-

AuthorSearch Results

-

October 2, 2024 at 8:01 pm #12405

In reply to: Forex Forum

US500 4 HOUR CHART – Consolidation or retracement?

Retreat from the record high so far holding off a serious retracement by staying above the 5772 line.

With a Geopolitical cloud hanging over markets and Friday’s US jobs report looming, keep an eye on 5700 as that will likely set the tone.

No matter what, the Middle East risk should keep stocks cautious into the weekend.

October 2, 2024 at 7:53 pm #12404In reply to: Forex Forum

October 2, 2024 at 12:44 pm #12386In reply to: Trading Academy

Trading in current conditions

We have all said a lot about trading in geopolitical turmoil’s, but I would like to mention something that is directly causing a havoc within all those trading on Small time frames ( just like me 😀

No matter how good your system/strategy is, right now we have to rethink our entry and stop loss levels – every now and then we can see some “unnatural” spikes happening where they shouldn’t be.

In reality, your trade would be just fine if there wasn’t that silly spike….hitting your stop loss just for fun.

So what to do?? Well, idea of widening my stop is not something that I favour – so for me better solution is to move to a bit bigger time frame ( from let’s say 4min chart to 10 min chart, or even bigger) as those spikes would be more natural and easier to avoid.

Just my 10 cents worth….

October 2, 2024 at 12:42 pm #12385In reply to: Forex Forum

We have all said a lot about trading in geopolitical turmoil’s, but I would like to mention something that is directly causing a havoc within all those trading on Small time frames ( just like me J

No matter how good your system/strategy is, right now we have to rethink our entry and stop loss levels – every now and then we can see some “unnatural” spikes happening where they shouldn’t be.

In reality, your trade would be just fine if there wasn’t that silly spike….hitting your stop loss just for fun.

So what to do?? Well, idea of widening my stop is not something that I favour – so for me better solution is to move to a bit bigger time frame ( from let’s say 4min chart to 10 min chart, or even bigger) as those spikes would be more natural and easier to avoid.

Just my 10 cents worth….

October 1, 2024 at 2:04 pm #12337In reply to: Forex Forum

October 1, 2024 at 10:15 am #12308In reply to: Forex Forum

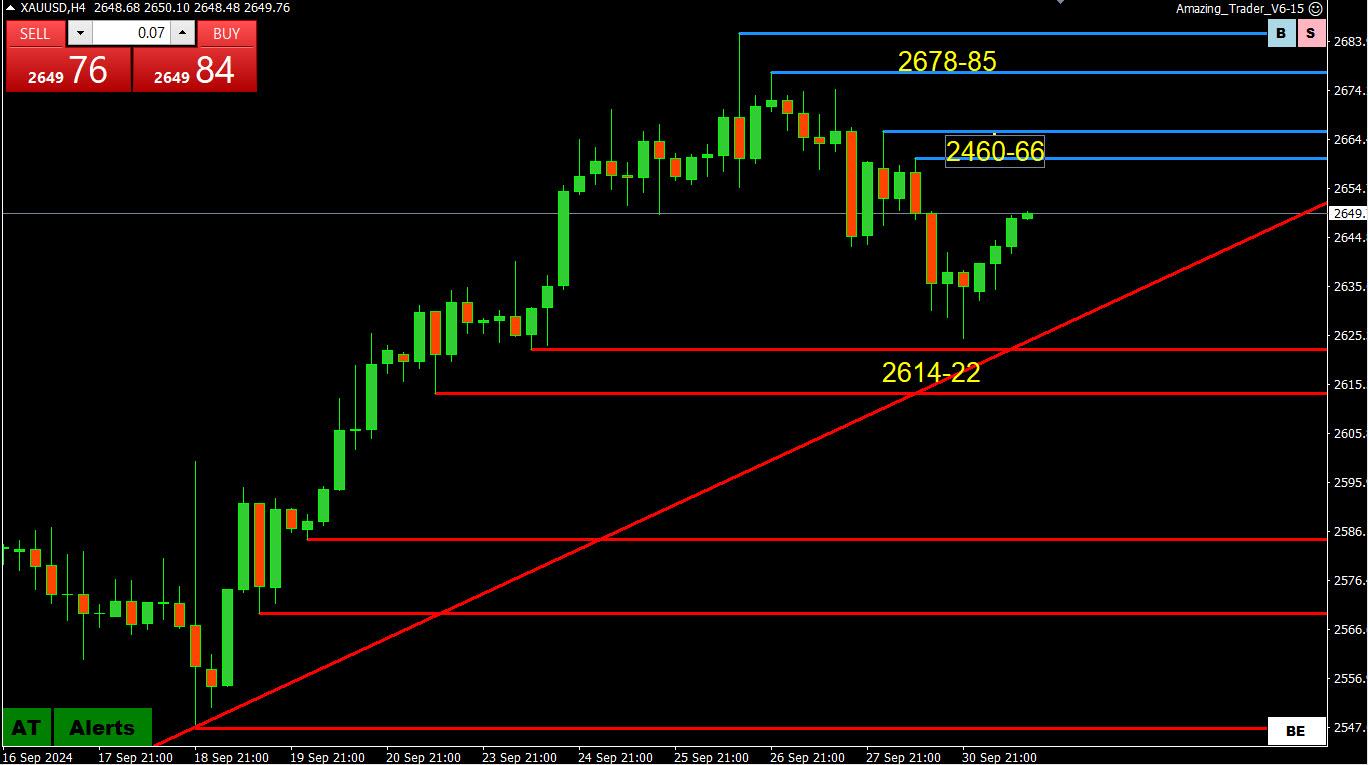

XAUUSD 4 HOUR CHART

Having paused above the top of 2614-22 support the focus shifts back to 2650 as a bias setter.

To suggest another run at the record high, 2660-66 would need to be overcome.

Otherwise, rising Middle East tensions suggest some safe haven demand but unless the high is taken out, it may just be a period of consolidation within 2600-2700.

September 30, 2024 at 5:58 pm #12287In reply to: Forex Forum

… Looking forward, if the economy evolves broadly as expected, policy will move over time toward a more neutral stance. But we are not on any preset course. The risks are two-sided, and we will continue to make our decisions meeting by meeting. As we consider additional policy adjustments, we will carefully assess incoming data, the evolving outlook, and the balance of risks. Overall, the economy is in solid shape; we intend to use our tools to keep it there.

September 27, 2024 at 4:02 pm #12188In reply to: Forex Forum

Food for thought.

1. Why would you pay attention to a “bias indicator” based on the total of retail customers of a brokers client base knowing the vast majority of retail traders are wrong and lose their money? Nice gimmick.

2. A well known and highly frequented FX “advisor” frequently quoted in news feeds, primarily to retail audience noted very early this morning before the action really hit that “UsdChf is trading flat, best to stay away.” Why? Would it not be better to learn how and why to be active in it successfully? The pair dropped over 100 points in a short period of time. They don’t know what they are doing beyond average in my opinion. They do have solid informational value if you are novice.

3. Why would you not listen to a highly skilled and very kind former bank Trader like Jay Meisler instead? Or a former in demand CTA such as myself or the other actual and very skilled former bank traders who frequently post here in GVI?

I sold UsdJpy right before it collapsed last night in late Asia. I have been long AudUsd since yesterday. I have been short UsdChf since yesterday against a lot of opinions to be long US Dollar. I have been long GbpUsd since yesterday. Picking away at EurJpy on both sides the entire way. You won’t find that with Youtube or TikTok gurus or the aforementioned not as stellar as advertised advisory sources which are popular.

You will find it here in GVI.

Disclaimer – I am not paid by GVI or under contract with GVI in any fashion. I am simply commenting in the hope of being helpful and enjoy the input from others here.

September 27, 2024 at 1:46 pm #12175In reply to: Forex Forum

Purely because I want to help. I sold UsdJpy before the results in late Asia. I am sure you can see the result.

A brief expansion of prior post regarding UsdJpy and Japan’s new leader. The reason I know about why the pair was obliterated is because I am very much like a CTA. Because I was one. What separates a lot of people from the pack is dedication. I know about the change in leadership in Japan because I was active and absorbing mass amounts of vital information during the Asian session. Which I do every night, even on Saturdays and Sundays. I do not participate based on gimmicks offered by brokers or youtube stars, or TikTok stars.

Final note on the subject and then back to markets – If I were you I would listen to Jay with GVI. He was a real bank trader, and a very good one. Not the kind who was a bank trader but not talented but tries to sell themselves on youtube. An actual, solid, talented bank trader. If you do not think he is good you are fooling yourself.

Very simply, dedication and a professional approach. Not pajama trading approach.

September 26, 2024 at 9:59 am #12089In reply to: Forex Forum

XAUUSD 4 HOUR CHART

Consolidating between 2650-2570 (record high) for 2 days… given the strength of this move, there are not likely to see a lot of stops above the high bid… keeps a bid as long a 2650 trade.

Risk on/risk off does not seem to influence gold so watch to see if can extend its record high… if not then it would need to break below 2650 to suggest anything more than a pause.

September 25, 2024 at 8:13 pm #12080In reply to: Forex Forum

US500 4 HOUR CHART

This is a hard one with the upside showing some signs of consolidating and at least on this chart needing to clear 5750 to put 5800 on the radar.

On the downside, support is at 5670-00.

Note that CFD price feeds can differ between broker, even those using the same symbol. Ss, look at the chart pattern if the levels below do not line up with the prices on your chart.

September 25, 2024 at 2:10 pm #12059In reply to: Forex Forum

September 24, 2024 at 4:59 pm #12024In reply to: Forex Forum

September 24, 2024 at 4:12 pm #12021In reply to: Forex Forum

I use a very cycle driven algorithm model. In that model for UsdJpy the key areas are 143.10 and 144.10 (ironically) at present. 143.60 is the price magnet (at present) and is right in the middle.

I sold 143.80, I bought 143.55 and then sold 143.69. Already out of the sell but if I see 143.40 break I will likely jump on it for 143.

September 24, 2024 at 9:19 am #11996In reply to: Forex Forum

USDJPY 4 HOUR CHART – WATCH THE MOVING AVERAGE BAND

Trading within the moving average band bounded by the 200 4 hour (yellow) on top and 4 hour 100 4 hour (blue) on the bottom, both still sloping down.

On the other side, technicals are tilting positive (rising red AT lines) but only a solid move above 144.50 ( high today 144,68) would suggest more scope to this retracement.

September 23, 2024 at 6:47 pm #11979In reply to: Forex Forum

US500 4 HOUR CHART – TAKING A BREATHER

Note that CFD price feeds can differ between broker, even those using the same symbol. Ss, look at the chart pattern if the levels below do not line up with the prices on your chart.

Remains in record high territory but taking a breather.

This suggests perhaps we see some consolidation unless a new (record) high is set.

Supports 5686, 5671, 5605

Resistance, 5723, 5735, ?

September 23, 2024 at 6:40 pm #11977In reply to: Forex Forum

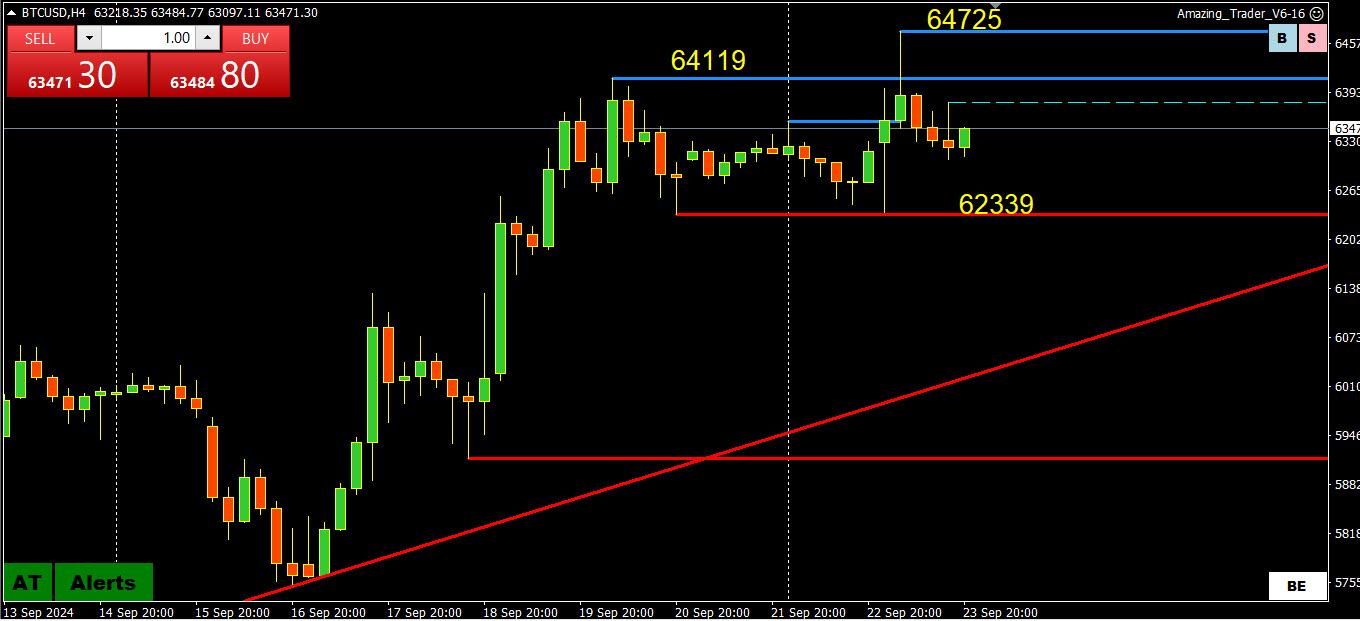

BTC 4 HOUR CHART – GLASS HALF FULL OR EMPTY?

Those trading BTC are likely frustrated watching GOLD trade to new record highs while this crypto strugglres to build momentum..

While technicals are tilted more to the upside, to suggest a shift in target to 70K it would have to solidly take out 65-66k

Otherwise, expect more chop while it stays within 60-65K.

September 23, 2024 at 8:01 am #11947In reply to: Common Sense Trading Q&A’s

I was asked this question:

Can I trade just using a mobile phone or do I need an internet connection and a laptop?

Of you want to have a chance of being a successful trader in leveraged trading, the answer are:

No (you cannot use just a mobile)

Yes (you need an internet connection and either a laptop or desktop computer)

Markets rarely operate like a textbook and can be quite fickle, especially of you are day trading. You might get lucky with some trades just using a mobile but odds are against you if you rely on it solely for your trading.

September 20, 2024 at 8:13 pm #11926In reply to: Forex Forum

September 18, 2024 at 4:22 pm #11805In reply to: Forex Forum

-

AuthorSearch Results

© 2024 Global View