-

AuthorSearch Results

-

February 25, 2025 at 10:04 am #20050

In reply to: Forex Forum

Using my platform as a HEATMAP

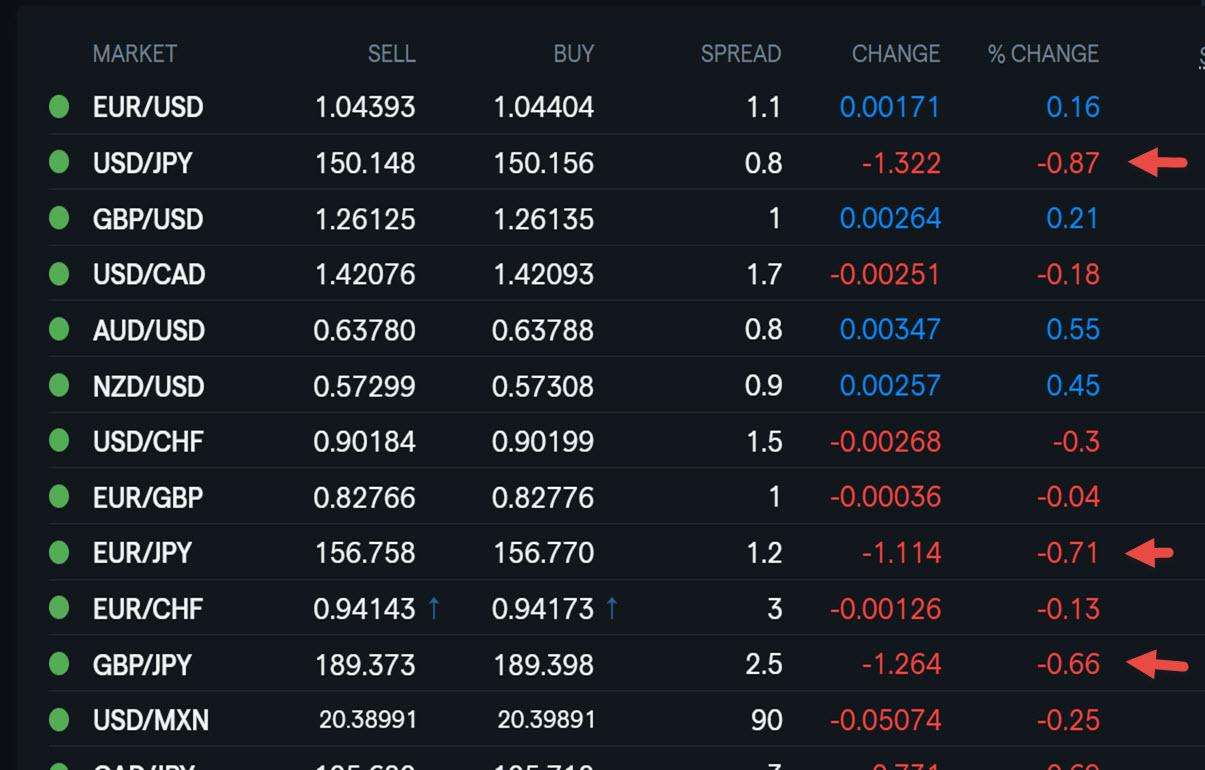

FX market => uncertain. Mixed with USD close to unchanged except a touch firmer vs the AUD and NZD.

USDJPY down from iye high after failing to hold above 150 (range 150.30-149.19) although clodr to unchanged on the day.

EURUSD in a tight range but holding above 1.0450

USDCAD and USDMXN still feeling the effects of Trump’s tariffs on track comments yesterday

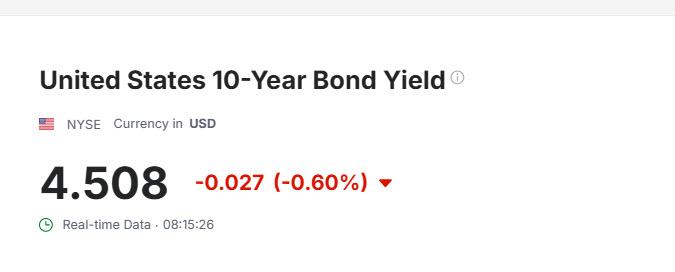

Stocks arw down, bond yields fall further (10-year 4.34%)

Light economic data calendar today

February 24, 2025 at 4:35 pm #20031In reply to: Forex Forum

February 24, 2025 at 3:01 pm #20029In reply to: Forex Forum

February 24, 2025 at 10:16 am #19993In reply to: Forex Forum

Using my platform as a HEATMAP

Dollar close to unchanged after post-German election trading.

Focus on the EU and EURUSD after the German election results were about as expected.

Initial positive reaction was partly driven by hope a new government would remove the debt brake and more spending would boost the Econ. Perhaps on second thought is the reality of trying to put together and then govern with a three party coalition from opposite sides of the political spectrum.

EURUSD is back to square one after failing to hold 1.05+

Modest bounce in USDJPY but still below 150

European and US stocks up

Gold up modestly

Light data day

February 23, 2025 at 12:00 pm #19971In reply to: Chart of The Week

This Chart of the Week is a textbook case:

USDJPY 150.91 broken => move down came within 5 pips of 149.34 support => bounce paused below 150.91 => failure setup the next move down through 149.34

Trading Tip: The bounce and failure to break 150.91 shook out the weak shorts so when USDJPY made a fresh run at the downside there was less ability to absorb the fresh selling as short postions had been reduced.

Feel free to ask questions or discuss

February 22, 2025 at 10:06 am #19953

February 22, 2025 at 10:06 am #19953In reply to: Forex Forum

EurJpy

Trend week down,

Anticipate spill over selling early next week

that once it breaks x (to be determined)– btw for those that still want to buy the dips as they have all this past week I say

beware because we could get a decent quick run to 146ish and later to 135 and 120.I am no longer targetting the 128-132 level

BTW

note that the almost exact same levels are cropping up for UsdJpy

which if I am right means EurUsd has no place to run to either up nor down.

– We shall see

February 21, 2025 at 6:40 pm #19932In reply to: Forex Forum

USDJPY DAILY CHART – Major level cited

JP, the stalemate was broken when 150 was firmly broken as stocks extended slide

Break of 149.34 exposes the major support at 148.63, the base of the move to 158.85

If you go to the weekly, it shows a risk for 139.50 if 148.63 gives way.

At a minimum, 149.34-39 needs to be regained to slow the threat but only 150+ would negate it.

February 21, 2025 at 4:27 pm #19926In reply to: Forex Forum

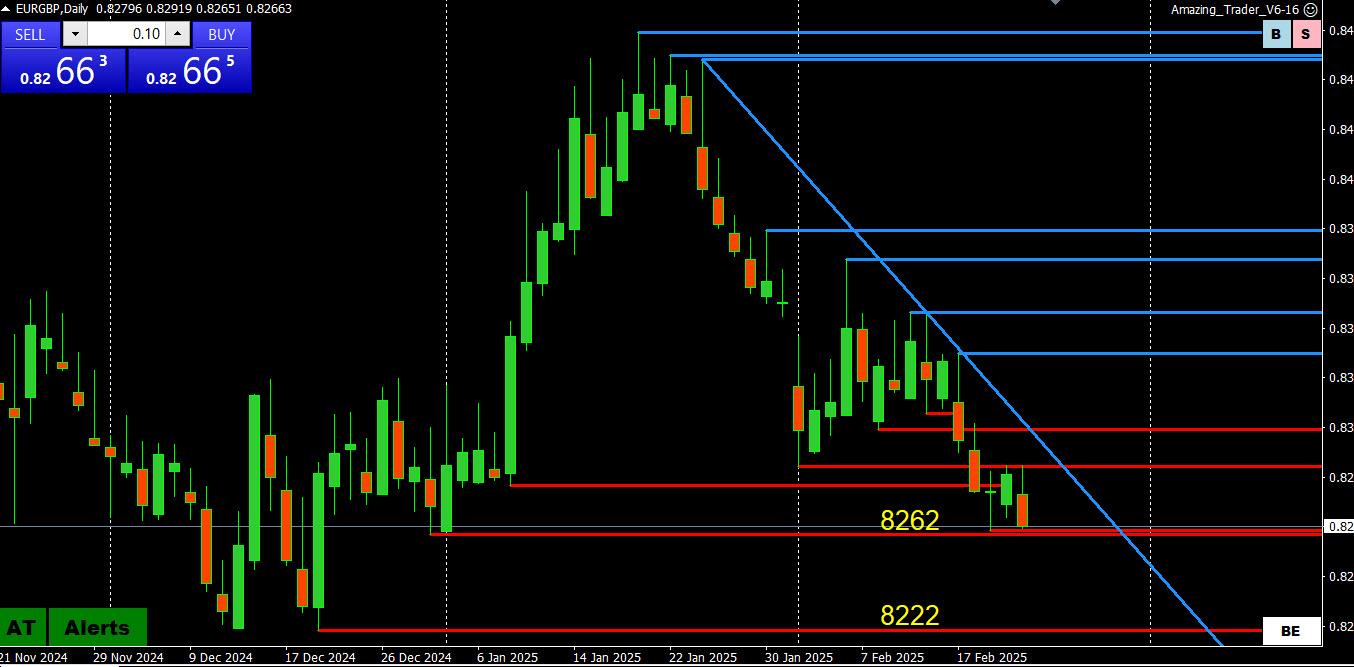

EURGBP DAILY CHART – Weighing on EURUSD

I got an email calling this Freaky Friday but there is some logic behind EURUSD falling (tests 1.0450, holding so far) despite weak US data1. EURJPY selling (biggest weight)

2. EURGBP selling (adding to it)

10-year bund is down 7bps while 10 year gilt is up 3bps

GER30 is down for the 3rd day after coming very close to 23000.

There could also be some flows ahead of the German election.

Whatever the case, .8262 is a key support with next level at .8222

Note, EURJPY selling is a greater weight on EURUSD

February 21, 2025 at 3:28 pm #19924In reply to: Forex Forum

More downside misses in US data… risk off… yields dip… JPY getting the flows… USDJPY back below 150… JPY cross offsetsa lifting thr USD elsewhere… stocks down

Source data headlines: Newsquawk.com

February 21, 2025 at 3:21 pm #19923In reply to: Forex Forum

February 21, 2025 at 2:39 pm #19918In reply to: Forex Forum

February 21, 2025 at 11:30 am #19903In reply to: Forex Forum

US OPEN

EUR weighed on by PMIs & JPY hit by Ueda remarks, Commodities are pressured by the firmer Dollar ahead of US PMIs

Good morning USA traders, hope your day is off to a great start! Here are the top 4 things you need to know for today’s market.

4 Things You Need to Know

European bourses are mostly higher after paring initial pressure following dire French PMIs; US futures are modestly mixed.

DXY attempts to recoup lost ground, EUR weighed on by PMIs, JPY hit by Ueda remarks.

BoJ Governor Ueda said if markets make abnormal moves, the BoJ stands ready to respond nimbly, such as through market operations, to smooth market moves.

Bunds bolstered by soft PMI metrics; Commodities are pressured by the firmer Dollar.

February 21, 2025 at 10:32 am #19902In reply to: Forex Forum

February 21, 2025 at 9:58 am #19900In reply to: Forex Forum

Using my platform as a HEATMAP

Dollar is firmer after yesterday’s sell-off

Led by USDJPY which had bounced back above 150 but remains below yesterday’s 150.91 breakdown level.

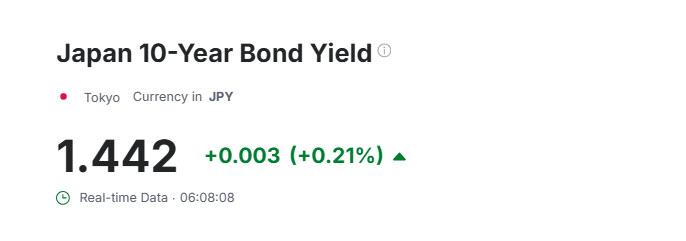

Only news I have seen is a pushback by several officials on rising JGB yields (10 year hit a 15+ year high)

EURUSD backed off from 1.05 awaiting Sunday’s German elections…. 1.0450 = neutral while within 1.04-1.05

Stocks steady after yesterday’s sell offs.

Gold extended its retreat from yesterday from a new record high but so far contained after testing 2918 support (low 2917).

Highlights:

Flash EZ and UK PMIs

Japan CPI (hotter but ignored)

See our Economic Calendar for upcoming US data

TGIF

February 20, 2025 at 7:45 pm #19883In reply to: Forex Forum

February 20, 2025 at 2:46 pm #19869In reply to: Forex Forum

February 20, 2025 at 1:25 pm #19846In reply to: Forex Forum

February 20, 2025 at 12:05 pm #19842In reply to: Forex Forum

Us OPEN

Trump suggests a trade deal with China is “possible”, USD/JPY briefly dipped below 150 ahead of US data & Fed speak

Good morning USA traders, hope your day is off to a great start! Here are the top 5 things you need to know for today’s market.

5 Things You Need to Know

US President Trump remarked that a new trade deal with China is possible; EU’s Sefcovic says they are prepared to talk about reducing the 10% US auto tariff.

European bourses opened mixed but have gradually edged higher; US futures modestly lower.

USD is softer vs. peers, JPY benefits from yield dynamics, AUD boosted post-jobs.

USTs inch higher continuing post-FOMC price action while EGBs remain in the red.

Crude and metals benefit from the softer Dollar; Rio Tinto says “Near-term market conditions are expected to remain challenging in 2025”.

February 20, 2025 at 10:47 am #19831In reply to: Forex Forum

February 20, 2025 at 10:38 am #19829In reply to: Forex Forum

-

AuthorSearch Results

© 2024 Global View