-

AuthorSearch Results

-

February 10, 2025 at 10:55 am #19270

In reply to: Forex Forum

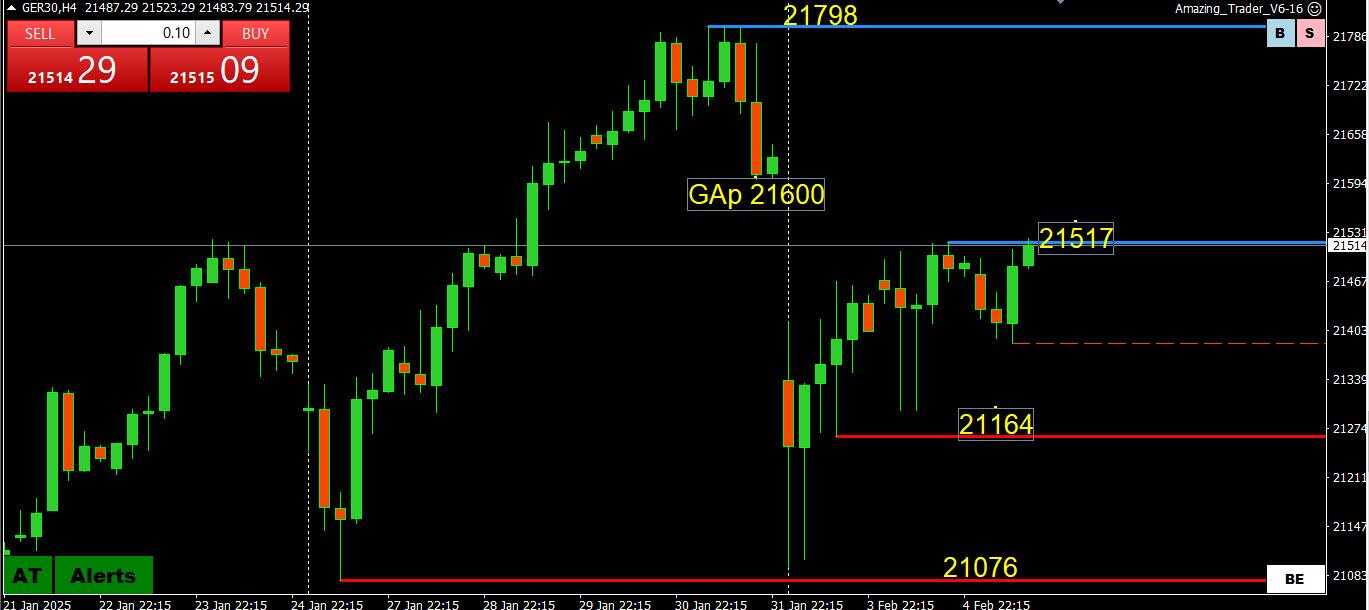

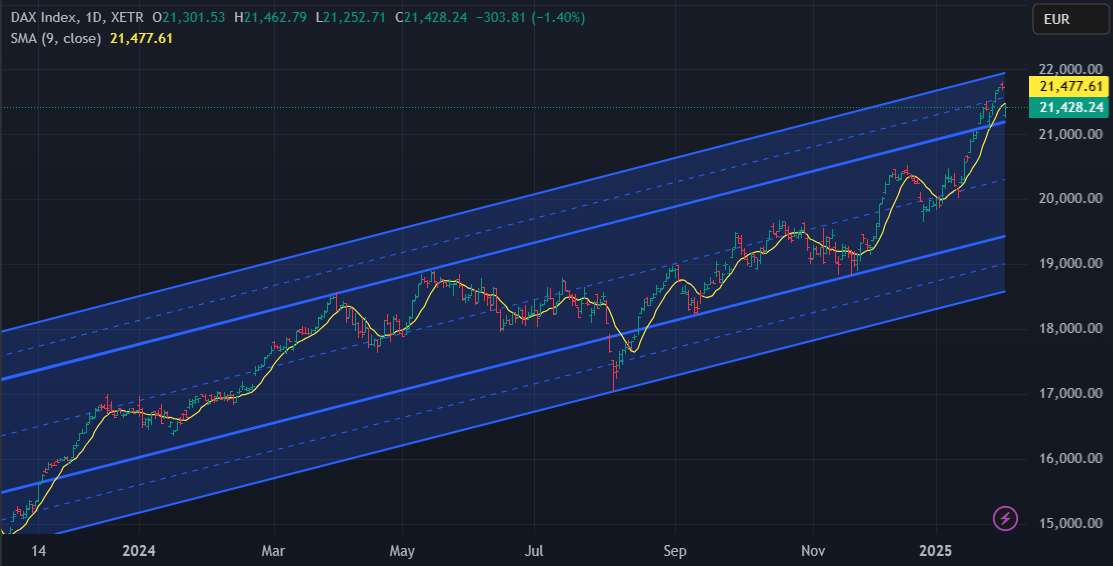

GER30 4 HOUR CHART – TAKING A PAUSE?

The DAX (GER30) has been a star performer, up each week so far this year. This winning streak will be a key focus this week.

In this regard, the record high set last week at 21946 had yet to be touched today so consolidation while below it.

On the downside, only below 21386 would dent momentum and suggest a pause.

February 10, 2025 at 1:05 am #19262In reply to: Trading Academy

Mr. Bobby, thanks for taking out your time to reply me, I really do appreciate, but you lost me at the 96% win rate at 1 to 3 RR, was it a typo or you really meant what you said. That win rate means you lose on average once every 25 trades, that is incredibly high for a positive RR of above 1 to 3, you should literally be a billionaire if those stats hold true. And is there any sort of broker statement or any third party tracker you have connected to your account, to help me solidify my belief in you. Maybe Tradezella or myforexbook or any of them? Because truly I have never seen anyone win 96% of the time with a positive RR. I look forward to seeing the broker statement, Thanks so much in Advance Sir

February 6, 2025 at 10:41 pm #19142In reply to: Forex Forum

US500 4 HOUR CHART – Little Engine That Could

Do you remember the children’s book, The Little Engine That Could who said I think I can, I think I can” as it tried to chug up a hill.

Well, US500 is trying to chug up to its record high ay 6119 but so far it does not have the power to do so.

This leaves it consolidating within a 5900-6100 range, where it keeps a bid as long as it stays above 6000.

February 6, 2025 at 8:32 pm #19136In reply to: Forex Forum

February 5, 2025 at 10:02 pm #19096In reply to: Forex Forum

February 5, 2025 at 9:07 pm #19082In reply to: Forex Forum

XRPUSD

This is my view on probable development in coming weeks.

Support at 1.90

Resistance at 3.00

In the case support holds any attacks, we are going to continue moving Up within the lower channel.

It should take 2-3 weeks of consolidation and approach to previous all time high (3.40)

If it happens like that, next target would be in 5.50 area

February 5, 2025 at 7:10 pm #19069

February 5, 2025 at 7:10 pm #19069In reply to: Forex Forum

Trump solved a problem that has plagued the world for decades… he has decided to take over and develop Palestine which is the best option because their going back is only gonna make matter’s worst… it’s gonna become an insurgency along the lines of a riotus civil war… one that would over run the Israeli border…

February 5, 2025 at 4:18 pm #19051In reply to: Forex Forum

February 5, 2025 at 1:32 pm #19040In reply to: Forex Forum

February 4, 2025 at 8:19 pm #19009In reply to: Forex Forum

February 4, 2025 at 5:55 pm #19006In reply to: Forex Forum

February 4, 2025 at 10:31 am #18987In reply to: Forex Forum

February 4, 2025 at 10:25 am #18986In reply to: Forex Forum

February 3, 2025 at 8:52 pm #18974In reply to: Forex Forum

February 3, 2025 at 7:01 pm #18970In reply to: Forex Forum

The population inside of the United States would need to live frugally and save their money, buy what is essential. It’s no wonder when the elders say that money saved is money earned, don’t waste it on useless things, instead invest wisely and see for yourselves how money makes money.

Buying treasuries is a way to start and is like a karmic blessing from the central bank, and you’re bound to do well in life just because of that one virtue, it’s like blessings of grandparents and great grandparents. There is absolutely no way to fail in buying treasuries.

Case in Point: I reckoned I could buy another brand new ride but then my parents reminded me of the above principles, and I followed the advice to the T simply by following the principle of delayed gratification, and I don’t regret it one bit. I can buy another one later down the line but then at that time I’d postpone it again and use that money to buy stocks…lol

My Logic to buttress their point: A new vehicle is parked in a parking slot for 85% of the time but yet depreciates 20%-30% per annum considering wear and tear which takes place while it’s being used for only 15% of the time, exceptions being the luxury cars (Ferrari etc) which cost many times more than the cost of many mid to high-range vehicles and cost the same amount as a mid-range vehicle to maintain on a per annum basis…

GL GT

February 3, 2025 at 10:56 am #18929In reply to: Trading Tip of The Week

January 31, 2025 at 6:29 pm #18839In reply to: Forex Forum

January 31, 2025 at 4:23 pm #18832In reply to: Forex Forum

Budget 2025: Focus on growth and fiscal consolidation

The street expects Finance Minister Nirmala Sitharaman to walk the path of fiscal prudence as she readies to deliver her eighth consecutive Union Budget on February 1

The street expects the upcoming Union Budget to signal policy continuity for fiscal prudence even as it aims to revive the animal spirits of the economy. Economists and analysts believe the budget announcements will be centEred around the fiscal consolidation path outlined by the government but are likely to continue with the subsidies announced earlier with a continued focus on increasing the outlay for capital expenditure.

January 30, 2025 at 10:54 pm #18775In reply to: Forex Forum

January 30, 2025 at 10:08 pm #18770In reply to: Forex Forum

-

AuthorSearch Results

© 2024 Global View