-

AuthorSearch Results

-

January 27, 2025 at 10:51 am #18482

In reply to: Forex Forum

January 23, 2025 at 8:53 pm #18321In reply to: Forex Forum

January 23, 2025 at 8:38 pm #18315In reply to: Forex Forum

Crude Oil Futures – CL1!

Crude Falls as Trump Prods Saudi Arabia and OPEC to Lower Oil Prices

March WTI crude oil (CLH25) Thursday closed down -0.82 (-1.09%), and March RBOB gasoline (RBH25) closed up +0.0084 (+0.40%).Crude and gasoline prices settled mixed on Thursday, with crude falling to a 1-1/2 week low. Crude gave up early gains Thursday and turned lower after President Trump said he would push Saudi Arabia and OPEC to reduce the price of crude.

An increase in crude oil held worldwide on tankers is bearish for oil prices. Vortexa reported Monday that crude oil stored on tankers that have been stationary for at least seven days rose by +2.5% w/w to 54.23 million bbl in the week ended January 17.

January 23, 2025 at 10:39 am #18265

January 23, 2025 at 10:39 am #18265In reply to: Forex Forum

January 22, 2025 at 9:04 pm #18244In reply to: Forex Forum

Light Crude Oil Futures – CL1!

Crude Prices Slip on Dollar Strength and Tariff Concerns

March WTI crude oil (CLH25) Wednesday closed down -0.39 (-0.51%), and March RBOB gasoline (RBH25) closed down -0.0286 (-1.35%).Crude prices came under pressure Wednesday after President Trump warned that he is considering a 10% tariff on all Chinese goods in retaliation for the flow of fentanyl from the country.

Wednesday’s monthly report from the Bundesbank signals weak energy demand in Europe’s largest economy and is bearish for crude prices after the report said, “In the first quarter of 2025, the German economy is unlikely to emerge from its long period of stagnation.”

January 22, 2025 at 8:48 pm #18239

January 22, 2025 at 8:48 pm #18239In reply to: Forex Forum

January 22, 2025 at 2:04 pm #18218In reply to: Forex Forum

EURUSD Daily

In line with what I said yesterday, so no need to repeat myself.

Now only remaining question is if EUR manages to close above that trendline tonight…

This is now the first signal that things are changing in EUR favour – It is a very early sign – 1.01800 held its ground, and more pull-push actions will be seen, with 1.02050 acting as a Major support.

This is a first time in awhile that I can see 1.06500 coming in play once again, but it will take some time so don’t expect any instant solutions.

We will continue following the developments on the Daily and Intraday basis as well – so stay tuned for more insights…

January 20, 2025 at 6:56 pm #18117

January 20, 2025 at 6:56 pm #18117In reply to: Forex Forum

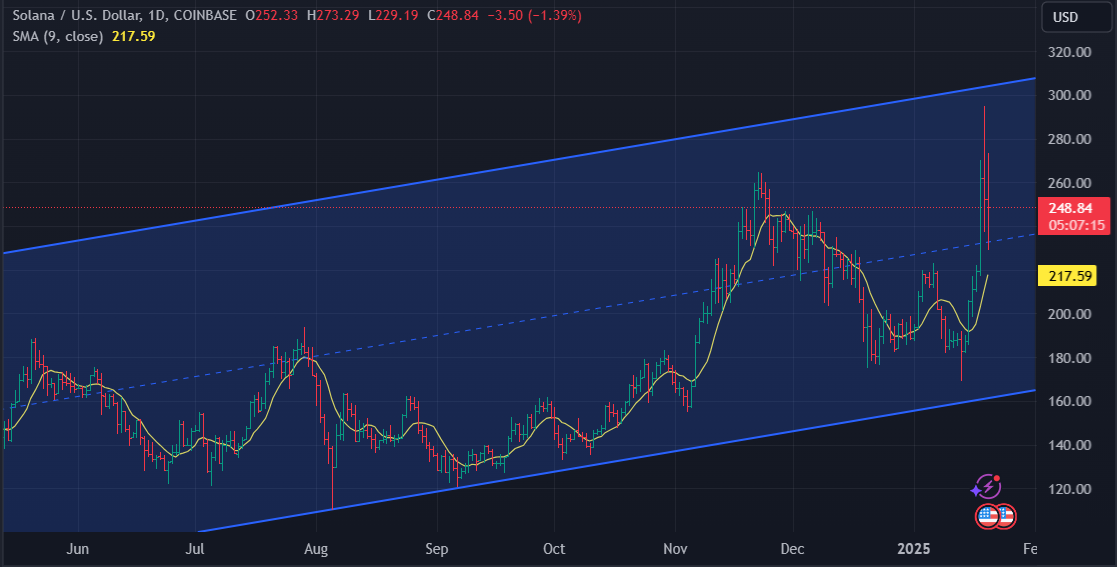

SOLUSD

Solana Bulls Counter Bearish Pressure To Keep Price Above $240

Solana price action is heating up as bulls show efforts to fend off bearish pressure and maintain the cryptocurrency above the vital $240 support level. This threshold has emerged as a key marker of market sentiment, serving as a critical point of defense for buyers aiming to keep the uptrend intact.

January 18, 2025 at 7:08 pm #18046

January 18, 2025 at 7:08 pm #18046In reply to: Trading Academy

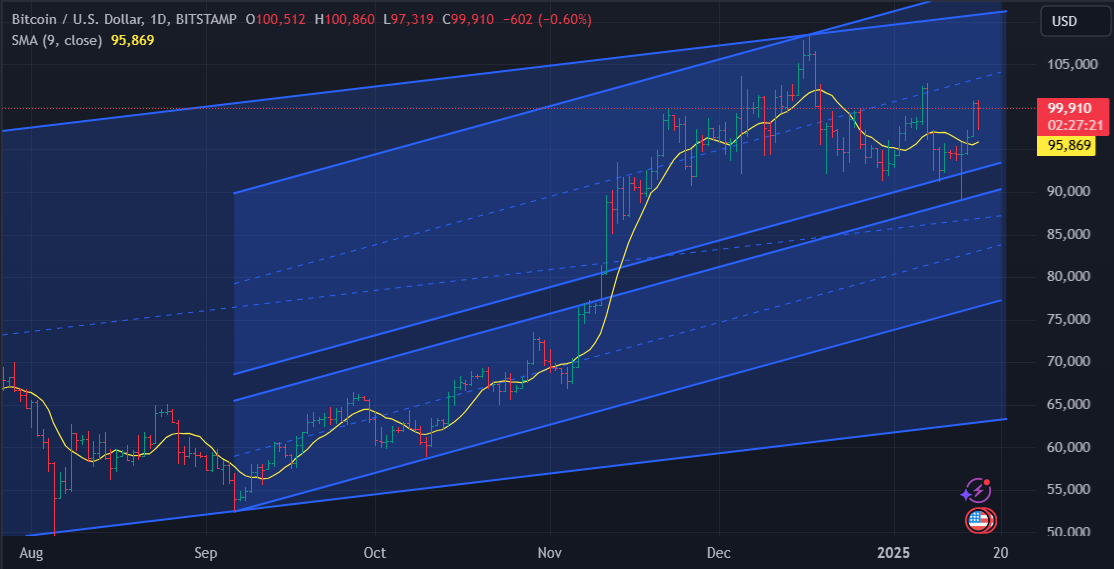

Only thing that bothers me with BTC and its advances is time-space correlation right now.

This is a fifth day in a row of pushing Up – so might be the time for some consolidation.

Do not try to sell it – it can just continue Up with some sideways corrections.

Personally I wouldn’t touch it till Tuesday – Monday is Trump Inauguration day….so be very careful.

January 16, 2025 at 9:38 pm #17956In reply to: Forex Forum

BTCUSD Daily

Resistance 100.850.00 & 102.750.00 – have to be taken or more consolidation will be needed.

89K should hold, but even if lost at one point there is always 80K area for Coin to be picked up.

Right now – the pattern that is unfolding is not looking good for immediate BTC advance , but taking into account Trump Inauguration and all who knows….

January 16, 2025 at 9:20 pm #17952

January 16, 2025 at 9:20 pm #17952In reply to: Forex Forum

January 15, 2025 at 8:39 pm #17853In reply to: Forex Forum

SOLUSD Daily

Solana stayed shy of the Support trendline ( similar to Bitcoin) , and it has to take out 223.00 to attack the high.

However, it is still very much possible to see prolonged consolidation and to reach 160.00 prior to renewed Up Trend.

Be patient and do not try to run after it – you might end up buying a high that can last even several weeks….

January 15, 2025 at 7:18 pm #17844

January 15, 2025 at 7:18 pm #17844In reply to: Forex Forum

Rafe ,,, remember those drones that were hovering over NJ and area ? Those were training … to swarm down 5 minutes before the inauguration and abduct donald … BUT … then the good guys will have jammed and hacked the navigational software and deposit donald one or two feet inside the w/h …. the crowds will be going absolutely wild

nothing normal about donald !

January 15, 2025 at 1:57 pm #17816In reply to: Forex Forum

EURUSD:-

My Long Term forecast for EURUSD is as follows:

There is solid resistance @ 1.1036, which is the recommended level from which to short this pair. Shorts can be initiated at lower levels if resistance proves too strong. The markets have taken a breather @ 1.0323 awaiting the outcome of Trump’s Inauguration ceremony and markets are at the same time gathering downside momentum towards the first target @ 0.9612. Below 0.9612 there is nothing but solid support target @ 0.8188.

A breach above 1.1036 would negate my views and would call for thorough re-evaluation of macroeconomic fundamentals.

Comments and Opinions appreciated.

GL GT!

January 14, 2025 at 9:33 pm #17804In reply to: Forex Forum

January 13, 2025 at 12:25 pm #17699In reply to: Forex Forum

January 12, 2025 at 6:51 am #17653In reply to: Forex Forum

AnonymousThe main contribution to renewable energy has comes from wind power, at 31% of total production, followed by solar power at 12%, biomass at 8%, and other renewable sources such as hydroelectricity for the remaining 3.4%. In 2024, renewable energy accounted for almost 60% of German electricity production in the first half of the year. This production level, however, is smoothed out over a given period and does not reflect moments of crisis such as the “Dunkelflaute.”

Dunkelflaute

Literally “flat, dark calm,” Dunkelflaute is characterized by a simultaneous lack of wind and sun in winter, when demand for electricity in Germany is at its highest.

https://www.gatestoneinstitute.org/21244/europe-germany-renewable-energy

January 10, 2025 at 3:20 pm #17582In reply to: Trading Tip of The Week

4. Trading Tip: How to Use Retracements to Your Advantage

Retracements are a necessary evil. They are a market’s mechanism to shake out weak longs or shorts when positions get too over extended on one side or the other.’

See why retracements are important

Let’s say we are in a trend. The market gets overbought or oversold. It needs a shakeout. By shakeout I mean the market needs to squeeze out the weak hands, the weak shorts or weak longs before it can go after a new high or low….

…the currency (or any market) needs to do now is make a new retracement low or high (as the case may be) before buyers/sellers come in and resume the trend.

The point here is when you have a retracement and it stalls, beware of the move back in the direction of the overall trend as the market has less ability to absorb the flows than before the market corrected.

Textbook case: EURUSD Retracement

As this chart shows, it was a textbook case in the EURUSD, which plunged to a 1.0682 low after the U.S. election results. It then retraced sharply to 1.0833 but did not go far enough to break the downtrend. It then reversed in favor of the trend to break to a new low.

The key takeaway is when in a mature trend or one that has moved too far, too fast a retracement is necessary to setup a move to a new low or high. Keep this in mind when trading in a trend. View a retracement as a necessary evil that is needed before a trend can resume. BUT don’t ignore what charts are saying when a market retraces.

In this regard , keep an eye on longer term technical levels that would either keep the current trend intact or break a level that would change the technical picture. Following this logic will allow you to take advantage of retracements rather than letting them take advantage of you.

Addendum: November 13, 2024

To further prove the logic of what I discussed, See the following chart where a mini retracement that took out stops and weak short EURUSD positions was followed by a move down to a new low.

January 10, 2025 at 10:01 am #17552In reply to: Forex Forum

AnonymousJanuary 8, 2025 at 9:06 pm #17379In reply to: Forex Forum

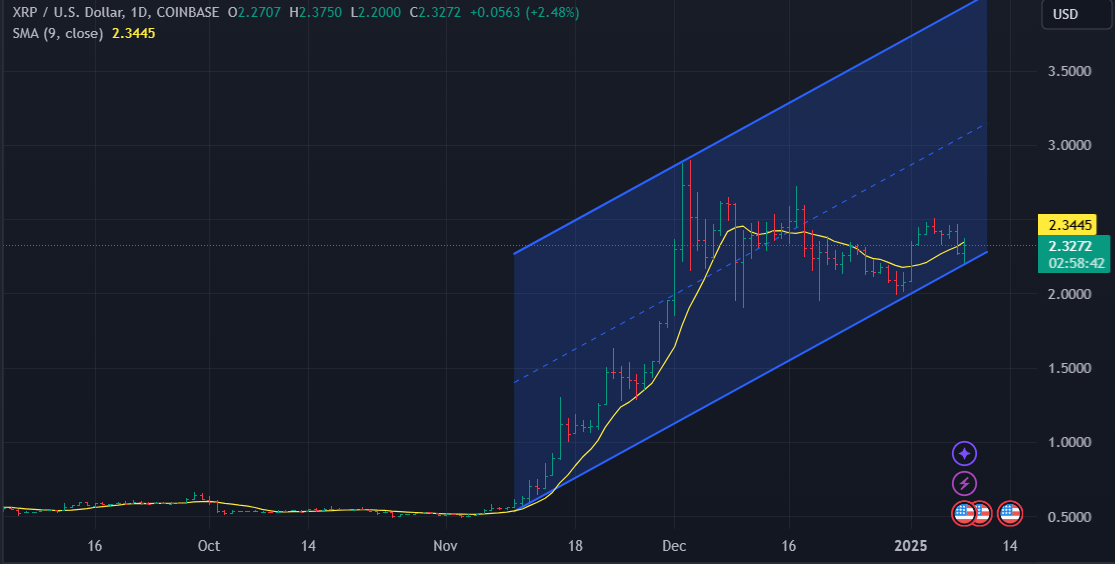

XRPUSD

XRP Stronger Than Everyone: 2.2 Million Transactions

As the most successful cryptocurrency, XRP has maintained its position as the most reliable asset on a market that is prone to volatility. At $2.03, XRP has risen 10.6% in the last week, surpassing Bitcoin, Ethereum and Binance Coin, which are suffering losses ranging from 4% to more than 8%.

XRP is consolidating within a bullish triangle pattern, with resistance at $2.50 and immediate support at $2.20. Significant buying interest could be generated by a breakout above $2.50, which could lead to $3.00, a crucial psychological level.The downside is that a retracement toward $1.90 might occur if the $2.20 support is lost.

-

AuthorSearch Results

© 2024 Global View