- This topic has 11,679 replies, 48 voices, and was last updated 4 months, 2 weeks ago by GVI Forex 2.

-

AuthorPosts

-

January 28, 2025 at 1:08 pm #18557January 28, 2025 at 1:03 pm #18555January 28, 2025 at 12:10 pm #18551

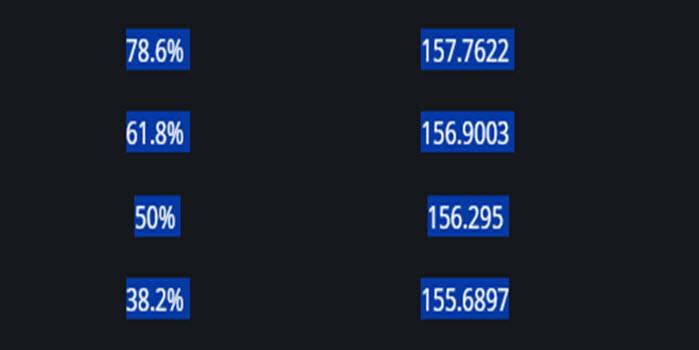

USDJPY 4 HOUR CHART – Key levels

Bounce from 153.73 would need to break the trendline + 156.25 to suggest the low is on for now.

Otherwise, keep an eye on 155 to set its tone (while within 154=156) and the risk tone as set by US equities.

FIBOS for 158.86 => 153.73 using our Fibonacci Calculator

January 28, 2025 at 11:29 am #18548

January 28, 2025 at 11:29 am #18548A look at the day ahead in U.S. and global markets from Mike Dolan

Markets took a deep breath on Tuesday after Wall Street’s shock start to the week, with the emergence of cheap Chinese artificial intelligence rival DeepSeek lopping more than half a trillion dollars off what had been America’s most valuable firm Nvidia.

Morning Bid: Deep Breath After AI Jolt, Trump Tariffs Rumble

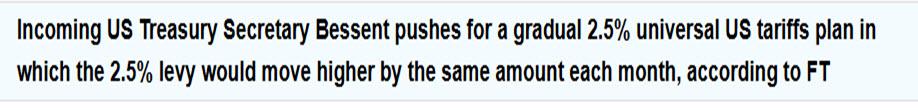

January 28, 2025 at 11:26 am #18547January 28, 2025 at 11:25 am #18546January 28, 2025 at 11:24 am #18545January 28, 2025 at 11:19 am #18544January 28, 2025 at 11:08 am #18541NEWSQUAWK US OPEN

NQ outperforms with NVIDIA +5% pre-market, USD gains on punchy Trump tariff rhetoric

Good morning USA traders, hope your day is off to a great start! Here are the top 4 things you need to know for today’s market.

4 Things You Need to Know

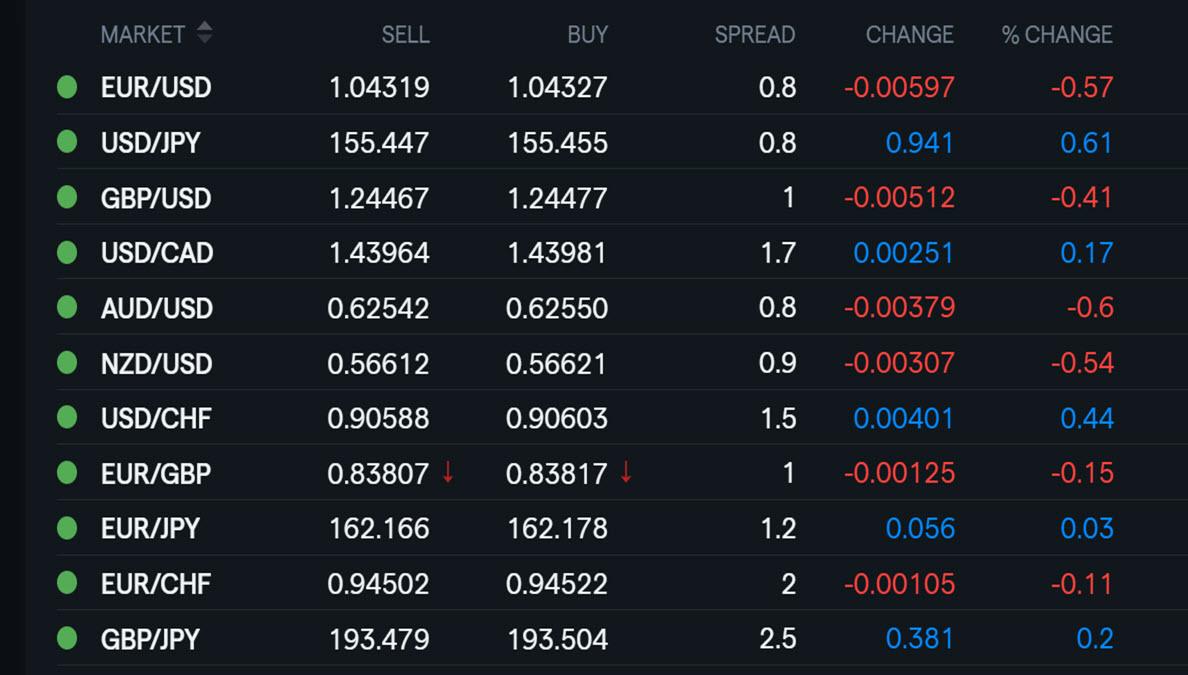

European bourses are on a firmer footing; NQ outperforms with NVIDIA +5% in pre-market trade.

USD bounces back following punchy Trump tariff rhetoric; G10s broadly in the red.

Bonds continue to pullback from Monday’s largely tech-driven highs, supply in focus.

Energy is firmer but base metals are mixed amid tariff threats.

January 28, 2025 at 11:05 am #18540January 28, 2025 at 10:47 am #18539January 28, 2025 at 10:12 am #18538Using my platform as a HEATMAP shows

The day after an earthquake wher the damage was not as bad as initially thought but wary of aftershocks,

The dollar trading firmer after:reacting to Treasury Secretary Bessent’s tariff remarks (reaction to news is what matters)

Panic selling in equities at this time yesterday easing

USDJPY back above -155

EURUSD backing away from 1.05

Focus should shift to respective monetary policy meetings (BoC, Fed, ECB)

January 28, 2025 at 9:39 am #18537EUR/USD AT 1.04195 REACHED ITS CONSIDERABLE LOWEST POINT TUESDAY MORNING AND HAS RETRACED SINCE THEN. AS AT THIS TUESDAY MORNING OF 28TH JANUARY 2025, EURO HAS RISEN TO THE POINT OF 1.04429.

THE EURO IS ON AN UPWARD TREND. IT HIT 1.04940 MONDAY NIGHT AND A FURTHER UPWARD MOVEMENT WAS EXPECCTED BUT MARKET RETRACED OVERNIGHT IN A SHARP DOWNWARD SLOPE AROUND 12 MIDNIGHT NIGERIAN TIME LATE YESTERDAY.

I THINK THE MARKET IS STARTING TO MAKE AN RETURN TO ITS PREVIOUS LEVEL AT 1.04940 THOUGH PRESENTLY AT 1.04424. THE MOVEMENT UPWARD IS SLOW BUT STEADY. IN A FEW HOURS/ DAYS THE EURO SHOULD HAVE MADE A 100% RETURN TO ITS FORMER TREND.

THIS IS MY HONEST POSITION THIS EARLY TUESDAY MORNING AT ABOUT 10:40AM NIGERIAN TIME.

THANKS,

TOPE AJALA

FROM NIGERIAJanuary 27, 2025 at 11:48 pm #18533January 27, 2025 at 11:16 pm #18532January 27, 2025 at 9:19 pm #18530NAS100 DAILY CHART – What do you say?

What do you say about an up like an escalator down like an elevator move other than the high is likely in for now.

On the other side, now dependent on holding 20475 (2025 low) to prevent a run at 20000-20300… Monday’s freefall low was 20600. .

Back above 21192, at a minimum, is needed to slow the risk.

January 27, 2025 at 9:13 pm #18529January 27, 2025 at 8:40 pm #18527January 27, 2025 at 8:35 pm #18526NIO Inc.

Is Trending Stock NIO Inc. (NIO) a Buy Now?

For the current quarter, NIO is expected to post a loss of $0.40 per share, indicating a change of +11.1% from the year-ago quarter.Right now it is in range between 4.00 and 4.50, but if below 4.00 targets first 3.60 and 3.20 later on.

You should be very careful with NIO as below 3.60 the road would be opened for a ride all the way to 1.20

So if you are buying it to hold onto it and in cash, you can go for it in instalments, so even if the worst comes through you gonna end up with a reasonable average price at the end.

If you trade CFD’s – it is in a bearish mode – so watch your six

January 27, 2025 at 8:30 pm #18525

January 27, 2025 at 8:30 pm #18525 -

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View