-

AuthorSearch Results

-

March 20, 2025 at 1:16 pm #21182

In reply to: Forex Forum

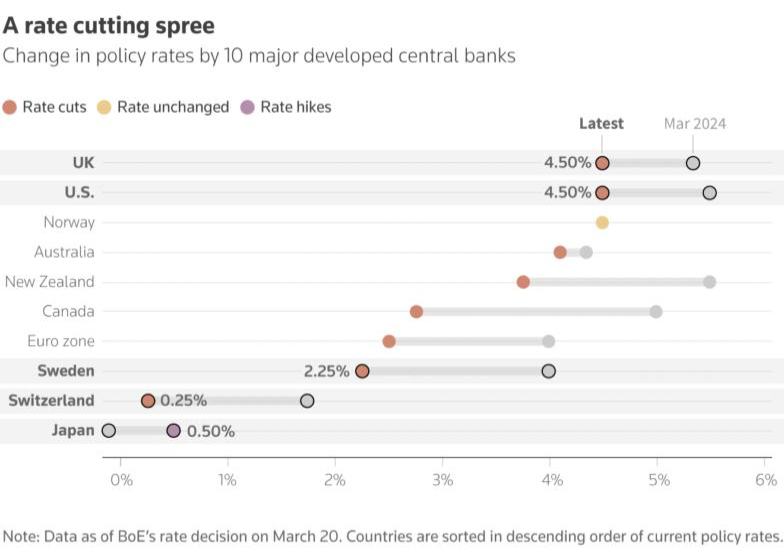

Dollar higher as Fed signals no rush to cut rates, BoE holds rates steady

· Dollar up as Fed says in no rush to cut

· Sterling slips after hitting four-month high, BoE on hold

· SNB cuts, Riksbank on hold

· Aussie down after soft labour data, kiwi down 0.5%

· The dollar rose on Thursday after the Federal Reserve indicated it was in no rush to cut rates further this year due to uncertainties around U.S. tariffs, while the pound remained lower after the Bank of England kept rates steady.

· The Swiss franc weakened slightly after the Swiss National Bank lowered its policy rate to 0.25%, while the Swedish crown was soft after its central bank maintained its interest rate.

· U.S. policymakers projected two quarter-point interest rate cuts were likely later this year, the same median forecast as three months ago, even as they expect slower economic growth and higher inflation. On Wednesday, the Fed held its benchmark overnight rate steady in the 4.25%-4.50% range.

· “There is probably not enough in the Fed communication to build fresh USD shorts,” said ING FX strategist Francesco Pesole.

· Traders are pricing in 63 basis points of Fed easing this year, about two rate reductions of 25 bps each and around a 50% chance of a third. Markets are fully pricing in the next cut in July, LSEG data showed.

March 20, 2025 at 10:32 am #21168

March 20, 2025 at 10:32 am #21168In reply to: Forex Forum

March 19, 2025 at 8:49 pm #21149In reply to: Forex Forum

March 19, 2025 at 3:58 pm #21133In reply to: Forex Forum

March 19, 2025 at 10:14 am #21100In reply to: Forex Forum

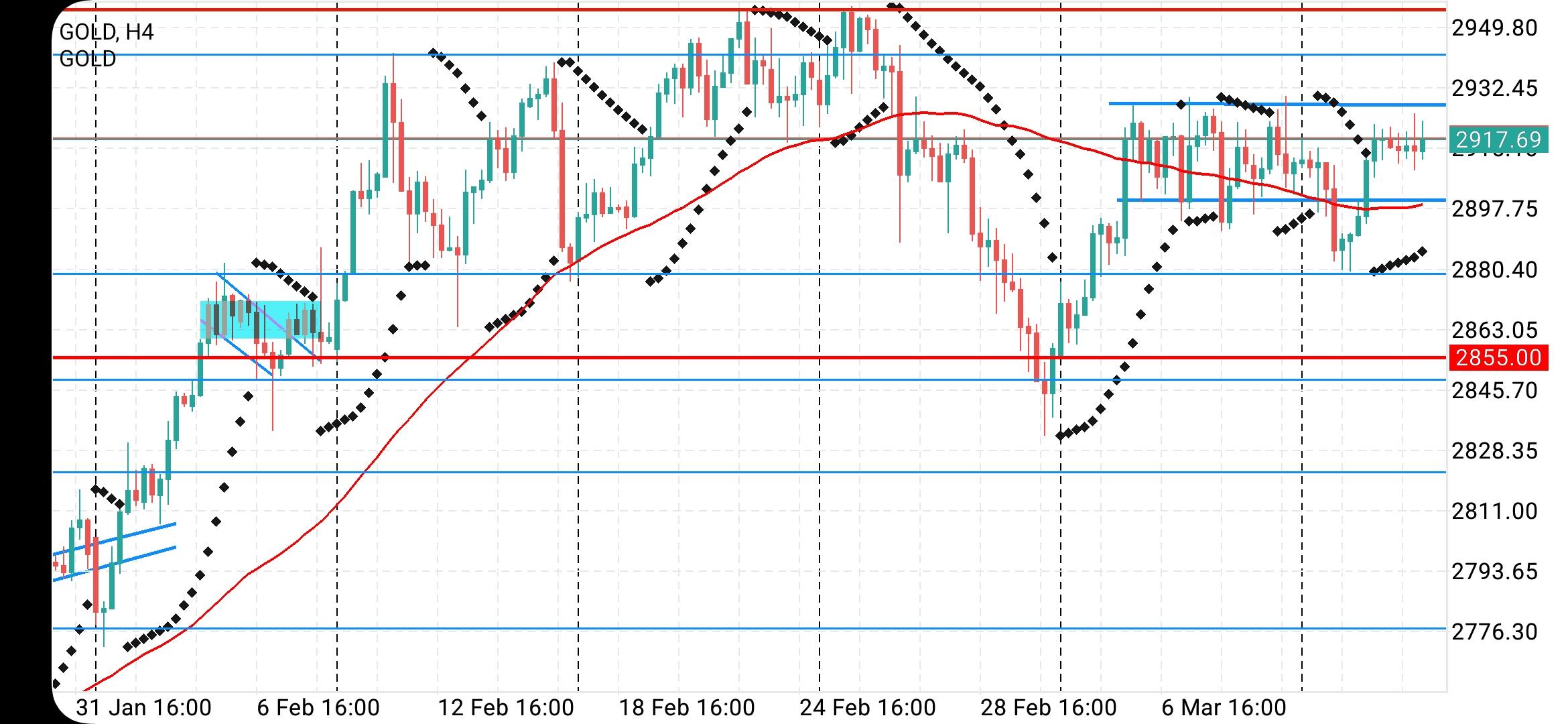

XAUUSD 4 HOUR CHART – PAY ATTENTION

I always pay attention when any instrument trades around the :50” level….

This time it is XAUUSD pausing below 3050 (high 3045)

It is hard to call for a correction given the strength of trend but stall below 3050 suggests some consolidation

BUT only below 3000 would dent the risk on the upside, below 2978 would negate it..

March 19, 2025 at 9:53 am #21099In reply to: Forex Forum

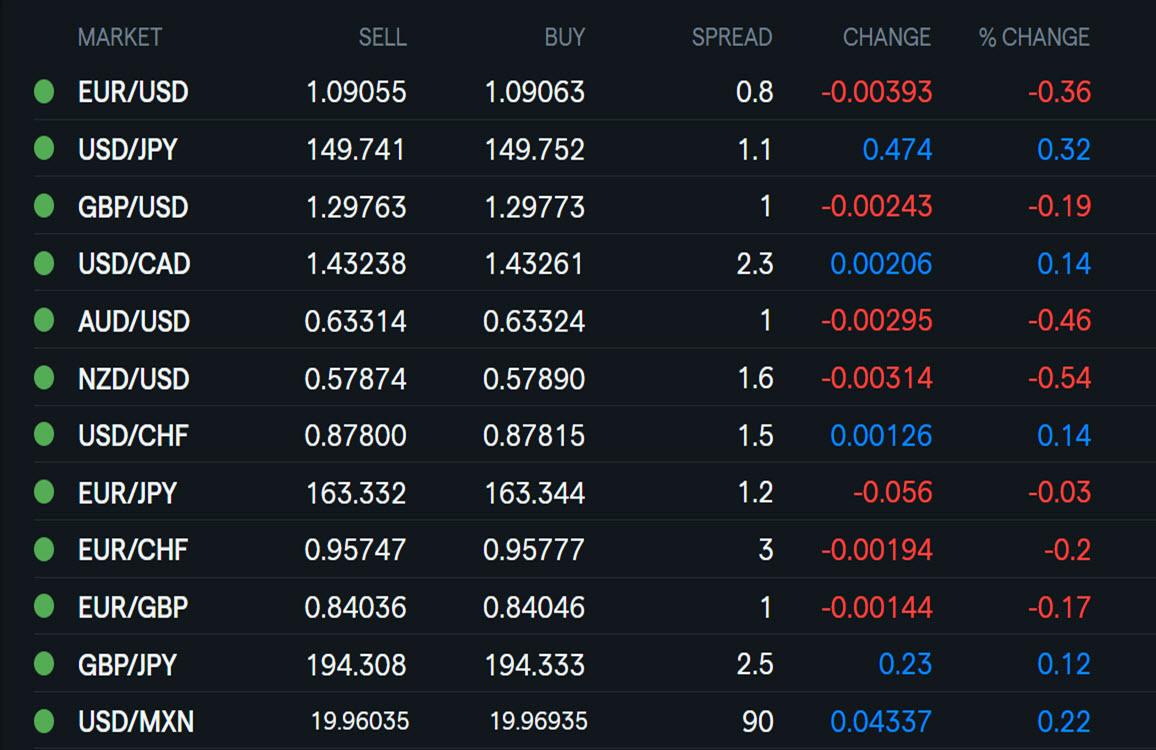

Using my platform as a HEATMAP shows

… the dollar trading firmer

EURUSD back to 1.09 for the 7th day in a row after running stops to a low at 1.0873. Note a failure again to make a serious run above 1.0950 (this time paused below it).

Perhaps some disappointment the Trump-Putin call did not result in a full ceasefire

USDJPY 150 briefly tested (high 150.02) after the BoJ kept policy steady

Turkish lira smashed following arrest of chief political rival

XAUUSD consolidating after surging to another record high yesterday

Looking ahead… Fed day today… see detailed FOMC preview

March 18, 2025 at 5:57 pm #21087In reply to: Forex Forum

euro 1.0947

puppy, on longer time bars, looks to be having a solid run uP. Hoever it has yet to pop over 1.1065

it may need to test 1.0875/50 and if the test would hold maybe re-charge for new run uP for 1.1065 amd beyond.

A “successful” ukrainian war resolution should be euro-positive to some degree.

March 17, 2025 at 6:45 pm #21035In reply to: Forex Forum

March 17, 2025 at 10:31 am #20990In reply to: Forex Forum

GBPUSD 4H

Is this a start of run to 1.32 ?

Supports: 1.29400 & 1.29300

Resistances: 1.29750 & 1.29900

We’ve been watching a consolidation from 12th March and it is starting Up again.

Now I don’t want to bother you with details, but one is very important – how Cable is going to close this bar – for more advances I prefer somewhere around 1.29500 and then for the new high.

Worst case scenario is if it closes close to the previous high – than expect a pull back towards MA’s

March 17, 2025 at 10:17 am #20989

March 17, 2025 at 10:17 am #20989In reply to: Forex Forum

EURUSD DAILY CHART – 5 days in a row

Past 5 days trading around 1.09 except one day when the high was 1.0897 (close enough)

Range over this period has been 1.0822=-1.0947… midpoint is 1.08845 as a reference level.

Next directional move will be dictated by whether 1.09 becomes a solid support or resistance…. looking at this chart shows either uptrend out of steam so consolidting

March 17, 2025 at 10:05 am #20988In reply to: Forex Forum

March 17, 2025 at 12:41 am #20984In reply to: Forex Forum

March 13, 2025 at 1:30 pm #20856In reply to: Forex Forum

March 12, 2025 at 6:47 pm #20805In reply to: Forex Forum

March 12, 2025 at 1:05 pm #20785In reply to: Forex Forum

March 12, 2025 at 12:45 pm #20779In reply to: Forex Forum

March 12, 2025 at 9:27 am #20767In reply to: Forex Forum

USDJPY 4 HOUR CHART – Back above 148

It is hard to fight real money flows that seem to be driven by JPY crosses, such ad EURJPY, which is building on yesterday’s breakout above 161.27 and helping to pull USDJPY above 148.

While damage is not fatal (i.e. it would need to move above 151.30 for an outside week), the solid move through 148.00-40 has broken the downward momentum

So, expect support if 148+ holds bit would need to get through 150.00-20 to suggest anything more than a retracement.

Watch the risk on/off mood as the former seems to be a factor today.

–

March 11, 2025 at 2:51 pm #20742In reply to: Forex Forum

March 11, 2025 at 11:10 am #20730In reply to: Forex Forum

US OPEN

Sentiment improves modestly after Monday’s hefty losses, and DXY hits fresh YTD low awaiting further Trump updates

Good morning USA traders, hope your day is off to a great start!

Here are the top 4 things you need to know for today’s market.

4 Things You Need to Know

· European bourses are mixed; US futures are firmer attempting to consolidate following the prior day’s hefty losses.

· DXY hits a fresh YTD low as EUR/USD reclaimed 1.09 on German defence spending optimism.

· USTs hold near unchanged while Bunds slump on the latest fiscal updates.

· Commodities broadly supported by a diving Dollar; XAU back above USD 2.9k.

March 10, 2025 at 10:45 am #20631In reply to: Forex Forum

-

AuthorSearch Results

© 2024 Global View

still consolidating

still consolidating