-

AuthorSearch Results

-

April 2, 2025 at 10:18 am #21852

In reply to: Forex Forum

BTCUSD 4h

Support at 83.850 held nicely and in advance.

Next bar is very important – if it manages above 85.600, we’ll be seeing 87.600 shortly after.

BTC has to take it over and reach 91K in order to finally break this consolidation.

Anything else would bring us back to Yoyo phase and more of trendless waste of time.

April 2, 2025 at 9:41 am #21850

April 2, 2025 at 9:41 am #21850In reply to: Forex Forum

March 31, 2025 at 12:20 pm #21704In reply to: Forex Forum

fears … worries … LoL

and degenarte traders ask: where and how to profit

my version of DLRx is at 103.75

and chart signal suggest puppy needs to hold the level

if not the construct would go “bearish” from current consolidationthis first week of the month, outside of tariffs, will see some incoming data fpr players to consider:

ISM, PMI, NFPMarch 27, 2025 at 4:02 pm #21553In reply to: Forex Forum

March 26, 2025 at 7:25 pm #21487In reply to: Forex Forum

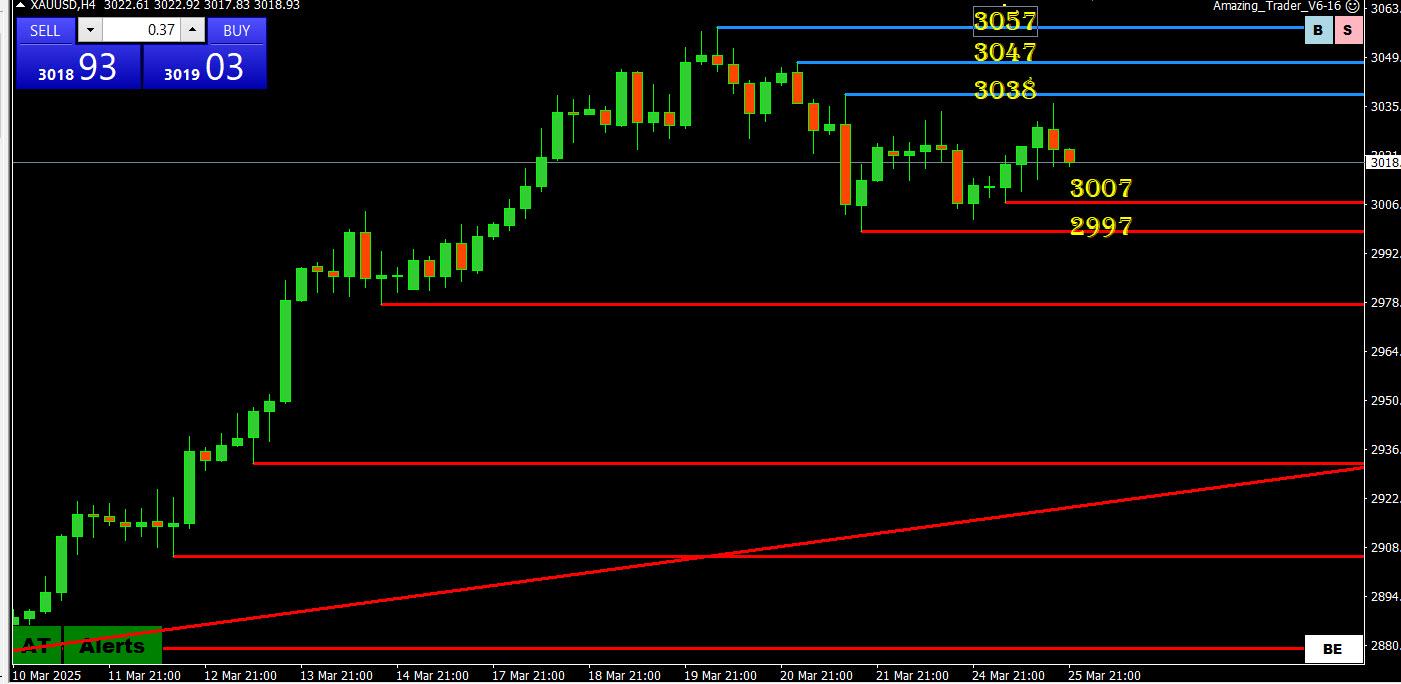

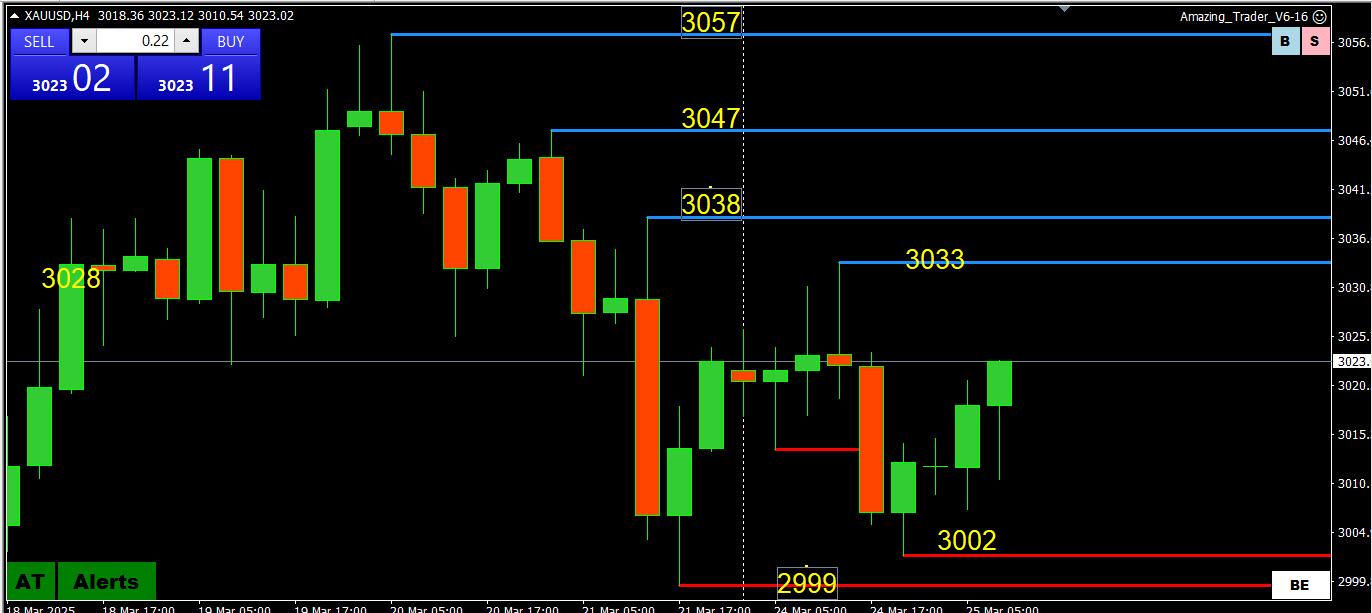

XAUUSD 4 HOUR CHART – More consolidation

Continues to consolidate between 2999 – 3038,

Range is too tight to last for long… …going strictly by charts, there is a retracement risk as long as it trades below 3038 but

…my hesitation is how betting on retracements following through in XAUUSD has been a losing bet and … why the 3000 area is so important.

March 26, 2025 at 9:33 am #21436In reply to: Forex Forum

XAUUSD 4 HOUR CHART – Glass half empty or half filled?

Continues to consolidate between 2999 – 3038,

Glass half fllled: biding its time for another run up unless 3000 is firmly broken… above 3038 would be needed to end lingering retracement risk and put 3047-57 in play again

Glass half empty: lingering retracement risk while below 3038… would need to break 2999 to extend it

March 25, 2025 at 7:33 pm #21404In reply to: Forex Forum

XAUUSD 4 HOUR CHART – The Power of AT

You can see the power of The Amazing Trader (AT), both its levels and logic by this earlier post, which is still valid (note the high was 3035).

Still consolidating between 2999 – 3038, seemingly biding its time for another run up unless 3000 is firmly broken.

Break of 3038 would cool lingering retracement risk

Break of 2999 would expose 2978, which is the key level to maintain the daily uptrend. .

March 25, 2025 at 12:27 pm #21355In reply to: Forex Forum

Robert – Re: RSI

I have been using it long ago, but never as exclusive Indicator.

RSI 9 was my favourite.

What I can see from your Cheat Sheet, idea to draw trend lines on it never crossed my mind to be honest 😀 And just by looking at it right now, I can see logic.

Let me give you some unorthodox view on RSI – my approach was the same as everyone else’s and it gave me hard time many times, until I had a chit chat with a friend of mine. At the time ( late 90’s) he was a chief dealer at one of the Central Banks.

He told me how they use it – and I was shocked :

When RSI gets above 100 or below 20 – so overbought or oversold, and hesitates to change the direction, it is a prime sign that market will continue strongly in the direction it was already in – so while we water rabbits were going contra, expecting it to change the trend, market ( and all those CB’s) were just using our stops and orders to continue their Rally.

Of course, after some time market changes the direction, but it is not the same when it does like 3-500 pips higher/lower: D

I am not saying that it always works, but just one interesting Tip for you…

March 25, 2025 at 9:59 am #21341In reply to: Forex Forum

XAUUSD 4 HOUR CHART – Consolidating

I hate the word consolidating but with that said…

XAUUSD still consolidating between 2999 – 3038, seemingly biding its time for another run up unless 3000 is firmly broken.

Otherwise, break of 3038 would cool lingering retracement risk

Break of 2999 would expose 2978, which is the key level to maintain the daily uptrend. .

March 25, 2025 at 9:37 am #21340In reply to: Forex Forum

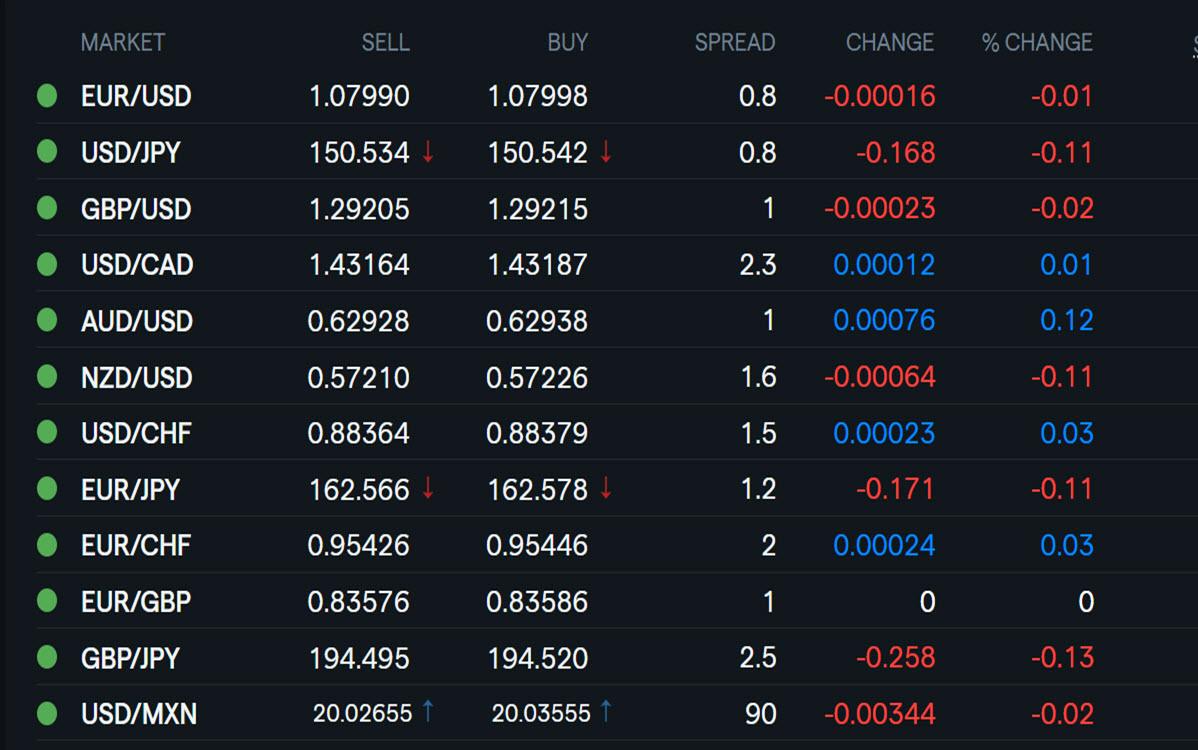

Using my platform as a HEARMAP shows

…the dollar trading close to unchanged after briefly extending its rebound overnight.

EURUSD 1.08 is the bias setting level…. what caight my eye is the low (1.0777) poauxed above the 1.0765 ley support/target. .

XAUUSD a touch firmer after holding iff another run at 3000

US equities consolidating and so far not following through on yesterday’s rally.

Light news day… headline watch remains on the next Trump tariff comment

March 24, 2025 at 8:26 pm #21330In reply to: Forex Forum

US500 4 HOUR = Weekly down pattern broken

Last week, the 4 week down pattern was broken with an inside week… this week has started out with a higher high but as this chart shows, there are layers of resistance to get through from 5749-5871… at a minimum a solid 5800+ and then 5871+ would be needed to shift focus back to 6000.

On the downside, as pointed out last week, there is a double bottom at 5597 and only through there would shift the risk back to the low…. Keeps a bid if 5749 becomes support

March 24, 2025 at 2:08 pm #21302In reply to: Evaluation – Daily Trades

March 24, 2025 at 2:07 pm #21300In reply to: Forex Forum

March 24, 2025 at 10:02 am #21281In reply to: Forex Forum

XAUUSD 4 HOUR CHART – In limbo

Chart still showing a downside risk that needs to take out 3038 to break the momentum… but only above 3047 would put the record 3057 high in play again

On the other side, the quick bounce Friday from 3000 suggests consolidation unless this level is taken out.

Range: 2999/3013 – 3038/3047/3057

For those that missed it, the following came out Friday and may have been a trigger for the XAUUSD sell off.

Robert “Bo” Hines, executive director of the President’s Council of Advisers on Digital Assets, said that if the move to sell some of the gold in Fort Knox to buy Bitcoin remained budget-neutral, it could be considered.

March 21, 2025 at 8:17 pm #21257In reply to: Forex Forum

I posted this earlier and what was a classic AT setup once again played out to perfection

You can get a free ($!) AT trial as aa member benefit for joining GTA (free)

XAUUSD 4 HOUR – What is The Amazing Trader (AT) saying

Posted earlier

AT Directional Indicator (2 blue lines off the high) indicating a downside risk BUT only a move through 3022 would suggest anything more than consolidation.

Below 3022 lies 3000-05

Above 3047 would put the record 3057 high in play again.

March 21, 2025 at 1:31 pm #21236In reply to: Forex Forum

DLRx 103.60

–

overall USD is getting some love from market, BUT not enuff to be charging out of call it consolidation zoneanother overall is that bonds too are more mixed that lop-sided.

jerome tried to bamboozle players with some blablah about stagflation …

and so my so-far instinct observation is that with CB yikyakings about rates and ploicies over, players are and will put focus on any “clarifications” about April 2nd tariffications dynamics.

still overall in my reading of market sentiment about the dollar is that there retisence to rush into it, which by extention means that a rally in the dollar should have limited octane. in other words dlrx puppy will be needing to rush through 104 decisively and hold the level.

euro 1.0832 as I type.

I am biased down on this one. I maintain it needs to test decisively 108.20 Sup failure of which should open up approx 100 southerly pips and towards the 200dma.

.March 21, 2025 at 10:49 am #21228In reply to: Forex Forum

XAUUSD 4 HOUR – What is The Amazing Trader (AT) saying

AT Directional Indicator (2 blue lines off the high) indicating a downside risk BUT only a move through 3022 would suggest anything more than consolidation.

Below 3022 lies 3000-05

Above 3047 would put the record 3057 high in play again.

March 20, 2025 at 5:44 pm #21206In reply to: Forex Forum

March 20, 2025 at 4:57 pm #21197In reply to: Forex Forum

Ethereum Price Analysis: Is ETH Ready for a Decisive Break Above $2K?

Ethereum has been going through a terrible period of depreciation, as the price has been consistently making lower highs and lows. Yet, things might just be about to change.On the daily chart, ETH has been in a strong downtrend, breaking below the critical 200-day moving average and losing multiple key support zones. Prices have recently bounced from the $1,900 demand zone but face resistance near the $2,100 level.

The 200 DMA, currently above $2,800, adds additional overhead pressure, making recovery attempts challenging. Meanwhile, the RSI is climbing from oversold territory, indicating potential short-term relief. However, unless ETH regains the $2,400 area and the 200-day moving average, the broader trend remains bearish.

March 20, 2025 at 2:40 pm #21193

March 20, 2025 at 2:40 pm #21193In reply to: Forex Forum

GER30 4 HOUR – What is The Amazing Trader (AT) showing

2 blue AT lines (bearish directional indicator) requires a firm break below 22925 to build momentum to the 22400 area.

Otherwise, it is just consolidation.

-

AuthorSearch Results

© 2024 Global View