-

AuthorSearch Results

-

March 1, 2024 at 5:00 pm #2329

In reply to: Forex Forum

JP – it feels to me like they are more reactive to the markets/economy, which is how it should be. The one’s who are full of hot air are Yellen and Powell. Yellen because she is a communist and Powell because he is scared lol.

Believe AudJpy has decent odds to challenge 98.30-40 area eventually where it would be prudent to consider the sell side for positioning even if it inevitably challenges 99 from a longer term viewpoint. Currently 98.05. EurJpy will inevitably trade below 162 looking outward, likely after another short lived bout of buy side interest.

March 1, 2024 at 3:33 pm #2326In reply to: Forex Forum

JP – JP – well that is what happened to us when we were stuck at 4% LDR for a year lol. Very large layoff ensued, myself included due to out of balance salary on the high side for my title. Offered a new position but passed.

Regarding Boj –

Ueda is pretty rational in my view though never having met the man. If the 2% is yet to be achieved he should say so. Tempered Usd/Jpy enthusiasm going forward. No way I am on the buy side at these levels.

March 1, 2024 at 2:22 pm #2312In reply to: Forex Forum

March 1, 2024 at 1:45 pm #2310In reply to: Forex Forum

March 1, 2024 at 12:49 pm #2308In reply to: Forex Forum

March 1, 2024 at 9:17 am #2288In reply to: Forex Forum

USDJPY 15 min chart – red lines dominating, momentum pointing up but faces the invisible hand

After yesterday’s false break to the downside we are back to staring at 150.89 and the invisible hand guarding it.

A break/close above 150.79 would produce an outside week key reversal BUT ONLY A FIRM BREAK OF 150.84-89 WOULD OPEN THE DOOR ON THE UPSIDE.

Expect support on dips as long as 150.30 holds.

February 29, 2024 at 5:25 pm #2274In reply to: Forex Forum

February 29, 2024 at 3:26 pm #2262In reply to: Forex Forum

Clearly risk on, but stalling at the moment. Buy stops worked beautifully now looking to re-enter lower on the risk currencies (Eur-Aud etc). Not biting on the buy side of UsdJpy going forward due to BoJ, worked yesterday but sell stops turned out to be more appropriate. Seller of UsdJpy going forward even if I have to wait for buy side of the market to run out of steam.

February 29, 2024 at 3:15 pm #2261In reply to: Forex Forum

February 29, 2024 at 10:50 am #2237In reply to: Forex Forum

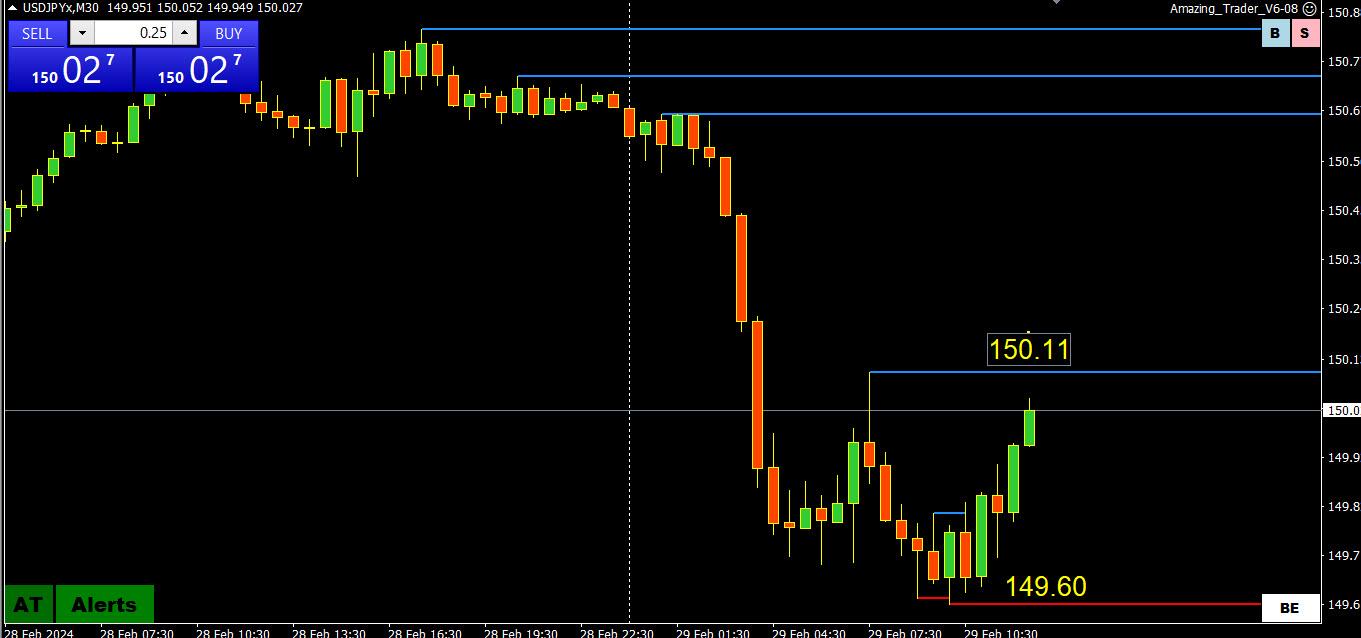

USDJPY 30 Min Chart – Invisible hand 1, Market 0

Having failed to take out the invisible hand protecting 150.89 (double top at 159.84) left the market vulnerable to the BoJ yak on interest rate risk

So, far the move down paused above the 149.53 bottom of the range, leaving the focus on 150 to set the trading tone.

Expect more chop if it stays within 149.53 and 150.84/89)

February 29, 2024 at 8:57 am #2227In reply to: Forex Forum

February 28, 2024 at 3:53 pm #2184In reply to: Forex Forum

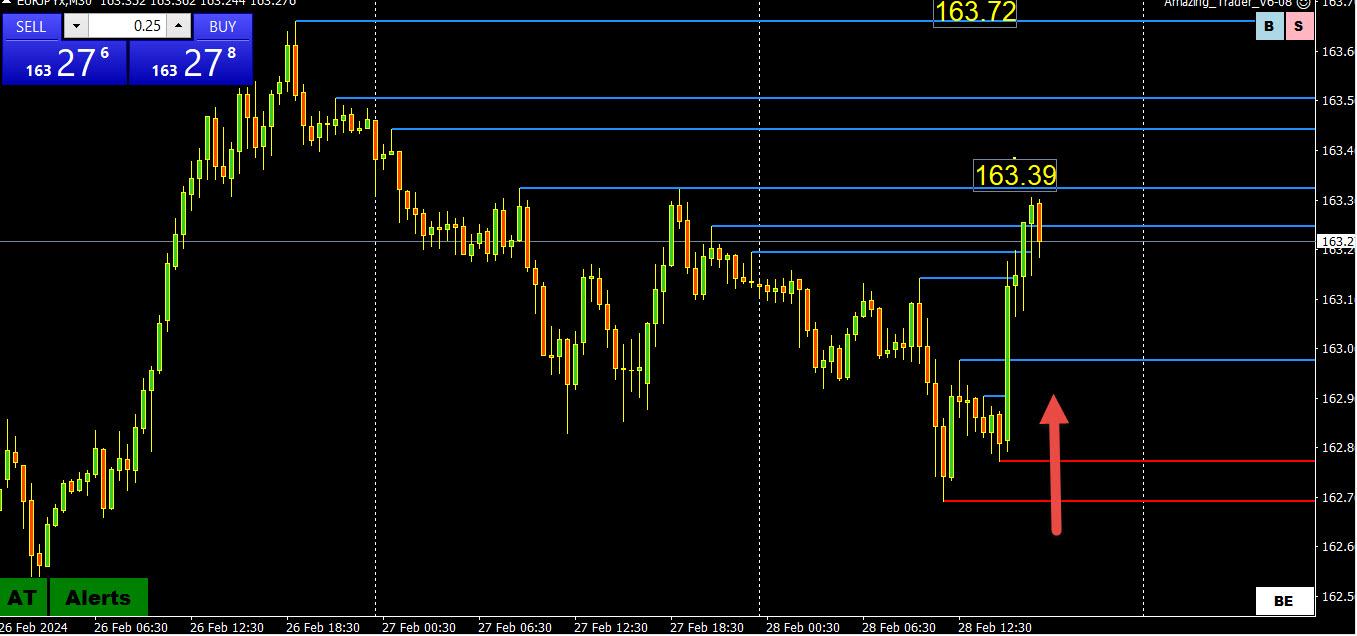

IEURJPY 30-minute chart – risk turns up

Simple algebra: EURUSD X USDJPY = EURJPY (Hint: One reason for the EURUSD bounce from 1.08)

Chart:

Two red lines drawn off the bottom showed a shift in directional risk to up

So far, pause just below 163.39

Recent and key resistance is at 163.72

Go to shorter time frames for intra-day supports

February 28, 2024 at 3:09 pm #2180In reply to: Forex Forum

February 28, 2024 at 3:03 pm #2178In reply to: Forex Forum

February 28, 2024 at 1:51 pm #2169In reply to: Forex Forum

February 28, 2024 at 9:34 am #2150In reply to: Forex Forum

February 28, 2024 at 2:20 am #2139In reply to: Forex Forum

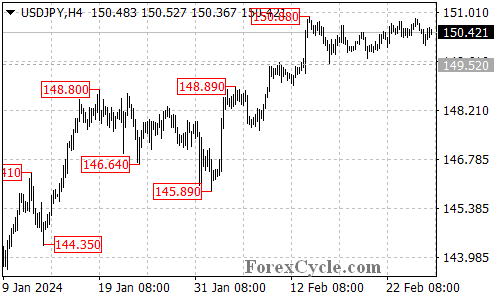

USDJPY Analysis: Consolidation Continues, Key Levels to Watch

The USDJPY pair has failed in its attempt to break above the 150.88 resistance level and remains within a trading range between 149.52 and 150.88.

Nevertheless, as long as the 149.52 support level holds, the sideways movement could be viewed as consolidation for the uptrend from 145.89. A breakout above the 150.88 resistance level could potentially trigger another rise towards the 151.90 resistance level.

The critical support level to monitor is at 149.52. A breakdown below this level would suggest that the upside move has concluded at 150.88. In such a scenario, the pair could find support around the 148.80 area.

February 27, 2024 at 3:36 pm #2126In reply to: Forex Forum

February 27, 2024 at 3:28 pm #2124In reply to: Forex Forum

February 27, 2024 at 2:54 pm #2118In reply to: Forex Forum

-

AuthorSearch Results

© 2024 Global View