- This topic has 11,679 replies, 48 voices, and was last updated 4 months, 2 weeks ago by GVI Forex 2.

-

AuthorPosts

-

January 27, 2025 at 8:24 pm #18524

DAX – GER30 – XETR

Dax holding above 21.000 and looks like as defining a gravity .

Based on time-space analysis and some common sense, we might be in line for some nice correction.

Unless it manages to consolidate in sideways correction, we should be seeing levels around 20.500 if not even 19.350.

Next couple of days watch for double top formation – and if so, deeper correction will be on its way

January 27, 2025 at 8:19 pm #18523January 27, 2025 at 8:16 pm #18522

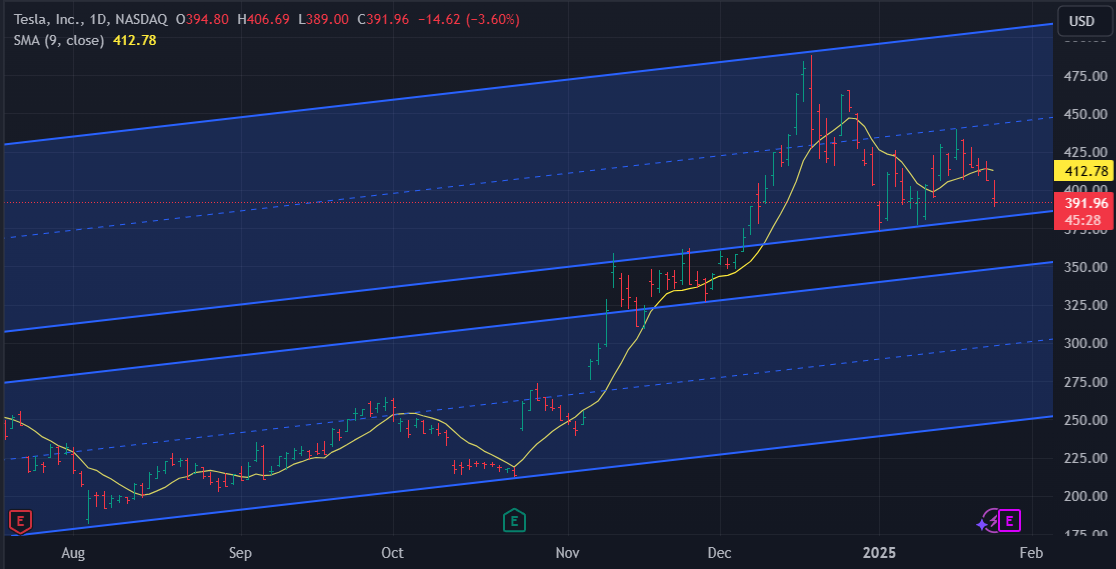

January 27, 2025 at 8:19 pm #18523January 27, 2025 at 8:16 pm #18522Tesla – TSLA

Tesla Stock Is Dropping. Why It’s a Victim of DeepSeek Hysteria.

Tesla stock falling Monday — and China’s artificial-intelligence impact on Nvidia and other tech companies looks to be the biggest reason.Shares of the EV maker were down more than 3.7% at $391.52

The drops came after Chinese AI app DeepSeek topped Apple’s app chart over the weekend. It seems to perform as well as other AI apps such as OpenAI’s ChatGPT, but appears to have been developed at a fraction of the cost.

January 27, 2025 at 8:11 pm #18521

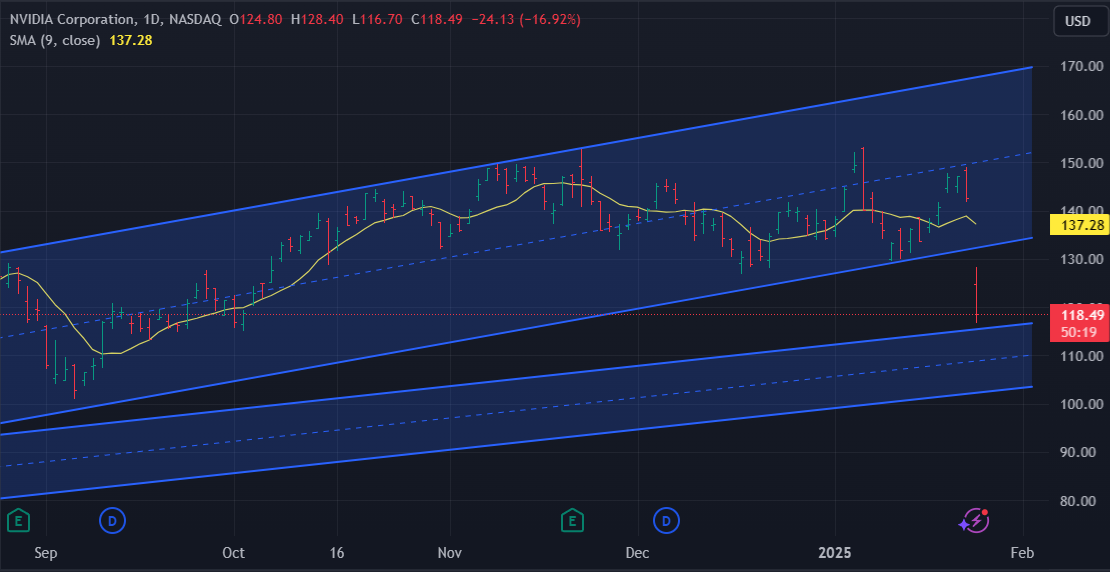

January 27, 2025 at 8:11 pm #18521Nvidia – NVDA

Nvidia Stock Sinks in AI Rout Sparked by China’s DeepSeek

The Chinese artificial-intelligence upstart has trained high-performing artificial intelligence models cheaply-and without the most advanced gear provided by Nvidia and others. That has pulled the rug from under global companies riding the AI wave, including chip makers, infrastructure suppliers and power stocks, as investors question the outlook for AI spending.Nvidia tumbled 16%, wiping out more than $500 billion in market value and tarnishing one of the stock market’s brightest stars of recent months. The tech-heavy Nasdaq Composite sank 3.3%.

January 27, 2025 at 8:06 pm #18520

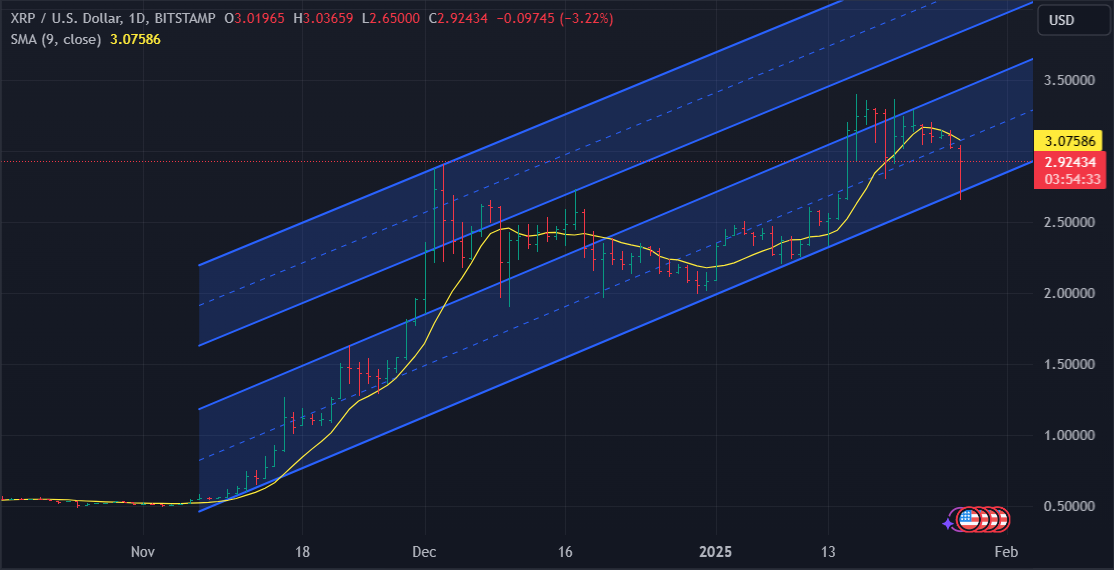

January 27, 2025 at 8:06 pm #18520XRP Price To $5.85: Analyst Reveals Why The New Week Will Be ‘Dynamic’

A new XRP price prediction has surfaced, with a crypto analyst forecasting that the popular altcoin will experience a dynamic surge to $5.85 in the new week. Based on the Elliott Wave Theory and key technical indicators, the analysis outlines how XRP could see a significant upside after breaking out a symmetrical triangle pattern.

All that from a reliable source of course – X Guru of some sort

Well that’s all nice and peachy, but a bit “wishful thinking” scenario , based on”reading” of indicators and Elliot Waves…

But what we do have here in front of us :

– Clear savage profit taking to start with

– Support trendline shaken, but not stirred

– 3.20 represents a pivot – needs a close above it to continue up

– Pattern calls for a top formation – so maybe can reach 3.30

– Before close below 2.70 it is still Bullish

–

January 27, 2025 at 6:18 pm #18519January 27, 2025 at 6:16 pm #18518I TOOK A BUY AT 7PM NIGERIAN TIME ON USD/CAD WITH A N ASCENDING PATTERN FORMATION. AT PRICE 1.43975 PRICE WENT ON A FURTHER BUY, WHICH SHOULD CONTINUE FOR A WHILE BEFORE RETRACING. MARKET OPENED AT PRICE 1.4356 AND HAS BEEN ON AN UPTREND FOR A FEW HOURS BUT IT GOT TO PRICE 1.43975 BEFORE RETRACING. THE LOWEST POINT OF PRICE TODAY IS QT 1.43327 AND SINCE THEREIS A SUPPOST AT THAT PRICE, IT MOST LIKELY WILL RETRACE AND RETURN TO ITS FORMER POSITION.

MARKET WENT FROM THE LOWEST POINT AND HAS STEADILY CLIMBE TO ITS CURRENT POSITION OF 1.43975 AND I PROJECT A FURTHER BUY IN THE CURRENCY PAIR. I HAVE PLACED MY TP AT PRICE 1.44069 WHERE I’M SURE IT WILL AT LEAST GET TO BEFORE IT CAN RETRACE.

THAT IS MY SUBMISSION FOR NOW.THANKS,

TOPE AJALA

FROM NIGERIA.January 27, 2025 at 6:07 pm #18517EUR/USD 1-month implied volatility traded 7.55-7.6 on Monday after last week’s setback from the low 9’s to the low 7’s. Price action in spot and options is consistent with more upside potential toward 1.0900 if some key resistance levels can be overcome, although policy divergence will cap the extent of overall gains.

EUR/USD risk reversals are attracting some demand from their lower levels for EUR puts/USD calls as a way to hedge any renewed spot losses.

January 27, 2025 at 5:47 pm #18514January 27, 2025 at 5:34 pm #18512

January 27, 2025 at 5:47 pm #18514January 27, 2025 at 5:34 pm #18512This is obviously the temporary pause in stocks I felt last week we would begin to see either Thursday/Friday or today. Nothing dramatic. Could last up to 5 days before stabilizing. Could be less than that. Euro obviously is/will be impacted negatively to some extent with the risk off mood. So far it is just tempering gains. I do see some stabilization in Treasury Core Bonds and that is helping Euro. Wednesday holds the cards.

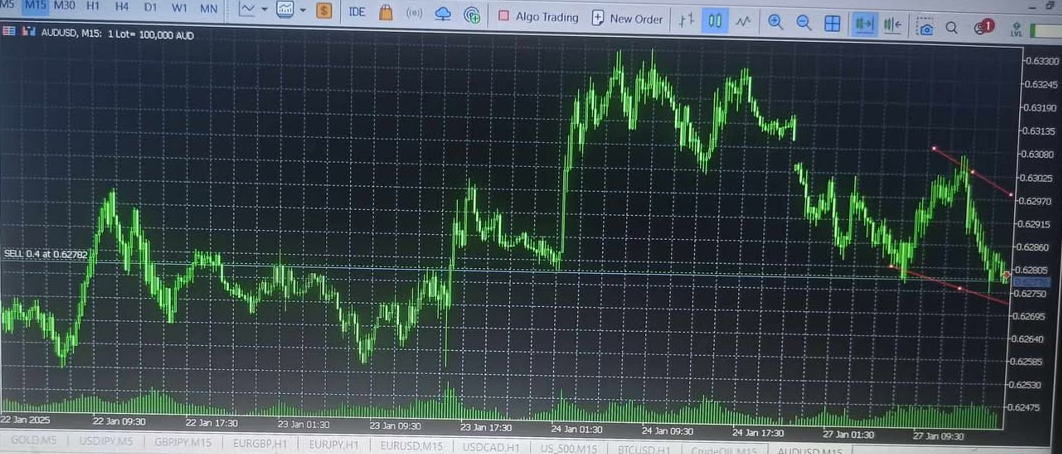

January 27, 2025 at 5:17 pm #18511AUD/USD IS ON A DOWNWARD SLOPE STARTING FROM THE HIGHEST OF TODAY 0.63046 RANGE AND SINCE MIDDAY HAS BEEN SLOPING DOWNWARDS ON A SELL. IT HAS BEEN SELLING FOR THE PAST 4 HOURS, I SEE A FURTHER SELL AT LEAST FOR 20 PIPS.

AT 6PM MONDAY, JANUARY 27TH 2025, AUD/USD IS GOING ON A CONTINUATION TO PRICE 0.6271. I HAVE PLACED A SELL TRADE AND I AM HOLDING THIS POSITION TILL IT HITS THE TP AT THE SAID PRICE.

THIS IS MY LATEST TRADE.

THANKS,

TOPE AJALA

FROM NIGERIAJanuary 27, 2025 at 4:51 pm #18509“U.S. and Colombia reach deal on deportations; tariffs and sanctions put on hold” – cnbc

reach deal … what an understatement of donald’s squeezing the colombian’s neck n head

not only did he pull back reciprocal tariffs hitback but he even offered the presidential jet to ferry the expulsees back to colombia

January 27, 2025 at 4:37 pm #18507GBP/JPY AT EXACTLY 5:30PM NIGERIAN TIME SHOWS A DOWNWARD SLOPE BIAS. THERE WAS A DESCENDING GAP WHICH I TOOK ADVANTAGE OF FOR A FEW PIPS. MARKET PRICE WAS AT 192.37 AS AT THEN THEN I WENT IN FOR A FEW PIPS, WITH THE PLAN TO EXIT AT PRICE 152.25

THIS IS A GOOD MONDAY EVENING TO TRADE THE MARKET AS MARKET IS TRENDING BEAUTIFULLY. I HOPE TO CATCH A FEW PIPS HERE BEFORE MARKET RETRACES AND GOES THE OTHER WAY.

January 27, 2025 at 3:49 pm #18499At the Federal Reserve’s first meeting in 2025, consumers are going to want what Fed Chair Jerome Powell simply can’t give them: An answer to how much longer interest rates are going to stay high.

Americans got a taste of the rate cuts they were craving last year. With inflation slowing and the job market flashing warning signs of an abrupt slowdown, officials on the Federal Open Market Committee (FOMC) slashed their benchmark financing rate a full percentage point across three consecutive meetings. The federal funds rate now holds in a target range of 4.25-4.5 percent.

The FOMC doesn’t look like it’s going to cut interest rates a fourth consecutive time when it wraps up its two-day meeting on Jan. 29. Experts say a cut at the Fed’s next rate-setting gathering in March might not happen, either, if inflation stays sticky and the economy remains resilient.

January 27, 2025 at 3:42 pm #18498EURUSD profit target it…1.25:1. R/R

Join GTA (FREE) and request a half price Amazing Trader members only AT access

January 27, 2025 at 3:35 pm #18497EURUSD 15 MINUTE CHART – AT ALERT

This is the Amazing Trader pattern that triggered an AT sell alert at 1.05185/tp 1.04973/SL 1.05371

It is also the pattern that indicated a potential top and change in directional risk

January 27, 2025 at 2:37 pm #18496January 27, 2025 at 1:40 pm #18495January 27, 2025 at 1:29 pm #18494January 27, 2025 at 1:26 pm #18493 -

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View