-

AuthorSearch Results

-

March 18, 2024 at 9:42 pm #3234

In reply to: Forex Forum

March 18, 2024 at 9:36 pm #3232In reply to: Forex Forum

March 18, 2024 at 11:02 am #3152In reply to: Forex Forum

USDJPY 4 HOUR CHART

The key flow giving EURUSD support is a firmer EURJPY ahead of the BoJ decision early Tuesday.

If you want to sell JPY and not force the BoJ to intervene, one way is to follow the path of least resistance, which is on its crosses.

The chart shows 3 levels of resistance above the market and on the downside, needing to hold the 162.17 level to keep a bid.

As SF Monege pointed out. the prudent approach is to step back and let the dust settle on the BoJ decision as all that is certain is that there should be volatility following it.

March 17, 2024 at 2:37 pm #3137In reply to: Forex Forum

March 16, 2024 at 3:09 pm #3114In reply to: Forex Forum

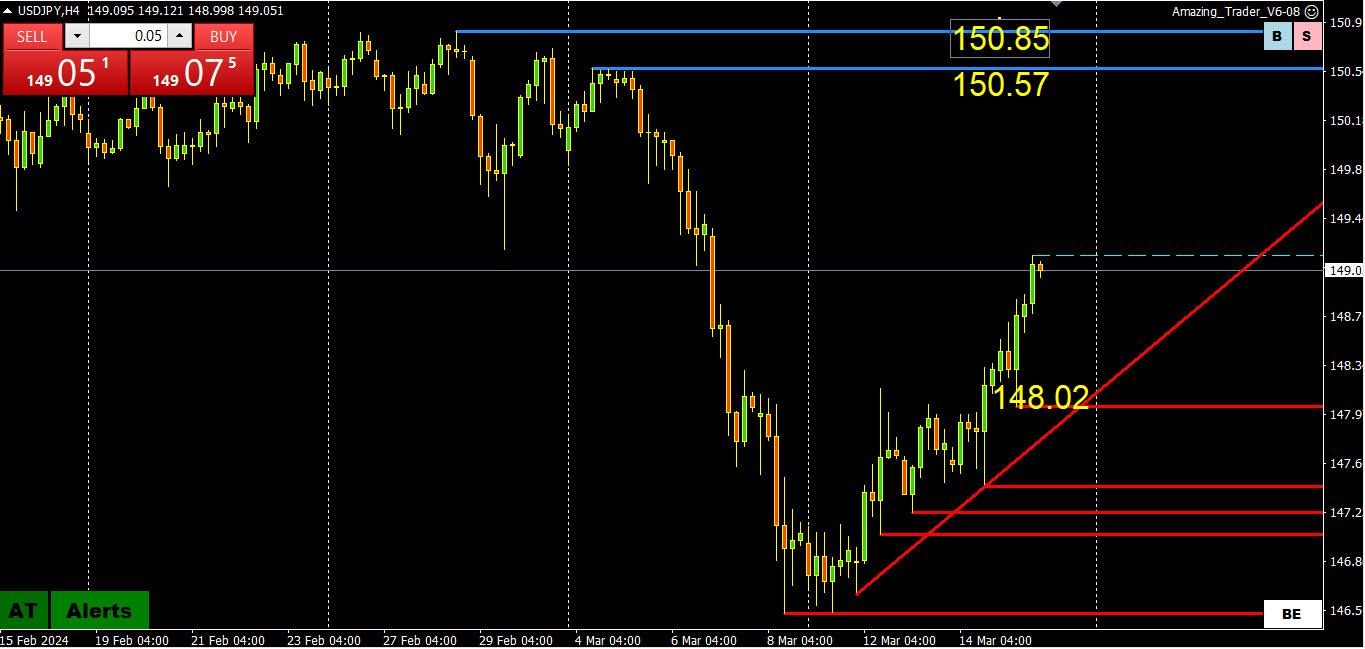

USDJPY 4 HOUR CHART

THE FOCUS TO START THE WEEK WILL BE ON USDJPY AND JJPYCROSSES AHEAD OF THE BOJ MARCH 19 DECISION.

The only levels that really matter are 148 and 150 as key levels lie outside of it although 148.03 (and the trendline) are key supports on this chart (suggests 149 as the midpoint)

There are several articles on the BoJ and JPT in our new and outstanding blog

March 15, 2024 at 5:03 pm #3088In reply to: Forex Forum

Hah…. Thanks, I think. Funny day. Just when I thought ok we’re set for some across the board directional follow thru -> Nothing.

Lets review

– Quad witching today.

– US yields higher.

– BoJ guy hints at policy rate change (higher) at next weeks meeting.

– Dovish comments on economy and rates (lower) from ECB guys.Yet-> JPY weaker, EUR stronger against some flat against others, Copper Silver higher. Not a whole lot of logic found here.

FX market (read EUR) remains as non-comital as it’s been over the last year. I think it’ll stay that way with a bias against the weak links (chf) over the next few weeks.

Stocks I think are running on air which could see a downdraft the next six weeks or so. That said is it really worth trying to time the stock market as in the long run it only goes up.

Bonds not going up any time in the forseeable future. There’s A LOT of people that enjoy earning an effortless 5%……

March 15, 2024 at 3:40 pm #3072In reply to: Forex Forum

EURJPY 4 HOUR

I was asked why the dollar is not moving up with higher yields today.

My answer: Look at the JPY where weak crosses are giving other currencies, such as the EURUSD, some offset support.

So, take a look at EURJPY, which is testing the next resistance at 162.18.

161.70 is now the key support.

March 15, 2024 at 10:45 am #3050In reply to: Forex Forum

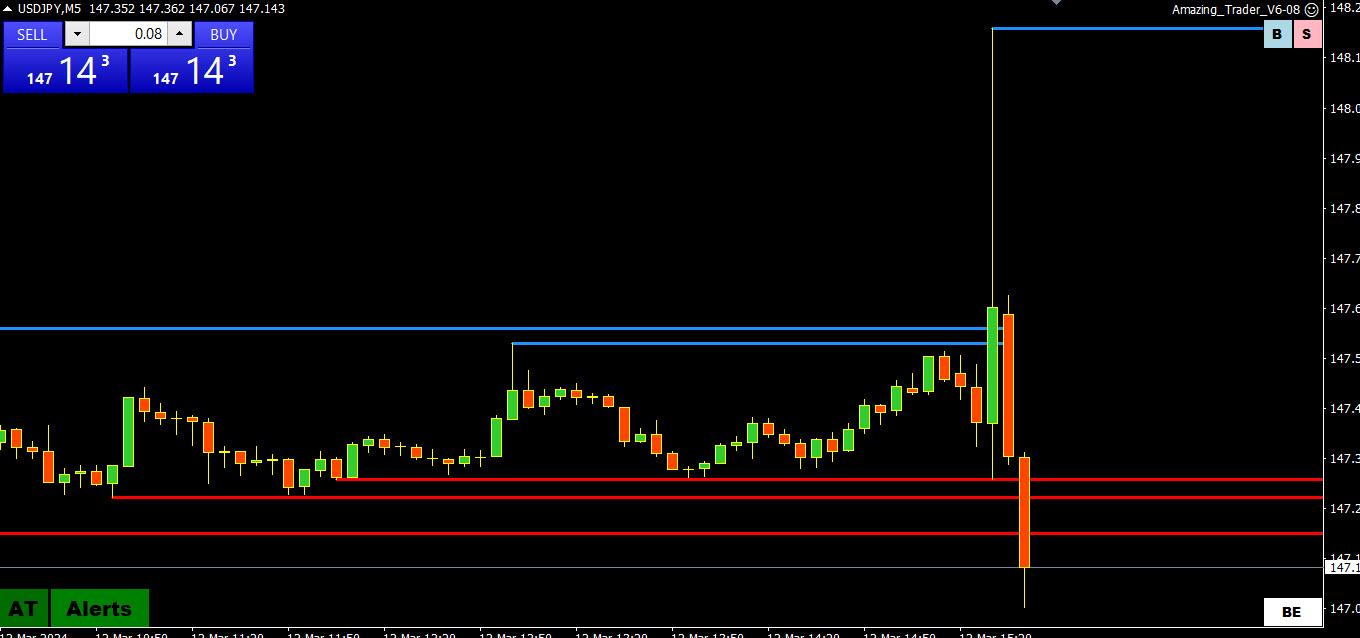

USDJPY 4 HOUR CHART

Some pre-BoJ meeting cold feet have JPY trading weaker

Offsets out of EURJPY buying are helping so far to keep EURUSD above 1.0867 (see post below)

Rising red AT lines show risk to the upside as long as it stays above 148.00-04 but…

Major resistance is not until the upper 150+ so not close to key levels.

March 15, 2024 at 12:07 am #3040In reply to: Forex Forum

March 14, 2024 at 6:01 pm #3027In reply to: Forex Forum

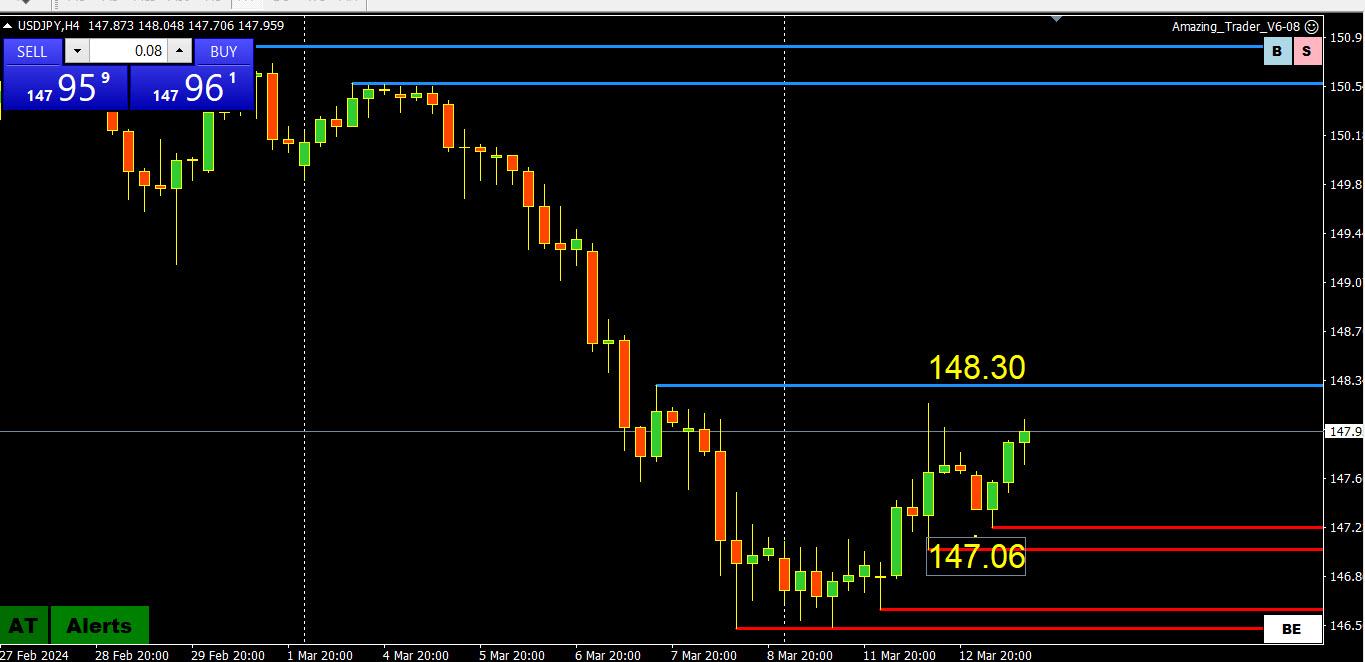

USDJPY 4 HOUR CHART

Key levels are obvious

148.30 resistance (void above it)

148 sets the biasUSDJPY finding support despite the risk of the long-awaited rate hike next week, neutralized by higher US bond yields.

March 13, 2024 at 2:52 pm #2943In reply to: Forex Forum

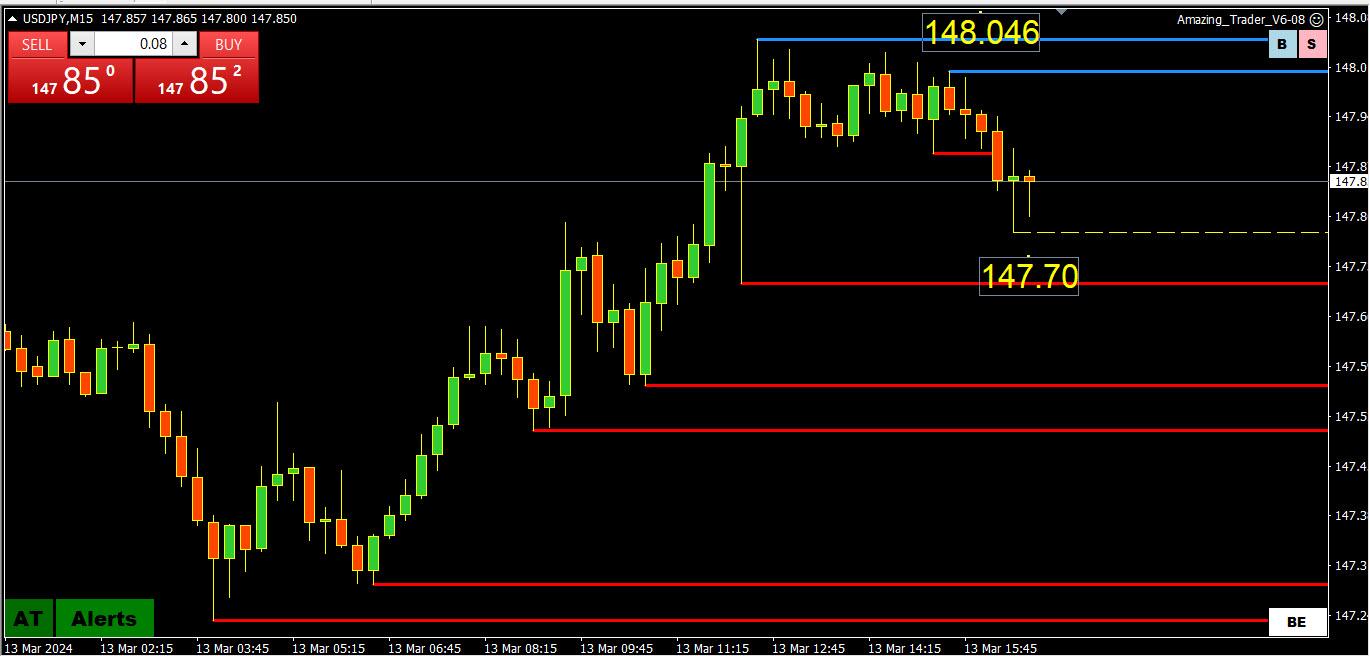

USDJPY 15 MIN CHART

Let’s take a look at a shorter-time frame chart

USDJPY has backed off from a tepid test of 148ish and is still trapped with a bid while above 147.70 support (noted earlier).

See my blog article Is a BoJ Rate Hike Discounted? How Will USDJPY React?

March 13, 2024 at 1:10 pm #2935In reply to: Forex Forum

March 13, 2024 at 12:21 pm #2933In reply to: Forex Forum

EURJPY 4-Hour Chart

Red AT lines are now dominating as pre-BpJ trading sees USDJPY firm back towards 148 and offsets giving EURUSD some support.

Levels are clear on the chart with a bid while above 161.56 and the trendline.

These are fickle times ahead of the BoJ but for now there seems to be some cold feet from the JOY longs.

March 12, 2024 at 1:44 pm #2871In reply to: Forex Forum

March 12, 2024 at 12:33 pm #2868In reply to: Forex Forum

March 12, 2024 at 10:24 am #2862In reply to: Forex Forum

USDJPY 30 MIN CHART – Correcting but still below the latest breakdown level

A failure to decisively break below 146.50 leaves the range to 148. On the other side, only 148+ would deflect risk on the downside.

As I noted, 147.61 was a breakdown level so the one blocking a shift in risk back to 148. So far the rebound has paused just below it.

Intra-day levels are in the chart.

NOTE

USDJPY bounced after BoJ Gov Ueda, testifying, gave no hint of a rate hike at next week’s meeting. He said we will see what data shows later in the week.

If trading USDJPY, do it intra-day as one off-hand comment overnight can send this pair up or down as market awaits next week’s BoJ decision.

US CPI next on deck.

March 12, 2024 at 1:17 am #2857In reply to: Forex Forum

March 12, 2024 at 12:42 am #2856In reply to: Forex Forum

March 11, 2024 at 7:21 pm #2849In reply to: Forex Forum

A bit different approach to USDJPY

As major supports behind this Up trend are far and away right now -143.250 & 139.000, only approach to trading USDJPY is intraday – time frames from 1h and bellow.

But if we look at it on this Daily chart, the following can be concluded – if in next two days USD finds the strength to go above 148.800 (lots, I know we will be looking at the renewed and even stronger Rally Up.

However, ” If” is not a reliable trading tool, but “Wait and see” comes as a good strategy , so we should accept that approach…

In the mean time, as long as USD is on the defensive, Short it on the smaller time frames given Sell signals , be fast and do not be greedy . March 11, 2024 at 5:30 pm #2847

March 11, 2024 at 5:30 pm #2847In reply to: Forex Forum

Read earlier that Claude Erb, a former commodities portfolio manager at TCW Group, plots bitcoin’s actual price over the past decade along with Erb’s application of Metcalfe’s Law with the result being a fair value of $35,000 for Bitcoin.

Side note, some ideas for orders I tried to post earlier but it would not post for some reason – buy side AudChf 5790 – Buy side AudCad 8900 – Sell side GbpChf 1260 – GbpUsd Buy side 2812 or lower – AudUsd buy side 6594 or lower – UsdJpy sell side 147.10 or higher –

-

AuthorSearch Results

© 2024 Global View

USDJPY 4H Chart – Fibbo Fans

USDJPY 4H Chart – Fibbo Fans