-

AuthorSearch Results

-

April 5, 2024 at 2:45 pm #4102

In reply to: Forex Forum

April 5, 2024 at 1:54 am #4051In reply to: Forex Forum

My colleagues are looking to take long June Yen futures positions in the week of 4/15 around 6620 and lower. I am doing nothing but taking sell side trades in spot (Usd/Jy, Eur/Jpy, Nok/Jpy, Sgd/Jpy, mainly) for over a week now obviously but cycling intra-day primarily. Conceivable Usd/Jpy actually compromises 152 in coming weeks but there is nothing to warrant being on the buy side in my view unless you are balancing portfolios.

April 4, 2024 at 9:27 pm #4046In reply to: Forex Forum

April 4, 2024 at 5:07 pm #4042In reply to: Forex Forum

April 4, 2024 at 2:59 pm #4036In reply to: Forex Forum

Apology if too many posts, attempting to be of help. Took the money here on the UsdJpy sell at 151.52 bid due to the odds of the 10yr yield holding around here and looking to be on the sell side again higher up. Have trailing sell stop for entry regardless should BoJ get an idea. Gbp sell is from above current market nearer to the figure.

April 4, 2024 at 2:38 pm #4034In reply to: Forex Forum

Viewing gains in EurJpy and Sterling as solid buy side waves against the larger sell side momentum. Hence am short against Yen again in Eur and Usd, while in on the sell side light in GbpUsd but not as confident in that one so observing intently. It appears my preference this week has been the risky venture of counter trading. Noting the yield and hoping it doesn’t decouple with Dxy like it has done more than usual in recent days.

April 4, 2024 at 10:26 am #4010In reply to: Forex Forum

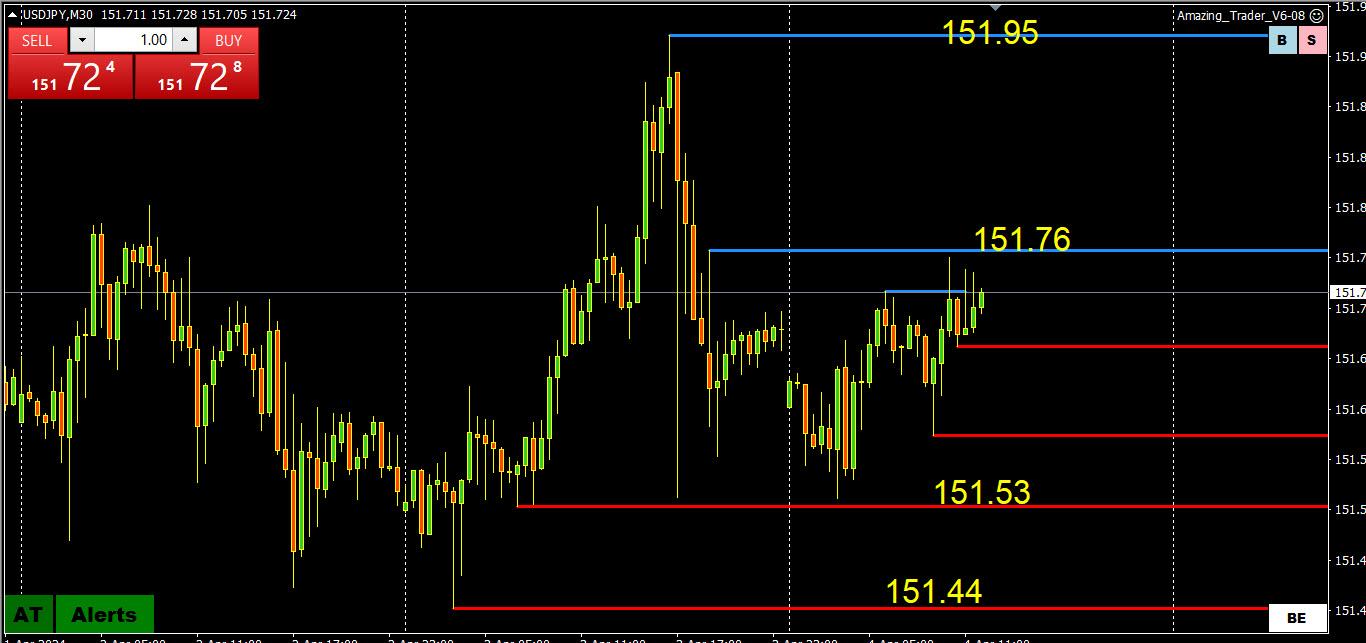

USDJPY 30 MINUTE CHART – AN ALERT OR WARNNG?

USDJPY came within a couple of pips of 151.97 yesterday and has backed off a touch but remains bid despite the BoJ intervention threat (note weak JPY crosses.

AN ALERT OR A WARNING

I RECEIVED AN EMAIL ABOUT USDJPY THAT I WOULD NORMALLY IGNORE EXCEPT IT CAME FROM SOMEONE WHO IS A WELL-CONNECTED SOURCE.

THE XXX (NAME OMITTED BUT IT WASN’T THE BOJ) MAY DROP THE BALL ON USDJPY ONE FINE MORNING.

I am only the messenger but would be remiss if I did not pass this on given the source.

April 4, 2024 at 10:05 am #4007In reply to: Forex Forum

AUDUSD 4 HOUR CHART – THE OUTPERFORMER

Note, my posts yesterday about following the oath of least resistance.

AUDUSD has so far been the outperformer today as flows from the JPY continue to keep USDJPY in sight of 152 but reluctant to challenge the BoJ while the USD trades soft elsewhere, helped by offsets from JOPY crosses.

I had to go to a 4-hour chart to find the key resistance, which is not until .6635 so damage so far has not been fatal.

In the absence of nearby support, look at former resistance for the first levels. of support or revert to shorter time frames.

April 4, 2024 at 1:30 am #4005In reply to: Forex Forum

April 4, 2024 at 12:56 am #4003In reply to: Forex Forum

April 3, 2024 at 5:43 pm #3984In reply to: Forex Forum

April 3, 2024 at 2:32 pm #3967In reply to: Forex Forum

April 3, 2024 at 1:39 pm #3961In reply to: Forex Forum

April 3, 2024 at 1:28 pm #3959In reply to: Forex Forum

EURHPY 4 HOUR CHART

The market is so far choosing the path of least resistance by selling JPY on its crosses.

This is seeing both EURUSD and USDKPY both bid, the latter sees the 151.97 (and BoJ threat) looking while the latter is staying below 1.08 (upside limited while below it)

See the chart for EURJPY levels

Nice call by MOInedge on short JPY vs all

April 3, 2024 at 3:55 am #3939In reply to: Forex Forum

April 2, 2024 at 9:18 pm #3932In reply to: Forex Forum

April 2, 2024 at 4:32 pm #3923In reply to: Forex Forum

April 2, 2024 at 4:22 pm #3922In reply to: Forex Forum

April 2, 2024 at 11:10 am #3900In reply to: Forex Forum

USDJPY Monthly

This is NOT a Bitcoin, Nvidia or Gold…this is Yen (not Sparta definitely 😀

Mind you, all time High of Modern times is at 160.360

It is becoming kind of hilarious….a Small correction is like 1000 pips lower, and a decent one…well…how about 2.500 pips .

Trading it on anything bigger than half an hour chart takes some Cojones 😀

April 2, 2024 at 9:57 am #3890

April 2, 2024 at 9:57 am #3890In reply to: Forex Forum

It feels more like the start of a new year than the start of the second quarter.

The key focus will be on US data and how the bond market reacts.

Powell speaks tomorrow.

USDJPY remains in a 151-152 range, betterment bid in the upper half. I read that any intervention should it occur would target a 5 yen drop. I also read that the effects of intervention would be short-lived.

EURUSD stays soft but tight range, suggests a cautious approach awaiting key data from mid-week on

-

AuthorSearch Results

© 2024 Global View