-

AuthorSearch Results

-

March 21, 2024 at 2:49 pm #3428

In reply to: Forex Forum

March 21, 2024 at 12:31 pm #3409In reply to: Forex Forum

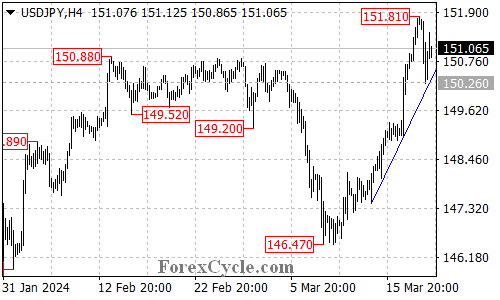

USDJPY Analysis: Pullback and Support Levels

USDJPY has experienced a retracement from 151.81 to a low of 150.26, with the pair now testing the support of the ascending trend line on the 4-hour chart.

If the trend line support remains unbroken, the current pullback from 150.26 could be interpreted as a period of consolidation for the uptrend starting from 146.47. In this scenario, there is still potential for further upward movement towards the 170.00 area after the consolidation phase.

The key support level to monitor is at 150.26. If the price falls below this level, it could indicate the potential completion of the uptrend that initiated from 146.47, with the next target set at the 149.00 area.

March 21, 2024 at 1:54 am #3392In reply to: Forex Forum

March 20, 2024 at 4:45 pm #3364In reply to: Forex Forum

With BoJ making a move on rates I think it gave the market less concern over intervention, so Amman’s assessment earlier may be spot on as he usually is. I am just not touching longs in UsdJpy because anything overly aggressive to the upside could put the “I” word back in play. I’m in crosses only pre-Fed.

March 20, 2024 at 3:56 pm #3360In reply to: Forex Forum

March 20, 2024 at 3:42 pm #3351In reply to: Forex Forum

March 20, 2024 at 3:23 pm #3349In reply to: Forex Forum

March 20, 2024 at 3:04 pm #3347In reply to: Forex Forum

March 20, 2024 at 3:00 pm #3346In reply to: Forex Forum

March 20, 2024 at 2:58 pm #3345In reply to: Forex Forum

What there seems to be especially in eur/usd and to some degree gbp/usd is a lack of desire to commit. The weaker links (jpy and chf) are easier to punch down on so there in lies the path of least resistance. That said I don’t get the feeling there are that many people that have been short jpy for months or even weeks…..

March 20, 2024 at 2:50 pm #3343In reply to: Forex Forum

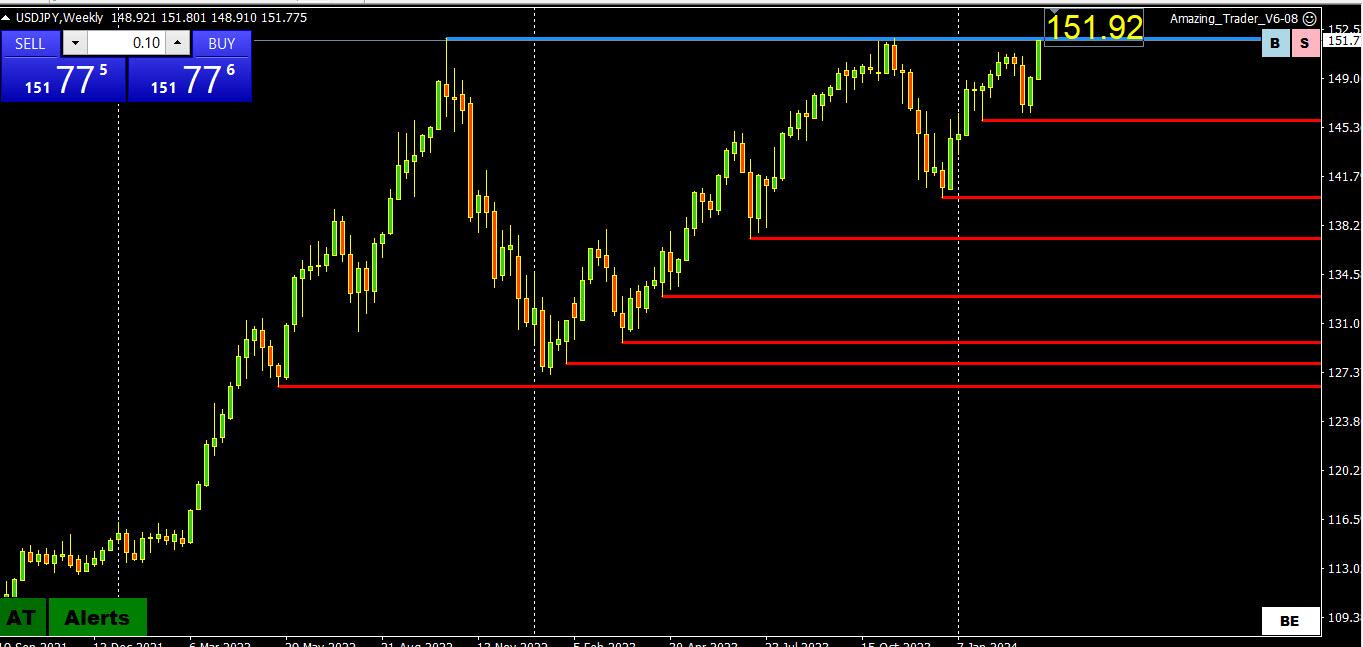

USDJPY WEEKLY CHART – Major RResistance In Sight

There is only one level worth noting in USDJPY, the major resistance at 151.92

A break above this level would leave a blank on charts so use magic levels (152, 155, etc) as potential targets.

So it is a case of boom or bust at 151.92. If I were in the BoJ’s shoes, I would have 2 choices: defend 151.92 or let it run through 152 and then come in covertly to smack it back down but its shoes are too big for me to fill.

Whatever the case, watch 152 as this will dictate whether there is a run at 153.50 and 155.00 or form a range to 150.00.

March 20, 2024 at 11:23 am #3330In reply to: Forex Forum

March 20, 2024 at 10:35 am #3327In reply to: Forex Forum

EURJPY DAILY CHART

EURJPY is currently an outperformer, following the “path of least resistance:, trading above its major resistance at 164.29. This leaves the next target as guesswork (165 is one of those magic levels). Back below 164.29, at a minimum, would be needed to slow the move up.

Much might depend on whether USDJPY can trade similarly by taking out its major resistance at 151.92.

So far, offsets out of this cross are helping to keep EURUSD above its supports (see prior posts).

March 20, 2024 at 10:22 am #3325In reply to: Forex Forum

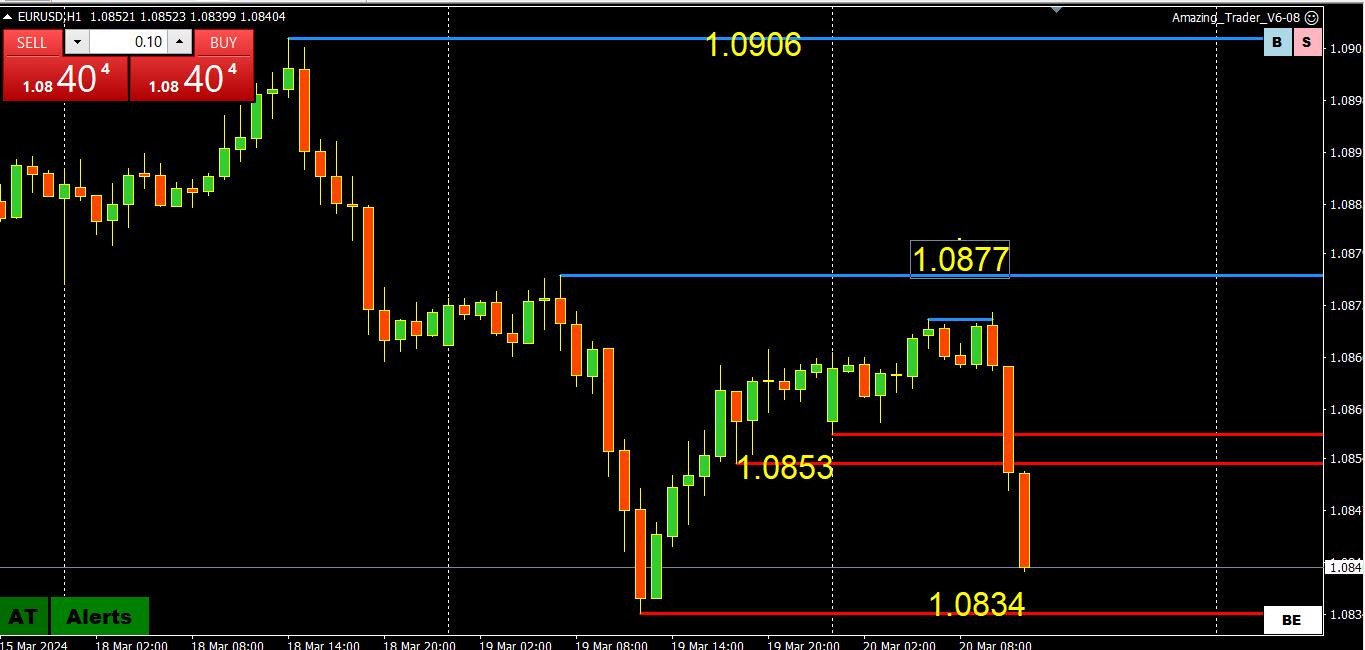

EURUSD 1 HOUR CHART

It took 17 1-hour candles to go from 1.0853 to 1.0873 and just 2 to break back below it. This tells you the current risk in a market that has had bouts of what we like to say “trading bid in an offered market” with buying driven more by its crosses (e.g. eurjpy) than outright vs the USD.

I don’t like to draw conclusions from a pair trading in a 43 pip range (1.0834-77) other than to say 1.0887 and 1.0906 would need to be broken to change the picture.

4 hour chart to follow .

March 20, 2024 at 4:48 am #3320In reply to: Forex Forum

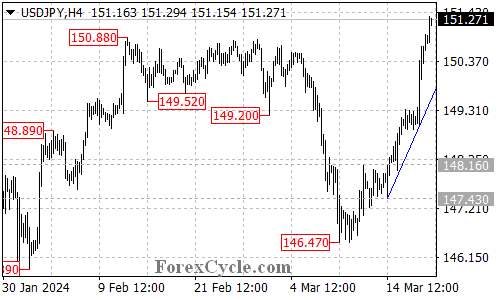

USDJPY Analysis: Breakout and Potential for Further Upside Movement

USDJPY has successfully surpassed the 150.88 resistance level, with the upward movement from 146.47 extending to a peak of 151.33.

As long as the price remains above the ascending trend line on the 4-hour chart, there is still potential for additional upward movement in the upcoming days, with the next target estimated around 160.00.

The initial support level to monitor is at 150.35. If the price breaks below this level, it could suggest a period of consolidation for the uptrend starting from 146.47, with the pair likely finding support at the rising trend line.

A decisive break below the support provided by the trend line could indicate the potential completion of the current uptrend.

March 19, 2024 at 7:23 pm #3310In reply to: Forex Forum

GBPJPY DAILY CHART

I had to go to the daily chart looking for a chart level.

All that is left is a breakout above 191.191.32 as support and a monthly resistance above 185.

The key support area is distance at 187.94 as seen on this chart.

In a market like this look for the new high to act as a key resistance.

Be o alert in GBP as CPI, expected to dip, will be released overnight.

‘

March 19, 2024 at 5:09 pm #3300In reply to: Forex Forum

March 19, 2024 at 3:09 pm #3287In reply to: Forex Forum

March 19, 2024 at 2:56 pm #3281In reply to: Forex Forum

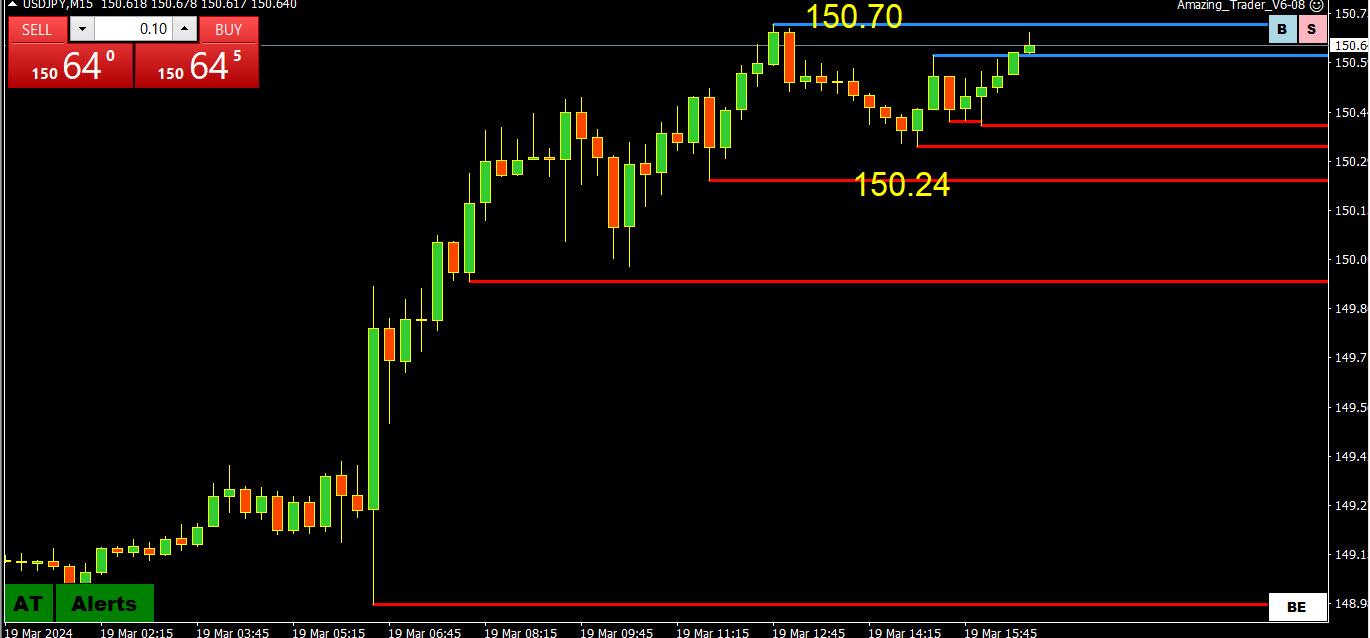

USDJPY 15 Minute Chart – Is the BoJ lurking?

Just to show you there is a method to my madness when I follow the AT lines

As noted in my earlier post, key levels are at 150.24 and 150.85 (seen on a 4-hour chart) and USDJPY is trading within this range but upper end is exposed while above 150.50

Currently, an invisible hand seems to be back protecting 150.85, at least for now

March 19, 2024 at 11:03 am #3259In reply to: Forex Forum

USDJPY 4 Hour Chart

USDJPY 4 Hour ChartBoJ’s decision to hike rates and end the era of negative interest rates was not a surprise. Indications of a go-slow approach make this a dovish hike and the JPY has responded accordingly.’

USDJPY targeting 150.85 if it can stay above 150.24-50, with a stronger risk if above 150.57.

If I was in the BoJ’s shoes I would be lurking above 150.50 but only to smooth the move and prevent a full rout by defending 150.85(?).

Note prior USDJPY uodate was deleted in error.

-

AuthorSearch Results

© 2024 Global View