-

AuthorSearch Results

-

April 23, 2024 at 8:53 pm #5093

In reply to: Forex Forum

April 23, 2024 at 1:57 pm #5073In reply to: Forex Forum

April 23, 2024 at 1:55 pm #5072In reply to: Forex Forum

April 23, 2024 at 9:07 am

wfakhoury AmmanGOLD

2328.00 is the consolidation level.

2281.00 has been confirmed and will be reached if it stays below 2300.

Use level 2300 for the movement..above it will consolidate to 2328 below it will decline to 2281

___________________________________

2328.00 Reached from 2300.

100% GuaranteedApril 23, 2024 at 10:24 am #5051In reply to: Forex Forum

GBPUSD 30 MINUTE CHART -1.23-1.24

GBPUSD getting a pop from its flash PMI but not enough to take out 1.2399

This leaves GBPUSD consolidating within 1.23-1.24

Expect a mgnetic 1.2350 to be pivotal and set its intra-day boas.

What has taken some pressure off the downside is EURGBP buying pressures easing.

April 23, 2024 at 9:07 am #5037In reply to: Forex Forum

April 22, 2024 at 9:07 pm #5027In reply to: Forex Forum

Bobby – as I mentioned earlier covered calls fell off of a cliff this morning. That either amounts to everyone getting out or letting them go naked on an uphill run. If you look as the relation with spot in simple technical terms that anyone can understand, Dxy is holding with rates which supports the idea stocks are not as happy as they seem. We had a strong close on 4/11 that turned into a pump and dump lasting six days. Also S/P options did not clear Fridays high mark so not sold on the hoopla at this point.

April 22, 2024 at 8:43 pm #5025In reply to: Forex Forum

April 22, 2024 at 9:40 am #4990In reply to: Forex Forum

April 22, 2024 at 8:37 am #4981In reply to: Forex Forum

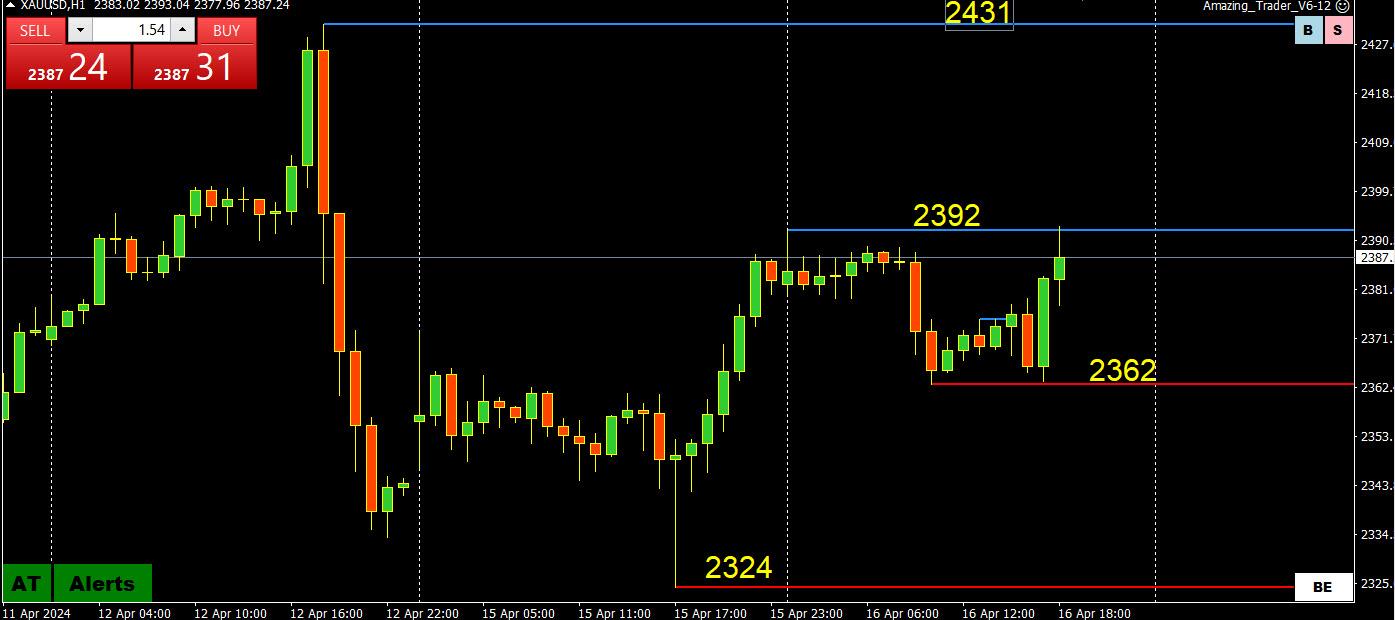

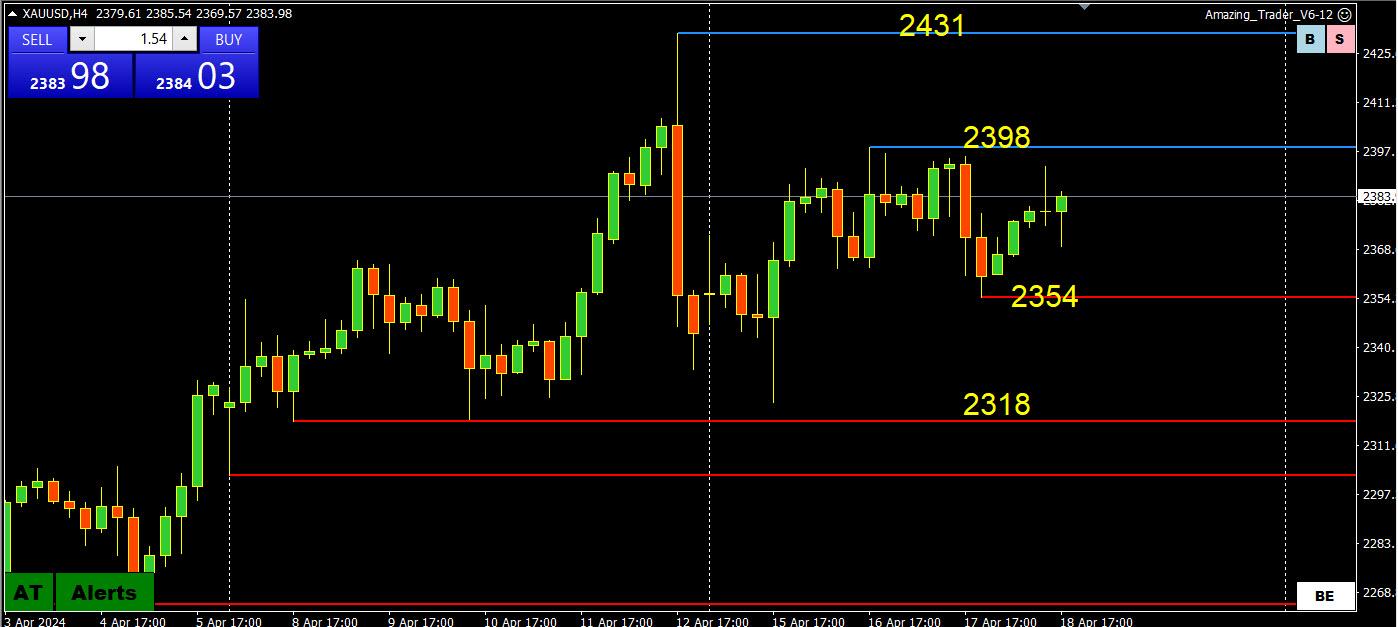

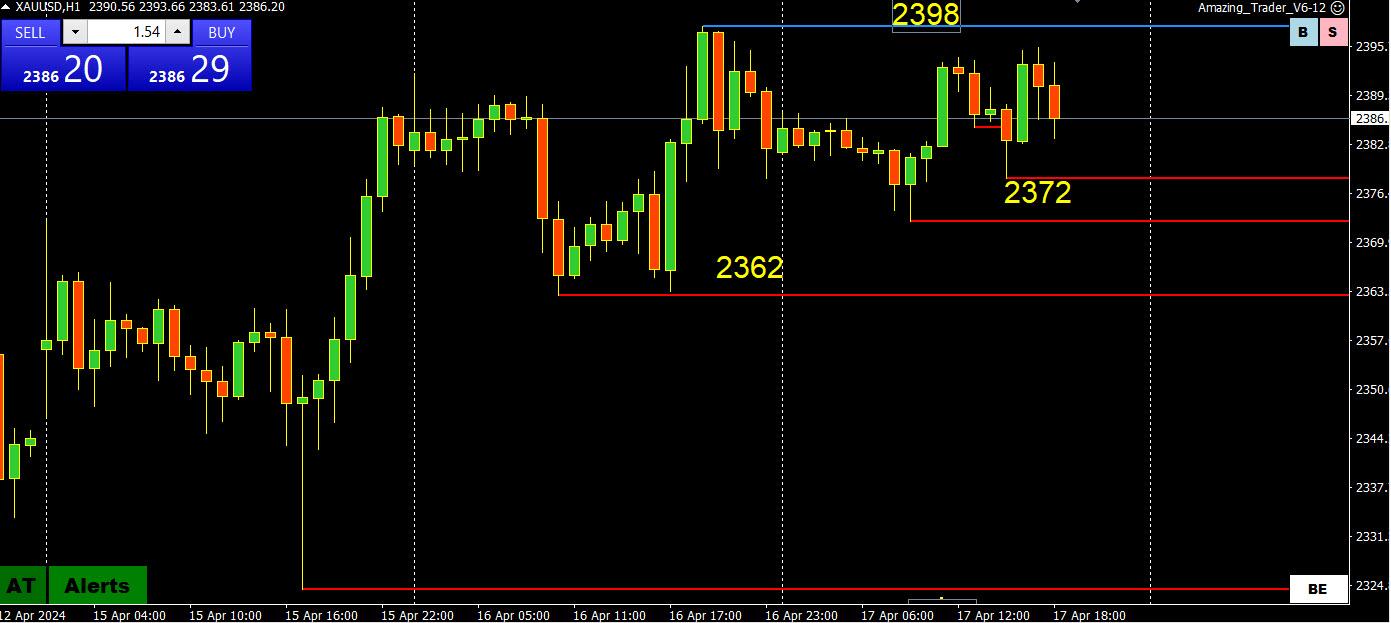

XAUUSD 4 HIUR CHART — CONSOLIDATION OR CORRECTION?

I have asked this question before and the jury is still out although technicals are tiled towards correction as long as it stays below 2402.

With that said, the key level remains untouched at 2318. To put it at risk, a move below 2350 would be needed (the low of the day so far is at 2351).

April 22, 2024 at 8:28 am #4980In reply to: Forex Forum

April 22, 2024 at 7:33 am

wfakhoury AmmanApril 3, 2024 at 8:21 am

wfakhoury AmmanEURUSD

NOW 10766

10757 confirmed will be reached

10760 is the consolidation level; buy below it, sell above it, and tp at it.

10666 confirmed will be reached if it keeps below 10760.

_____________________

Proved——————————————————————

Amman, on 3rd of April you wrote that price will go to 1.0666 if stays below 1.0760……after you wrote it, price went up to 1.0885 …..so how is this good call, please?

also you always say your signal are valid for about 48 hours …. this is like 20 days later!!!!!!

April 22, 2024 at 7:33 am #4972In reply to: Forex Forum

April 19, 2024 at 3:38 pm #4908In reply to: Forex Forum

For novices in this, here is what it is like to actively get into the volatility I was involved in when UsdChf and UsdJpy so aggressively sold off while globally the same volatility occurred on a massive scale across markets. I sold at the top in both pairs in Asia before it hit. I did very handsomely and got out. I thought it was a consortium of entities intervening and found out quickly after it was the military strike. I hit a retracement and did ok. I hit again but it was near the lows and paid for it on a very significant pull back that is very not normal in scope or speed and coughed up a portion of the gains unnecessarily before going “flat.” Balanced intent matters in such conditions.

April 19, 2024 at 10:58 am #4877In reply to: Forex Forum

Just an observation and not to be cute == because I sold both UsdJpy and UsdChf an hour before the sessions started and was in the thick of battle all the way down to the lows in both – the rebounds in price were aggressive and seemed like plunge protection team and CTA momentum algo’s both at work. I’ve been around it before.

April 19, 2024 at 10:53 am #4875In reply to: Forex Forum

Yen futures are near the absolute lows tested several times this week. It would be a stretch in my opinion to justify the concept of the price to go lower under current conditions (Asian central banks verbally drawing boundary lines in the strength of their currencies-widespread volatility-geopolitical) so the futures sustaining a bid (sell side of Usd/Jpy) is clearly dominant. So we have highly likely seen the highs of the day in Usd/Jpy and Usd/Chf over the prior 6 hours (4am PST right now). Buy side of oil and gold obviously. Usd/Chf sell side. Usd buy side elsewhere. I’ve been on the sell side since Asia in both pairs as I mentioned for two weeks. See zero reason to change that right now.

April 19, 2024 at 8:45 am #4860In reply to: Forex Forum

1:45 Monedge // The belligerents appear to be tactically playing to their internal political ego – “Iranian air base reportedly attacked in ‘limited’ Israeli reprisal strike and a look at me how meek and ginger I am “Iran downplays apparent retaliation and Israel keeps mum in sign both sides are looking to climb back from brink of war following international pressure for restraint” (timesofisreal) for international propaganda posturing purposes while the leader of the indisdensible nation and most powerful military pipsqueeks that “The US was given advance notification Thursday of an intended Israeli strike in the coming days, but did not endorse the response, a second senior US official said.” (cnn) trying to plead innocence.

In the meantime MY price of a liter of gasoline went up from $1.65 to 1.9x overnite. I have not yet looked at some of my energy digging and distribution stocks.

Odds of escalation appear – to me – low atm, as even published records out of Iran seem to highlight its heroic and defense and that the attacker did not go after cenrifuges at nuclear installation (al j)

April 18, 2024 at 4:02 pm #4844In reply to: Forex Forum

April 17, 2024 at 3:24 pm #4770In reply to: Forex Forum

April 17, 2024 at 9:30 am #4727In reply to: Forex Forum

April 16, 2024 at 11:55 pm #4720In reply to: Forex Forum

April 16, 2024 at 5:01 pm #4701In reply to: Forex Forum

-

AuthorSearch Results

© 2024 Global View

CHART

CHART