-

AuthorSearch Results

-

February 21, 2024 at 10:05 am #1842

In reply to: Forex Forum

FX option expiries for 21 February 10am New York cut

The first being for EUR/USD at around 1.0778-80, which could help to limit any downside action in the session ahead. That also sits near the 100-hour moving average, seen at 1.0776 currently. As such, the expiries could double up as a supportive layer for price action before rolling off later.

Then, there is the one for USD/JPY near 150.00 again. The large expiries there should keep price action more limited and centered around the figure level still, as we have seen through the week so far.

February 21, 2024 at 9:07 am #1836In reply to: Forex Forum

February 20, 2024 at 5:36 pm #1824In reply to: Forex Forum

February 20, 2024 at 2:43 am #1787In reply to: Forex Forum

February 19, 2024 at 3:11 pm #1764In reply to: Forex Forum

February 19, 2024 at 1:57 pm #1760In reply to: Forex Forum

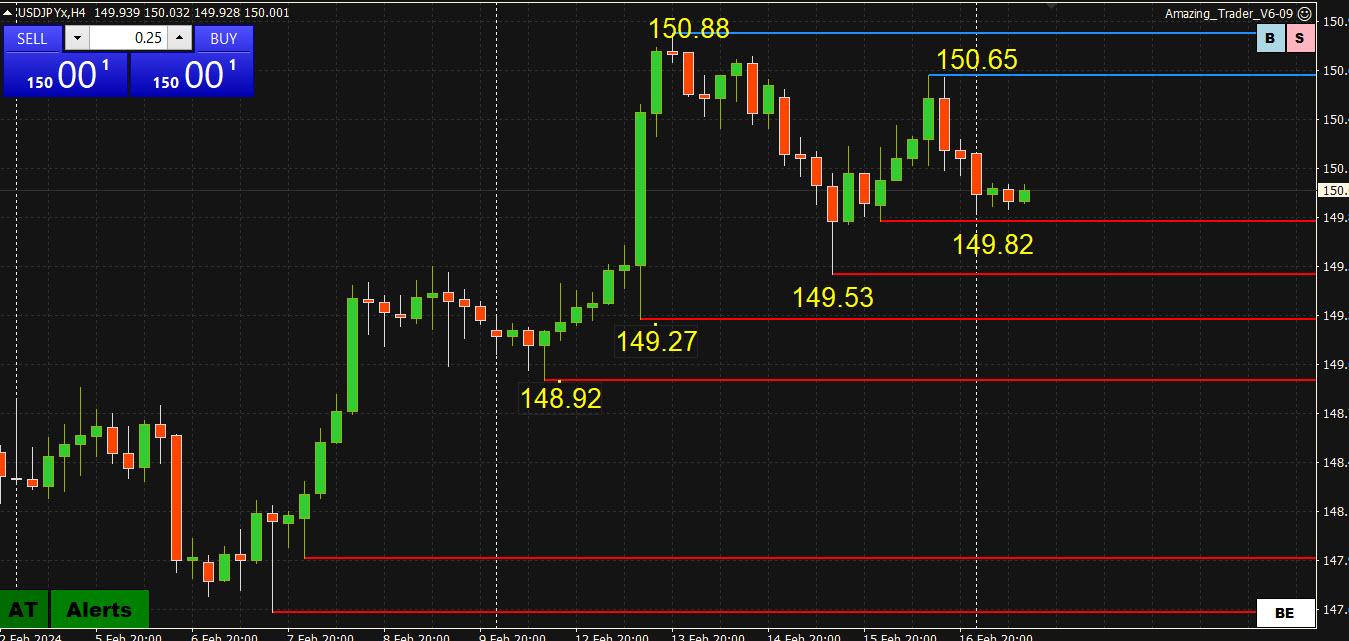

USDJPY 4 Hour Chart – Uptrend consolidating

150.00 is the bias-setting level going forward.

4-hour Levels are very clear

Sup: 148.92/149.52/149.82

Res: 140.65/150.88

Note, USDJPY tends to be most sensitive currency to moves in US bond yields

Scross down the forum to see USDJPY analysis from ForexCycle

February 19, 2024 at 2:52 am #1745In reply to: Forex Forum

USDJPY Analysis: Uptrend Continues, Resistance and Support Levels

The USDJPY pair is currently within a rising price channel on the 4-hour chart, indicating that the pair remains in an uptrend from 145.89.

As long as the channel support holds, the upside move is likely to continue. A breakthrough of the 150.88 resistance level could potentially take the price towards the 151.90 resistance level.

On the downside, a breakdown below the channel support could bring the price to test the 149.52 support level. If the price breaks below this level, it would indicate that the upside move has already completed at 150.88, and the next downside target would be around the 147.50 area.

February 18, 2024 at 10:49 am #1723In reply to: Forex Forum

USDJPY – Week Ahead

Yen is losing it’s ground last 7 weeks, with some sudden waves of strength here and there, mainly coming from Japanese officials blubber (seems to me that they just want to keep it steady and slow – the decline) .

Resistances at: 150.900, 151.950 and target one in 154.000 area.

Supports at : 150.100, 149.900, 148.800 and the last one at 148.450

Major levels of interest right now are Supp 149.900 and Res 150.900

Not much data in coming week, but check it always in Economic Calendar

February 16, 2024 at 5:37 pm #1686

February 16, 2024 at 5:37 pm #1686In reply to: Forex Forum

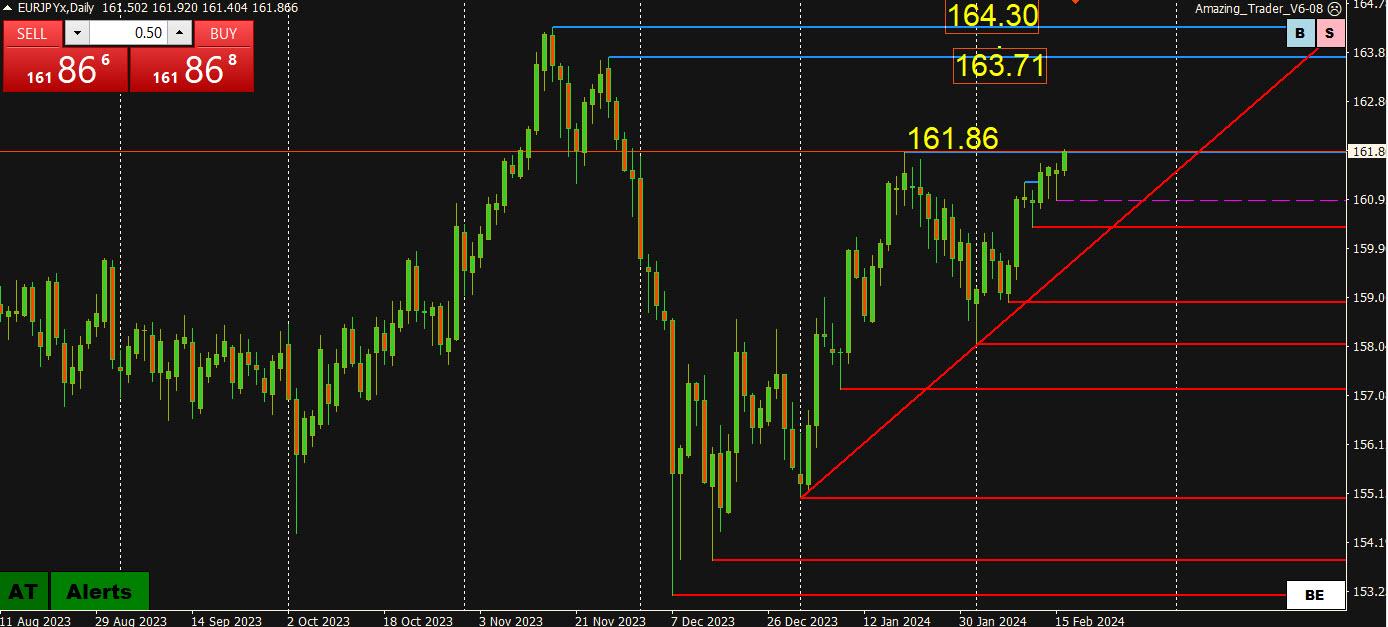

Our friends @GTWO3 are looking for EUR/JPY to turn lower from the 162.00 area as the rally from 12/27 is short covering rather than new buyers …

February 16, 2024 at 4:57 pm #1685In reply to: Forex Forum

EURJPY Daily Chart

Testing res at 161.86

Question is can EURJPY make a run at…

Key res 163.71 and 164.30

To do so, either USDJPY would need to move sharply higher, EURUSD would need to move sharply higher, a combination of the two or EURUSD would need to lag a sharp move up in USDJPY. It’s simple algebra.

Whatever the case, given broader USD trends, it would probably take JPY weakness for the key EURJPY resistance to come into play.

February 16, 2024 at 3:59 pm #1681In reply to: Forex Forum

February 15, 2024 at 7:09 pm #1653In reply to: Forex Forum

USDJPY

To be able to continue to the new highs , Yen has to close above 150.200 tonight ( any close above 150.000 awakens the attention )

Otherwise, the risk is to the downside, with the first support at 149.550, followed by 148.500

It might all come to the USA Data tomorrow– Economic Calendar

February 15, 2024 at 4:23 pm #1647In reply to: Forex Forum

February 15, 2024 at 4:05 pm #1646In reply to: Forex Forum

February 15, 2024 at 3:53 pm #1644In reply to: Forex Forum

February 15, 2024 at 10:00 am #1621In reply to: Forex Forum

USDJPY 1-hour chart

JPY is the strongest currency today.

After the sharp spike on US CPI, USDJPY is currently retracing.

With no supports (red lines) until 149.23,

FIBO levels: Check out our Fibonnaci calculator

50% = 150.055 (broken)

61.8% = 149.86

76.4% = 149.58

So, as long as 149,86 holds, the focus stays on 150, which will dictate the tone for this pair.

February 15, 2024 at 6:59 am #1620In reply to: Forex Forum

February 14, 2024 at 4:14 pm #1610In reply to: Forex Forum

Not tradable on the basis of 1- timing and or 2- Frequency. There’s nothing saying it HAS TO BE 3 cuts of 25 bps. It could come as a combination of…

Time for the financial press and those calling for financial armagedon to tap the breaks and give yesterdays CPI some perspective. The YOY number actually dropped sowing signs of annual improvement. The MOM numbers missed expectations by 0.1 otherwise known as a rounding error OR like previously mentioned maybe expectations were just too low…..

This number alone is not enough to send equities into a tailspin or the USD to the moon. IMO I see it as a range trade 1.0650-1.0750 until next NFP with some bias towards relative weakness in the CHF and JPY….

February 12, 2024 at 10:35 pm #1526In reply to: Forex Forum

USDJPY Day ahead

Yen has to stay above 149.200 overnight, to be able to continue straight up. However, if loses it, support at 149.050 might give up this time and allow for a greater correction to 148.500 area.

Major support is at 147.850

If support at 149.200 holds it’s ground, it will lead the pair straight to 150.200

February 12, 2024 at 3:29 pm #1499

February 12, 2024 at 3:29 pm #1499In reply to: Forex Forum

Re: my post from the last night :

EURUSD Day ahead

Resistances : 1.07950 and 1.08350/400

Supports : 1.07800 , 1.07700 and 1.07200

Judging by the current pattern, we should see the attack at the supports tomorrow, but expect as always for Europe to do some buying early euro morning…if they break through 1.07950 we should see at least 1.08200 ( depending on how they spent their weekends…)

Same goes for other two postings – JPY and GBP….Bellow is a current chart for EURUSD

-

AuthorSearch Results

© 2024 Global View