- This topic has 11,679 replies, 48 voices, and was last updated 4 months, 2 weeks ago by GVI Forex 2.

-

AuthorPosts

-

January 28, 2025 at 8:05 pm #18581

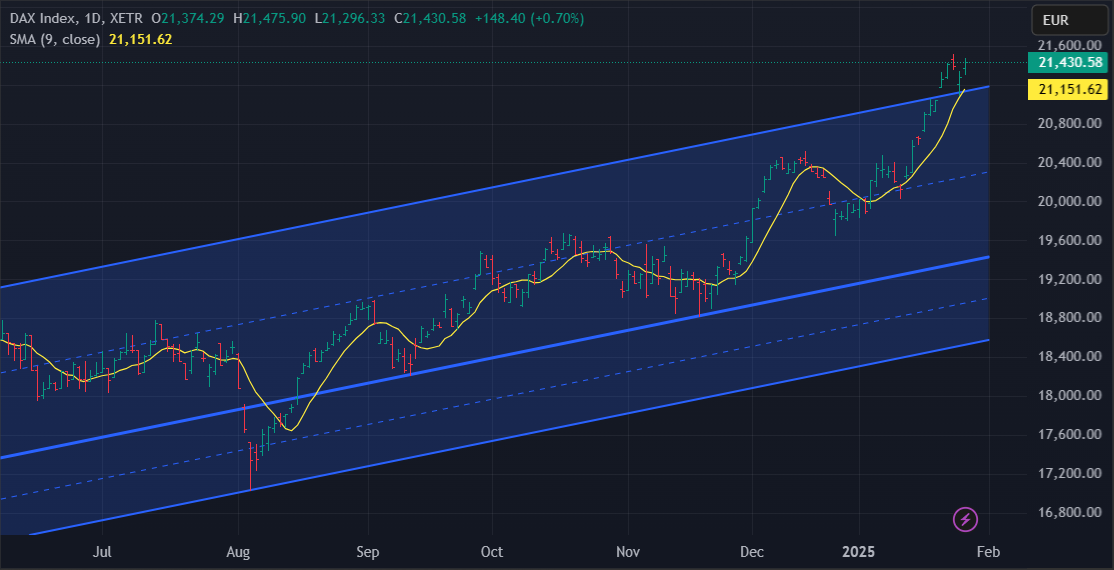

CAC40

CAC 40 Edges Lower on Tuesday

French lagging behind Deutch and Swiss – a lotThe CAC 40 slipped 0.1% to close at 7,897 on Tuesday, extending the prior session’s sharp selloff as pressure from DeepSeek’s launch of a low-cost AI model weighed on key equities.

Meanwhile, investors turned their attention to upcoming monetary policy decisions, with the Federal Reserve set to announce its decision on Wednesday, followed by the European Central Bank on Thursday, alongside the ongoing corporate earnings season.

Schneider Electric led losses, plunging 7.5% to its lowest level since September, while Stellantis fell 1.2%, and STMicroelectronics dropped 3.2%, offsetting broad based gains across luxury goods, financial services, and healthcare sectors.

January 28, 2025 at 7:59 pm #18580January 28, 2025 at 7:55 pm #18579

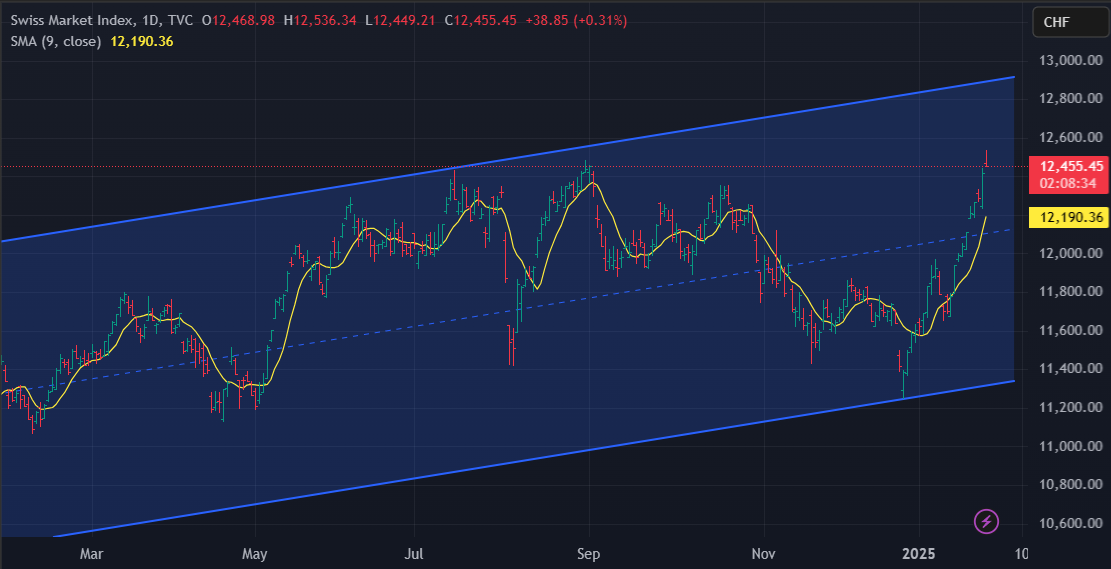

January 28, 2025 at 7:59 pm #18580January 28, 2025 at 7:55 pm #18579DAX Rebounds and Hits New Peak

Germany’s DAX Index Jumps on Corporate Earnings Boost

The blue-chip DAX index ended Tuesday 0.70% higher as market watchers digest the latest wave of earnings results from major companies, boosting investor sentiment.Sartorius SRT was the top-performing stock during the trading session, gaining 11.47% at closing. The German life sciences group said its preliminary sales revenue for 2024 was broadly in line with the prior-year level and issued a “deliberately cautious” outlook for 2025. January 28, 2025 at 7:49 pm #18578

January 28, 2025 at 7:49 pm #18578People will see how AI shuts itself down eventually and then everyone clamors for the trusty radio… the young generation of today don’t know what is an AM/FM radio which works on 2 D-cell batteries… it’s all that AI euphoria going on nowadays. Yeah, AI is good but only up to a certain extent it can do one thing which is to help improve the processing powers of the human mind.

January 28, 2025 at 7:41 pm #18577Shark Menace: I won’t solve it… too much law law law law law… laws are working against the people… All they need to do is issue a small number of commercial shark harvesting permits to a maximum of like 4 people on each coast, permits allowing them harvesting rights from the shoreline up to 500 foot sea depth, permitting each to harvest and carry no more than 30 fish (above 50 inches) per day into port… it controls the population and is an evergreen source of direct income for fishermen,…

Shark attacks against mankind are becoming more common in almost each and every country which bans shark harvesting for commercial exploitation…

This is (I can be almost sure) going to become a common occurrence where a hobbyist fishing for snapper instead hooks a 6 foot bull shark by mistake and starts reeling it in, and a 9 foot bull shark moves in so quickly and bites the smaller 6 foot bull shark in half and darts off, only then to do a U-turn and swim back around to gobble up the other half of the 6 footer…

Sharks are creatures of ingratitude and cannot be trained/domesticated… Bull sharks have even been caught in freshwater rivers up to 1500 miles away from the ocean… Fully grown sharks have attacked people wading in a river, in as little as 12 inches of water depth…

Now what on earth can AI do to prevent something like that from happening…?

in other words AI is good for only one thing… and that one thing is to shut itself down…

January 28, 2025 at 7:34 pm #18576Market’s nowadays panic over the smallest matter… Besides the deepseek rout is a non-event as it just came out over the weekend and has not yet generated even a dolar of profit. At most it’s just a guzzler of electricity,… and a waste of time and money… The oligarchy touting AI as the next best thing cannot benefit from it,… it cannot help them sleep better than the soothing music playing on the radio… Radio AM/FM bands will make more money than AI in the long term… Just wait and see..

January 28, 2025 at 7:27 pm #18575January 28, 2025 at 7:22 pm #18574January 28, 2025 at 7:12 pm #18573DLRx N of 107 is positive for the dollar

JEROME is unlikely to surprise the market and is likely to oooh and aaah about further intentions about meddling with rates

I am guessing that the biggly loaded long dollars ahve not washed out in the recent dip but on the other hand it should also limit further dramatic dollar rise. I could see more dollar upside if donald comes out swingging more but .

10-yr N of 4.5% also lends support to the DLR

January 28, 2025 at 6:47 pm #18572January 28, 2025 at 5:58 pm #18571Euro is reacting to Treasury bonds lately fairly well. What looked like a possible breakout to the upside recently in Euro was not in the bonds. Various stock futures and indices have also been providing a clear window into flows. Stocks are up today but overall they are still experiencing sell side flows of weight. A bit stiff to not anticipate Euro sub 1.04 coming up even if temporary. Common sense might dictate pre-Wednsday positioning in play.

January 28, 2025 at 4:04 pm #18570EURUSD failed to test 1.0444 let alone 1.0450/57 but downside contained after a pauwe above 1.0411.

USDJPY trading well above 155 on the pop in stocks

XAUUSD above 2650 after finding support in my 2725-35 zone but still just consolidating.

NASDAQ The UP 1.1%

Now the wait is on for CB meetings or next Trump tweet.

January 28, 2025 at 3:05 pm #18569January 28, 2025 at 2:50 pm #18567January 28, 2025 at 2:36 pm #18566Uncertainties around U.S. policies could slow global economic growth modestly in 2025, according to major brokerages. They expect U.S. President Donald Trump’s likely plan to raise tariffs to fuel volatility in global markets, raising inflationary pressures, which could limit major central from easing their monetary policy.

Following are the forecasts from some top banks on economic growth, inflation and the performance of major asset classes in 2025.

Forecasts for stocks, currencies and bonds:

Brokerage S&P 500 target U.S. 10-year yield EUR/USD USD/JPY USD/CNY

January 28, 2025 at 2:32 pm #18565January 28, 2025 at 2:28 pm #18564

January 28, 2025 at 2:32 pm #18565January 28, 2025 at 2:28 pm #18564The euro could rise slightly if the European Central Bank delivers a cautious tone about interest rate cuts at Thursday’s meeting, Bank of America analysts say in a note. “The market is already pricing two cuts for the next two meetings, and the ECB is unlikely to commit to more cuts beyond that right now.” This potential caution could provide some modest support to the euro given short positioning that bets against the single currency, they say. However, BofA remains cautious on the euro in the near term due to the risk of U.S. trade tariffs, which could add to the case for further ECB rate cuts. The euro falls 0.6% to $1.0432.

January 28, 2025 at 1:42 pm #18560January 28, 2025 at 1:25 pm #18559January 28, 2025 at 1:11 pm #18558 -

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View