-

AuthorSearch Results

-

February 16, 2024 at 1:35 pm #1672

In reply to: Forex Forum

February 16, 2024 at 12:37 pm #1665In reply to: Forex Forum

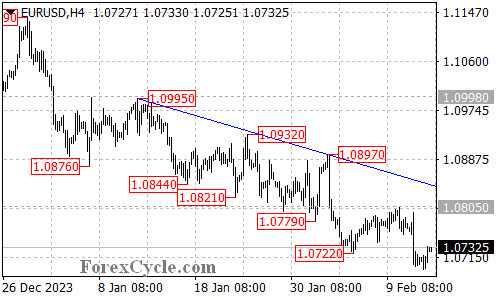

EURUSD – looking at the chart bellow, and in my own station, I have to admit that time wise – Rule of Thumb – there is a chance for the pair to break Up and change two months old trend ( Daily chart)

I am pretty sure that the solution will present itself after today’s data.

But what I also see is the fact that on the Monthly chart, the pattern suggests that we are in the early stages of a New Downtrend creation, that if comes through will open the road for as low as 0.75 area…Lots , I know…

Of course this is not helping in our daily trades, but just wanted to shine some light on the issue.

What I know for sure ( from the experience ) is that we can break above that downtrend line, even spend some time above 1.08 , but if that happens , 1.09450 will come up as a next level for unloading the EUR….and then we’ll all see clear downtrend forming .

February 15, 2024 at 2:07 am #1619In reply to: Forex Forum

EURUSD Analysis: Downtrend Continues, Resistance and Downside Targets

The EURUSD pair remains below a falling trend line on the 4-hour chart, indicating the continuation of the downtrend from 1.1139.

As long as the price remains below the falling trend line, it is likely that the downside move will persist. The next target area for the pair would be around 1.0670, followed by 1.0600.

As long as the price remains below the falling trend line, it is likely that the downside move will persist. The next target area for the pair would be around 1.0670, followed by 1.0600.The initial resistance level is located at 1.0750. A breakthrough above this level would suggest a consolidation phase for the downtrend is underway. In such a scenario, the price could retest the 1.0805 resistance level. If this level is surpassed, it may trigger further upside movement towards the falling trend line.

It is important to note that only a break above the trend line resistance would indicate the completion of the downtrend.

In summary, the EURUSD pair remains in a downtrend, with the price staying below a falling trend line on the 4-hour chart. Downside targets have been identified, while resistance levels have also been highlighted for potential retracements. The completion of the downtrend would require a significant break above the trend line resistance.

February 12, 2024 at 8:49 pm #1518In reply to: Forex Forum

As for the Forum form and functions:

– What we have here is the newest machine for forums

– Old site’s forum was becoming obsolete – I am talking about PHP, Mysql and shit-not the Form or capabilities

– We are still learning how to control this monster , and what can be done with it

– What you are seeing here and posting at is just a single Topic .

– In the background is a whole wide and endless universe

I have been on the Forum from 1997 – no need to explain to me how the old forum worked and what it was all about. I am thrilled that Jay has included me in the project as we are lokkkmv to make Global-View once again the go to site for serious traders.

This is Here and Now. We are trying to come up with what we are all used to, but to enrich it and make it even more interesting.

We need Subject button and not only to be able to write under it, but to click and go to that exact Subject.

We need an option to open a new Subject.

I had to swallow like 3 Pepticaids at a time , just to control my ulcer , until we got possibility to post photos.

I spent few days looking for the Like button, just to hear now that you don’t like it ( No , you can’t just add what you want…it MUST be compatible with everything else).

Now, we have all those functions , and if you don’t trust me, e-mail me and I’ll get you in and show you.

So why don’t we do it ??? Well, once again, it is not that easy to come up with the solution that will suit us…it was made by people that have no clue about markets and our needs…they are all about million and one discussion board, so called forums and other similar stuff around the net.

We’ll tame this animal and then we’ll be able to relax.

I have not traded for over 3 months – and I trade for a living…so gimme a break guys…

P.S. All possible ideas, a wishing lists and similar – please send by e-mail….do not start futile discussions about it on the forum….If needed , we’ll organize a referendum on subjects like “Like” button…

February 12, 2024 at 4:44 pm #1506In reply to: Forex Forum

February 5, 2024 at 4:34 pm #1242In reply to: Forex Forum

healing bleeding hearts: some bits to leave some bits to take

–

* It’s not uncommon to turn to material possessions to fill the void created by isolation.* Being part of a community can be more rewarding than the temporary satisfaction that comes from spending.

* Even small acts of kindness can make us braver and bolder in connecting with people.

Op-ed: Embrace community over consumerism. It may be the secret to a more satisfying life – on cnbc of all places

February 2, 2024 at 12:08 pm #1159In reply to: Forex Forum

February 1, 2024 at 12:14 am #1045In reply to: Forex Forum

January 31, 2024 at 3:48 pm #1032In reply to: Forex Forum

Ok Monedge is back in GVI. We love Global View and hope you all have a great trading day. What worked for us last night was a sell stop in Usd/Jpy. Pretty dicey but our model simply said place it, sometimes you have to trust your model. The pair will obviously rebound but we do not feel like going long at this point, even though it is considerably sold. Jay has told everyone for decades to be careful about catching a falling knife. That could apply here.

January 30, 2024 at 4:56 pm #982In reply to: Forex Forum

ECB’s Nagel (hawk) says Germany’s economic outlook is not great. Inflation is absolutely moving in the right direction.

Source: Newsquawk.com

January 25, 2024 at 11:41 pm #773In reply to: Forex Forum

Hello one n all

–

“The Treasury Secretary acknowledged that consumer prices, which have weighed on economic sentiment, continue to be too high.”

Yellen, Criticizing Trump, Says Biden’s Economy Has Delivered Gains NYTBottom line is higher GDP means FED stays higher for longer with all implications to trading.

This story caught my eye earlier and “takes the cake”

(keyword: “urged”)

(Bloomberg) — Energy Secretary Jennifer Granholm urged Jamie Dimon, David Solomon and other top Wall Street brass at a private New York dinner to invest in clean power, according to people familiar with the event.Granholm invoked President Joe Biden’s signature climate law in making her case to the chairmen of JPMorgan Chase & Co. and Goldman Sachs Group Inc. and more than a dozen other executives, said the people, who requested anonymity to discuss private conversations. Other executives urged to pitch in with additional investment, according to the people familiar with the event, included Philipp Hildebrand, vice chairman of BlackRock Inc.; Centerview Partners LLC co-founder Blair Effron; Dina Powell McCormick, vice chairman of client services at BDT & MSD Partners; and Joseph Bae, co-chief executive officer of KKR & Co.

The Energy Department didn’t respond to a request for comment. The attendees and their firms either didn’t respond or declined to comment. well duhHH

Dimon, Solomon Urged by Biden’s Energy Chief to Back Clean Power

January 25, 2024 at 5:16 pm #749In reply to: Forex Forum

Yen

San Francisco Monedge 16:35 GMT 11/29/2023

Eur/Jpy and Usd/Jpy are remaining short to this point after entering the session bid. Our algorithm model employs a series of primarily momentum driven factors and ultimately spits out a number. Currently the number is 42%, which is solidly selling after peaking around 70%.

Eventually we should see buying as it nears lower percentages. We prefer momentum vs level picking, which is also important of course. So far today the cycles have been very predictive.

Bottom line stay short for now until a bit later. -

AuthorSearch Results

© 2024 Global View