- This topic has 11,679 replies, 48 voices, and was last updated 4 months, 2 weeks ago by GVI Forex 2.

-

AuthorPosts

-

January 22, 2025 at 1:38 pm #18216

Global-view.com Giveaway – Round 3 – 27. January – 3. February 2025

Dear Members (and those who wish to participate), we are happy to announce that the Third Round of our Weekly Evaluations is STARTING at Monday– 27.01.2025.

Grand Prize is a Prop Trading Challenge Account – $ 15.000

Second Prize is a Prop Trading Challenge Account – $ 10.000

To remind you all of the Rules :

Global-view.com Giveaway – Round 3 – 27. January – 3. February 2025

January 22, 2025 at 1:08 pm #18213EURJPY 4 HOUR CHART – TESTS RESISTANCE

Credit again to The Amazing Trader for highlighting this key resistance, which was the start of the move down to the 159.65 low.

Even if you do not trade EURJPY, it pays to keep an eye on it when you sewe the JPY move in the opposite direction of the EUR vs the dollar. ‘

The high in EURJPY coincided with the top in EURUSD at 1,0457.

January 22, 2025 at 12:32 pm #18211January 22, 2025 at 12:06 pm #18210A bit of a tug-of-war with USDJPY firming, JPY weaker on key crosses.

Not to pat myserlf on the back so I will give credit to The Amazing Trader for highlighting the EURUSD 1.0457 level.(scroll to see chart)

January 22, 2025 at 11:34 am #18208A look at the day ahead in U.S. and global markets from Mike Dolan

Retaining a persistent, if uncertain, threat of new tariffs, U.S. President Donald Trump quickly switched his attention to technology and artificial intelligence this week – exciting the red-hot sector that’s about to report its latest earnings round.

Trump on Tuesday announced a private sector investment of up to $500 billion to fund infrastructure for artificial intelligence, aiming to outpace rival nations in the business-critical technology.

Morning Bid: Trump Switches to AI as Tariffs Lurk, Netflix Soars

January 22, 2025 at 11:32 am #18207NEWSQUAWK US OPEN

NQ bid after Trump’s AI investment, NFLX +15% post-earnings, softer Dollar supports oil/precious metals

Good morning USA traders, hope your day is off to a great start! Here are the top 4 things you need to know for today’s market.

4 Things You Need to Know

European bourses trade at best levels, Stoxx 600 makes a record high; NQ outperforms as President Trump announces a USD 500bln AI investment.

USD tilts lower as markets await further developments from the Trump administration.

USTs are a little firmer, Bunds bounce on ECB Lagarde remarks, who is seemingly not too concerned about US tariffs at this point in time.

A softer dollar supports oil and precious metals, but base metals trade mixed on tariff threats.

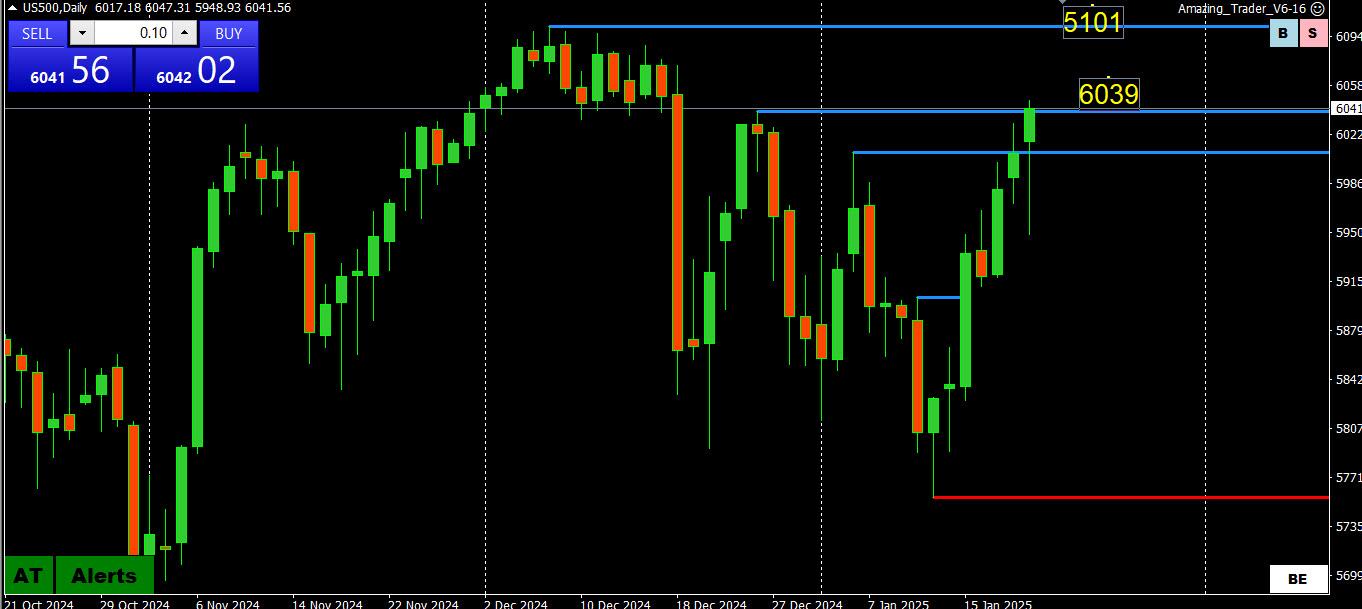

January 22, 2025 at 11:26 am #18206January 22, 2025 at 11:06 am #18205January 22, 2025 at 10:56 am #18204January 22, 2025 at 10:47 am #18203January 22, 2025 at 10:39 am #18202January 22, 2025 at 10:32 am #18201EURUSD DAILY CHART – What happened to parity?

Wasn’t the talk of parity just a few weeks ago and now 1.05 looms above.

You can see why 1.0457 is a key level, also a 4=week high. While 1,05 would likely prove tough, a move above 1.0457 would put it on the radar.

‘On the downside, 1.0435 needs to hold to keep a strong bod. Back below 1.04 would negate the upside risk.

January 22, 2025 at 10:23 am #18200Using my platform as a HEATMAP shows

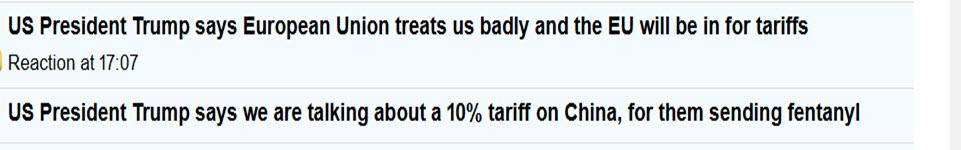

The dollar is trading a touch softer except vs the JPY despite the BoJ likely to raise rates this week and the BOE and ECB likely to cut.’ One clue may have been another Trump taro\iff threat was ignored.

So, looking for a reason for the recent softer USD, I came across this in a Reuters article..

The dollar looks stretched on positioning, sentiment and valuation metrics – hedge funds last week held the biggest net long dollar position in nine years; ‘long dollar’ is one of investors’ most crowded trades, according to Bank of America’s latest fund manager survey; and Citi analysts reckon the currency is overvalued by 3%.

January 22, 2025 at 9:29 am #18199January 21, 2025 at 11:27 pm #18198January 21, 2025 at 10:15 pm #18197(Reuters) – A look at the day ahead in Asian markets.

Day two of the second Donald Trump administration, and exchange rates are in the global market crosshairs as investors nervously try to figure out how to trade the immediate fog shrouding the U.S. president’s trade policy

Morning Bid: Whipsawed dollar and fog of uncertainty? Get used to it

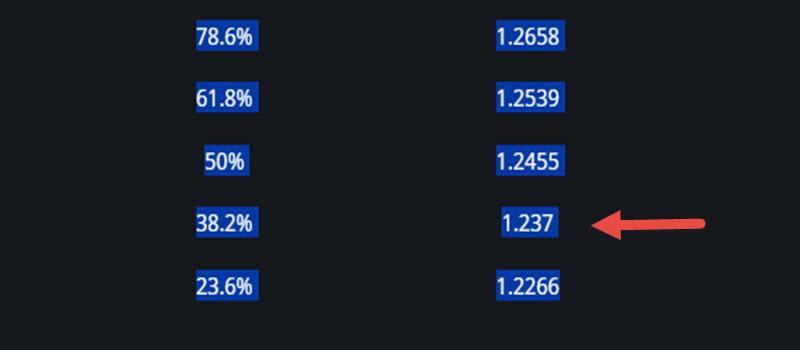

January 21, 2025 at 9:26 pm #18184January 21, 2025 at 9:18 pm #18183January 21, 2025 at 9:11 pm #18182January 21, 2025 at 9:08 pm #18181USDCAD DAILY CHART –Back into its range

Yo-Yo price action continues with USDCAD back into 1.4279-1.4467 where it has traded for over 4 weeks with only a brief exception this week. Next directional move will com from a firm break of this range.

Wide range is now 1.4261-1.4516,

Note, the failure above 1.45 has potential to be a bear signal.

-

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View