-

AuthorSearch Results

-

February 21, 2025 at 10:13 am #19901

In reply to: Forex Forum

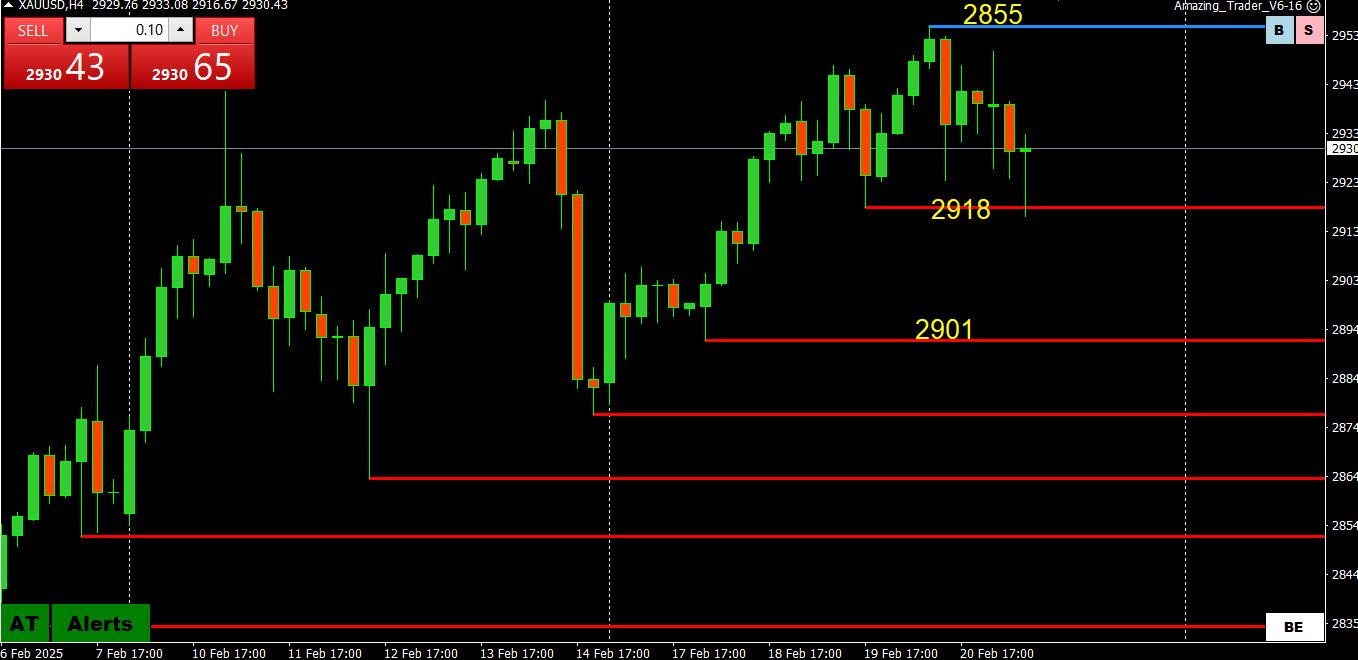

XAUUSD 4 HOUR CHART – Tests support

XAUUSD so far fighting off retracement pressure by holding (just) below support at 2918 cited yesterday.

This leaves it consolidating within a 2917-2950/55 range with a lingering retracement risk unless the upper end is taken out,

To repeat, betting on a retracement has been a losing bet and why I have been citing 2918 as the level hat needs to hold to contain the retrace risk

February 20, 2025 at 10:56 am #19832In reply to: Forex Forum

February 19, 2025 at 9:00 pm #19822In reply to: Forex Forum

February 19, 2025 at 8:36 pm #19820In reply to: Forex Forum

February 19, 2025 at 5:57 pm #19807In reply to: Forex Forum

February 18, 2025 at 1:14 pm #19723In reply to: Forex Forum

February 18, 2025 at 7:56 am #19710In reply to: Forex Forum

February 17, 2025 at 1:48 pm #19654In reply to: Forex Forum

February 17, 2025 at 8:19 am #19639In reply to: Forex Forum

February 16, 2025 at 2:00 pm #19618In reply to: Forex Forum

I would strongly suggest Trump be gentle in matters of immigration and on tariffs. Yes, with hardened criminals yes, be as hard on them as possible but with the normal decent people who work hard… on them please be gentle… live and let live is the name of the game… The spill over effects of all that action has to be considered thoroughly… Increasing Sales tax is a safer and wiser option and by far the wisest defensive measure…

What needs to be done with urgency is for the shipping lines to resume international operations and get capacity to pre-pandemic levels. You know though that the kinds of people who work on ships?. Phillipinos, Malay, Indonesian etc. I have seen those people in action and they are international expatriates, but that being aside… they are “reputed” for working very hard for very long hours. what they do is earn and at the time of retirement they retire back home to their families, some of them stay back but then they retire and live peacefully, so nothing wrong with that. Now on the matters of immigration and tariff crackdowns which when combined may cause shipping industry workers and the shipping lines to boycott port visits… some companies can refuse to export while some will be willing to export but the shipping lines may not be willing to carry the cargo because they don’t have hard working expatriate’s… the only solution then is to hire the Chinese to work on those ships and who knows what Intel they may gather and spill… it might end up that China might create their own shipping lines (if not already) and not only manufacture and export goods to other countries but deliver them to the destinations as well… guarded and escorted of course into the port by Chinese naval vessels… Then you’ll have a problem…

February 15, 2025 at 6:31 pm #19603In reply to: Forex Forum

Putin has something in him called Benevolence,.. not a wicked man or cruel man or madman as made out to be. Putin is the one who made a great success of Post USSR Russia… Let us not forget that.

In the early days they did not have money to pay the military but he grew the country out of those conditions and improved the quality of life in his country and many other nearby countries to a great extent and many of the best things are in store for Russia. If he had not sold a drop of oil to Europe from those days until today then where would Europe be now?

Other people need to not forget the good things he has done for their countries and their economies…

February 15, 2025 at 11:27 am #19596In reply to: Forex Forum

I posted this after the retail saLes report yet bond yields went even lower before backing up a touch into the close.

It was another example of how a market can remain illogical longer than one can remain solvent.

I am not sure if it is a case of the algos running the trading asylum as the bond market is usually a truer barometer but maybe it has joined the club

As I posted after tghe retail sakes report

DOLLAR DOWN AFTER RETAIL SALES MISS

I wonder whether the LA fires and winter storms distorted the numbers but the reaction tO the news is all that mattersz.

10 year yield falls below 4.50%

To illudtrate my point

WASHINGTON, Feb 14 (Reuters) – U.S. retail sales dropped by the most in nearly two years in January, likely weighed down by frigid temperatures, wildfires and motor vehicle shortages, suggesting a sharp slowdown in economic growth early in the first quarter

But the larger-than-expected and across the board decline in retail sales reported by the Commerce Department on Friday probably does not reflect a material shift in consumer spending as it also followed four straight months of hefty increases.

A sharp upward revision to December’s sales took some of the sting from the report. Economists also noted that it was difficult to strip out large seasonal swings from the data at the turn of the year, which was also evident in the January consumer inflation report.

US retail saleUS retails post biggest drop in nearly two years amid winter freeze

February 14, 2025 at 8:44 pm #19592In reply to: Forex Forum

XAUUSD 4 HOUR CHART Logic prevails

There’s an old saying in trading, Markets can remain illogical longer than you can stay solvent.

I thought of this saying as the dollar sold off on easing tariff concerns and hopes for an end to the Ukraine war yet GOLD continued to press higher.’

Well, today logic prevailed after 2942 held for a double top.

Now XAUUSD needs to stay above 2863 as a break would negate the last leg to 2952 and expose a risk if a retracement.

February 14, 2025 at 8:27 pm #19590In reply to: Forex Forum

What right does Trump have to decide for how much Walmart sells eggs?

He has all his presidential rights and authority however to implement a higher sales tax on imported eggs which would make them cost the same as locally produced ones.

The Prime Ministers of other countries will come to Trump and tell him to drop sales taxes for eggs sold by retailers? They can’t decide prices in their own countries then how will they do that in the United States? Who gives them the right and authority to do that here?

February 14, 2025 at 6:27 am #19552In reply to: Forex Forum

February 13, 2025 at 7:48 pm #19520In reply to: Forex Forum

February 13, 2025 at 10:11 am #19469In reply to: Forex Forum

XAUUSD 4 HOUR CHART – Watch 2900

Failure to test 2952 (low 2963) gas contained the retracement and move back above 2909 has cooled the risk.

So choice is consolidation between 2863-2942 or a fresh run at the high.

In any case 2900 will likely be pivotal in setting the trading bias.

Intra-day, 2922 has so far capped the upside.

February 13, 2025 at 6:26 am #19466In reply to: Forex Forum

February 12, 2025 at 11:48 am #19415In reply to: Forex Forum

NEWsQUAWK US OPEN

USD and USTs steady ahead of US CPI while crude slips; reports suggest optimism surrounding Middle Eastern talks

Good morning USA traders, hope your day is off to a great start! Here are the top 5 things you need to know for today’s market.

5 Things You Need to Know

US President Trump responded “We’ll see” when asked if reciprocal tariffs are still coming on Wednesday.

European bourses hold an upward tilt pre-US CPI and with tariffs capping optimism; US futures are mixed.

USD steady ahead of CPI, JPY is on the backfoot given the yield environment.

USTs trade steady ahead of CPI, German yields continue their march higher.

Crude slips on inventories which saw a surprise build in headline crude stockpiles, reports suggest there is “some optimism about reaching a solution” on Middle Eastern talks

February 11, 2025 at 3:24 pm #19369In reply to: Forex Forum

Apple’s AI Push Boosts Older iPhone Sales, Morgan Stanley Says

Morgan Stanley notes that Apple’s AAPL new AI initiative, Apple Intelligence, slightly improved iPhone demand in the U.S. during the December quarter. However, the boost came mainly from discounted iPhone 15 Pro models rather than the latest iPhone 16 series. Emerging markets like India remain a key growth driver for Apple, with iPhone shipments up 4% year-over-year in South Asia.

Meanwhile, Apple AAPL recently agreed to a $490 million settlement to resolve claims that CEO Tim Cook hid declining iPhone demand in China.

-

AuthorSearch Results

© 2024 Global View