-

AuthorSearch Results

-

March 27, 2025 at 4:12 pm #21555

In reply to: Forex Forum

Stocks dip, gold hits record, after Trump’s latest tariff salvo

Auto stocks fall on latest Trump tariff shotDollar up against Canadian dollar, Mexican peso

Gold hits record high

Global stocks dipped and gold hit a record high on Thursday in the wake of U.S. President Donald Trump’s latest tariffs that expanded the trade war to auto imports.

Trump announced 25% tariffs on all vehicles and foreign-made auto parts imported into the United States late on Wednesday, scheduled to take effect on April 3. This weighed on Japan’s Nikkei <.N225> and South Korea’s KOSPI KOSPI stock markets.

Countries around the globe threatened retaliatory tariffs.

U.S. stocks shook off initial declines and were roughly unchanged while automakers slumped. General Motors GM tumbled about 8%, while Ford F dropped more than 4%, reflecting concerns about the impact on their supply chains. U.S.-listed shares of Stellantis STLAM fell about 3%.

The Dow Jones Industrial Average DJI rose 20.71 points, or 0.05%, to 42,478.39, the S&P 500 SPX climbed 6.42 points, or 0.12%, to 5,718.66 and the Nasdaq Composite IXIC advanced 21.25 points, or 0.09%, to 17,920.27.

March 24, 2025 at 2:07 pm #21301In reply to: Forex Forum

Futures buoyant ahead of data-driven week

S&P 500 futures rise over 1%

Traders brace for news on tariff barrage

PMIs, US PCE, China earnings in focus

Wall Street shares looked set to open higher on Monday and the dollar firmed at the start of a data-driven week, while the threat of U.S. tariff hikes made investors cautious in Europe.

S&P 500 futures ES1! were up about 1.2% and Nasdaq 100 futures NQ1! were 1% higher at 1218 GMT.

U.S. President Donald Trump’s administration is likely to exclude a set of sector-specific tariffs while applying reciprocal levies on April 2, according to media reports over the weekend that helped sentiment in early trading.

The pan-European STOXX 600 SXXP ticked down 0.1%, with most of the region’s indexes lower except for Germany’s DAX, which rose 0.2% after data showed manufacturing output there increased for the first time in almost two years.

This week’s data releases include global purchasing managers’ surveys, the U.S. Federal Reserve’s preferred inflation reading, inflation data in Australia and Japan, a budget update in Britain, and major earnings in China.

March 20, 2025 at 4:37 pm #21195In reply to: Forex Forum

Wall St rises in choppy trading, Fed comments provide tailwind

Weekly jobless claims at 223,000

Accenture falls after flagging federal contract cancellations

Darden Restaurants narrows annual profit forecast

Indexes up: Dow 0.42%, S&P 500 0.34%, Nasdaq 0.50%

U.S. stock indexes recouped some of the early losses on Thursday, as investors digested the Federal Reserve’s outlook on interest rates amid persistent tariff worries.

Traders looked to build on the previous session’s gains after a massive sell-off in recent weeks due to the uncertainty tied to President Donald Trump’s trade policies.

The Fed maintained current interest rates on Wednesday as expected and reaffirmed its forecast for two 25 basis point reductions by the end of year.

The central bank also projected slightly reduced growth and increased inflation for the year, alongside a modest uptick in the unemployment rate by 2025.

All the three major stock indexes closed higher by more than 1% each in the previous session. The CBOE volatility index VIX, also known as Wall Street’s fear gauge, fell 0.3 points and was last at 19.6 – at a nearly one-month low.

March 18, 2025 at 5:30 pm #21084In reply to: Forex Forum

U.S. stocks fall as Fed convenes, euro wavers as Germany passes debt reform

· Israeli strikes on Gaza revives Middle East tensions

· U.S. housing starts, industrial output surprise to the upside

· Safe-haven flows keep gold above $3,000

· Wall Street turned lower and gold surged to record highs on Tuesday as Israeli airstrikes on Gaza revived geopolitical jitters and the U.S. Federal Reserve gathered to discuss monetary policy amid growing economic uncertainty.

· A vote by Germany’s parliament to overhaul government spending caused the euro to waver, although it also sent European stocks higher and boosted German shares to near-record highs.

· Even so, all three major U.S. stock indexes were lower in early trading, with weakness in tech-related megacap stocks dragging the tech-laden Nasdaq down the most.

March 10, 2025 at 9:47 pm #20703In reply to: Forex Forum

February 27, 2025 at 11:34 am #20167In reply to: Forex Forum

A look at the day ahead in U.S. and global markets from Mike Dolan

What appeared like a solid earnings beat from AI-bellwether Nvidia (NASDAQ:NVDA) failed to impress nervy tech investors, with anxiety about the wider U.S. economy persisting as trade tariff drums keep beating.

Morning Bid: Even Nvidia beat gets a shrug, tariff war looms

February 26, 2025 at 11:47 am #20122In reply to: Forex Forum

A look at the day ahead in U.S. and global markets from Mike Dolan

Hit by draining consumer and business confidence amid uncertainty about Washington’s economic policies, Wall Street stock indexes are all tripping into the red for 2025 – with the slide stalling for now, awaiting megacap Nvidia (NASDAQ:NVDA)’s earnings today.

The latest sideswipe from main street has unnerved stock, bond and credit markets across the piece.

Morning Bid: Confidence-sapped stocks find foothold as Nvidia awaited

February 25, 2025 at 11:49 am #20056In reply to: Forex Forum

A look at the day ahead in U.S. and global markets from Mike Dolan

Rancorous geopolitics continues to grab most headlines again this week, but it’s creeping anxiety about a slowing U.S. economy that’s unnerving investors most about Wall Street stocks.

Wary of Wednesday’s results from megacap chip giant Nvidia (NASDAQ:NVDA), the S&P500 lost its 6,000 handle for the first time in three weeks on Monday and both the tech-heavy Nasdaq and small cap Russell 2000 are now negative for the year to date.

Morning Bid: S&P500 loses 6,000 handle amid U.S. slowdown fearsFebruary 7, 2025 at 12:46 pm #19177In reply to: Forex Forum

Riiiiiight …

Today’s Jobs Report Will Be Confusing. Here’s What to Know. – By Justin Lahart , Reporter via WSJ

February 5, 2025 at 11:42 am #19028In reply to: Forex Forum

A look at the day ahead in U.S. and global markets from Mike Dolan

As the week’s tariff rollercoaster levels out a bit, Wall Street stocks are tilting lower again – clouded by a poor reception for Alphabet (NASDAQ:GOOGL)’s results, lingering China tariff hike plans and fresh interest rate rise speculation in Japan.

U.S. stock futures were back in the red ahead of Wednesday’s bell as shares in megacap Alphabet plunged 7% overnight. The drop came amid doubts about the Google parent’s cloud computing business, much like Microsoft (NASDAQ:MSFT) last week, and anxiety about its huge investment in artificial intelligence – especially in the light of last week’s DeepSeek news.

January 29, 2025 at 7:14 pm #18671In reply to: Forex Forum

Another headline reads as:

UBS Upgrades British American Tobacco p.l.c. – Depositary Receipt () (BTI)

There are 720 funds or institutions reporting positions in British American Tobacco p.l.c. – Depositary Receipt (). This is an increase of 45 owner(s) or 6.67% in the last quarter. Average portfolio weight of all funds dedicated to BTI is 0.31%, an increase of 2.21%. Total shares owned by institutions increased in the last three months by 16.45% to 242,907K shares.

https://www.nasdaq.com/articles/ubs-upgrades-british-american-tobacco-plc-depositary-receipt-btiJanuary 28, 2025 at 4:04 pm #18570In reply to: Forex Forum

EURUSD failed to test 1.0444 let alone 1.0450/57 but downside contained after a pauwe above 1.0411.

USDJPY trading well above 155 on the pop in stocks

XAUUSD above 2650 after finding support in my 2725-35 zone but still just consolidating.

NASDAQ The UP 1.1%

Now the wait is on for CB meetings or next Trump tweet.

January 27, 2025 at 8:11 pm #18521In reply to: Forex Forum

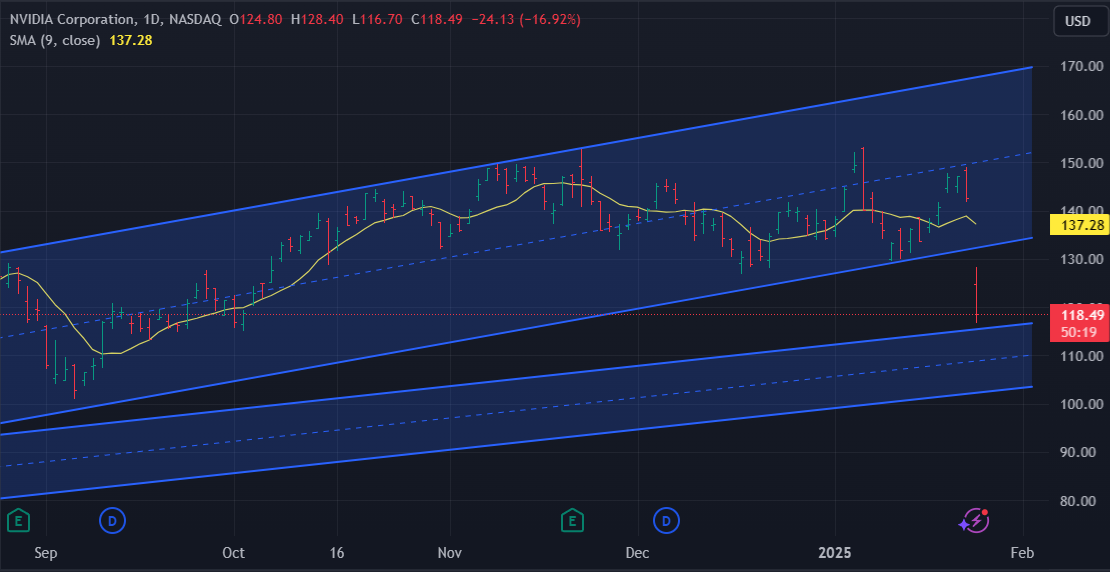

Nvidia – NVDA

Nvidia Stock Sinks in AI Rout Sparked by China’s DeepSeek

The Chinese artificial-intelligence upstart has trained high-performing artificial intelligence models cheaply-and without the most advanced gear provided by Nvidia and others. That has pulled the rug from under global companies riding the AI wave, including chip makers, infrastructure suppliers and power stocks, as investors question the outlook for AI spending.Nvidia tumbled 16%, wiping out more than $500 billion in market value and tarnishing one of the stock market’s brightest stars of recent months. The tech-heavy Nasdaq Composite sank 3.3%.

January 27, 2025 at 10:49 am #18481

January 27, 2025 at 10:49 am #18481In reply to: Forex Forum

Europe’s technology sector led the pan-European STOXX 600 index SXXP lower, down 0.7%, while the blue-chip Euro STOXX 50 STOXX50 dropped 1.4% in early European trading.

The STOXX Europe 600 technology index (.SX8P) fell as much as 4.6%, its biggest one-day drop since mid-October.

Futures on the tech-heavy Nasdaq Composite NQ1! in the U.S. tumbled over 3.1% and S&P 500 futures ES1! sank 2%.

January 22, 2025 at 8:54 pm #18241In reply to: Forex Forum

NAS100 DAILY CHART – Record high still looms

Bid but major level remains at the record 22143 high. If you want to see the key indicator, keep an eye on cash NASDAQ INDEX 20,000

NAS100 keeps a bid as long as it trades above 21192 but anything other than a new record high and a new leg up would be considered a disappointment.

January 22, 2025 at 6:34 pm #18234In reply to: Forex Forum

January 22, 2025 at 6:34 pm #18233In reply to: Forex Forum

January 8, 2025 at 8:58 pm #17377In reply to: Forex Forum

Nvidia – NVDA

NVDA: Nvidia Stock Wipes Out $230 Billion Right After Touching Record. What Happened?

· Nvidia stock drops 6.2%

· Investors react to Huang’s speech

· Not much excitement in shares this year

Shares of the AI darling erased 6.2% as the company’s big Las Vegas event failed to spark enthusiasm among investors.

Nvidia stock NVDA was among the biggest losers in tech on Tuesday when the whole market tanked. Frankly, the 2% loss for the Nasdaq was largely a result of Nvidia’s fall, which erased about $230 billion from the chip giant’s valuation. Shares of Nvidia tumbled 6.2% a day after the company unveiled its next-gen gaming graphics cards at the CES tech trade show in Las Vegas (and just as shares hit an intraday record).

January 8, 2025 at 9:28 am #17321

January 8, 2025 at 9:28 am #17321In reply to: Forex Forum

Thursday, January 9 will a Day of mourning for the passing of President Jimmy Carter

On Dec. 30, President Biden ordered that “all executive departments and agencies of the Federal Government shall be closed on Jan. 9,” except those necessary for “national security, defense, or other public need.” Federal employees will still be paid for the day.

The Postal Service will suspend mail delivery and close post offices, but there will still be limited package delivery service, a spokesman said.

National parks will generally be open, but their administrative offices will be closed.

The New York Stock Exchange and Nasdaq will also be closed, as will the United States Supreme Court and other federal courts, along with the Library of Congress.

January 3, 2025 at 11:03 am #17025In reply to: Forex Forum

-

AuthorSearch Results

© 2024 Global View