-

AuthorSearch Results

-

April 1, 2024 at 7:12 pm #3887

In reply to: Forex Forum

April 1, 2024 at 6:26 pm #3885In reply to: Forex Forum

April 1, 2024 at 6:09 pm #3879In reply to: Forex Forum

April 1, 2024 at 5:43 pm #3875In reply to: Forex Forum

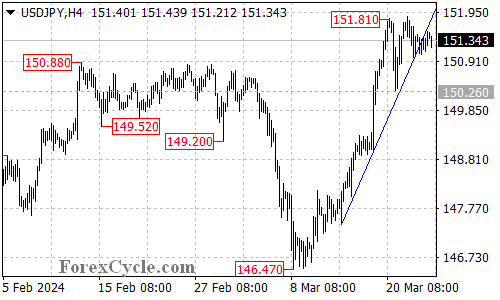

USD 4 HOUR CHART – INTERVENTION THREAT LOOMS BUT…

USDJPY remains within 151-152 with the market wary of pushing the top side too hard.

However, given the overall USD strength and the pop in bond yields, any intervention would likely prove short-lived unless it continues in a sustained way.

With that said, traders will be wary as they do not want to get caught in the first wave should there be intervention.

March 31, 2024 at 10:58 pm #3845In reply to: Forex Forum

USDJPY Week Ahead

Intervention or no intervention – that is the question !

If we just ignore it, this is what it is right now :

Support at 150.500 – has to Hold for move Up

Resistance at 152.000

In my opinion, this is the perfect set up for targeting 155.000

I don’t trade opinions…even my own – but I see it only Up as it is.

March 29, 2024 at 5:14 pm #3802

March 29, 2024 at 5:14 pm #3802In reply to: Forex Forum

USDJPY 4 hour chart – Intervention of not?

Range is very clear 151.00-151.97 but next week is a new ball game.

There seems no compelling reason to intervene as verbal intervention has so far cooled threat but noit negated the threat to 152 and higher.

If they are serious about squeezing the USDJPY longs, then breaks of 151.00/0/trendline/150.26 (and 150.00) would be needed.

March 28, 2024 at 9:49 am #3737In reply to: Forex Forum

AUDJPY 4 HOUR CHART – SHORT JPY POSITIONS BEING UNWOUND

USDJPY IS ABOUT UNCHANGED WHILE THE USD IS FIRMER VS OTHER PAIRS

AUD AND NZD ARE WEAKEST, EUR THEN GBP AND CAD ARE NEXT

WHAT DOES THIS TELL YOU?

JAPANESE INTERVENTION THREAT IS BEING TAKEN SERIOUSLY AHEAD OF A LONG HOLIDAY WEEKEND AS SHORT JPY (CARRY TRADE?) CROSSES ARE BEING UNWOUND

ON THIS CHART AUDJPY NEEDS TO TRADE BACK ABOVE.9842 OR RISK STAYS ON THE DOWNSIDE

March 27, 2024 at 2:20 pm #3688In reply to: Forex Forum

March 27, 2024 at 12:53 pm #3672In reply to: Forex Forum

March 27, 2024 at 12:53 pm #3671In reply to: Forex Forum

March 27, 2024 at 10:16 am #3668In reply to: Forex Forum

March 27, 2024 at 8:47 am #3666In reply to: Forex Forum

This is a very timely article posted yesterday in our blog

With USDJPY setting a new 32-year high, traders are keeping one eye out for any hints of intervention, This has seen Japanese officials step up verbal intervention in an effort to contain or at least deter the USDJPY from making a run at another new high.

Trader Alert: Will the Bank of Japan Intervene and Does Forex Intervention Work?

March 26, 2024 at 2:48 am #3608In reply to: Forex Forum

USDJPY Update: Trend Line Break and Support Levels

The recent price action in USDJPY has seen a break below the ascending trend line on the 4-hour chart, indicating that a prolonged consolidation phase for the uptrend starting from 146.47 is currently in progress.

As long as the critical support level at 150.26 remains intact, there is potential for the upward momentum to resume, with the possibility of further advancement towards the 170.00 region following the consolidation period.

The initial support level to monitor is at 150.95. If this level is breached, it could lead to a test of the key support at 150.26. Only a decisive breakdown below this pivotal level would suggest the potential completion of the uptrend that originated from 146.47.

March 25, 2024 at 5:36 pm #3596In reply to: Forex Forum

March 25, 2024 at 10:22 am #3563In reply to: Forex Forum

Verbal intervention earlier with USDJPY still within reach but staying below 151.90, a 32 year high.

Japan’s top currency diplomat on Monday warned against speculators trying to sell off the yen, saying its weakness did not reflect fundamentals, in the latest warning about the currency’s “big slide” against the dollar….CNBC

March 24, 2024 at 11:02 pm #3558In reply to: Forex Forum

March 24, 2024 at 4:26 pm #3552In reply to: Forex Forum

USDJPY 4 HOUR CHART – CONSOLIDATION?

With Goldman raising its 3-month USDJPY forecast (see prior post), let’s take a look at a 4-hour USDJPY chart.

With 151.90 remaining the major resistance (shown on a daily chart), currently protected by 1.5181-86, the current range is consolidating between 150/152, with 151 acting as a neutral midpoint.

The key support is at 150.26. above it keeps 151.90 in play, a stronger risk if 151.00 can become support.

The reason that I looked at the range as consolidation is that the upcoming week is not a normal one

Pre-Easter week and a 4-day long weekend break

A week normally dominated by position adjustment rather than aggressive positioning

Light economic calendar, highlight Friday’s US PCE report

Month/quarter end for many on Thursday with markets closed on Friday-Monday

The actual quarter end is Friday

March 24, 2024 at 4:27 am #3551In reply to: Forex Forum

March 22, 2024 at 1:37 pm #3479In reply to: Forex Forum

March 22, 2024 at 7:58 am #3453In reply to: Forex Forum

USDJPY

In a buy mood.

151.95 confirmed will be reached.

15240 confirmed, too, will be reached.

Any decline below 150.50 will return to it.____________________________________________________________

Price moved successfully exactly as the signal, it declined to 150.23 then rose to 150.50 then to 151.90 -

AuthorSearch Results

© 2024 Global View