-

AuthorSearch Results

-

December 16, 2024 at 9:47 am #16310

In reply to: Forex Forum

December 13, 2024 at 9:33 pm #16227In reply to: Forex Forum

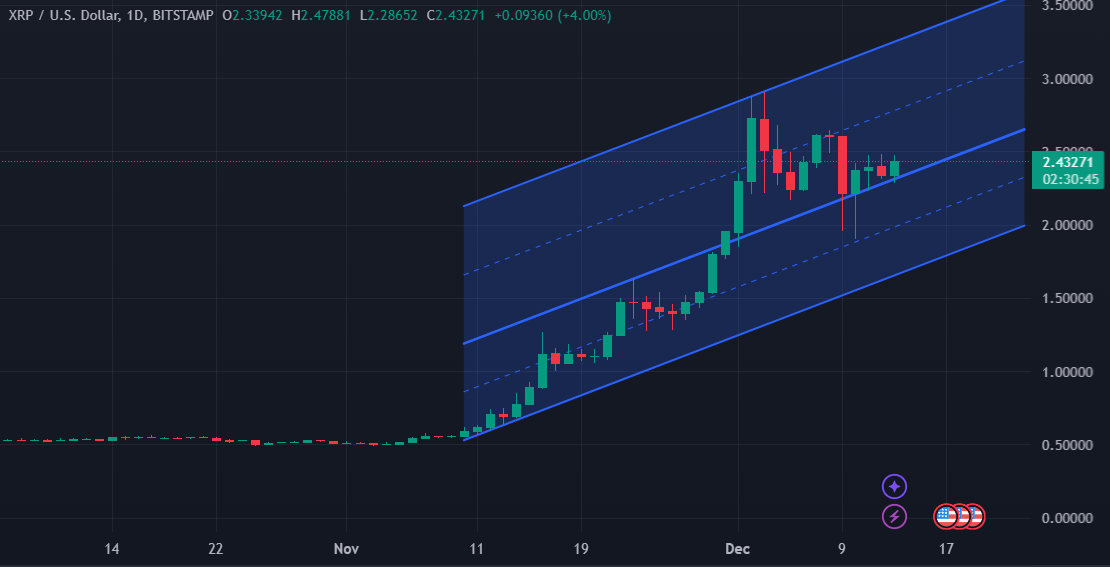

XRPUSD

XRP Joins AI Hype Train With $100 Million Investment

There is a new development in the cryptocurrency world that has people talking. XRP, which has been flying under the radar lately, is set to benefit from a $100 million investment in artificial intelligence development. The commitment comes from KaJ Labs, the developer behind Atua AI, a platform focused on on-chain enterprise solutions. Their plan is to integrate advanced AI tools into the XRP ecosystem, enhancing its functionality within decentralized finance (DeFi) and enterprise operations. December 13, 2024 at 9:28 pm #16226

December 13, 2024 at 9:28 pm #16226In reply to: Forex Forum

December 12, 2024 at 9:11 pm #16186In reply to: Forex Forum

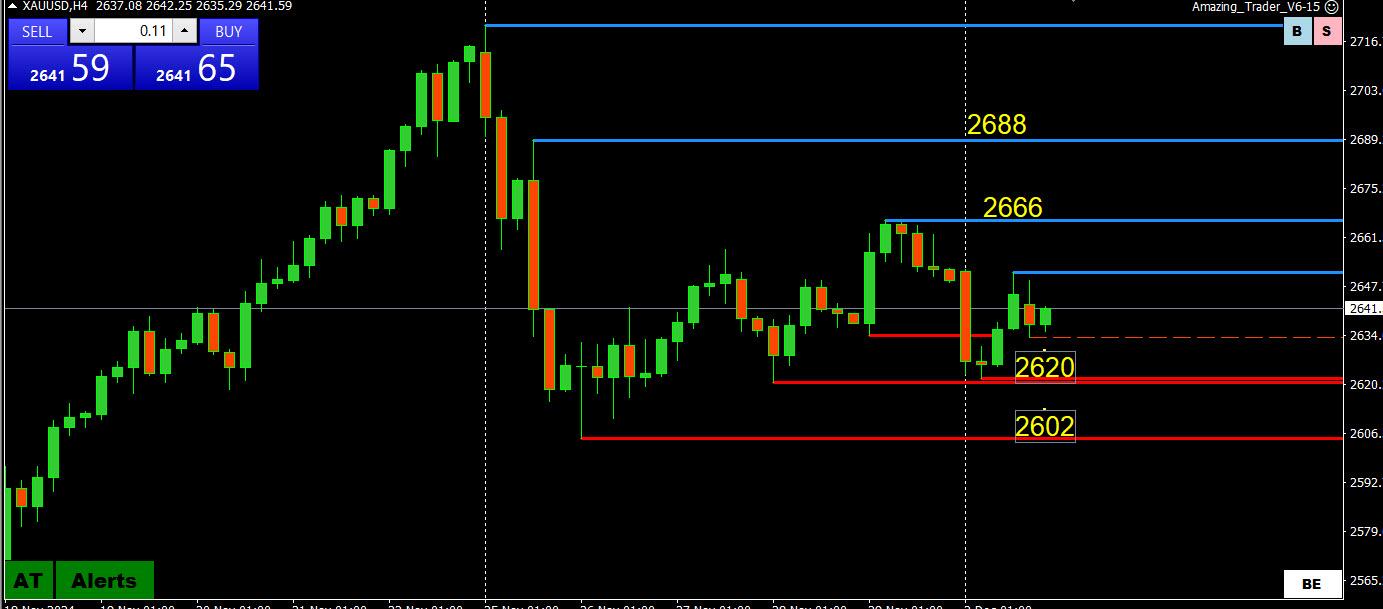

XAUUSD 4 HOUR CHARTT – MISSION ACCOMPLISHED THEN…

We have been citing 2721 AS THE NEXT TARGET AND A BRIEF RUN THROUGH IT DID NOT LAST.

This leaves 2674 as the level that needs to hold to keep the risk on 2721+ as a break would put an end to this latest episode.

In any case, back below 2656 would suggest a greater retracement risk. Otherwise esxpet some consolidation.

December 12, 2024 at 3:12 pm #16159In reply to: Forex Forum

December 11, 2024 at 9:03 pm #16136In reply to: Forex Forum

US500 4 HOUR CHART – 6100 OR BUST?

Just when it looked like US500 was ready for a retracement it switched gears and made a fresh run at the upside.

To keep this simple, anything other than a firm break of 6100 would be considered a disappointment.

So it is either consolidation (while above 6030-35) or a run at a new record high

December 9, 2024 at 11:57 pm #15985In reply to: Forex Forum

As Holidays are approaching, we in Global view team have found a way to make the best of you very happy.

We are going to give away every week, for next three months FREE entry to Prop Challenge to those that perform the best in our Evaluation.

It is absolutely free and without any hidden fees !

December 9, 2024 at 8:36 pm #15958In reply to: Forex Forum

December 9, 2024 at 8:35 pm #15957In reply to: Trading Hot Line

December 9, 2024 at 11:06 am #15914In reply to: Forex Forum

December 9, 2024 at 10:11 am #15911In reply to: Forex Forum

December 5, 2024 at 10:10 am #15671In reply to: Forex Forum

December 3, 2024 at 11:38 pm #15570In reply to: Forex Forum

December 3, 2024 at 10:28 pm #15551In reply to: Forex Forum

December 3, 2024 at 3:13 pm #15504In reply to: Forex Forum

I see a lot of volume in 149.60 area still present for UsdJpy based on futures and options contracts with 149.30 being the same but less. So the potential for a stop/order run through the latter is conceivable and .60 you may hit a sweet spot unless the market absolutely reverses in my view. A bit much to ask for today but possible.

December 2, 2024 at 8:34 pm #15439In reply to: Forex Forum

December 2, 2024 at 8:34 pm #15438In reply to: Forex Forum

December 1, 2024 at 7:52 pm #15354In reply to: Forex Forum

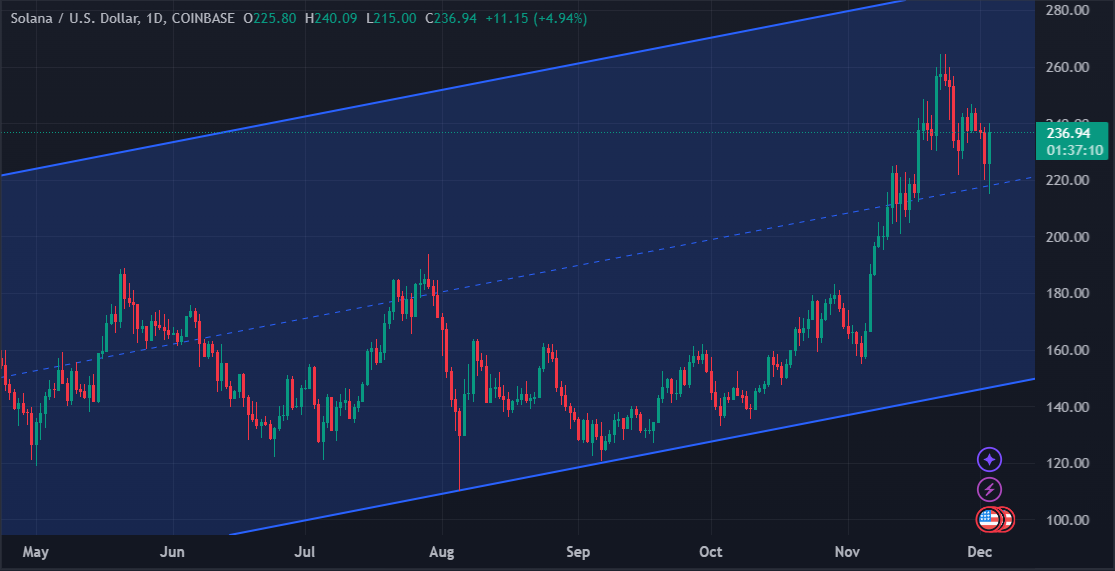

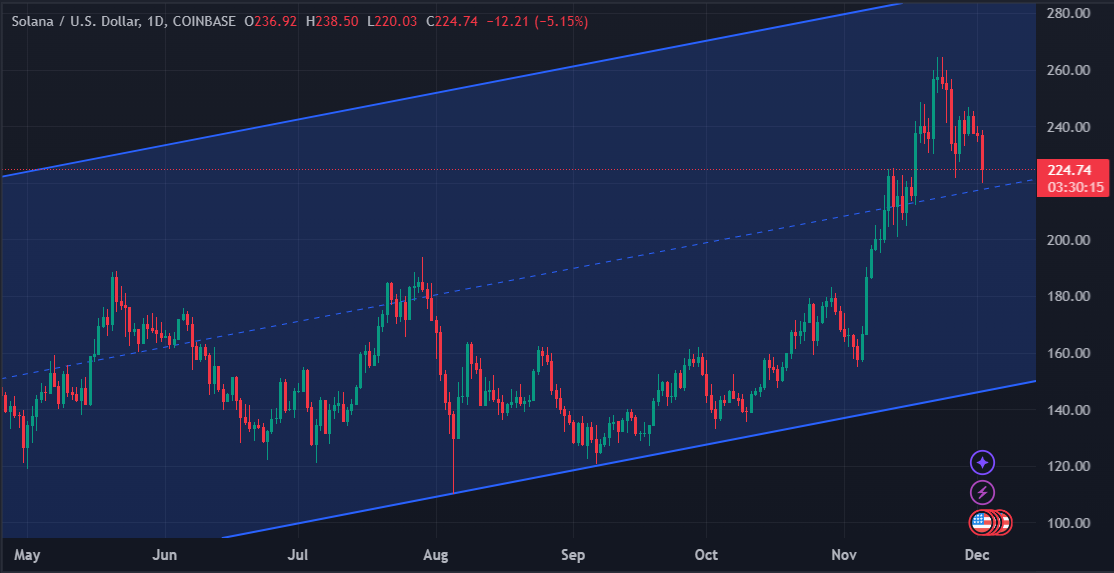

XRPUSD

Ripple Surpasses Solana as XRP Price Hits 6-Year High Above $2

The impressive performance of Ripple’s native token continues with another surge in the past 24 hours that pushed its price above $2 for the first time since early 2018.

In the process, XRP has surpassed SOL to become the fourth-largest cryptocurrency by market cap.

November 28, 2024 at 5:10 pm #15254

November 28, 2024 at 5:10 pm #15254In reply to: Forex Forum

You know there is something wrong with you when almost the first thing you do on a holiday morning is peer into markets, closed or not.

The way I see it the big question is have the Trump trades been just a reaction or will the condition stick, and what will the volatility look like going forward.

1. I think we see continuation of current/recent conditions overall.

2. The more unanswered questions are solved the less uneasiness there will be.

3. Some developments will cause further chaos such as what we have seen in non-US Dollar vehicles.

4. The irony is Trump’s aggressiveness will yield stability in areas where there was little prior.

5. There will be structural improvement.

The bottom line is there is a mountain of repair work taking place already before he even gets into office. The arrangement with Mexico yesterday is an example.

The one that is bothering me is the monstrosity Yellen, the Fed and the others have left us with relation to deficits, including the trade deficit which is has been so far out of balance it has knocked the purchasing power of the US Dollar down to roughly 5 cents on the Dollar as compared to 1918.

(I spend countless hours into the wee hours of night in analysis).

The bottom line should be a long running bull run in US stocks, strength in micro-cap stocks as well including MSCI as a carry over benefit.

Continued Dollar strength overall for the long haul with some intermissions.

November 27, 2024 at 8:19 am #15168In reply to: Forex Forum

-

AuthorSearch Results

© 2024 Global View