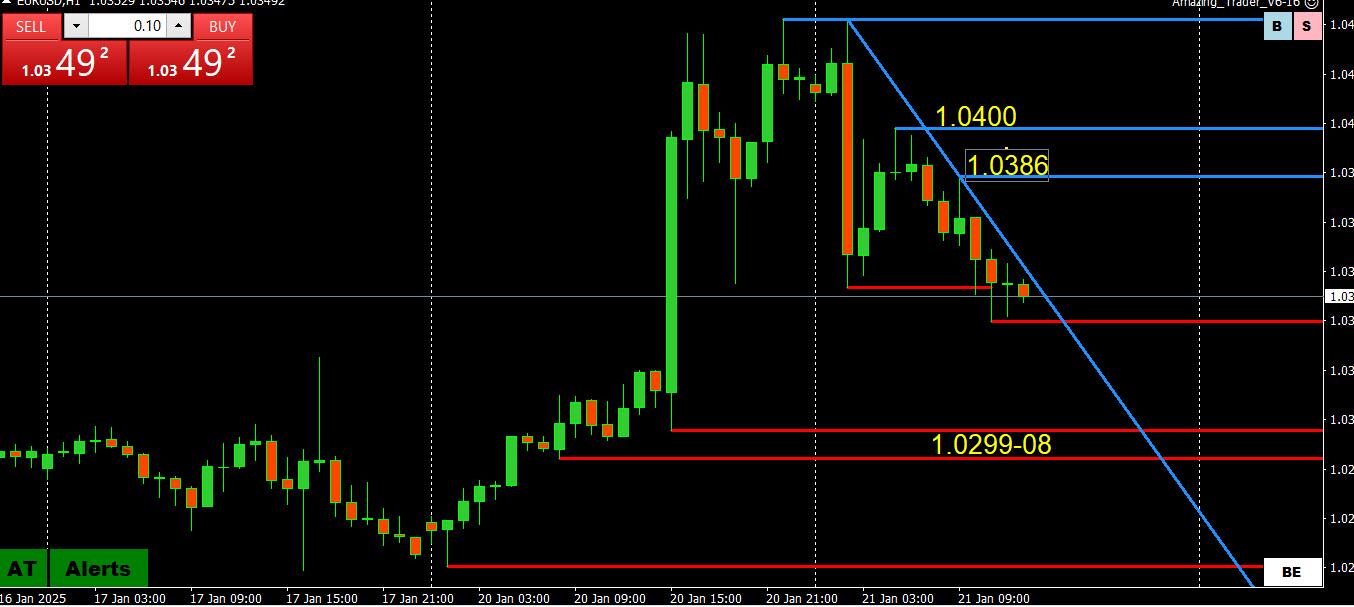

EURUSD Daily

Another day, another test of trendline – and again failure…

Yesterday a question was raised : what is a Firm break – it is when they manage to close above/below the trendline , and at best twice in a row.

Now twice it failed….

Look at that yellow MA – I know…it means nothing to you…but to me it is a world.

If EUR manages to close tonight just above it, tomorrow we’ll be seeing a sharp leg UP, and most probably a final break of the trendline in that case.

But if it closes just below it – another leg down.

Pay attention to “just above/below” – exactly that…anything else would be no mans land.

As I stated days ago – 1.03500 is the pivotal point, and as long as EURUSD plays around it , both ways are possible. All Bets are OFF Only on the decisive break of 1.04350 and capability of the pair to stay above it.

January 21, 2025 at 11:44 am #18145

January 21, 2025 at 11:44 am #18145NEWWQUAWK US OPEN

US futures edge higher, DXY bid whilst CAD & MXN take a hit as President Trump signals tariffs.

Good morning USA traders, hope your day is off to a great start! Here are the top 4 things you need to know for today’s market.

4 Things You Need to Know

European bourses are modestly firmer, US futures edge higher with the RTY outperforming ahead of the first full day of trade as Trump returns to office.

USD bounces back from Monday’s selling as tariff threats loom; the Loonie underperforms as Trump signals tariffs on Canada & Mexico.

Benchmarks have pared initial early morning upside, with USTs a little firmer whilst Bunds dip into the red.

Crude and base metals on the backfoot amid Trump tariff rhetoric.

January 21, 2025 at 11:18 am #18144January 21, 2025 at 11:18 am #18143A look at the day ahead in U.S. and global markets from Mike Dolan

Likely a taste of things to come, stock and currency markets were knocked back and forth on the first day of Donald Trump’s new presidency as they second guessed his trade tariff plans and remained largely in the dark on the issue as U.S. markets return from Monday’s holiday.

January 21, 2025 at 11:11 am #18141January 21, 2025 at 11:09 am #18140Aw I posted late yewterday (note high was 1.0434…..

Is this just a relief reaction that tariffs were not announced on day one of the new Trump era?

For a fatal blow, the daily trendline and 1.0435-55 would need to be firmly broken.

On the downside, only a break of 1.0330-54 would expose 1.03 again.

To keep it dimple today, 1.0350 will wet the intra-day tone while within 1,03-1.04 but updide ie limited while below 1.0385-00

January 21, 2025 at 10:43 am #18139GER30 DAILY CHART – WHEN MIGHT IT PAUSE?

DAX continues to set record highs despite German economic woes.

So, the question now is what might derail the relentless march higher… in this regard, wild card may be any Trump tariffs.

In any case, only resistance is the new record high, keeps a bid while above 20537 (see chart).

January 21, 2025 at 10:24 am #18138January 21, 2025 at 10:17 am #18137January 21, 2025 at 9:53 am #18136January 21, 2025 at 9:46 am #18135USDCAD 1 HOUR CHART – Elevator doiwn, elevator up

As I posted late yesdterday

1.4279-1.4467 has been the range for over 4 weeks with both sides briefly broken, the past few days, so far without follow throug.

Now that the downside hasa just been tested, a firm move below 1.3279 would be needed to suggest more scope on the downside. Otherwise it is back into the range.

Usdcad ais bck in its range after the tariffs news spike to 1.4516… but this time with support on dips as long as it stays aboive 1.4393.

January 21, 2025 at 8:25 am #18132There are times when markets react to news that makes you want to scratch your head so hard your hair would fall out.

The reaction yesterday to the WSJ tariffs story was one of them. It is why I called it a relief reaction that there was no mention of tariffs on day one.

Well, that did not last the full day as life in the new Trump era started with headline roulette.

As I wrote to a GV member late yesterday afternoon

The reaction Monday was bs. . . Just a matter of when Trump calls for tariffs

Trump made me sound like a genius although I didn’t expect to see it come so soon (scroll below for the headline).

The moral is that life in Trumpworld should be viewed as actions speak louder than words.

As we should all know by now there will will be no shortage of words to create headlines and volatility but in the end actions are what counts.

In this regard the threat of tariffs are words but a cloud over markets and what the actual policy entails is what will matter in the end.

January 21, 2025 at 8:02 am #18126Here is the full story

Trump says he’s thinking of imposing 25% tariffs on Canada and Mexico in February

January 21, 2025 at 2:09 am #18125January 20, 2025 at 10:26 pm #18124January 20, 2025 at 9:15 pm #18122January 20, 2025 at 9:00 pm #18121January 20, 2025 at 8:43 pm #18120USDCAD DAILY CHART – STILL IN A RANGE?

1.4279-1.4467 has been the range for over 4 weeks with both sides briefly broken, the past few days, so far without follow throug.

Now that the downside hasa just been tested, a firm move below 1.3279 would be needed to suggest more scope on the downside. Otherwise it is back into the range.

January 20, 2025 at 7:02 pm #18118NIO Inc.

Nio is trying to resurface above 4.50

NIO Inc. (NIO) Rises But Trails Market

The most recent trading session ended with NIO Inc. (NIO) standing at $4.10, reflecting a +0.49% shift from the previouse trading day’s closing.

Heading into today, shares of the company had lost 10.13% over the past month

The investment community will be paying close attention to the earnings performance of NIO Inc. in its upcoming release. January 20, 2025 at 6:56 pm #18117

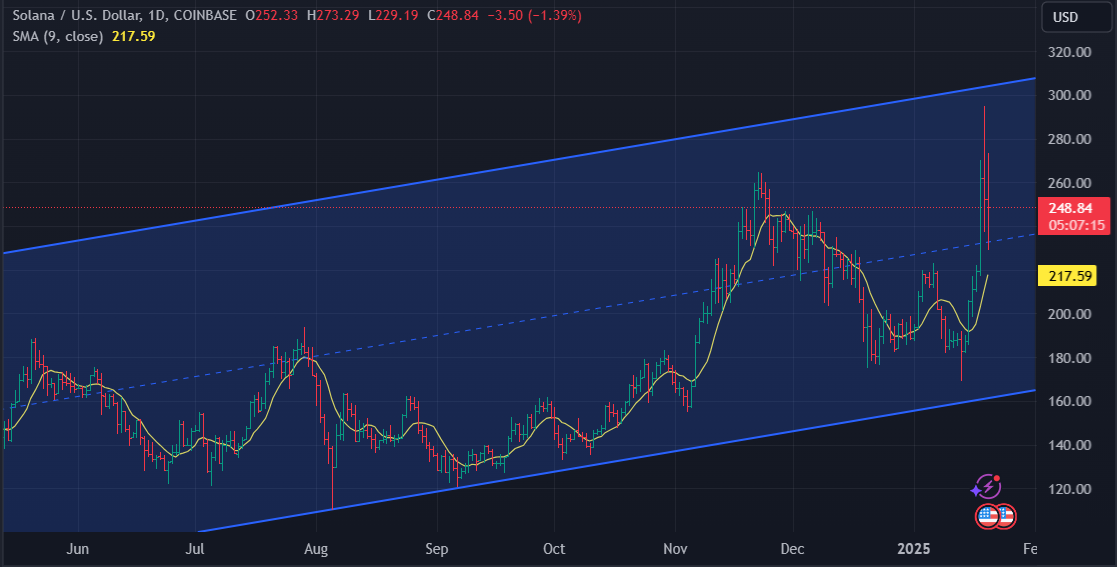

January 20, 2025 at 6:56 pm #18117SOLUSD

Solana Bulls Counter Bearish Pressure To Keep Price Above $240

Solana price action is heating up as bulls show efforts to fend off bearish pressure and maintain the cryptocurrency above the vital $240 support level. This threshold has emerged as a key marker of market sentiment, serving as a critical point of defense for buyers aiming to keep the uptrend intact.

-

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View