-

AuthorSearch Results

-

December 13, 2024 at 11:21 am #16204

In reply to: Forex Forum

A look at the day ahead in U.S. and global markets by Samuel Indyk

The stellar year for U.S. stock markets took a bit of a breather on Thursday, perhaps expected after a rally that has led the Nasdaq to 20,000 for the first time this week and the S&P 500 to another new record high.

Gains have been driven by optimism over artificial intelligence and rate-cut expectations, with attention now turning to the Federal Reserve’s last policy meeting of the year, beginning next Tuesday.

The central bank is likely to follow up November’s 25 basis point rate cut with another of the same magnitude, taking the fed funds rate to 4.25%-4.5%.

But where the Fed plans to take rates in 2025 is what will interest markets more.

Morning Bid: Wall St near records as central banks end 2024 with rate cuts

December 12, 2024 at 11:47 am #16149In reply to: Forex Forum

A look at the day ahead in U.S. and global markets from Mike Dolan

With interest rates tumbling across the world and set to fall stateside again next week too, Wall Street stocks are sizing up one of the best years of the century so far.

The tech-laden Nasdaq surged again on Wednesday and closed above 20,000 for the first time ever – almost four times the peaks of the dot.com bubble in 2000 and up almost 35% for 2024 to date.

Morning Bid: Europe eases with Swiss surprise as Nasdaq clocks 20k

November 18, 2024 at 11:49 am #14528In reply to: Forex Forum

A look at the day ahead in U.S. and global markets from Mike Dolan

Wall Street feels a little bruised after its worst week in 10 spoiled the post-election party, with home truths on interest rates and earnings seeping back in along with all the uncertainty on what a new administration will actually do come January.

Stocks were side-swiped on Friday after a week of irksome inflation readings, hot retail updates and Federal Reserve boss Jerome Powell’s equivocation on future easing.

There was also trepidation, however, ahead of chip giant Nvidia (NASDAQ:NVDA) latest earnings report on Wednesday – as the world’s biggest company by market value and artificial intelligence bellwether faces another test of the near 800% stock boom over the past year.

October 30, 2024 at 8:52 pm #13716In reply to: Forex Forum

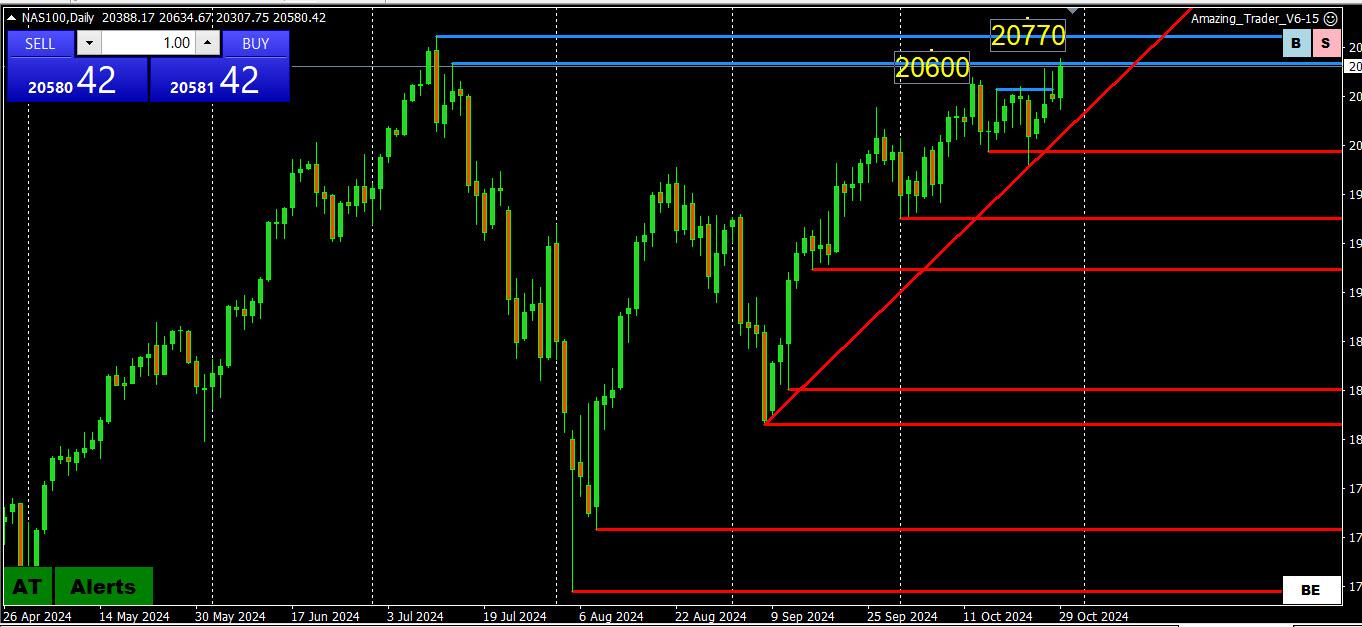

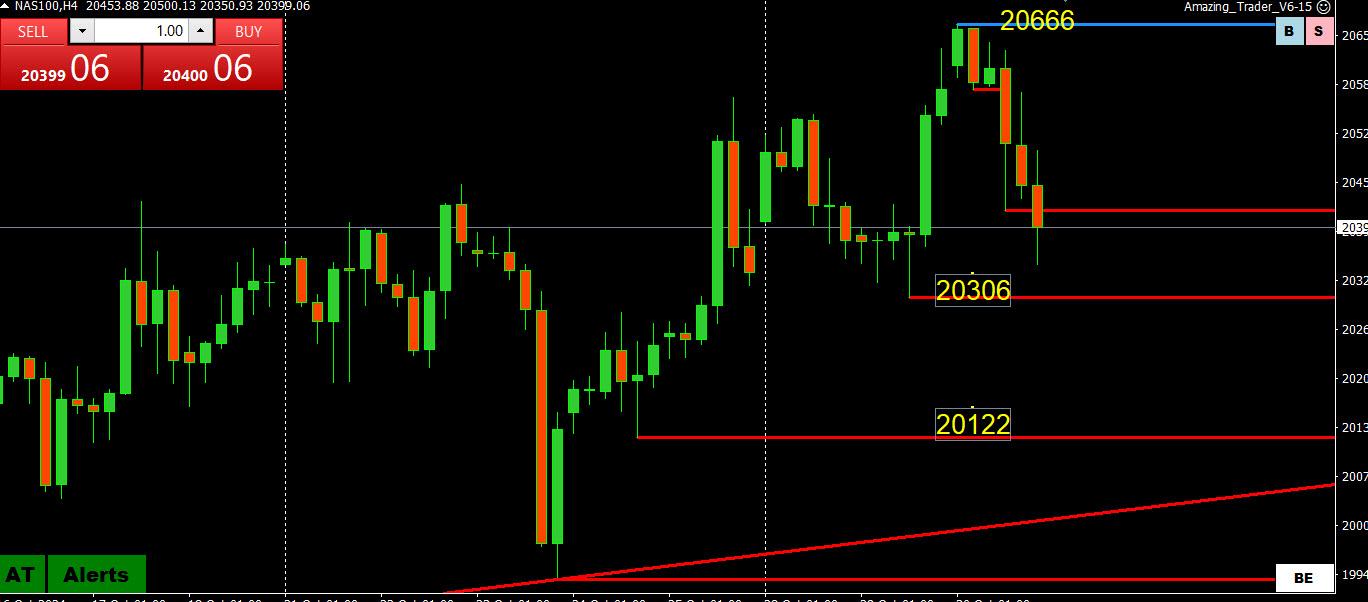

NAS100 4 HOUR – Retracing off the high

Retracement from its high needs to hold 20306 to keep the current up episode intact.

Otherwise, risk is for 20122 but downside contained unless 20,000 is breached

So far, NAS100 came close but has yet to set a record (missed by 100 pts), thus not confirming the record high set in the Nasdaq Index. I am not sure how significant this is as it is a CFD but worth pointing out.

October 29, 2024 at 8:27 pm #13636In reply to: Forex Forum

October 24, 2024 at 3:07 pm #13388In reply to: Forex Forum

October 14, 2024 at 10:38 am #12880In reply to: Forex Forum

A look at the day ahead in U.S. and global markets from Mike Dolan

With U.S. Treasury markets closed on Monday, Wall Street stocks are set to cruise on higher into the unfolding corporate earnings season – but may first have to take early direction from China’s weekend stimulus update.

The Colombus Day holiday closes Federal offices and the bond market but the New York Stock Exchange and Nasdaq remain open and stock futures are higher first thing, building on the S&P500’s (.SPX), opens new tab latest charge to new record highs.

Morning Bid: China doubts as economy struggles, US bonds closed

October 4, 2024 at 8:05 pm #12482In reply to: Forex Forum

October 3, 2024 at 7:31 pm #12442In reply to: Forex Forum

Nasdaq 100 – NDX

Wall St set for lower open; jobs data, Middle East conflict in focus

Weekly jobless claims at 225,000

September ISM non-manufacturing data due at 10 a.m. ET

Levi Strauss tumbles after saying it is exploring unit sale

East, Gulf coast workers’ strike enters third day

Futures off: Dow 0.28%, S&P 500 0.38%, Nasdaq 0.29%

Wall Street was poised to open slightly lower on Thursday after a moderate rise in jobless claims sparked worries about the health of the labor market, while cautious investors kept an eye on the Middle East for any escalation in hostilities.

October 3, 2024 at 7:28 pm #12441

October 3, 2024 at 7:28 pm #12441In reply to: Forex Forum

S&P 500 – SPX

S&P 500 Falls 21.85 Points (0.38%)

Indexes ease with U.S. jobs report ahead, Middle East in focus

Weekly jobless claims at 225,000US service sector activity accelerates to 1-1/2-year high

East, Gulf coast workers’ strike enters third day

Indexes: Dow down 0.6%, S&P 500 off 0.38%, Nasdaq down 0.2%

Major U.S. stock indexes were lower on Thursday afternoon ahead of Friday’s monthly U.S. payrolls report and as investors kept a watchful eye on the growing conflict in Middle East.

October 1, 2024 at 9:13 pm #12363

October 1, 2024 at 9:13 pm #12363In reply to: Forex Forum

Nvidia – NVDA

Nvidia Stock Slips to Start a Crucial Quarter. What’s at Stake ?

Nvidia stock slid Tuesday at the start of a crunch quarter for the chip company.

Shares fell 3.7% to close at $117.

The tech sector took a hit after Iran fired a barrage of missiles at Israel, escalating the conflict in the Middle East. Investors flocked to safer areas of the market, and the Nasdaq Composite dropped over 1%.

Nvidia has climbed 136% in 2024, powering the company’s market capitalization to nearly $3 trillion and cementing its status as an artificial-intelligence bellwether.

The fourth quarter is likely to be crucial for growth, given the chip designer is expected to ramp up production of its new Blackwell graphics processing units. It has said it expects the GPUs to drive “several billion dollars” worth of sales.

September 23, 2024 at 8:55 pm #11989

September 23, 2024 at 8:55 pm #11989In reply to: Forex Forum

Nasdaq 100 – NDX

Wall St ends slightly higher after Fed policymakers back rate cuts

Survey: US business activity steady in September

Intel gains on report of Apollo’s investment offer

GM slips after Bernstein downgrades stock

Indexes up: Dow 0.15%; S&P 500 0.28%; Nasdaq 0.14%

Fed officials including Raphael Bostic, Neel Kashkari and Austan Goolsbee supported the central bank’s last rate cut and voiced support for more cuts in the rest of the year.

September 19, 2024 at 9:10 pm #11879

September 19, 2024 at 9:10 pm #11879In reply to: Forex Forum

September 17, 2024 at 8:47 pm #11776In reply to: Forex Forum

Nasdaq – NDX

Nasdaq composite: Once again, it’s make-or-break for breadth

Dow futures up slightly, S&P 500 slip, Nasdaq 100 off ~0.5%Sep NY Fed Manufacturing index 11.5 vs -4.75 estimate

Euro STOXX 600 index off ~0.1%

Dollar down; bitcoin off ~2; gold edges up; crude up >1%

U.S. 10-Year Treasury yield ~flat at ~3.66%

NASDAQ COMPOSITE: ONCE AGAIN, IT’S MAKE-OR-BREAK FOR BREADTH

The Nasdaq composite IXIC is still down more than 5% from its record highs. That said, the tech-laden index is on a five day win streak, and just posted its biggest weekly rise since early-November 2023.September 16, 2024 at 4:05 pm #11709

The Nasdaq composite IXIC is still down more than 5% from its record highs. That said, the tech-laden index is on a five day win streak, and just posted its biggest weekly rise since early-November 2023.September 16, 2024 at 4:05 pm #11709In reply to: Forex Forum

September 12, 2024 at 6:46 pm #11590In reply to: Forex Forum

Nasdaq 100 – NDX

Wall St mixed in choppy trade as PPI data keeps smaller rate cut in view

August producer prices slightly above estimatesModerna tumbles after dour FY25 revenue forecast

Indexes: Dow down 0.13%, S&P 500 up 0.18%, Nasdaq up 0.43%

Wall Street’s main indexes were mixed in choppy trading on Thursday after higher-than-expected producer prices data kept a smaller 25-basis point rate cut by the Fed firmly on the table, while Moderna slumped following a downbeat revenue forecast.

September 12, 2024 at 6:34 pm #11587

September 12, 2024 at 6:34 pm #11587In reply to: Forex Forum

Nvidia – NVDA

Nvidia’s stock extends gains: ‘The time to worry is clearly not now’

Nvidia Most Active Stock in S&P 500 and Nasdaq 100 So Far Today

Would be highest close since Aug. 28, 2024, when it closed at $125.61Currently up five of the past six days

Currently up four consecutive days; up 16.76% over this period

Longest winning streak since Aug. 19, 2024, when it rose for six straight trading days

Best four-day stretch since the four days ending Aug. 15, 2024, when it rose 17.29%

Up 0.58% month-to-date

Up 142.44% year-to-date

Down 11.45% from its all-time closing high of $135.58 on June 18, 2024

Up 163.4% from 52 weeks ago (Sept. 14, 2023), when it closed at $45.58

September 12, 2024 at 1:57 pm #11573

September 12, 2024 at 1:57 pm #11573In reply to: Forex Forum

September 12, 2024 at 1:14 pm #11570In reply to: Forex Forum

August 30, 2024 at 9:35 pm #11165In reply to: Forex Forum

Goldilocks market?

Summary

Economic data supports expectation of 25 bps cut in September

Marvell jumps after forecast beats estimates

Ulta Beauty tumbles following annual forecast trim

S&P 500 +1.01%, Nasdaq +1.13%, Dow +0.55%

Aug 30 (Reuters) – Wall Street stocks rose and the Dow scored a second consecutive all-time closing high on Friday, with Tesla and Amazon climbing after fresh U.S. economic data raised expectations that the Federal Reserve will cut interest rates modestly in September.

-

AuthorSearch Results

© 2024 Global View