-

AuthorSearch Results

-

October 30, 2024 at 4:03 pm #13700

In reply to: Forex Forum

JP – forwards contracts have dark clouds all over the place. Options implied volatility shows stable movement for the current contract (not a directional metric just market participation climate). Sell side looks dominant internally into buy side volume. Buy side is dominant overall but the activity is showing a tussle approaching 0880.

Implied volatility in Yen is stale at present, it was rising a bit a week ago and a month ago, so the options market is of the belief we don’t see any dramatic price swings right now. That can change of course and the MOF/BOJ decision tonight has plenty of potential to alter that. Right now it is moving lock step with Black-Scholes application so the read is sturdy. The higher priced options are at 144.90 roughly.

Side note – my primary email was hacked again last night so you have to reach me by phone or through Jay until I get it resolved. The day I became a CTA years ago they have been after my email and bank accounts since lol.

October 30, 2024 at 2:36 pm #13692In reply to: Forex Forum

October 29, 2024 at 9:15 am #13584In reply to: Forex Forum

USDJpY DAILY CHART – Fun and Games

Fun and game yesterday after USDJ{Y retreat from a 153.85 post-election high found support in its opening week gap (above 152.35-40) and popped back above 153. Scroll back to yesterday’s posts to see a good real-time illustration of trading opening week gaps.

Here is a way to keep it simple

If current range is 152-155, then the 153.50 midpoint will dictate which side is ultimately at risk

If the range i a tighter 152-154, then 153 sets the tone.\

Correction: USDJPY high should read 143.88

Otherwise, uptrend is intact unless 151.44 is taken out but consolidating while below 153.85.

October 29, 2024 at 8:25 am #13581In reply to: Forex Forum

BTCUSD WEEKLY CHART – RECORD HIGH ON THE RADAR?

While currencies consolidate, BTCUSD is trying to make a run at its record 73840 high following the long awaited move back above 70K.

To make a run at the high, 72K would need to be firmly broken.

Back beoow 70L would cool the risk, strong bid while above it.

October 29, 2024 at 8:19 am #13580In reply to: Forex Forum

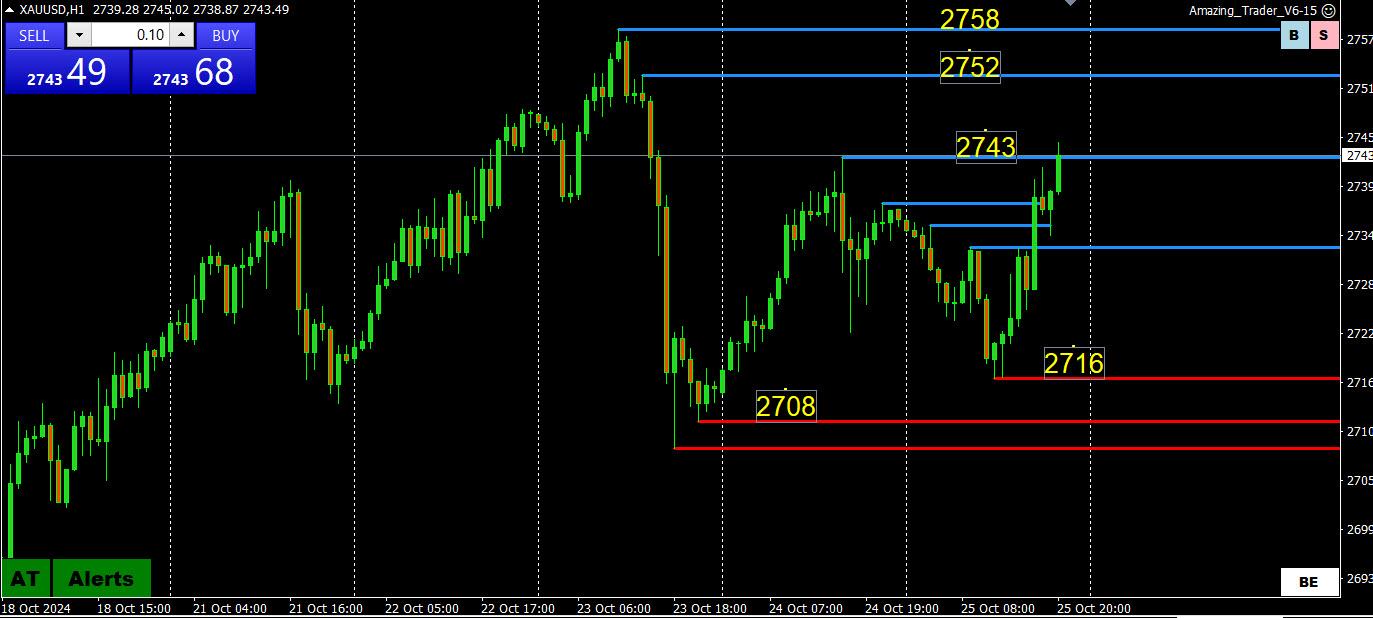

XAUUSD 4 HIUR CHART – AIMING FOR ANOTHER RECORD HIGH?

Keep this one simple

Uptrend consolidating

Watch 2750… if it becomes support, a run at the record high would seem inevitable

Should 2758 be broken, it would then need to become support for 2780-00 to come on the radar.

Back below 2739-50 would cool the risk.

October 29, 2024 at 8:12 am #13579In reply to: Forex Forum

EURUSD 4 HOUR CHART – FOCUS ON 1.08

Current consolidation range is 1.0761-1.0839, a symmetric 39 pip range either side of 1.08.

1.08 has printed 4 days in a row coming into today… see if this pattern can be extended or broken.. a break of this type of pattern often sends a directional signal.

So, 1.08 is clearly pivotal and will dictate the tone going forward.

October 28, 2024 at 2:04 pm #13531In reply to: Forex Forum

October 28, 2024 at 10:11 am #13513In reply to: Forex Forum

October 28, 2024 at 9:31 am #13506In reply to: Forex Forum

EURUSD 4 HOUR CHART – 1.08 PATTERN

EURUSD extending its trading pattern around 1.,08 to 4 days in a row a it consolidates above last week’s 1.0761 high.

To further highlight the 1.08 pattern, the current range is 39 pips either side of it (1.0761-1.0839)\

To suggest momentum for a run at 1.0761, 1.0782 swould need to be broken.

October 25, 2024 at 6:00 pm #13463In reply to: Forex Forum

October 25, 2024 at 9:55 am #13419In reply to: Forex Forum

USDJPY 4 HOUR CHART – Consolidating before the election

While attention has been on the US election, Japan goes to the polls this weekend.

This runs the risk of a gap opening to start next week and also the BoJ waiting in the wings to covertly intervene if needed.

Otherwise, 152 remains a pivotal level, 151.40 = 200 daily mva (paused above it).

Suggests a 51.50-152.50 as a possible consolidation range.

October 25, 2024 at 9:26 am #13418In reply to: Forex Forum

XAUUSD 4 HOUR CHART – Consolidation or Retracement?

‘

It has been hard to bet against the relentless rise in XAUUSD but chart shows potential for a top for now, a retracement or at least consolidation.To suggest a retracement, 2700-08 would need to be firmly taken out.

Otherwise, just consolidation.

October 24, 2024 at 1:43 pm #13379In reply to: Forex Forum

October 24, 2024 at 12:21 pm #13372In reply to: Forex Forum

October 24, 2024 at 11:21 am #13359In reply to: Forex Forum

October 24, 2024 at 9:51 am #13340In reply to: Forex Forum

I guess looking back, it was too much to expect a one way market given the current geopolitical and political (US election uncertainties,

In any case, there were some failures worth noting

EURUSD failed to stay below 1.0777

USDJOY failed to reach 153.39 (61.8%)

AUDUSD failed ti hold breaks of .6621 and the 200 day mva (6626)

XAUUSD failed in the 2700-14 support zone

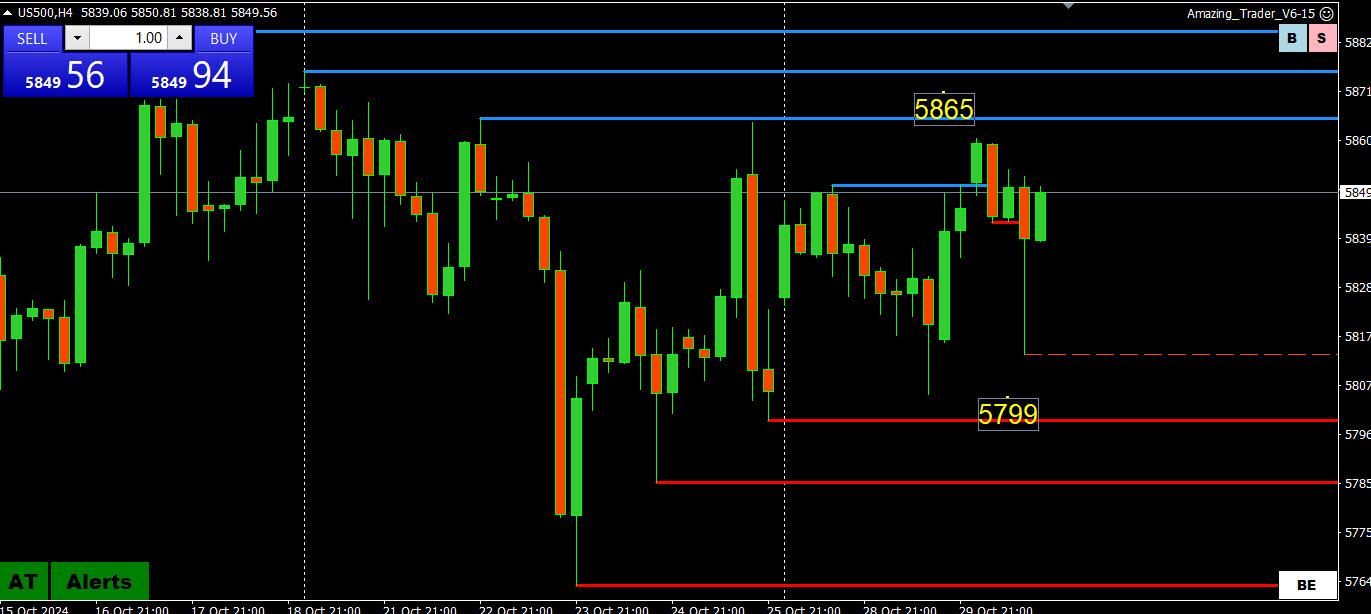

US500 failed to sustain break below 5805However, so far this has just given the market a breather. To suggest anything

More than this EURUSD would need to solidly regain 1.0800, GBPUSD 1.30 and/or USDJPY stay below 152 and move back below its 200 day mva.October 23, 2024 at 7:14 pm #13304In reply to: Forex Forum

Yen option buyers started coming in around 8:30 PST / 11:30 EST. The result has not yet seen results to cause absolute conviction of Yen pairs selling off and sticking but a decent start in terms of positioning. To this point it has been a one day sell. The same timing took place for US stocks and they lifted at the same times but to this point it could just be bottom feeding or hedging or portfolio adjustments. Fairly convincing week however and today especially to consider the sell side having staying power for Yen pairs.

October 23, 2024 at 2:42 pm #13289In reply to: Forex Forum

October 22, 2024 at 7:29 pm #13230In reply to: Forex Forum

October 21, 2024 at 8:07 pm #13176In reply to: Forex Forum

-

AuthorSearch Results

© 2024 Global View