-

AuthorSearch Results

-

May 6, 2024 at 9:29 am #5820

In reply to: Forex Forum

GBUSD 15 minute CHART – Better bid but consolidating

GBPUSD is a bit of an outperformer so far today (note firmer GBPJPY_ but consolidating with the UK closed today for a holiday/.

As this chart shows, there are layers of support ahead of the pivotal 1.25 level with key resistance above 1.26 (Friday’s high).

This suggests little to go for within a 1.25-1.26 range other than intra-day levels as show on this chart.

May 6, 2024 at 9:03 am #5819In reply to: Forex Forum

EURUSD 4 HOUR CHART – CONSOLIDATING

EURUSD has so far traded in a tight range as it consolidates below Friday’s 1.0812 post-USjobs report high.

A key level to keeping a bid is to stay above the 1.0752 mini breakout level (Power of “50”) with support at 1.0724 below it.

On the upside, the key level is obvious at 1.0812 as only above it would add legs to the upside.

May 5, 2024 at 10:27 pm #5814In reply to: Forex Forum

I felt urge to concur with our California colleagues from Monedge , regarding possible Longs in USDJPY above 155…

Back in days when I was trading OPM ( Other people’s money J , the sheer sizes of the positions held didn’t let me play on small time frames, paired with spread at the time and clients expectations , not to mention that every stop loss could have been yet another signal for a client or two to withdraw their funds…

Executing a stop was like inviting the Devil to take your soul…

We have used hedging as a first aid , but again – different times…we had all different European currencies that were pretty much pegged to each other , so USD could have been bought and sold at the same time, with the same margin , and you could even make money just sitting hedged…

HOW you’re asking…well, interest rate differentials…Long USDCHF, Short USD FF – in both cases you were earning interest….there have been some even more drastic examples , but not really hedging…

I remember when a client of mine didn’t want his profits to be calculated any other way but in USD – Dollar was rallying up like crazy…so those of you who are or were on that side of the game surely understand the problem – for those of you who have no idea what am I talking about – If your Home currency is the one that is appreciating the most, all the profits that are going to be made will lose some ( at least in percentages) till year’s end….Got it ??

So in one moment of genius ( or maybe that was just a desperation on my end) , after deep research and some help from a friend ( few of them to be exact – all on the dealing desk of SA Central Bank ) I went Short USDZAR – interest rate differential was about 16% in my favour .

It was one extremely risky move on my part, but within next 4 months paid me truckloads – 8% on Traded amount , plus about 15% of ZAR appreciation vs USD….Mind you, Leverage was not nearly as high as today and we could go as much as 1:10 . But in this devilish trade I made around 215% on funds held. Call me a lunatic, but that’s how the game was played back then…eat or be eaten..

Have to admit that it was kind of easier to trade then, with pretty clear positions of Central Banks and Gov’s in general, not to mention that we had Alan Greenspan 😀

So you got the hint of my experience – and I am going to tell you what No sane advisor, analyst, influencer or a Guru won’t:

When caught with your pants down, but still breathing a bit, use every and any move in your direction to exit the doomed position. Book the loss. And never turn back again. If market decides to go your direction further, well hell…it is not on you – it is on that guy who entered the original trade in the beginning…But that is the only way to survive for sure , to be able to fight another day…

Or just let it be, kiss your margin good buy and start doing something else…like tomato growing plantation…

May 4, 2024 at 11:19 pm #5770In reply to: Forex Forum

May 4, 2024 at 4:37 pm #5731In reply to: Forex Forum

May 4, 2024 at 12:34 am #5705In reply to: Forex Forum

From my alma matter – McGill University

an example of the art saying everything and nothing at the same time to everyoneDear McGill alumni, parents and friends:

I know that many of you have been watching the events unfolding on our downtown campus this week with much concern. I would like to take this opportunity to provide you with an update on what my administration is doing to resolve the situation.

The heartbreaking state of affairs in the Middle East that has led to the encampment on McGill’s campus is complex. I recognize that there are a wide range of positions on the subject and that there is a need for these perspectives to be heard. I also recognize the pain that people on all sides are feeling amid the human suffering caused by these events. I hear it in the conversations I have with people from across McGill and beyond, and it deeply pains me. I would like nothing better than for peace to prevail.

As I have stated on several occasions since last fall, everyone has a right to protest and express their views in an appropriate manner and place, and I support the right of all members of the McGill community to do so on our campuses in ways that respect the law and conform to McGill’s policies and procedures.

An encampment on the University’s property, including on its grounds, goes beyond those boundaries. That is why I decided earlier this week to request the assistance of the police, who have considerable expertise in de-escalating and resolving situations such as these. We are closely collaborating with them, in full respect of the values we hold dear as an institution.

The situation is complex and difficult. We are working diligently and in good faith with our stakeholders to ensure the health and safety of our community, while maintaining a respectful and inclusive campus environment that prioritizes our mission of teaching, learning, and research.

I thank you for your support, and the trust you have placed in my administration.

Sincerely,

Deep Saini

President and Vice-Chancellor

McGill UniversityMight make an analyst but a high probability failure as an FX trader

May 2, 2024 at 11:02 am #5594In reply to: Forex Forum

A look at the day ahead in U.S. and global markets from Mike Dolan

Anxious bond traders seem to have taken solace from the Federal Reserve’s surprisingly sharp brake on its “quantitative tightening” process on Wednesday, while the yen capitalized on an easier dollar after what seemed like the second bout of Japanese intervention this week.

April 30, 2024 at 4:17 pm #5486In reply to: Forex Forum

April 29, 2024 at 5:07 pm #5414In reply to: Forex Forum

Covered calls are bid for stocks as well as some other facets, but some internals are not solid so it appears to me that the bid in stocks in moderately on the apprehensive side but bid so far. Dxy withstood the overnight selling but has to clear 106.05 and hold to accelerate in my view, otherwise the 105 area might be seen. I’m looking to sell GbpUsd around 2600 but am biased long overall until the tune changes. Staying on the bid in AudUsd and crosses on pullbacks and believe it might temporarily stall around 6600 in both spot and futures.

April 26, 2024 at 3:08 pm #5286In reply to: Forex Forum

April 24, 2024 at 3:13 pm #5148In reply to: Forex Forum

Options on S/P are in the middle of value on the updraft although prices are showing a decline from highs, so it would take quite a bit of pressure (I do expect some) to change the bid bias. Dow volume ratios are right in the middle of high and low parameters and so the bid is still in play even with a decline similar to S/P. Advancing issues vs declining issues are low and have a bit of room underneath. So the bottom line is the bid holds, I wouldn’t be sold on the selling changing the course yet.

April 24, 2024 at 2:15 pm #5142In reply to: Forex Forum

April 24, 2024 at 1:09 pm #5134In reply to: Forex Forum

April 24, 2024 at 12:50 pm #5133In reply to: Forex Forum

April 24, 2024 at 9:24 am #5111In reply to: Forex Forum

April 24, 2024 at 9:11 am #5109In reply to: Forex Forum

April 24, 2024 at 9:08 am #5108In reply to: Forex Forum

April 24, 2024 at 8:43 am #5106In reply to: Forex Forum

April 24, 2024 at 8:33 am #5104In reply to: Forex Forum

April 24, 2024 at 8:09 am

wfakhoury Amman

GOLD

Time to sell

2303 has been confirmed and will be reached. then at 2281.

Any rise above 2328 will return to it.

Also, 2323 is a consolidation level.

____________________________

2323 still active as a consolidation level and will be reached from the 2317 area.April 24, 2024 at 8:09 am #5100In reply to: Forex Forum

-

AuthorSearch Results

© 2024 Global View

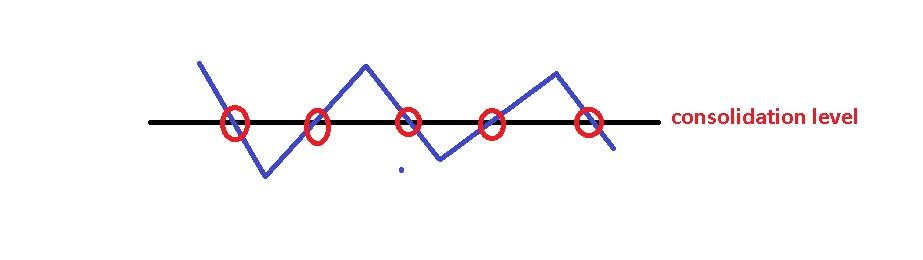

Consolidation is used in technical analysis to describe the movement of a price within a well-defined range of trading levels. Consolidation generally means the price will hit a defined level several times.

Consolidation is used in technical analysis to describe the movement of a price within a well-defined range of trading levels. Consolidation generally means the price will hit a defined level several times.