-

AuthorSearch Results

-

March 10, 2025 at 9:36 am #20629

In reply to: Forex Forum

EURUSD bounce just now from above 1.08 would need a solid 1.0850+ to shift the focus away from 1.08 and back to the 1.0888 high.

Bounce in EURJPY just now seemed to coincide with a modest bounce in US stocks off the lows.

In the current environment, look for stock market bounces to lack follow through, for exampole, as long as US500 stays below 5800

March 7, 2025 at 2:25 pm #20565In reply to: Forex Forum

March 7, 2025 at 1:43 pm #20559In reply to: Forex Forum

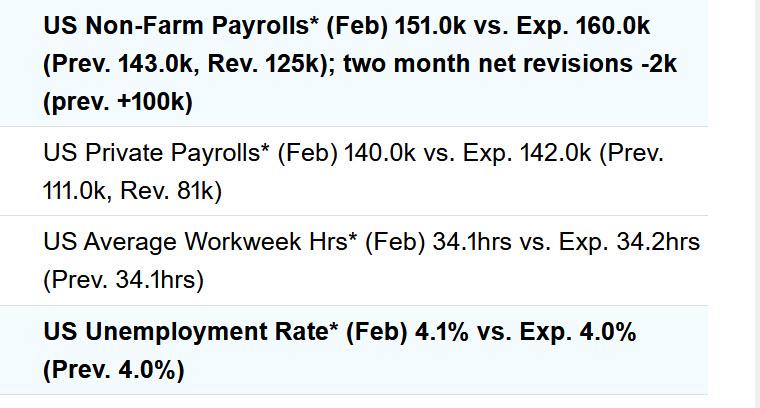

No big surprises in the jobs data… EURUSD extending high after a brief hesitation,, post data range 1.0843-88… 1.0850 will set the trading bias

<p style=”text-align: center;”>Try Newsquawk for 7 Days Free

March 7, 2025 at 10:56 am #20551In reply to: Forex Forum

EURUSD 1h

1.08550 taken out – if it closes this week above it, road is open for test of long time resistance trendline at 1.11800

That much on the big picture, so let’s now concentrate on trading possibilities intraday.

In a bit over 2.5h data are coming, and in mean time this is what we have:

Resistances: 1.08750, 1.09000 & 1.09500

Supports: 1.08450, 1.08200 & 1.07750

I expect pull backs from here, and waiting for a chance to get Long – either on approach to 1.08200 or Pattern creation after some consolidation ( in case it goes sideways and never reach it)

March 5, 2025 at 8:02 pm #20476

March 5, 2025 at 8:02 pm #20476In reply to: Forex Forum

March 5, 2025 at 7:33 pm #20474In reply to: Forex Forum

NIO Inc.

Resistance at 4.45

If it closes tonight close to it , we should see tomorrow another push Up.

Just a break of it won’t mean much – needs to break above it and stay above it, or it can slide down once again.

But all is good as long as it stays above 4.00 – consolidation might take some more time, and if holds Up trend might begin.

March 5, 2025 at 3:46 pm #20466

March 5, 2025 at 3:46 pm #20466In reply to: Forex Forum

March 5, 2025 at 12:48 pm #20461In reply to: Forex Forum

NFP week

–

headlines likely to kick market around in light of “incoming data” this week in the form of ADP, ISM, factory orders and then NFP on friday.Eur/Usd 1.0710 atm, HoD 1.0722 (and 200dma)

question is what is the player appetite to push the puppy higher or will players consolidate gains and bag some profits to say towards 1.06March 4, 2025 at 12:36 pm #20403In reply to: Forex Forum

President Trump’s Prefered Incite and Incentive Tool:

Rtrs / Trump says Japan, China cannot keep reducing value of their currencies

Summary

Weak Japan, Chinese currencies ‘unfair’ to U.S., Trump says

Solution to weak-currency policies is tariffs, Trump says

Japan says it is not adopting policies to directly weaken yen

China keeps guiding yuan firmer

March 4 (Reuters) – U.S. President Donald Trump said he told the leaders of Japan and China they could not continue to reduce the value of their currencies, as doing so would be unfair to the United States. …/..February 27, 2025 at 11:34 am #20167In reply to: Forex Forum

A look at the day ahead in U.S. and global markets from Mike Dolan

What appeared like a solid earnings beat from AI-bellwether Nvidia (NASDAQ:NVDA) failed to impress nervy tech investors, with anxiety about the wider U.S. economy persisting as trade tariff drums keep beating.

Morning Bid: Even Nvidia beat gets a shrug, tariff war looms

February 26, 2025 at 8:01 pm #20149In reply to: Forex Forum

February 26, 2025 at 11:01 am #20119In reply to: Forex Forum

February 25, 2025 at 8:21 pm #20090In reply to: Forex Forum

February 25, 2025 at 10:35 am #20052In reply to: Forex Forum

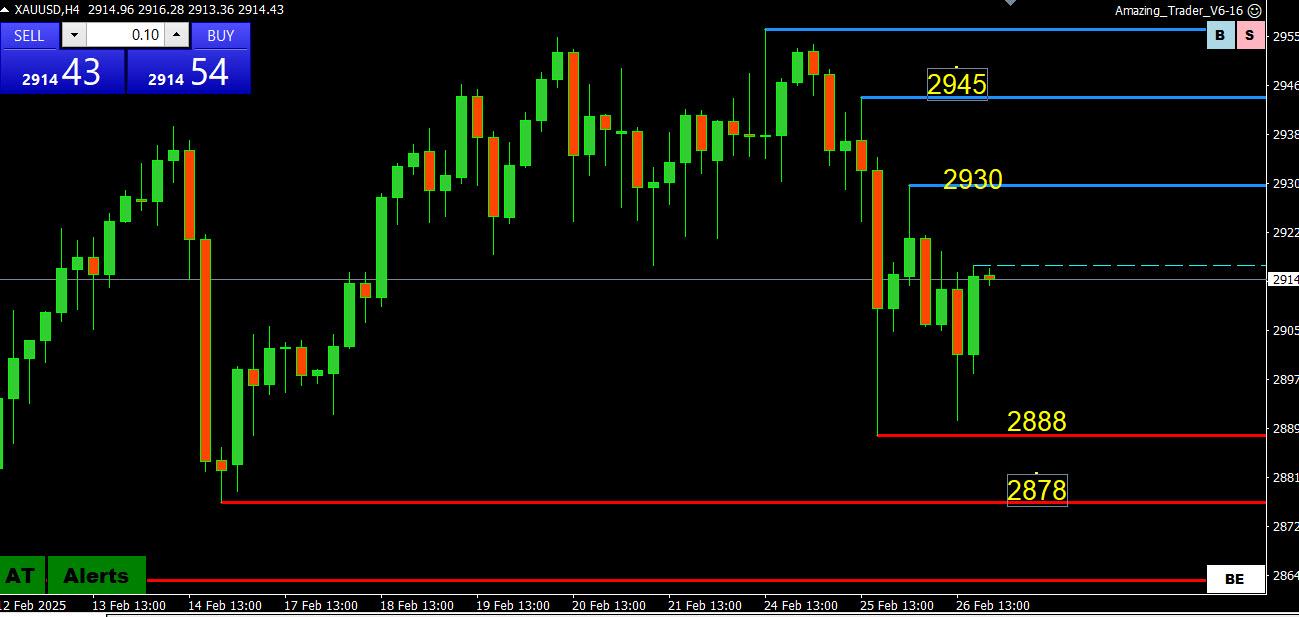

XAUUSD DAILY CHART – Looking tired?

Looking at this chart and trying to be objective, it has taken a lot of effort just to extend the record high from 2942 to 2956.

This would normally suggest a tired trend but given the failure to follow through on retracement attempts, it id hard to suggest anything but a pause until the pattern changes.

In this regard,

– Would need to establish 2950 as support to send a signal for a run at the –

– Would need to move below 2879 (last week’s low) to break the 9 week upo pattern,

Otherwise, it is just consolidation.

February 24, 2025 at 8:03 pm #20035In reply to: Forex Forum

XAUUSD WEEKLY CHART

9 green UP candles in a row and record highs each week, including the startt of this week. Betting on a retracement following through will remain a low probability bet until/unless this pattern is broken.

.

.Addendum:

To break this weekly pattern, 2878 would need to be broken.

To make a run at 3000, 2950 would need to becoe solid support

February 24, 2025 at 12:22 pm #20012In reply to: Forex Forum

DAX – GER 30

Dax is trying to find a support just above the Major trendline at 22.125

Resistance for today is at 22.515.

German elections are done, all fine and dandy ( or it is what the mainstream media wants you to believe…) so we are strictly technical right now.

I prefer more consolidation before we can expect DAX to renew it’s strength.

February 24, 2025 at 10:19 am #19995

February 24, 2025 at 10:19 am #19995In reply to: Forex Forum

February 21, 2025 at 6:49 pm #19935In reply to: Forex Forum

February 21, 2025 at 5:08 pm #19929In reply to: Forex Forum

February 21, 2025 at 12:28 pm #19907In reply to: Trading Tip of The Week

Trading Tip 10: Treat Forex Trading as Being in Episodes Not Trends

Most technical traders refer to momentum moves as trends. I prefer to look at the price moves as trading in episodes.

Like a streaming television show, an episode has a beginning and an end. It is no difference in trading except that is where the similarity ends.

The Forex Market trades in episode

The forex market trades in episodes on all time frames. The longer the time frame, the longer the episode is likely to be and vice versa.

What I mean by an episode is a period on a chart where a currency, for example, is trading in an uptrend, downtrend or in a consolidation range.

Don’t get caught trading an old episode

This is a critical concept to understand for if you are trading an old episode when a new episode has begun then you will find yourself on the wrong side of the market.

Anyone who has traded in the forex market, knows how fickle the price action can be. By getting in sync with the current episode, you can take advantage of this knowledge rather than having it take advantage of you.

With that said, many traders find themselves trading the old episode as it is often hard to switch gears, even when charts tell you it is time to do so. An example is looking to sell a rally after a currency has bottomed or looking to buy a currency after it has topped out.

What a difference a day makes

Look at this chart and ask yourself whether you would have been able to switch gears from an up episode to a down episode.

It is important to identify when a new episode begins and when it ends. It is also important to be aware of the broader trend as counter trend moves (e.g. retracements) tend to end more abruptly than moves with the overall trend.

So, the question you should be asking is how to stay one step ahead of the market rather than one step behind.

Think if it this way. Getting in sync with the current episode will find you swimming with the current rather than fighting it by swimming against it.

Why You Should Treat Forex Trading as Being in Episodes Not Trends

For a further discussion, sign up for the Global-View Trading Club membership is free).

To get Your Free Trial of The Amazing Trader Charting Algo Click HERE

-

AuthorSearch Results

© 2024 Global View