-

AuthorSearch Results

-

August 7, 2024 at 11:11 am #10205

In reply to: Forex Forum

August 6, 2024 at 11:23 am #10150In reply to: Forex Forum

better late than not at all ?

gimme a break !! … by early afternoon(Bloomberg) — Retail brokerages Charles Schwab Corp. and Fidelity Investments reported outages amid a global stock-market selloff Monday, though both said their issues were resolved by the early afternoon.

More than 15,000 users had reported an outage at Schwab at 9:50 a.m. in New York

“We apologize for the inconvenience,” SchwabAugust 5, 2024 at 12:13 pm #10082In reply to: Common Sense Trading

The Market Isn’t Your Enemy

In the current one way markets, the temptation to try and pick a top or bottom can be very strong. So, I am posting the article as a warning, one I learned many years ago the hard way and hopefully you will be able to avoid it. I suggst reading Bobby’;s Risk mangament update in the Trading Academy along with this article.

The Market Isn’t Your Enemy

One of my favorite articles I wrote as a warning to all traders is entitled, The Market Isn’t Your Enemy and it is worth repeating in the current market. I posted this (see below) several years ago to go along with the article and if it was today, I would not be surprised to see traders trying to fight the current trend the other way and sell the JPY with similar results. This is an article that has stood the test of time.

(November 2014)

I saw the trade recap of a trader I know for a long time, who I believe possesses good skills, and took a double take. I was really surprised by his trading sheet to say the least. It was last Tuesday when the JPY fell sharply. On that day, he lost on 13 consecutive trades either selling EURJPY or GBPJPY. You heard it right, 13 losers in a row until he finally gave up for the day.

While I cannot get inside his head, the trade recap suggested he lost discipline and got into a battle with a mindless market. It appears he fell into the trap I warned about in The Market Isn’t Your Enemy. It can happen to even experienced traders and for that reason I am repeating the article below for all to read:

The Market Isn’t Your Enemy

Have you ever had one of those trading days? Have you ever lost money trading and gotten mad at the market? Have you ever taken it personally, lost discipline and tried to convince yourself the market is wrong? Did this make you feel like the market was your enemy? Did this have you fight the trend in order to beat the market only to see your efforts repeatedly stopped out? This has probably happened to most traders at one time or another but it is not something you want to repeat.

The market is not your enemy. It is not a living organism although sometimes it might feel that way. The market is just a place where trades are transacted. Price action may sometimes seem illogical, even irrational but the market is never wrong as it does not have an opinion. It is only a place where forex rates are set. It is the collective will of those trading the market.

There is a term used in forex trading, the trend is your friend. When you catch a trend right, there is little stress, especially if you manage stops so that there is no risk of a loss. When you fight a trend, the market may feel like your enemy if you make it a battle of wills, yours against a place that has no will or opinion. .

Now, this is where the “market is my enemy” can take over. You can’t believe the market is acting irrationally and keep selling at every pause. Each time you get stopped out you get angry, not at yourself but at the market. You can’t believe the market is doing this to you and stiffen your back. You forget about what charts are saying, throw discipline out the window and become determined to catch the top by selling when charts are telling you to buy. By the time the move stalls out, you are beaten, having taken your lumps in what has been an emotionally draining day battling with an unemotional market. The market corrects without you on board.

Does this sound familiar? If so, then don’t repeat it. Step back when that feeling comes and take a deep breath. Walk away and come back with a clear head. Remember, the forex market is not your enemy. It is not a living organism. It is only a place where trades are transacted and prices set. When that feeling comes, remember the adage, “the market can remain irrational longer than you can remain solvent.”.

August 3, 2024 at 12:08 pm #10022In reply to: Forex Forum

adding to “detailed preview”

–

Gooslbee, on Friday, p1ssed on the hair-on-fire screamers for intra-meeting 50pt cutAug 2 (Reuters) – Chicago Federal Reserve Bank President Austan Goolsbee said on Friday the U.S. central bank should move in a “steady” way, a mild pushback against the rush of market bets that the Fed will react to a report of weak July jobs data with a bigger-than-usual half-point rate cut in September.

“We never want to overreact to any one month’s numbers,” Goolsbee said in a Bloomberg TV interview. Even so, he said, “Our absolute goal now is we want to settle at something like full employment, not blow through normal and deteriorate.” …/..Lets see … who ll prevail and trump

August 2, 2024 at 6:09 pm #9994In reply to: Forex Forum

August 2, 2024 at 3:35 pm #9991In reply to: Forex Forum

The difference between

“analysts” (After 5,000 words they will say “on the other hand.”)

and StrategistsAn August stocks slump is ‘absolutely normal’ — but strategists urge caution on buying the dip

https://www.cnbc.com/2024/08/02/august-stocks-slump-strategists-urge-caution-on-buying-the-dip.htmlby Sam Meredith, cnbc

August 2, 2024 at 2:48 pm #9985In reply to: Forex Forum

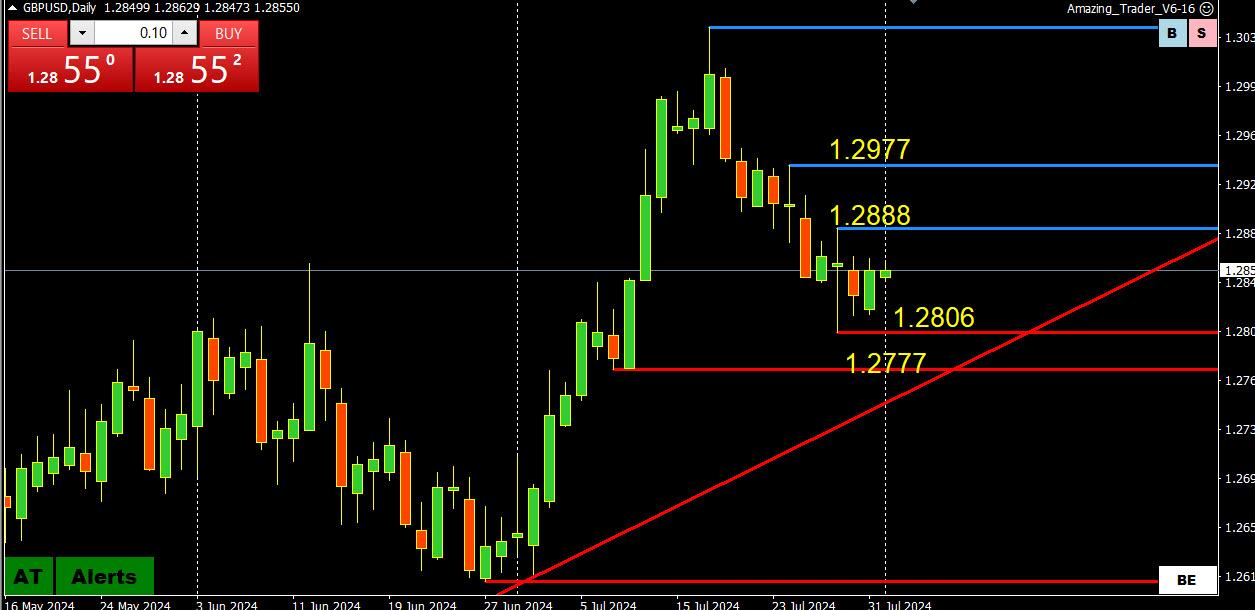

The problem to solve with internal metrics in markets is trusting them. I was long euro from yesterdays lows around the close of the day and held overnight to wake up to nice gains but the metrics telling me to get on the sell side of Sterling, which I was also riding long gains in. There is plenty of logic to substantiate not doing that and so I went with the logic and took the gains earlier than necessary. If you pay attention you can see an hour, a day, a week, two weeks ahead of time. But you have to trust it.

So I trusted the metrics and went on the sell side in Sterling at 2838 and here we are in the low 20’s. Now the metrics are showing dominance on the long side of Yen itself, and so if you are thinking of buying UsdJpy here approaching extension (technical) levels you would really need to have some guts as JP just pointed out.

In answer to JP’s point about fundamentals earlier, my view is that they have been in gear the entire way, you can’t deny that, where the problem to solve lies is the timing in the midst of the flows.

August 1, 2024 at 9:08 pm #9948In reply to: Trading Academy Q&A’s

August 1, 2024 at 10:07 am #9903In reply to: Forex Forum

USDJPY 1 HOUR CHART -THE LEVEL TO WATCH

The bLow off to 148.50 and subsequent BOUNCE back to 150 HAS WIPED THE DECK OF STOPS and suggests potential for a pause/low but only if 150 is solidly regained.

On the upside, there is a minor double to at 150.31. Key resistance is at 151.25.

In any case, 150, which has now traded 2 days in a row IS THE LEVEL TO WATCH as it will dictate what comes next.

July 31, 2024 at 11:40 pm #9893In reply to: Forex Forum

July 31, 2024 at 11:40 pm #9892In reply to: Forex Forum

July 31, 2024 at 9:57 pm #9890In reply to: Forex Forum

Key word: COULD

post-jerome presser headline round-up:WSJ – By Nick Timiraos

Federal Reserve Clears Path for September Rate Cut

Officials made two important changes to their policy statement that acknowledged recent progress in their inflation fight and that pivoted closer to lowering rates without making any explicit commitment.CNBC – By Darla Mercado

Fed recap: Chair Powell gives the September rate cut signal traders were hoping for

” Powell said a rate cut in September is “on the table,” provided the inflation data continues to be encouraging.”New York Times

Rate Cut ‘Could Be on the Table’ at Next Fed Meeting, Powell Says

Jerome H. Powell, the Federal Reserve chair, suggested an interest rate cut could be on the horizon after the central bank held rates steady at its most recent meeting.CNN

Fed opts to hold interest rates steady — but a cut could be coming in September

“A rate cut could be on the table in the September meeting,”

Powell said Fed officials will have to weigh the “totality of the data.”“Certainty is not a word that we have in our business,”

FoxNews

“A reduction in our policy rate could be on the table as soon as the next meeting in September.”“The question will be whether the totality of the data, the evolving outlook, and the balance of risks are consistent with rising confidence on inflation and maintaining a solid labor market,” Powell said. “If that test is met, a reduction in our policy rate could be on the table as soon as the next meeting in September.”

FT

Federal Reserve says first cut to US interest rates could come in Septemberall aboard, all on the same side of the boat !

July 31, 2024 at 9:15 pm #9889In reply to: Forex Forum

July 31, 2024 at 3:57 pm #9855In reply to: Forex Forum

As Jay pointed out and since we have 3 hours to kill before the Moscow Fed Announcement, I have a suggestion for novice traders from spending light years of time on technical analysis and drawing lines as both a normal person and an investment firm executive. You don’t need indicators. You can get to a point where you can simply see without them and you know how to play ball at a high level. Not many get there. You have to really want it.

That said –

Investors want structure and reasons why you allocate if they are to give you the tools to work with. They leave little room for pure absolute skill because they don’t understand it. A bit like an accountant who explains how to be an athlete where the numbers simply do not reflect some things.

So if you are going to secure funds you need a conservative and structured approach which includes a defined process of analysis and risk allocation. Regulatory bodies want it that way as well. Your indicators give you something to talk about, but it always comes down to what your “margin at risk ratio” is, which is how much you allocate at any given time from the total portfolio based on those defined parameters. The going rule has been if you go over 4% you are frowned upon as being a “maverick.”

July 31, 2024 at 1:48 pm #9844In reply to: Forex Forum

July 30, 2024 at 7:25 pm #9819In reply to: Trading Academy Q&A’s

NZDJPY

First we MUST wait for BoJ and FOMC – then we’ll know where everything goes.

Positioning yourself prior to such a big decisions is suicidal.

Technically speaking, that support at 89.800 has to hold for continuation of the Uptrend –

If lost, next one that can underpin it is at 85.300

Now this is where that knowledge on trading crosses comes to play – Based solely on the chart, I would tell you that we’ll be seeing few more weeks down at least….but it all depends on Majors…and it all has to wait on BOJ and FOMC !!!

July 30, 2024 at 10:15 am #9780In reply to: Forex Forum

July 25, 2024 at 12:01 pm #9630In reply to: Common Sense Trading

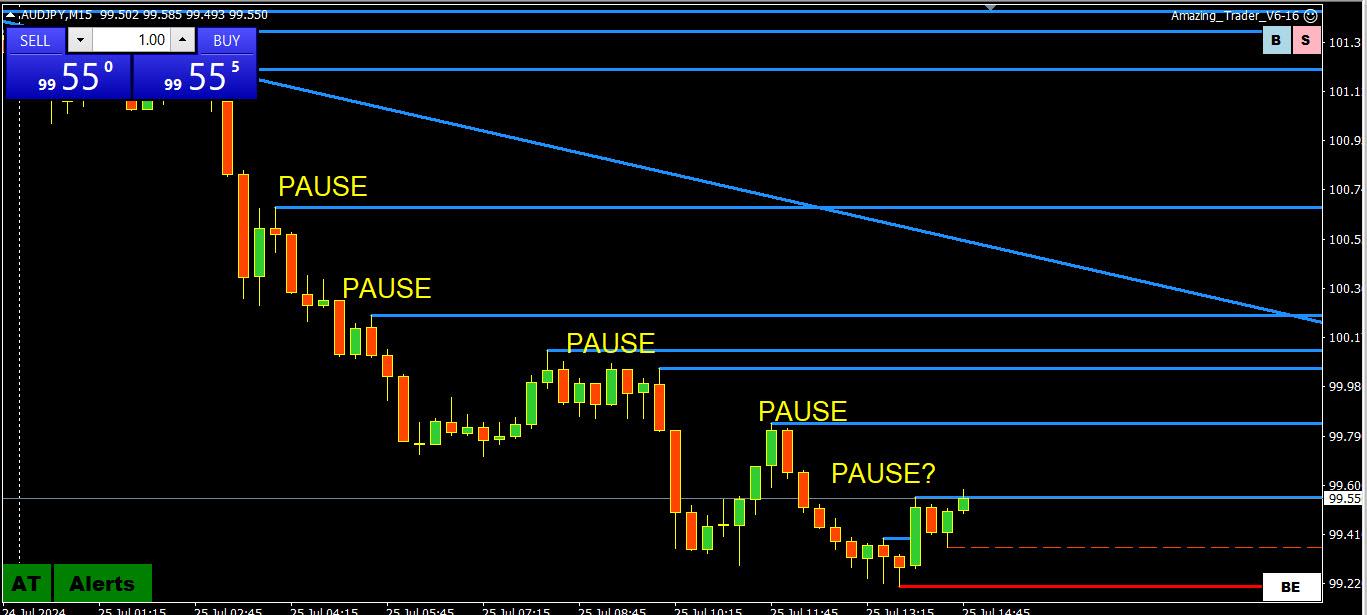

What is a Liquidating Market and How to Trade It

Not all markets should be treated the same. It is therefore tmportant to identify whether you are in a trend, correction, consolidation or what I call a liquidating market.

What is a liquidating market?

A liquidating market is one where the flows are looking to exit positions and not add to existing ones.

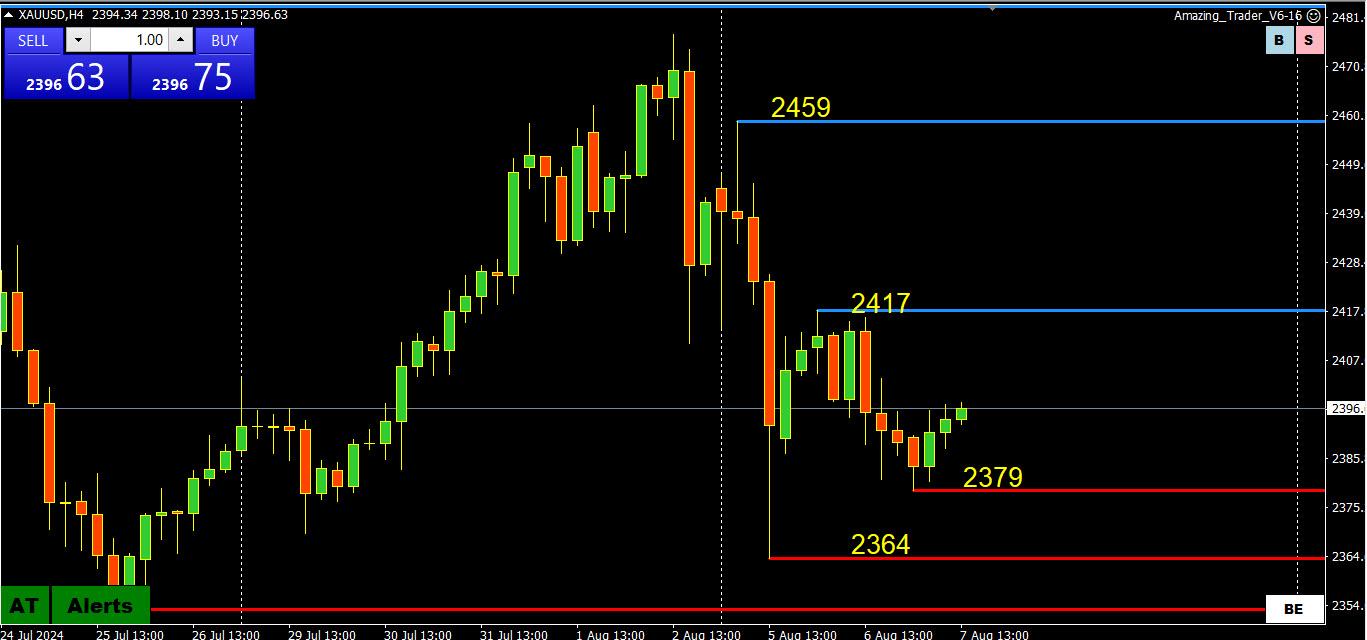

For example, take the current market where short JPY carry trade positions (we will discuss carry trades) are unwinding in forex, gold, stocks. One of the lead in fx is AUDJPY, which is down 11 days in a row. See this 15 minute chart from July 25, 2024 and not how at each pause, there is a minor uptick followed by a push to fresh lows.

So the question is once you recognize the market is in a liquidating mode, how do you trade it?

IDENTIFYING THE TYPE OF MARKET YOU ARE IN IS ONE OF MY KEY FOREX TRADING TIPS.

The way these types of markets tend to trade is that they move in spurts as orders get executed and positions liquidated. Once the order is done, you may see some backing and filling as selling (as in the above case) is done and bottom pickers come in. (and vice versa when short positions are liquidated).

This often gives a false sense of a bottom as the market backs away from the low until the next wave of sell orders. This squeezes those trying to pick a bottom as they get stopped out by fresh selling and a new low.

Much depends on whether key technical levels get triggered as this can accelerate the move and bring in fresh selling. Liquidating markets will eventually exhaust themselves and finally reach a bottom, either by a key technical level holding or by the selling just running out of steam.

How to trade a liquidating marker

The way to trade a liquidating market is either to sell (or buy as the case may be) on the backing and filling but that is often difficult as it is hard to find a nearby stop if the chart is like a one-way street.

Another way is to put a stop entry at the low or high to go with the next wave of sell (or buy =0 order liquidations.

The other way is to wait it out and only go against the move if you sense it has completely lost steam.

However, the tendency is to buy at each pause, hoping to catch the falling knife after a new low. The danger in this approach is that by the time a low is in place you may be too beaten up to catch the bottom.

The key point is to recognize the type of market you are in and that the hardest trade is often the right trade. The easy and in this case the wrong trade is to buy the easy to get filled at what looks like an attractive level trade.

Note I used a market that is liquidating long positions as an example. The same principle applies to when short positions get liquidated.

July 25, 2024 at 11:45 am #9628In reply to: Forex Forum

FRAUD

– only when a scam is successful can it be described as fraud

– for a fraud to be considered successful the scam operator must not ever be caught.Two Canadian journalists – Zak Vescera & Adrian Ghobrian – are left w/ jaws agog

Canadian company at the centre of alleged international pyramid scheme: authorities

A Canadian company – Metaverse Foreign Exchange Group Inc., also known as MTFE, pitched itself as a reputable online trading platform – is at the centre of an alleged pyramid scheme that foreign officials say stole more than US$2 billion from hundreds of thousands of people in Sri Lanka and Bangladesh, according to authorities in those countries.

Efforts to locate MTFE’s sole Canadian director, Randy Mathieu Lane, who had a listed address in Richmond, B.C., were unsuccessful.

July 22, 2024 at 1:56 pm #9470In reply to: Forex Forum

Good R/R in Singapore Dollar vs US Dollar (UsdSgd) from the 3440’s if it gets there again.

The good portfolio managers are taking risk off the table and hedging a bit in recent weeks. The bad ones are blaming it on Trump and losing money. Not sold on the doom and gloom permeating some media and money manager sources in the US should he take office, rather Europe looks more disjointed and unstable to me at present both ideologically and fundamentally, bearing in mind the US currently has no president or vice president.

The bottom line on rates is the FED will cut in September and that is being gradually priced in.

-

AuthorSearch Results

© 2024 Global View