-

AuthorSearch Results

-

April 15, 2024 at 12:53 pm #4612

In reply to: Forex Forum

April 15, 2024 at 9:03 am #4590In reply to: Forex Forum

EURUSD 4H

Resistances at 1.06650 & 1.06850

Support at 1.06400 & 1.06200

Before it breaks on either side, and taking into account geopolitical situation right now I am going to stay away from trying to call some larger moves.

Going solely Intraday – right now trying for higher, but need a signal to confirm.

April 15, 2024 at 12:33 am #4580

April 15, 2024 at 12:33 am #4580In reply to: Forex Forum

EURUSD 4 HOUR CHART – RELIEF?

The week is starting out with some relief that geopolitical risks have not escalated further. It is like trying to pick up the pieces after a hurricane or tsunami hits your town.

This leaves EURUSD consolidating where 1.0650 seems to be pivotal with no key nearby resistance.

Risk is still pointed down but would need to take out 1.0622 to build further momentum.

Given the one-way move down, use FIBO levels to give some order to the price action using our

Fibonacci Calculator

April 14, 2024 at 11:38 pm #4578In reply to: Forex Forum

THIS WEEK’S MARKET-MOVING EVENTS (all days local)

No better-than-mixed results are expected for Tuesday’s sweep of Chinese data headlined by an expected 4.9 percent year-over-year rate for first-quarter GDP. This would mark slight slowing from 5.2 percent in the first quarter. Monthly data on both industrial production and retail sales are also expected to slow.

The week opens with a busy Monday that will include Japanese machinery orders and Eurozone industrial production and will be highlighted by US retail sales which are expected to once again be solid. UK consumer prices expected to continue to fall in data for Wednesday…Econoday

April 11, 2024 at 4:06 pm #4400In reply to: Forex Forum

April 10, 2024 at 8:41 am #4291In reply to: Forex Forum

April 9, 2024 at 7:45 pm #4285In reply to: Forex Forum

April 9, 2024 at 3:30 pm #4264In reply to: Forex Forum

April 8, 2024 at 3:05 pm #4213In reply to: Forex Forum

DLRx 103.95

–

with nothing of substance on the econ calendar todahy players have room to argue things out (i.e. consolidate)the “better qualified” individuals are suggesting ambivalent things about alleged rate cuts with a bottom line attempt at maybe not quiet three cuts as “feasable” this year.

with 10-yr yield nearing 4.5% dlrx is rather subdued in its response.

In his friday yak jerome alluded to details about labor he & gang are watching such as turfing notices and surveys around jobs intentions – two rays of good hope from the FED’s point of view. The CPI numbers that are expected this week appear to be another ray of hope for the FED as “being on the right track” that earlier numbers were but a “bump”

Degenerate traders on the other hand would likely savage rates and ccies on upside surprise releases.

April 8, 2024 at 12:03 am #4177In reply to: Forex Forum

THIS WEEK’S MARKET-MOVING EVENTS (all days local)

With inflation cooling and economic activity no worse than steady, wait and see is the coming week’s policy directive. Forecasters expect no change at a run of central bank meetings: Reserve Bank of New Zealand and Bank of Canada both on Wednesday, the European Central Bank on Thursday, and the Bank of Korea on Friday. Federal Reserve minutes on Wednesday will detail conditions from three weeks ago when policymakers were cautious in their policy outlook. Data since have not changed the overall picture.

The week’s biggest data release will be US consumer prices on Wednesday which are not expected to show much cooling. If upward price pressure on food prices has abated, energy prices – particularly for gasoline – continued to rise in March. And more important than ever will be service prices that, despite past rate hikes, have continued to be a steady source of upward pressure.

Industrial production from Germany on Monday is not expected to improve, while monthly GDP data from the UK on Friday is expected to be mixed. Chinese inflation pressures in data for Thursday are expected to remain dormant, while Indian inflation data on Friday are expected to remain well above target… Econoday

April 6, 2024 at 10:39 am #4122In reply to: Forex Forum

April 5, 2024 at 3:00 pm #4105In reply to: Forex Forum

April 5, 2024 at 11:25 am #4065In reply to: Forex Forum

Morning Bid: Geopolitics, oil and payrolls make for a busy day

A look at the day ahead in U.S. and global markets by Alun John.

It is an unusual start to a first Friday of the month as, with Brent crude oil above $90 a barrel and driving a risk-off tone in markets around the world, investors are not solely thinking about U.S. non-farm payrolls.

Let’s not overstate it. They still are thinking a lot about the always-crucial jobs data, due at 0830 ET (1330 GMT), but after all three main U.S. stock indexes fell by over 1% on Thursday, while Treasuries rallied, it is not the only thing on their minds.

Morning Bid: Geopolitics, oil and payrolls make for a busy day

April 5, 2024 at 9:12 am #4060In reply to: Forex Forum

April 4, 2024 at 2:42 pm #4035In reply to: Forex Forum

April 4, 2024 at 2:38 pm #4034In reply to: Forex Forum

Viewing gains in EurJpy and Sterling as solid buy side waves against the larger sell side momentum. Hence am short against Yen again in Eur and Usd, while in on the sell side light in GbpUsd but not as confident in that one so observing intently. It appears my preference this week has been the risky venture of counter trading. Noting the yield and hoping it doesn’t decouple with Dxy like it has done more than usual in recent days.

April 4, 2024 at 11:50 am #4016In reply to: Forex Forum

April 3, 2024 at 11:39 am #3955In reply to: Forex Forum

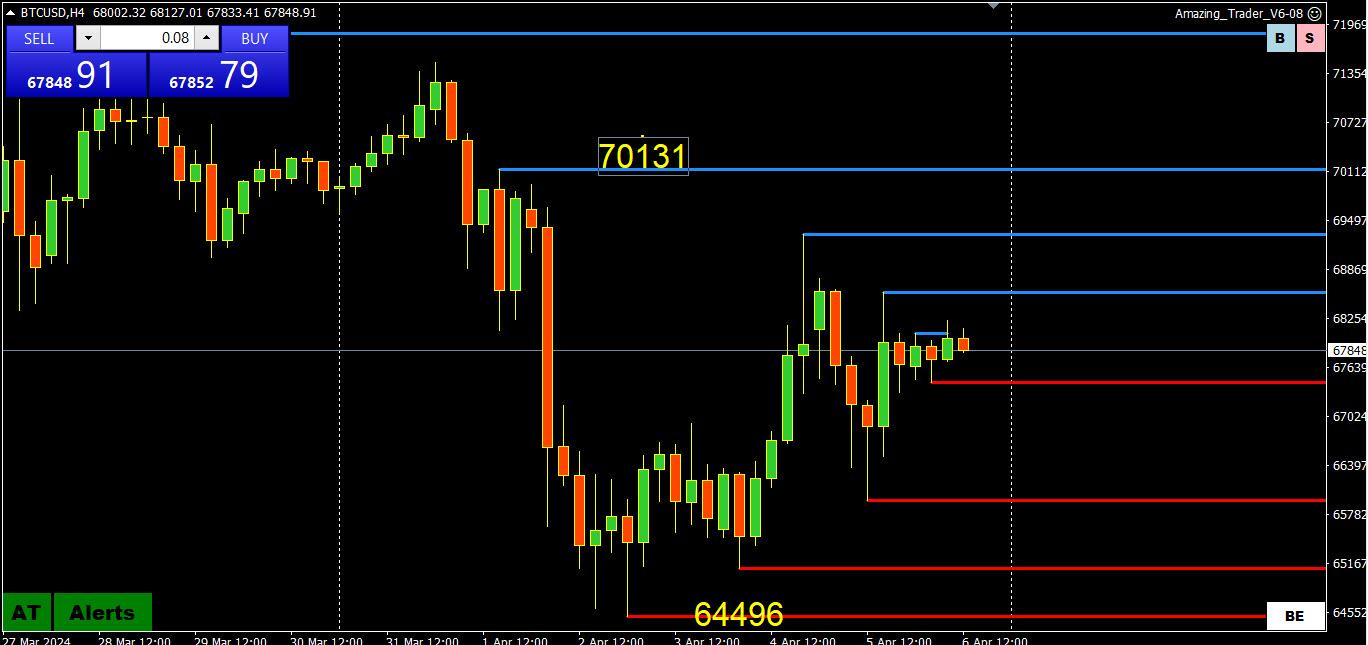

BTC 4 HOUR CHART — 65000-70000?

While I don’t trade BTC, I get requests to post a chart.

In this 4 hour chart I have bracketed 65000 — 70000 with moves outside it so far not following through after holding a dip below the bottom end..

Expect choppy trading (an understatement for BTC0 while within this range, next risk )retracement or run at the high) will be dictated by a solid move outside it.

April 3, 2024 at 8:21 am #3944In reply to: Forex Forum

April 1, 2024 at 12:31 am #3847In reply to: Forex Forum

THIS WEEK’S MARKET-MOVING EVENTS (all days local)

Japan’s quarterly Tankan survey will open the week amid expectations for slowing at large manufacturers. Slowing is expected for US nonfarm payroll growth on Friday to a still strong 200,000 in March from 275,000 in February; wage pressures are also seen slowing but still overheated. Likewise, slowing is expected for Canadian employment on Friday to a very solid 25,000 from February’s 40,700.

Inflation data from Europe will be Tuesday’s and Wednesday’s focus, first from German where some cooling is expected for March then from the Eurozone as a whole where only marginal cooling is the call, to 2.5 from 2.6 percent overall and to 3.0 from 3.1 percent for the narrow core.

Policy news will include the Bank of Canada’s business outlook survey on Monday and minutes from the Reserve Bank of Australia on Tuesday

Evonoday

-

AuthorSearch Results

© 2024 Global View