- This topic has 11,679 replies, 48 voices, and was last updated 4 months, 2 weeks ago by GVI Forex 2.

-

AuthorPosts

-

March 27, 2025 at 12:02 pm #21517

do you have an addiction weakness

–

Coming to a store near you: double-digit coffee price hikes

March 27, 2025 7:25Summary

Companies

Consumers face price hikes of about 20% in next weeks

Roasters reeling as raw bean prices double

After 21% hike, Brazil’s 3 Coracoes raises prices by 14% – document

Supermarkets pushing back against hikes as shop shelves emptyingLONDON/NEW YORK, March 27 (Reuters) – If your favourite coffee beans have vanished from the shelves, don’t worry – they will return soon. The bad news is they will be up to 25% more expensive.

March 27, 2025 at 11:57 am #21516

US OPEN

European bourses hit on auto tariff rhetoric, DXY mixed vs peers while EGBs & USTs diverge

Good morning USA traders, hope your day is off to a great start!

Here are the top 6 things you need to know for today’s market.t

6 Things You Need to Know

The US is to impose 25% tariffs on all cars made outside of the US effective on April 2nd

Trump reiterated that reciprocal tariffs are also set for next week but stated they will be lenient

Updates which weigh on European equities with Auto names lagging, US futures mixed/firmer

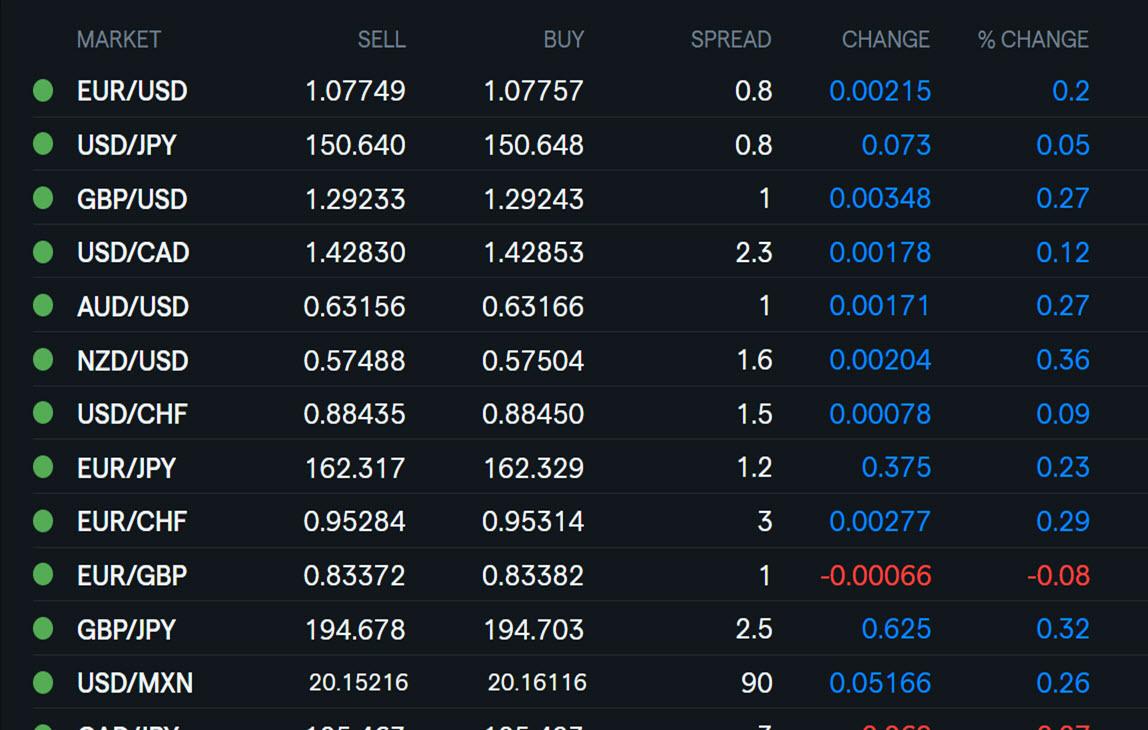

DXY mixed with GBP outperforming in an attempted recovery from Wednesday’s action while JPY lags

EGBs and USTs diverge as they focus on growth and inflationary implications of the latest rhetoric respectively

Crude benchmarks lower, TTF choppy, XAU gains and base metals slip

March 27, 2025 at 11:12 am #21515March 27, 2025 at 10:11 am #21514This is 11AM Nigerian time and the day is bright. GOLD (XAU/USD) is at price 3040. The market is set up for a bullish run . It reached to a high at price 3038 this early morning before retracing. it went bearish to the price range at 3026.62 and has since begun an upward movement. it is at 3040 area now and ready for a fresh bullish movement to price range at 3042.

Let us take a few pips and save the money in the bag. A 1-5% profit target should suffice. Don’t over leverage your Account. A word is enough for the wise.

Thsnks,

TOPNINE.March 27, 2025 at 9:58 am #21513March 27, 2025 at 9:47 am #21512March 27, 2025 at 9:35 am #21511March 27, 2025 at 9:10 am #21510Using my platform as a HEATMAP shows

… the dollar trading mixed to lower after aextending its upside in early trading.

EURUSD range 1.0733-1.0787 so…

…if -.07 does not trade then a 4 day pattern around this level will be broken (bearish indicator).

Approaching month/quarter end rebalancing said to favor dollar buying.

XAUUSD catching a bid

Relatively light calendar

U.S. weekly jobless claims, final Q4 GDP revision, pending home sales

Otherwise it remains a Trump and tariffs headline driven market

March 27, 2025 at 1:54 am #21509USDCAD 1.4278

RTRS Canada will react to Trump’s ‘attack’ soon, could impose tariffs, says Carney

OTTAWA, March 26 (Reuters) – Canada will soon respond to new tariffs on imported vehicles announced by U.S. President Donald Trump and could impose retaliatory measures against the United States, Prime Minister Mark Carney said on Wednesday.

Summary

Canada could impose retaliatory tariffs against US, Carney says

Carney to convene cabinet meeting for response strategy

Ontario Premier Ford advocates strong response to US tariffsCarney said Trump’s move was “a direct attack” and told reporters he would be convening a high-level cabinet meeting on Thursday to decide on a response.

“We will defend our workers, we will defend our companies, we will defend our country, and we will defend it together,” he said

we … yeah

March 26, 2025 at 10:05 pm #21506March 26, 2025 at 9:58 pm #21505March 26, 2025 at 9:57 pm #21504March 26, 2025 at 9:52 pm #21503March 26, 2025 at 9:08 pm #21502March 26, 2025 at 9:03 pm #21501March 26, 2025 at 8:32 pm #21495March 26, 2025 at 8:22 pm #21494US500 4 HOUR = 5600-5800?

As I have been saying all week, US500 would need to regain 5800-10 to build momentum… in this regard it has failed, leaving a void after 5752 was broken..’

On the downside, there is a double bottom at 5597 and only through there would shift the risk back to the low.

If 5600-5800 becomes the range, then te 5700 midpoint will set its tone.

March 26, 2025 at 7:53 pm #21493March 26, 2025 at 7:39 pm #21492(AP) — President Donald Trump on Wednesday will announce tariffs on auto imports, a move that the White House claims would foster domestic manufacturing but could also put a financial squeeze on automakers that depend on global supply chains. March 26, 2025

Leavitt said the tariffs would be detailed at a 4 p.m. EST news conference

March 26, 2025 at 7:39 pm #21491 -

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View