-

AuthorSearch Results

-

February 28, 2025 at 6:26 pm #20259

In reply to: Forex Forum

Dollar up (except vs JPY, stocks down), Trump=Zelensky press conference cancelled

February 28, 2025 at 2:34 pm #20239

February 28, 2025 at 2:34 pm #20239In reply to: Forex Forum

February 28, 2025 at 1:49 pm #20237In reply to: Forex Forum

February 28, 2025 at 10:29 am #20229In reply to: Forex Forum

February 28, 2025 at 10:05 am #20227In reply to: Forex Forum

Using my platform as a HEATMAP

Liquidating markets across asset classes taking no prisoners.

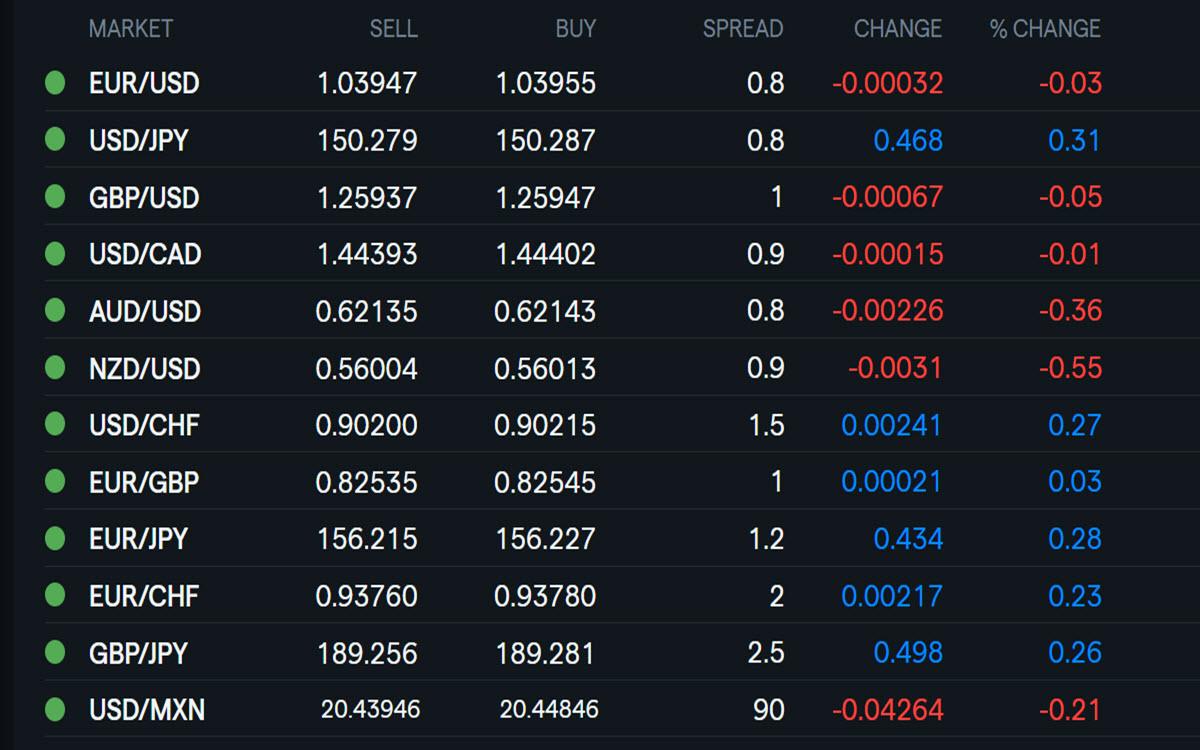

The dollar holding firm at month end with USDJPY back above 150 and AUD and NZD underperforming. .

Watch month end rebalancing flows to see whether a risk of dollar buying (hard to say how much has already taken place) given weaker stocks. I read bank report earlier in the week indicating it expects EURUSD selling given the underperformance of US stocks relative to European stocks

This is not an exact science so keep an eye on what looks like real money flows, especially ahead of the 4 PM month end London fixing

Elsewhere;

Golfdextending its retreat.

Cryptos down sharply

US bond yields falling further but off earlier lows.

US stocks finding some support but the day is young.

Looking ahead

US PCE (watch the core reading) is the key data release… See a detailed preview

Watch for Trump comments, especially after the carnage triggered by his tariff comments yesterday.

February 27, 2025 at 3:11 pm #20182In reply to: Forex Forum

Quick recap

EURUSD break of 1.0450..highly suggests 5 day pattern around 1.05 will be broken … 1.0400 is key support, then 1.0372

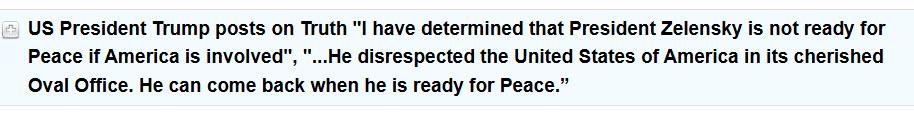

JPY getting safe haven flows… USDJPY brief move above 150 smacked back below it

GBPUSDF follows EURUSD with a lag (EURGBP lower)… UK so far escaping the tariff wrath of Trump

Stocks hit, boind yields off early highs

February 27, 2025 at 12:13 pm #20169In reply to: Forex Forum

February 27, 2025 at 11:44 am #20168In reply to: Forex Forum

US OPEN

NVIDIA +1% in pre-market after Q4 results, a pick up in yields lift the Dollar ahead of US data

Good morning USA traders, hope your day is off to a great start!

Here are the top 4 things you need to know for today’s market.

4 Things You Need to KnowNVIDIA +1.1% in US pre-market after headline beats whilst Q1 gross margins are seen easing.

European bourses on the backfoot with sentiment hit in Europe amid Trump’s EU tariff threats; US futures gain.Pick-up in US yields provides reprieve for USD, USD/JPY eyes a test of 150.

Crude trims recent losses but metals pressured by a firmer Dollar.

<p style=”text-align: center;”><strong><a href=”https://newsquawk.com?fpr=c3imf”>Try Newsquawk for 7 Days Free</a></strong></p>

February 27, 2025 at 11:06 am #20166In reply to: Forex Forum

February 27, 2025 at 10:41 am #20165In reply to: Forex Forum

February 27, 2025 at 9:41 am #20162In reply to: Forex Forum

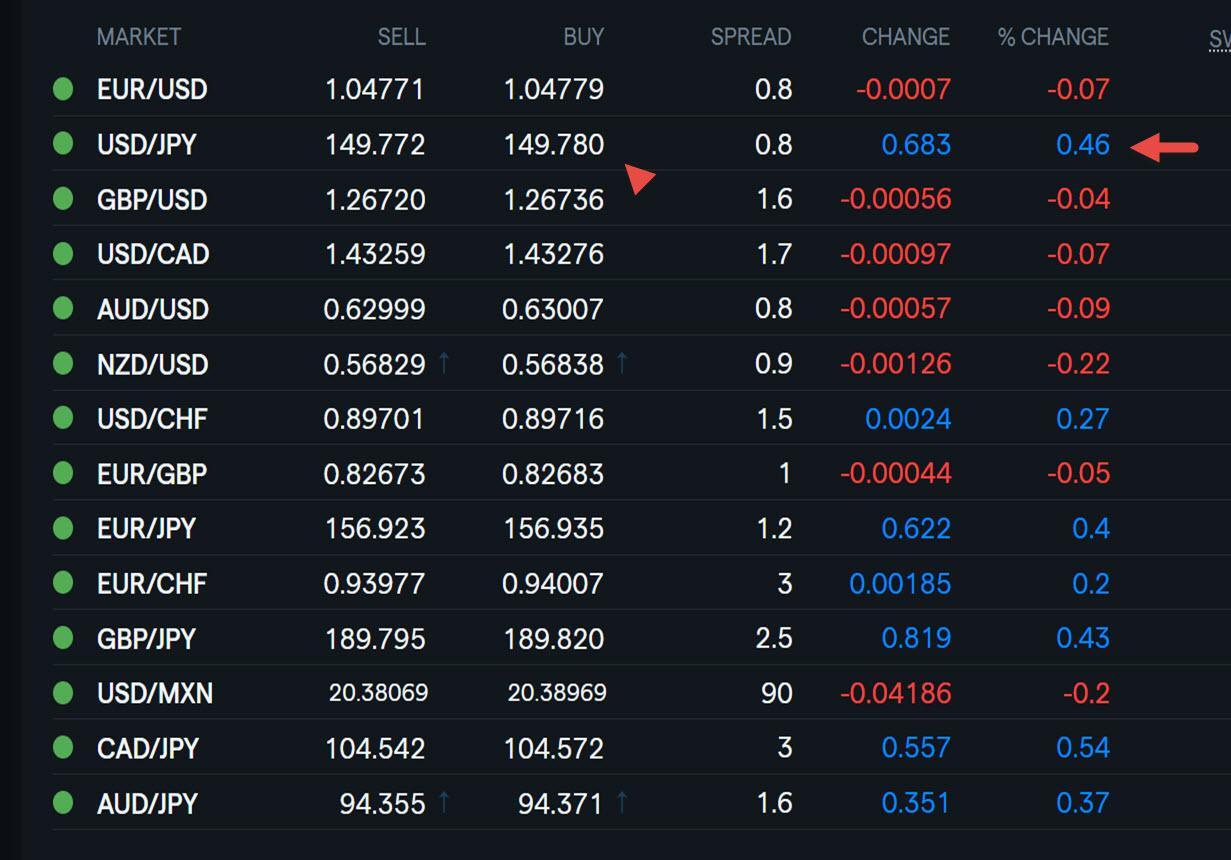

Using my platform as a HEATMAP shows

The dollar trading a touch firmer day before month end gyrations.

EURUSD yet to print 1.05 and extend its 5 day pattern around this level

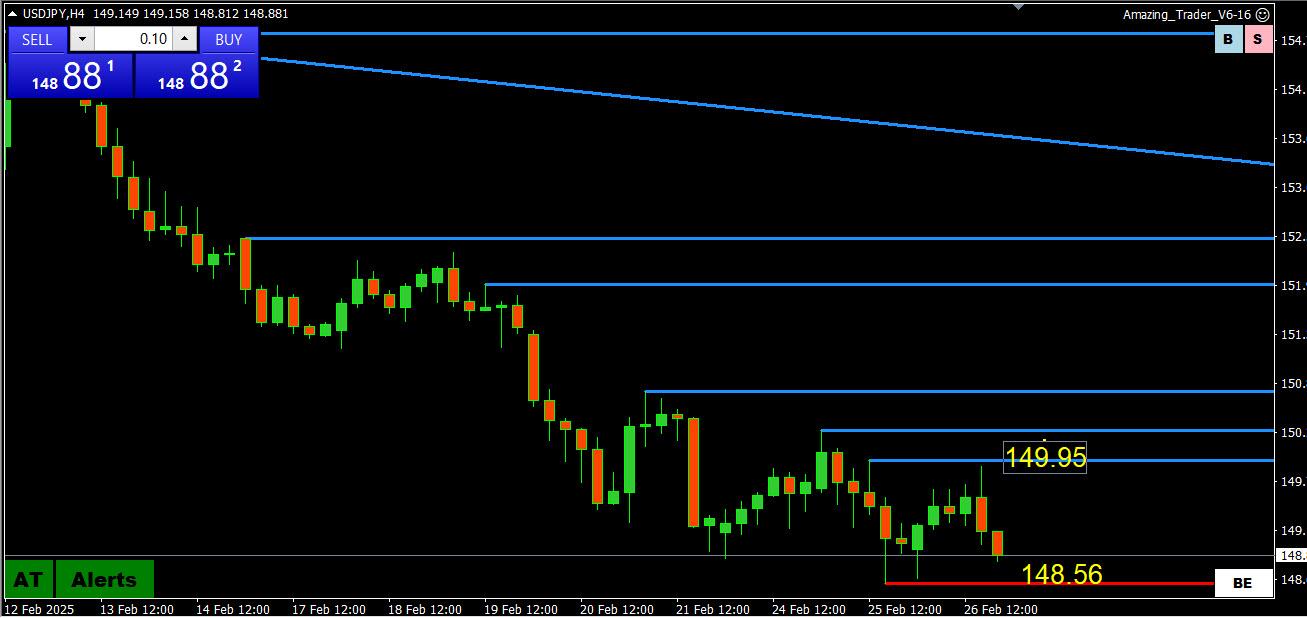

USDJPY the outperformer after again finding support in the 148s but is still below 150.

Elsewhere

Gold is weaker

US bond yields are up after a sharp fall to 4.25% (10 yr) yesterday

Stocks up a touch

Watch for

US economic data durable goods 2nd GDP revision, weekly jobless claims) : see our Economic Daya Calendar

Trump speak: Watch headlines on tariffs after conflicting talk yesterday on Mexico and Canada

Trump due to speak in the morning and then an afternoon presser with the UK PM

February 26, 2025 at 8:19 pm #20150In reply to: Forex Forum

February 26, 2025 at 7:59 pm #20148In reply to: Forex Forum

February 26, 2025 at 6:40 pm #20146In reply to: Forex Forum

February 26, 2025 at 2:57 pm #20127In reply to: Forex Forum

February 25, 2025 at 4:32 pm #20079In reply to: Forex Forum

February 25, 2025 at 4:11 pm #20078In reply to: Forex Forum

February 25, 2025 at 3:23 pm #20073In reply to: Forex Forum

February 25, 2025 at 2:55 pm #20071In reply to: Forex Forum

February 25, 2025 at 2:41 pm #20070In reply to: Forex Forum

-

AuthorSearch Results

© 2024 Global View