-

AuthorSearch Results

-

February 27, 2024 at 2:43 pm #2117

In reply to: Forex Forum

February 27, 2024 at 10:07 am #2090In reply to: Forex Forum

USDJPY 1-Hour Chart

Blue lines dominating, indicating some shift in risk to the downside or more of a two-sided market after another failure to take out 150.89

However, price action remains contained while within 149.53 and 150.89 where 150 should continue to set the bias

Supports on either side of 150: 149.93-150.01-150.12

150.54 needs to hold on top to keep the focus on 150 and away from 150.84-89

Why did USDJPY fall today?

Technicians will cite another failed run at 150.89 and market positioning that is heavily short JPY, both vs. the USD and on its crosses

Those who say news matters will cite the release of a smaller-than-expected fall in annual Japanese inflation in a market that is hypersensitive to any data that might prompt the BoJ to raise interest rates.,

February 26, 2024 at 4:36 pm #2070In reply to: Forex Forum

February 26, 2024 at 3:24 pm #2064In reply to: Forex Forum

For those of us who like to play around a bit with crosses, Nok/Jpy moves a little slower than other pairs and appears to be targeting 14.35 again. Bias has been decidedly buy side in the prior 10 days, any declines have not pierced outer range pivots but have been compromising upside key value areas and, 14.35 is one of them. Any price activity from 14.32 is likely to pull back today/overnight in our model.

February 26, 2024 at 11:44 am #2044In reply to: Forex Forum

February 26, 2024 at 11:30 am #2043In reply to: Forex Forum

February 26, 2024 at 2:40 am #2033In reply to: Forex Forum

USDJPY: Stuck in Limbo – Uptrend Consolidation or Downturn Signal?

USDJPY has been stuck in neutral territory, oscillating within a trading range between 149.52 and 150.88. This sideways movement leaves the near-term direction unclear, prompting questions about whether it’s a pause within the uptrend or a sign of a potential reversal. Let’s delve into the key support and resistance levels to understand the possible scenarios.

Uptrend on Hold? Sideways Consolidation as a Signal

149.52 Support: The Bullish Anchor: As long as the price remains above this crucial support level, the uptrend initiated at 145.89 remains valid. This suggests the current sideways movement could be a healthy consolidation phase within the ongoing uptrend.

Breakout Potential: If the bulls manage to accumulate enough strength and push the price above the 150.88 resistance level, it could signal a breakout from the range and trigger a further rise towards the 151.90 resistance, potentially solidifying the uptrend.Downturn Signals: Watching the Support Crack

149.52 Breach: A Reversal Indicator: A breakdown below the 149.52 support level would be a significant development, potentially indicating a completion of the uptrend from 145.89. This could lead to a decline towards the next support zone around 148.80, marking a potential trend reversal.

Overall Sentiment:

The current technical picture for USDJPY presents conflicting signals. The sideways movement creates uncertainty, leaving the near-term direction unclear. While holding above 149.52 and breaking above 150.88 suggest potential bullish continuation, a breakdown below support could signal a trend reversal and further decline. Monitoring the price action around the mentioned support and resistance levels will be crucial in determining the pair’s next move.

Disclaimer: This analysis is for informational purposes only and should not be considered as investment advice. Please conduct your own research before making any trading decisions.

February 24, 2024 at 12:37 pm #2008In reply to: Forex Forum

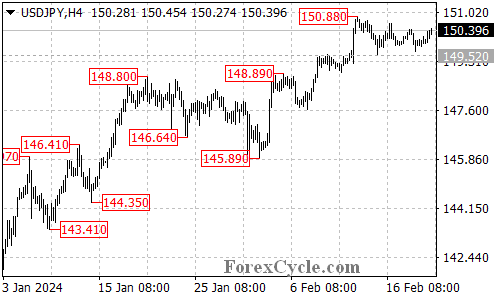

USDJPY Weekly Outlook

Supports at 149.800 and 148.650

Resistance 152.000

There is not much to say about this pair, except that Pattern wise it is destined to try 152.000 area.

Problem comes from the fact that we have already double top in place, and if rejected for the third time, it will be not only technically visible, but would mean that BOJ decided to put Money where their Mouth is.

We can always see sharp drops in JPY , followed by even sharper ascent . But any possible drop below 145.000 and consequently 143.300 would put the whole Up trend in question.

February 23, 2024 at 6:30 pm #2000

February 23, 2024 at 6:30 pm #2000In reply to: Forex Forum

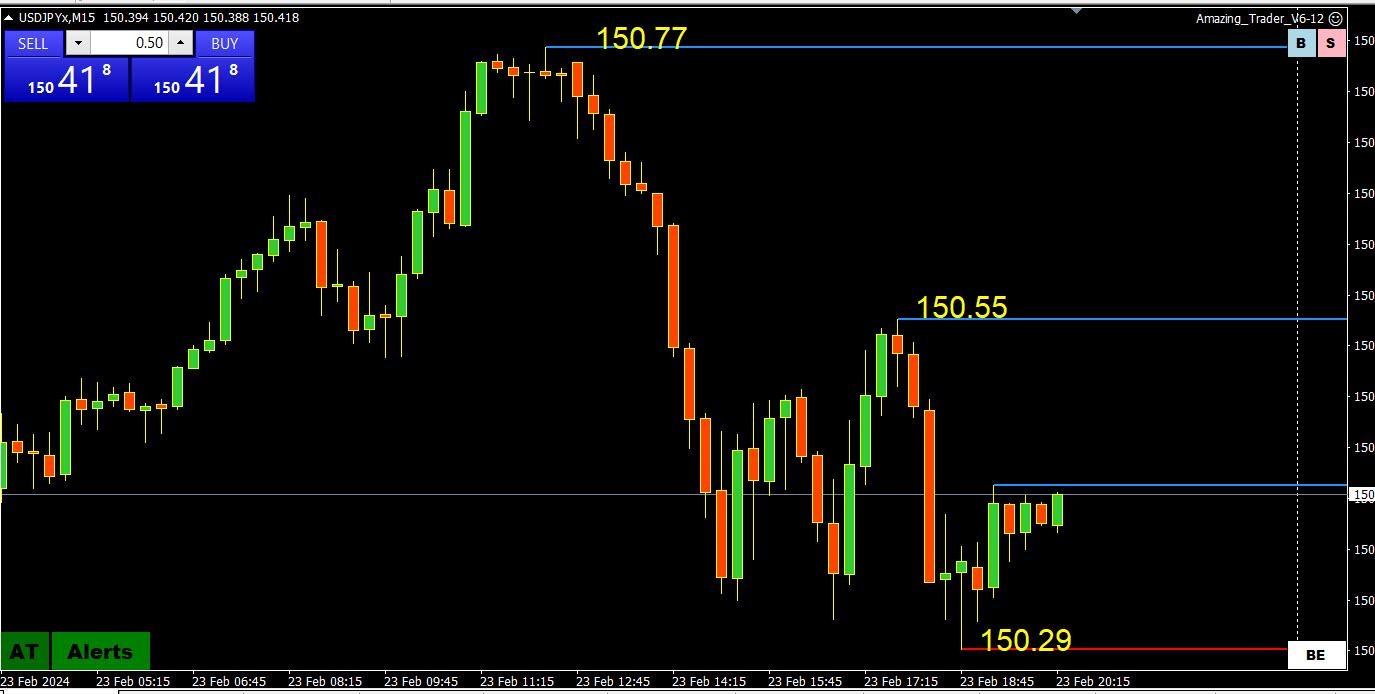

USDJPY 15 minute chart

Similar to others, USDJOY is ending the week with a whimper but getting a reprieve from the dip in US bond yields

Wise rRngw `149.53-150.89

I wouldn’t be surprised to learn the BoJ has been covertly intervening as it has been rumored for years to do so via surrogates.

Whatever the case, 150 remains the ultimate bias-setting level

February 23, 2024 at 3:37 pm #1993In reply to: Forex Forum

February 23, 2024 at 11:16 am #1978In reply to: Forex Forum

February 22, 2024 at 7:20 pm #1966In reply to: Forex Forum

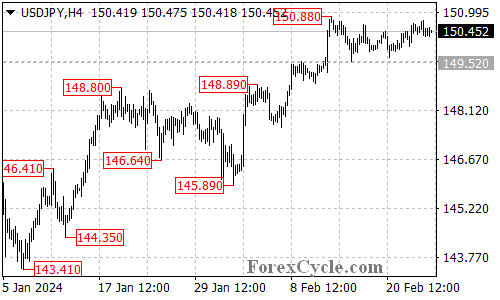

USDJPY 4-Hour Chart: Key resistance looms

Looking at this chart USDJPY has been in a 149.53-150.89 range for nearly 2 weeks

With rising red lines, momentum is swinging upwards but faces the key resistance level (recent high) at 150.89

A move through 150.89 would leave little until the major 151.90 level

Expect support on dips as long as 150+ trades

Beware as always of verbal intervention with the major level looming above..

February 22, 2024 at 5:14 pm #1959In reply to: Forex Forum

USDJPY

With bond yields edging up and BoJ dragging its feet there are probably a lot of carry trades being put on

With Nikkei soaring to record highs, there seems no rush for the BoJ unless it wants to replace verbal intervention with a rate hike hint risk comment.

Markets will soon start looking ahead to a hot PCE inflation release next week, which is also on month end.

February 22, 2024 at 4:17 pm #1956In reply to: Forex Forum

February 22, 2024 at 4:05 pm #1953In reply to: Forex Forum

Usd/Jpy is an equilibrium price for the pair in our model, the pair has been sideways overall for 5 days. As long as the market is not too aggressive in the eyes of the BOJ I could see the market testing 151 due to interest rate differentials and other factors, but clearly that level is a concern for the BOJ. A bit of a quandy. Favoring the bid from the 149.50 and 150 areas unless the market gives up.

February 22, 2024 at 3:29 am #1900In reply to: Forex Forum

USDJPY Analysis: Sideways Movement Continues, Resistance and Support Levels

The USDJPY pair has attempted to break below the 149.52 support level but failed and has since moved sideways within a trading range between 149.52 and 150.88.

As long as the 149.52 support level holds, the sideways movement could be seen as consolidation for the uptrend from 145.89. A breakthrough of the 150.88 resistance level could trigger another rise towards the 151.90 resistance level.

On the other hand, a breakdown below the 149.52 support level would indicate that the upside move from 145.89 has already completed at 150.88. In this case, the pair would find support around the 147.50 area.

February 21, 2024 at 5:33 pm #1874In reply to: Forex Forum

February 21, 2024 at 5:25 pm #1873In reply to: Forex Forum

February 21, 2024 at 5:24 pm #1872In reply to: Forex Forum

February 21, 2024 at 3:17 pm #1855In reply to: Forex Forum

-

AuthorSearch Results

© 2024 Global View