-

AuthorSearch Results

-

September 17, 2024 at 3:26 pm #11763

In reply to: Forex Forum

September 16, 2024 at 1:24 pm #11703In reply to: Forex Forum

September 15, 2024 at 8:06 pm #11678In reply to: Forex Forum

fwiw… UBS has forecasted 275bps.

I some what disagree… FED will either hold or raise them by 25bp now because a rate cut now means they cannot raise them later down the line in stormy weather. and that means the true one who is to meant to become the next US president won’t become president. In any case, Japanese can be helpful in buying short term treasuries since they lend at almost negligible interest rates.

They can think of cutting rates after a few more quarters…

The US needs to become a Saviour Economy as it once was. I would balance geo-economical tensions and keep geo-political dominance by ha-flyin-gas-bags in check… holding rates until inflation lingers/stays below the target level during many quarters would cause “inflation and it’s inflationary effects” to fizzle out.

low rates means people would then keep on borrowing, so that kind of servant mentality of theirs has to go, so they have to save their money (at high rates) so they do not need to take loans… or at least I want it to be that way.

think about it if Americans get outta debt the first thing they do is start helping people.

Americans also do tend to do better business by sourcing high quality goods at very reasonable rates from European and UK companies when they are not under economic uncertainty. They can always take loans from japanese funds to pay for european imports into the mainland, since there is negligible interest rate it would be very easy to pay off provide the tariff levels for european imports and egyptian cotton remains low…

eg. asian tiger economies which are still struggling to carry out a covid reset… The world will not recover from covid for many more decades because it will again become a resurgence in a few years of time.

many of the various economic classes in the asian economies lost their sole breadwinners and future sole breadwinners to covid, additionally some children lost their parents to covid and need to grow up to be sober and sensible young business people, and not turn to crime/join gangs etc. So those supporting them tend to look for stability in savings accounts to finance them through their growing years.

September 12, 2024 at 7:55 pm #11592In reply to: Forex Forum

September 12, 2024 at 6:58 pm #11591In reply to: Forex Forum

XAUUSD – Gold

Supports : 2530.00 , 2500.00 & 2470.00

Resistances : 2590.00 , 2620.00 & 2730.00

If what we have seeing in last two months was a consolidation phase, this might be a start of the Rally.

Two levels come to mind in that case : 2750 & 2850

Mind you, market has no brains – I still remember Gold at 250 ( yes, didn’t miss a zero here – two hundred and fifty ), and at that time I had a problem calming down some big clients , forcing them to hold on their gold ( physical ) .

Now in this time of uncertainty , what better then Gold ?

September 12, 2024 at 9:34 am #11551

September 12, 2024 at 9:34 am #11551In reply to: Forex Forum

USDJ[Y 4 HOUR CHART – CONSOLIDATING?

Looking for a bottom in this USDJPY remains a losing trade after another new low this week at 140,7o.

With that said, the two red AT lines is a pattern that has potential for a low but ONLY if 143.79 is firmly taken out.

Otherwise, current range us 140.70-143.79 as USDJPY consolidates after setting a new low.

September 10, 2024 at 2:52 pm #11498In reply to: Forex Forum

September 10, 2024 at 10:58 am #11492In reply to: Trading Academy

Intraday Trading Techniques – Part 2

As explained in previous lesson, determining the daily / 4h chart direction will give you a more clear view on intraday actions.

Let me repeat once again :

It has been said many times: “The trend is your friend.”b The question is, how does one find the trend? It often comes down to using various indicators to help determine which way a market has been moving, and thus where it might go next. One of the most popular to use to help determine this information is the moving average.

When the price of the market stays below the moving average, then the pair is said to be in a downtrend.

When it is above the moving average, it is said to be in an uptrend. Both are movements that can potentially be capitalized on, but the trader needs to be aware of how the different trends should impact their trades.The best recommendation from most experienced traders is that a trade should be placed in line with the prevailing trend.

There is no heroism in placing a trade that goes hard against the trend. This is actually a recipe for disaster in most scenarios, and it is a good way to lose money.

Don’t Get Faked Out

Try not to get too caught up in whether the price is just above or just below the moving average. Sometimes, using the moving averages alone is too simplistic.

There is one way to have a high probability of any given trade :

Always wait for the confirmation – in the case of Moving Averages it is most of the time two consecutive closings of bars ( above or below the MA’s)

Most of the traders will tell you to use additional Indicators in confirming the move, but I am always for a Simple solutions :

If you start combining too many different indicators, you are going to end up frustrated and missing trades

You will start to hang on your opinion , trying to find an indicator that supports it – The Disaster

You better arrange your Stop Loss in line with Profit Target and Risk/Reward Ratio and never commit too much of your current margin to just one trade.

That way, you have an upper hand and as long as your Probability in any given trade is above 50% , you can’t miss it.

September 10, 2024 at 10:44 am #11489In reply to: Forex Forum

September 9, 2024 at 9:27 am #11450In reply to: Forex Forum

GBPUSD DAILY CHART – Support tested

Today’s low 1.3087

As posted in out Weekly FX Chart Outlook

The failure to hold above it and retest the high suggests a lack of power but only a break of 1.3087 would suggest more to the downside. Above 1.3087 it is still in a consolidation mode.

September 9, 2024 at 12:06 am #11442In reply to: Forex Forum

EYE ON YELLEN

She believes• Treasury Secretary Janet Yellen said that she believes the U.S. economy is healthy and that recent months of cooler jobs data is a signal of a soft landing, not a recession.

• Yellen said the U.S. is not seeing meaningful layoffs and the economy is “deep into a recovery.”Treasury Secretary Janet Yellen sought to reassure the public on Saturday that the U.S. economy remains strong, despite a string of weak job reports that have rattled investors and weighed on the stock market.

“We’re seeing less frenzy in terms of hiring and job openings, but we’re not seeing meaningful layoffs,” “I’m attentive to downside risk now on the employment side, but what I think we’re seeing, and hope we will continue to see, is a good, solid economy.” – Yellen said at the Texas Tribune Festival in Austin

And all clowns at the festival laughed so hard they rolled on the floor and some in the mud outside

September 4, 2024 at 12:51 pm #11262In reply to: Forex Forum

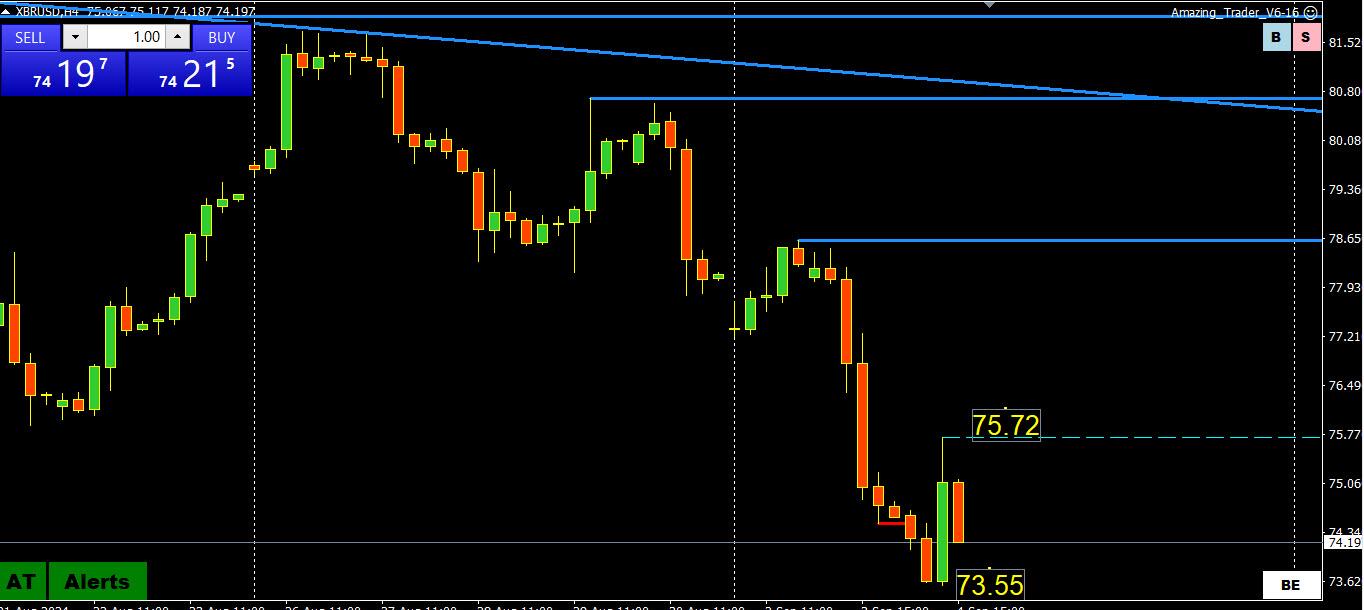

XBRUSD 4 HOUR CHART

Crude oil i getting a lot of attention as a risk indicator after melting down further yesterday. t then got a dead cat bounce today to 75.72 on chatter OPEC+ may hold off expected production increases..

Whatever the case, a solid move back above 75.00 would be needed to cool the sell-a-thon.

September 3, 2024 at 10:31 am #11212In reply to: Forex Forum

September 3, 2024 at 10:00 am #11209In reply to: Forex Forum

USDCAD 4 HOUR CHART – PRE-BOC JITTERS

As posted in our FX Weekly Chart Outlook

‘

‘Look for the focus to be on the BoC meeting on Wednesday where a rate cut is widely expected.In the meantime, 1.35 is one of those pivotal levels that would need to be solidly renewed along with a break of 1.3515 to suggest the bottom is in for now.

Given the absence of nearby resistance after the straight line move down, use our FIBO calculator for retracements to find levels of potential resistance beyond 1.35..

September 2, 2024 at 5:58 pm #11195In reply to: Trading Academy

Intraday Trading Techniques – Part 1

Anyone that came even close to some form of speculating in the markets, be it a forex, cfd’s, metals, crypto or any other existing instrument , started dreaming of making it a full time job ( with lots of money as a reward, of course J

Once first steps are taken, very quickly it becomes clear that just surviving in it is close to impossible, not to mention the original dream : full time job, lots of money, lots of free time, independence….

Still, the hope stays…there are some people out there that did it.

But is it really possible ??

Every single one of you was ( and is ) watching charts, seeing great moves ( OMG, if I just bought/sold it) , calculating possible profits and thinking of all the nice things that you could have done with that easily made money…

August 30, 2024 at 11:17 am #11124In reply to: Forex Forum

August 28, 2024 at 3:23 pm #11065In reply to: Forex Forum

Interesting facts related to super computing while we wait for Nvidia.

In the 1st decade of the turn of the century the net gain of jobs in the US was zero.

To visualize the impact of disruptive technology, In the 19th century 50% of workers were employed on farms. By the year 2000 the number was 2%. This is an isolated sector. AI comprises all sectors.

The amount of data stored on the worlds computers is now believed to be over 1,000 billion gigabytes. AI is accelerating the ability of robotics to use that data to actually form perpetually stronger learning and reaction by the computers themselves far in advance of the speed of humans.

Oxford University projects that almost half of global jobs are likely to be replaced in roughly 20 years. That equates to 60 million jobs in the United States.

August 27, 2024 at 10:26 pm #11028In reply to: Forex Forum

August 27, 2024 at 1:29 pm #10997In reply to: Forex Forum

August 26, 2024 at 9:12 pm #10969In reply to: Forex Forum

AUDUSD 4 HOUR CHART – TARGET HIT

Consolidating

Hit its key target at the 2024 .6797 high and then backed off.

Would need a firm break of.6800 for another 100 pips on the upside.

Room on the downside for a retracement but that is all it would be unless .6697 is taken out,

Use 6750 as one of those pivotal levels that needs to hold to contain the doiwnside.

-

AuthorSearch Results

© 2024 Global View