-

AuthorSearch Results

-

November 26, 2024 at 9:30 pm #15142

In reply to: Forex Forum

November 22, 2024 at 8:04 pm #14894In reply to: Forex Forum

Very simply Yen is in a buy cycle and UsdJpy is not. I would love to see futures dip again to start next week for another solid entry in spot. EurJpy is not moving with UsdJpy well and so for that one remains a good sell. Maybe long term. You really do benefit from at least paying attention to fundamentals.

November 22, 2024 at 3:18 pm #14886In reply to: Forex Forum

GBPUSD WEEKLY CHART -8 down weeks in a row

EURGBP at .8310 says GBPUSD is being pulled along for the ride by the falling EURUSD.

It has been 8 down weeks in a row so until/unless this pattern changes, it will stay in a sell mode but dependent on EURUSD for direction.

Key focal point is 1.25, solidly below it would be needed to put 1.2444 and the 1.2298 2024 low in play.

1.0220/1.2298 = .,8310

November 20, 2024 at 9:02 pm #14758In reply to: Forex Forum

November 20, 2024 at 8:47 pm #14755In reply to: Forex Forum

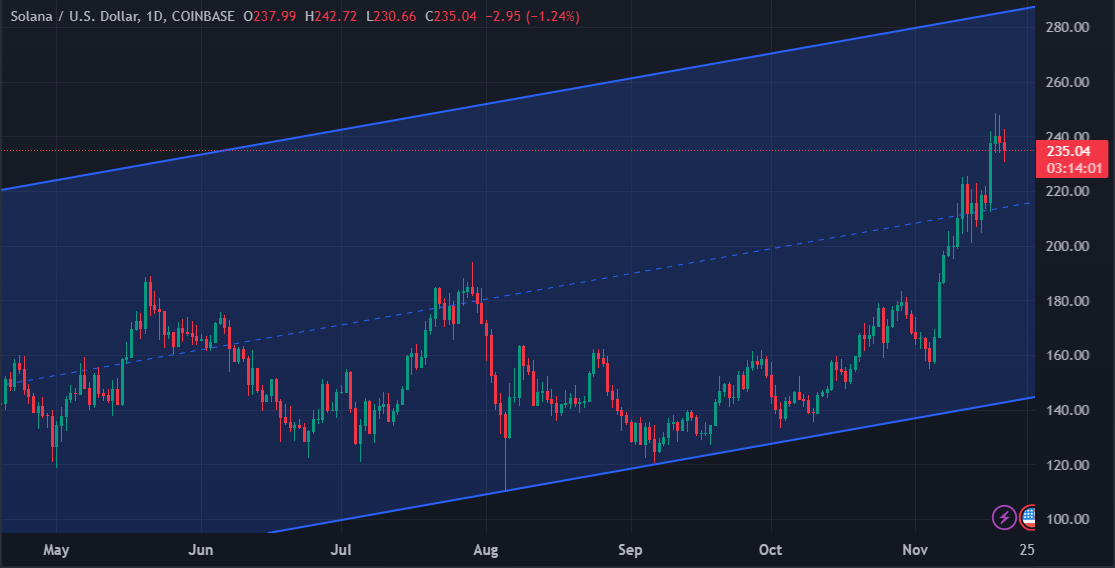

SOLUSD – Solana

Solana (SOL) Price Pattern Points to Brief Dip, $260 Target Next

Sol value could face a setback before its potential rise toward $260. At press time, SOL’s value is $237.88, representing a 15% hike in the last seven days.While SOL holders would expect the rally to continue, several technical indicators suggest that they might need to wait a little longer.

Solana Uptrend Pulls Back

November 18, 2024 at 9:56 pm #14588

November 18, 2024 at 9:56 pm #14588In reply to: Forex Forum

Solana – USD

Meme Coin Mania Ignites Activity on Solana, Coin Eyes the $260 All-Time High

A renewed surge of meme coin mania on the Solana network, driven by Donald Trump’s election victory, has sparked a significant rise in user activity since early November. This heightened demand positions Solana’s native coin, SOL, to potentially reclaim its all-time high of $260.

Currently, SOL trades just 6% below this peak, leaving the market speculating on how soon it might reach that milestone.

Users Flock to Solana for Its Meme Coins

November 18, 2024 at 8:58 pm #14581

November 18, 2024 at 8:58 pm #14581In reply to: Forex Forum

Amazon.com Inc – AMZN

Jeff Bezos Sold $3.37 Billion in Amazon Shares in November and The Sales Will Not Stop There

Until this is written, Bezos still has 911.11 million Amazon shares equal to around 9% of the Amazon’s total outstanding of 10.447 billion of shares. The sales are part of a prearranged trading plan under the SEC’s 10b5-1 rule, which allows corporate insiders to sell a predetermined number of shares at set times to avoid accusations of insider trading. November 18, 2024 at 12:15 pm #14530

November 18, 2024 at 12:15 pm #14530In reply to: Forex Forum

November 18, 2024 at 10:36 am #14523In reply to: Forex Forum

EURUSD 4 HOUR CHART – NO SURPRISE

It should come as no surprise to see EURUSD gravitate back to 1.0550, which is the bias setting level while within 1.05-1.06

Note firmer EUR crosses (e.g. EURJPY, EURGBP) giving EURUSD support but not enough to break the key 1.0593 level.

So let’s call it consolidation of the downtrend where only a break of 1.0590-00 would shift the risk from 1.0495-10.

November 14, 2024 at 8:38 am #14388In reply to: Forex Forum

XAUUSD DAILY CHART – CRUNCH TIME FOR THE BULLS

XAUUSD is down for the 5th day in a row and about 8.5% from its record 2790 high in just 2 week

CRUNCH TIME FOR THE BULLS::

2546 = next support/target

2543 = 100 day mva

Below 2543-46 would expose 2500 with key support below this level

On the upside, a solid move back above 2600 would be needed to ease the risk.

November 13, 2024 at 9:01 pm #14378In reply to: Forex Forum

November 13, 2024 at 8:52 pm #14376In reply to: Forex Forum

November 13, 2024 at 4:28 pm #14359In reply to: Forex Forum

US500 4 HOUR CHART – CONSOLIDATION?

I posted this late yesterday and so far, this is just consolidation.

Keep an eye on 5963 as a break would suggest a pause and risk of a retracement.

On the other side, 6000 is clearly a majo pivotal level that will dictate whether this is just consolidation or risk of a deeper retracement.

November 12, 2024 at 9:04 pm #14328In reply to: Forex Forum

November 12, 2024 at 8:59 pm #14327In reply to: Forex Forum

November 6, 2024 at 4:33 pm #14074In reply to: Forex Forum

Trump won every single swing state and the popular vote. That is an absolute statement blowout election by the American populous.

What one might hope for at a minimum is more fluidity in how the US operates as an institution going forward.

If they would kindly find a way to reduce the budget and trade deficits that would be nice. Trump will attack that right away, but there will surely be a battle to retain dysfunctional spending of tax dollars, such as millions in funding for child sex mutilation surgery and grooming research programs.

The country has been insane for a spell.

Bottom line for us in foreign exchange is stiff interest rates and yields might be expected.

November 5, 2024 at 6:43 pm #13997In reply to: Forex Forum

The only certainty following initial election results is there will be just as much if not more uncertainty.

I think US stocks in particular will go on a bull run regardless of who wins after the dust settles but the magnitude will be greater if Trump takes over. It will be fascinating to see how many outfits make ill advised moves out of emotion and denial.

This will be a contested election no matter who is looking like the winner and the dust won’t settle in the first 30 minutes.

In 2016 markets went absolutely ballistic. If you are participating you had better be sure you are correct.

November 4, 2024 at 12:30 am #13875In reply to: Forex Forum

XAUUSD 4h – Gold

Supports : 2730.00 , 2710.00 & 2695.00

Resistances : 2745.00 , 2760.00 & 2785.00

As long as below 2760.00 it will continue this so far correctional move Down.

Below 2710.00 this correction can escalate and go as low as 2595.00 and still be a Correction.

This coming week is filled with excitements coming from US Presidential election & FOMC decision , so everything is possible, but Pattern/ Time wise Gold is in for up to 2 weeks of consolidation.

November 3, 2024 at 2:05 pm #13842

November 3, 2024 at 2:05 pm #13842In reply to: Forex Forum

November 1, 2024 at 8:56 am #13787In reply to: Forex Forum

GBPUSD 1 MONTH – NEW MONTH, NEW BALL GAME?

GBP sold off yesterday on a plunge in the bond market (higher yields) and today it seems to be benefiting from the higher yields. So price action suggests month end flows may have been a factor in the ell off.

Whatever the case, it was a straight line move from 1.2999 to 1.2851.

For today 1.2880-85 needs to hold to keep the bid.

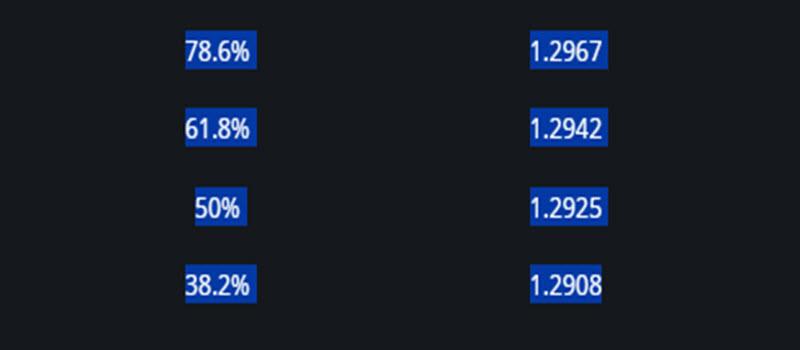

On the upside, no resistance other than the day high so treating the move up as a retracement, use FIBOS as possible levels

From our Fibonacci Calculator

-

AuthorSearch Results

© 2024 Global View