- This topic has 175 replies, 13 voices, and was last updated 4 months, 3 weeks ago by Belgrade Bobby.

-

AuthorPosts

-

January 31, 2025 at 2:54 pm #18819January 31, 2025 at 2:53 pm #18818January 31, 2025 at 2:53 pm #18817January 31, 2025 at 2:28 pm #18814January 31, 2025 at 2:26 pm #18813January 30, 2025 at 2:58 pm #18744January 30, 2025 at 2:19 pm #18740January 30, 2025 at 1:53 pm #18737January 30, 2025 at 1:52 pm #18736January 29, 2025 at 4:26 pm #18651

Mr Bobby, First of all, you can never lose 5 trades in a row with a 90% win rate, do the maths yourself, it’s 1 out of 10,000 (0.01%)

Or to put it in better perspective, there’s a 99.99% chance that you won’t lose 5 trades in a row, if you understand probability, you know how difficult this is.

Secondly, yes you need 9 wins in a row to cover one loss, but you can go on insane winning streaks, there’s almost a 10% chance of winning 22 trades in a row, do the maths yourself, that will also help you curb the losing streaks, should you lose 2 in a row, as for risking on prop firms, I use something called Kelly Criterion for my stake sizing, the optimal risk for me is 1/4 of the Kelly,The formula for Kelly is (F=BP-Q/B)

F is the optimal amount you should risk to get the maximum returns possible.

B is the reward for every one dollar risked,

P is the winning probability

Q is the losing probability

For my own strategy, the 1/4 Kelly recommends 6.25% risk, which translates to 0.625% risk per trade, according to my calculations, if you have an inverse risk to reward of $5 to $1, with an 87.5% win rate, (7/8) on average. And you take 4 trades on average a day, you will make a guaranteed, 5% after 30 days, with initial risk of 0.625% because of compounding, in 3 months, you should be done with both phases very conservatively, so by risking 0.625% per trade, you will need 8 losses in a row to hit ur daily drawdown, with a 90% win rate, the probability of you losing is 0.000001% (which is approximately 1 in 1 million, that’s totally impossible) win rate really affects drawdown, most traders are used to the drawdowns that comes with a 40% win rate, because most traders use a positive RR, they are more like to lose 4 in a row than they will win 4 in a row, that’s why they really need to risk 1% to 2%, with a higher win rate you can risk 5% to 10% and still be very okay

January 29, 2025 at 2:50 pm #18639OK Edikan – I thought that’s the way you look at it , and I did find some sense in it.

Problem is that it is enough to be wrong once to be screwed up – you need to be right 9 times in a row just to cover that loss.

But I do understand what are you talking about – I know that even 5 pips (5$) is enough to hold your position to make 3$ ( so even more then 1).

Real suffering comes from the fact that once your stop is hit, you rush in another one and easily you can roll 5 losses in a raw….and then it is game over.

And we are trying here to explain to the people ( most without much experience) what will secure their existence in this game.

On the other hand, going with the Prop , with their extreme rules ( like never below 5% of the peak ) this is suicidal ….Or you have to go with a very low leverage…so again : how to make their targets?

January 29, 2025 at 2:25 pm #18636Mt. Bobby, I read ur article on risk to reward, it still doesn’t change my view, I’m of the strong believe that win rate is heavily linked to RR, someone who risks $9 to make $1, on default has a win rate of 90%, you can prove this by yourself by taking random trades with a $9 to $1 inverse RR and track ur win rate, if you have an edge, u will easily win above 90%

January 29, 2025 at 11:37 am #18625Mr.Edikan, my name is Bobby but if you insist , you can call me Lord of Belgrade by all means 😀

Please read what I posted yesterday on R/R issue…

I am reading again what you posted, and really can’t see the logic – taking into account real trades I am missing a point.

Elaborate this issue a bit, so we can all get to the point.

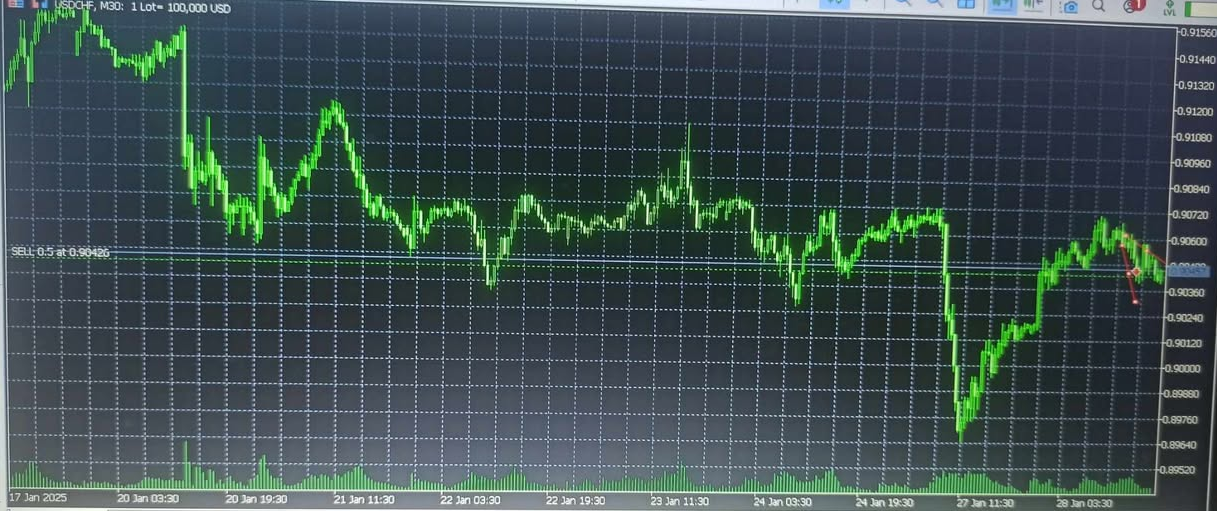

January 29, 2025 at 9:31 am #18609January 28, 2025 at 10:58 pm #18601January 28, 2025 at 2:59 pm #18568AT 3:30PM NIGERIAN TIME, USD/CHF CAME DOWN TO PRICE 0.90500 WHICH IS A PERFECT SET UP FOR A FURTHER BUY. IT WAS A DOWNWARD SLOPE WHICH SIGNIFIED FURTHER WEAKENING OF THE BASE CURRENCY AGAINST THE QUOTE CURRENCY CHF (SWISS FRANCS). THE MARKET WENT AS PREDICTED AND I SOLD UP TO 0.90401 WHERE I INTEND GETTING OFF THE GAS. THE MARKET WENT MY WAY AS I PLACED A0.5 SELL TRADE ON THE USD/CHF CURRENCY PAIR. THERE IS A CB CONSUMER CONFIDENCE NEWS COMING UP A T 4PM , A FEW MINUTES FROM NOW. THIS NEWS MIGHT SHAKE THE MARKET , BUT THE PREVIOUS WAS 104.7 WHILE THE FORECAST IS 105.9, IT REMAINS FOR MARKET TO REVEAL THE ACTUAL IN A FEW MINUTES. LET’S KEEP OUR FINGERS CROSSED.

I STAY AWAY FROM VOLATILE NEWS AS MUCH AS POSSIBLE BECAUSE PRICE CAN GO IN ANY DIRECTION. GOOD MONEY MANAGEMENT SKILLS IS REGUIRED HERE AND RISKING BETWEEN 1-3% OF TOTAL CAPITAL PER TRADE IS GOOD IF ONE DOES NOT WANT TO SHIP WRECK HIS ACCOUNT.

THIS IS MY CURRENT ANAYLSIS.

THANKS,

TOPE AJALA

FROM NIGERIA.January 28, 2025 at 2:23 pm #18563January 28, 2025 at 1:04 pm #18556January 28, 2025 at 11:45 am #18550January 28, 2025 at 11:43 am #18549THIS IS 12:30 PM NIGERIAN TIME. GOLD HAS JUST CONSOLIDATED. THERE WAS A SELL DOWN TO 2734.77 THIS MORNINGWHICH WAS THE LOWEST POINT IT HAS REACHED SO FAR TODAY TUESDAY JANUARY 28TH 2025. IN THE LAST 3 HOURS GOLD (XAU/USD) HAS BEEN ON AN UPWARD TREND.

THE UPWARD TREND IS GOINT TO CONTINUE TO AROUND 2746.5 AT LEAST AS PER MY SPECULATION. PRICA HAS BEEN RANGING AROUND PRICE 2744 IN THE LAST 24 HOURS AND I EXPECT A BREAK AWAY FROM THIS LEVEL SOON. A LOT OF FAKEOUTS AND FAKE CANDLES WHICH PROMISED A STRONG BUY BIAS BUT LATER RETRACED CAN BE SEEN ON THE HOURLY CHART. MARKET WILL SOON BREAK THE RANGE ZONE FOR A STRONG BUY SOON.

THAT IS MY LATEST PROJECTION/PREDICTION ON THE GOLD.

THANKS,

TOPE AJALA

FROM NIGERIA. -

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View