-

AuthorSearch Results

-

June 6, 2024 at 2:42 pm #7376

In reply to: Forex Forum

June 5, 2024 at 9:26 am #7274In reply to: Forex Forum

EURUSD 4 HOUR CHART – WAITING FOR THE ECB

EURUSD seems to be in a holding pattern waiting for Thursday’s ECB decision.

Chart show momentum to the upside but consolidating. A breal of 1.0858 would suggest some risk on the downside BUT only a break of 1.0827 would suggest the high is in for now. Otherwise, trend stays intact.

June 5, 2024 at 9:15 am #7273In reply to: Forex Forum

BTC DAILY CHART – 70000

BTC has been flying under the radar lately but as this Amazing Trader chart shows it has been in a consolidation but also slowly building momentum to the upside.

Key chart levels are clear:

‘

If 70K can hold as support there is only one obstacle to the record high.If 70K fails to hold, it is back to flying under the radar.

June 4, 2024 at 1:46 pm #7250In reply to: Forex Forum

re yen 155 market trying to figure out

there is nothing to figure. mof / boj happi slapping backs and high-fiving:

–

The Japan Times

Japan spent record ¥9.8 trillion to prop up yen in past month

The record spending on intervention shows the government’s resolve to push back against speculators betting against the yen.got that speculators ?

June 4, 2024 at 9:46 am #7219In reply to: Forex Forum

USDJPY DAILY CHART – 155 IN SIGHT

As I pointed out yesterday USDJPY was showing signs of correlating with the dip in US yields (lower) and getting some safe haven fflows as well (US equities lower).

As I pointed out yesterday USDJPY was showing signs of correlating with the dip in US yields (lower) and getting some safe haven fflows as well (US equities lower).This has it coming in sight of the pivotal 155 level and as I also pointed out yesterday a solid move bekow 155 would be a game changer as it would shift the focus away from 158 and above.’

So watch 155 to see how USDJPY trades with key supports shown on this chart

June 3, 2024 at 4:43 pm #7184In reply to: Forex Forum

JP – 4:17 It is building, becoming very difficult to purchase a house in the US in populated places. I did workouts coast to coast for a F500 bank and built a tip of the spear company doing the same but as an advocate for consumers while working coast to coast with banks and real estate companies. The “sub-prime” financing was off the charts in the era referenced in that article, sold on the secondary market like hot lead with nothing down half the time, unless you were triple A like Bank of America. I wouldn’t do loans I knew people would default on, for their own good, but there were still tons of them. Then the crash from inflated paper and values. Looks like inventory is high in Florida again.

That is definitely a USD impact and something to keep an ear on one might think.

June 3, 2024 at 9:59 am #7154In reply to: Forex Forum

GBPUSD 4 HOUR CHART – CONSOLIDATION

GBPUSD is trading softer with pressure coming out of its crosses (note firmer EURGBP, softer GBPJPY)_

Howeever, Tt is consolidating as well after last weel’s pause above the key 1.2674 level. This is the level that woould need to be broken to confirm the 1.28 faiure and that the high is in for now.

Aboce 1.2674 it is consolidating.

June 3, 2024 at 9:51 am #7153In reply to: Forex Forum

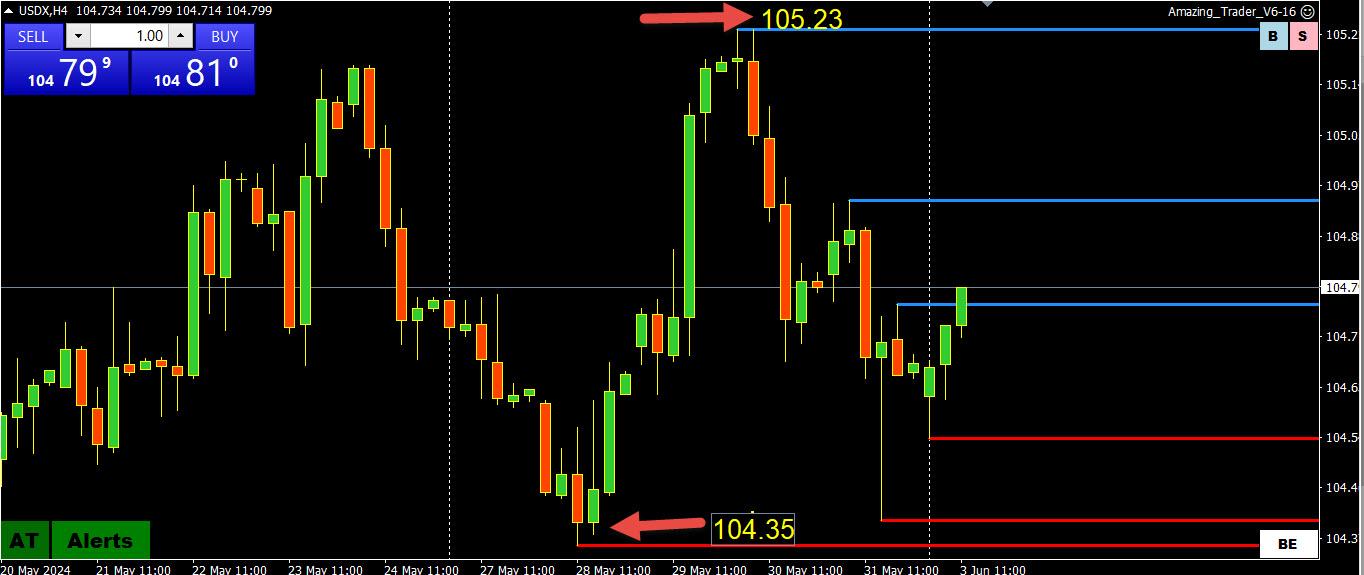

USDX 4 HOUR CHART – CONSOLIDATING

As I noted, USDX is on my daily checklist to see if it is acting as a EURUSD proxy (57.6% of the index)’

The price action is within the low-high band highlighted on this chart so best I can say it is consolidating.

Shifting back to the EURUSD, it is consolkidqting as well but with a softer tone if it stays below 1.0850.

June 2, 2024 at 9:42 am #7131In reply to: Forex Forum

AUDUSD DAILY CHART – CONSOLIDATION AS WELL

If you take a step back here as well you will see that the AUDUSD uptrend is still inatct but consolidating after setting a high at .6714 12 days ago.

Key levels are highlighted on the chartt: .6714 on top, .6557 on the downside. Only a break of ,6557 would confirm a break of the uptrend.

Consolidation range is also shown on this chart.

As we start a new month mark down the prior month’s range (.6454-.6714) as a reference.

June 2, 2024 at 9:32 am #7130In reply to: Forex Forum

USDJPY DAILY CHART – CONSOLIDATION BELOW KEY HIGHS

If you take a step back and look at the daily chart you will see that USDJPY spent the month of May trading below the 160.16 high and almost the entire month below 157.99.

As I have been saying, if I was in the BoJ’s shoes I would want to keep it trading below 158.00 lest the focus shift to 160.16 if above it,

There have been bouts of what seems like interventiion (not confirmed) that found support on deep dips (last one was at 156.34).

On the downside, it is easier to focus on the midpoint of 150-160 and use 155 as the pivotal level to set the tone within this range (finds support while above it).

On the upside, expect a limit if it stays below 158.

Normally I would say mark down the prio month;s range but in this case mark down 151.85-160.16.

June 1, 2024 at 10:39 am #7122In reply to: Forex Forum

May 30, 2024 at 2:23 pm #7029In reply to: Forex Forum

US pending home sales hit a 4 year low today. One might think the inflation consideration is not as buoyant.

Purchased a penny stock (TELL) in the 40’s that won’t go bankrupt for those of us who dabble. (UROY) is another. Specializes in natural gas. Israeli firm. I like Israeli stocks since they are the anti-thesis of anarchism. Solid market share, common sense management.

May 30, 2024 at 2:22 pm #7028In reply to: Forex Forum

May 27, 2024 at 10:31 am #6884In reply to: Forex Forum

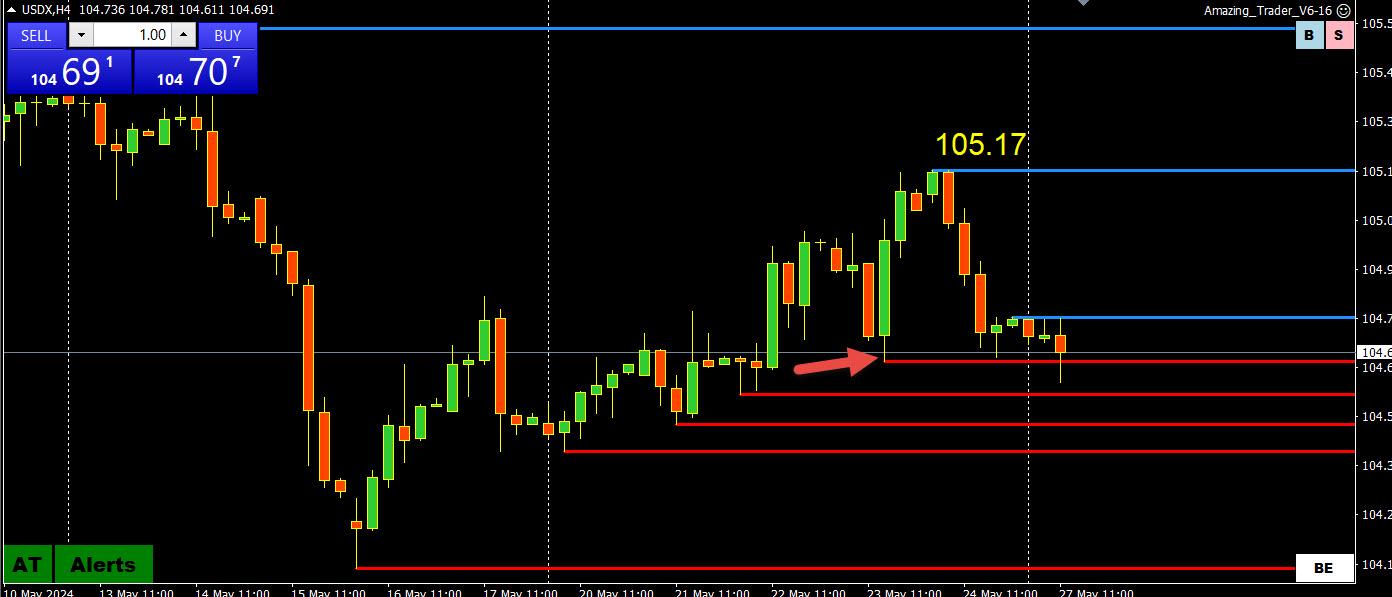

USDX 4 HOUR CHART – EURUSD PROXY?

As I noted, with EURUSD representing 57.6% of the index, it often acts as a proxy for the currency.

In this chart, the highlighted red AT line being broken would need to be sustained and then confirmed by a solid EURUSD move above 1.0863 to suggest a potential shift in direction or at least a loss of upward momentum

May 24, 2024 at 4:26 pm #6828In reply to: Forex Forum

Note to the forum – Monedge is adjusting its focus back toward primarily serving institutional and high net worth individuals.

If you are an individual just like anyone who does not fit those categories but may be interested in acquiring expertise on a more in-depth basis, we are still accepting clients and will maintain service for you but the window is closing to acquire our assistance if you are new. Therefore if you are interested, we suggest giving us a good look and moving fairly soon to sign us up to help you with your trading results (www.monedge.net) if desired.

And of course, Global View is a rock solid resource for a variety of interests and commentary, and we will continue to post here.

Thank you from the team at Monedge.

May 24, 2024 at 2:45 pm #6818In reply to: Forex Forum

Dxy is finally catching a little bid. Stock internals are negative even though the indices are showing very slight gains. Therefore not sold on much of a risk appetite environment (which would be long Euro) headed into the weekend. Expecting the 10yr yield to hold 44.50 and perhaps close near it, anything happen. Market is parking money and taking into consideration geopolitical and other uncertainty one might think.

May 24, 2024 at 8:20 am #6790In reply to: Forex Forum

HOW IS THIS FOR A NICKNAME FOR THE JPY. WE HEARD THIS TERM FIRST MANY YEARS AGO FROM A FORUM MEMBER AND I NEVER FORGOT IT.

LONDON, May 23 (Reuters Breakingviews) – For more than two decades, investors lost their shirts in Japan. In a trade that became known as a “widowmaker”, they sold short Japanese government bonds with their tiny yields, yet suffered as long-term rates crept ever lower and bond prices rose. Today, taking a long position in Japan’s currency is similarly threatening to shorten the lifespans of investors in the Land of the Rising Sun. Over the past three years, the yen has fallen by around 50% against the U.S. dollar. But there are good reasons that painful bet may pay off sooner.

May 23, 2024 at 2:09 pm #6749In reply to: Forex Forum

May 23, 2024 at 11:02 am #6728In reply to: Forex Forum

May 22, 2024 at 11:16 pm #6705In reply to: Forex Forum

BOSTON, May 22 (Reuters) – Goldman Sachs (GS.N), opens new tab CEO David Solomon said on Wednesday he does not expect the Federal Reserve to cut interest rates this year.

“I’m still at zero cuts,” Solomon said at a Boston College event. “I think we’re set up for stickier inflation.”

-

AuthorSearch Results

© 2024 Global View