-

AuthorSearch Results

-

March 6, 2025 at 4:20 pm #20525

In reply to: Forex Forum

March 6, 2025 at 3:26 pm #20514In reply to: Forex Forum

March 6, 2025 at 1:01 pm #20503In reply to: Forex Forum

March 6, 2025 at 11:10 am #20499In reply to: Forex Forum

EURJPY 4 HOUR CHART – Holds major resistance

With EURJPY one of the drivers of the EURUSD rally (among other crosses), it pays to take a look as the cross has backed off after a test of the major 161.17 level (see chart).

This has helped steady EURUSD while USDJPY slipped below 148.

Minor support 159.40 and 158.70

March 6, 2025 at 10:22 am #20497In reply to: Forex Forum

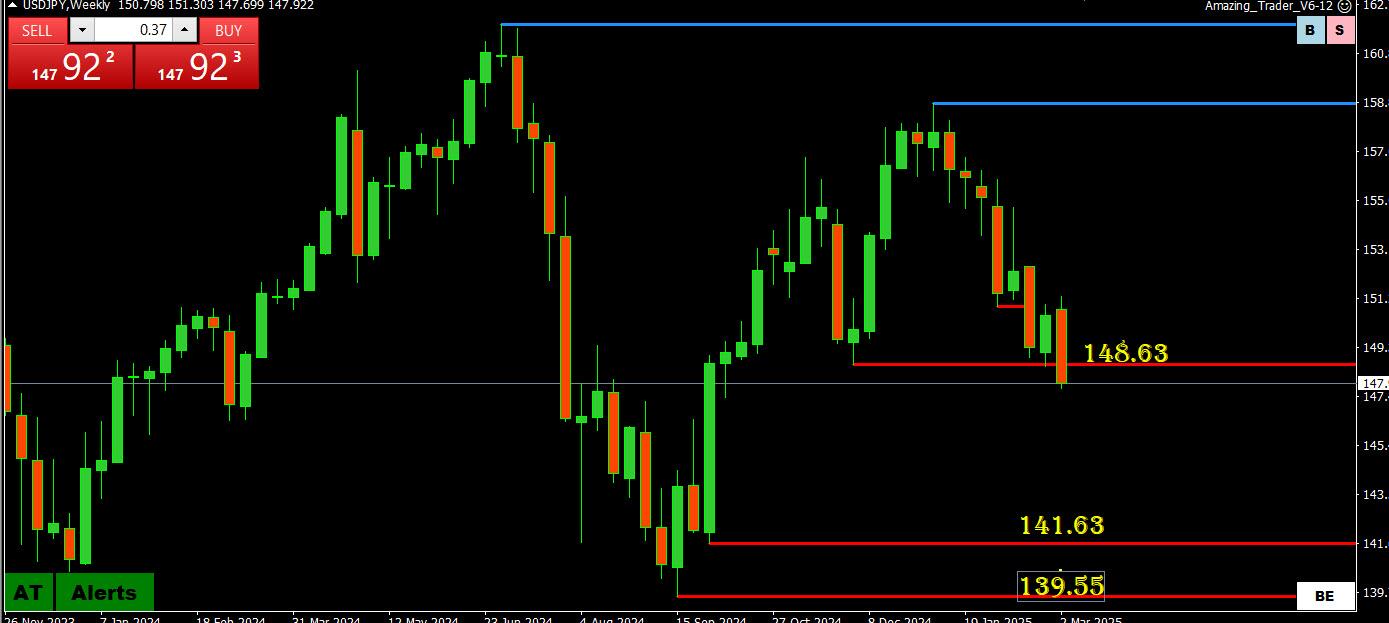

USDJPY WEEKLY CHART – Black hole

After lagging and at times diverging the past few days vs the EUR, JPY has firmed, both vs the dollar and on its crosses,

As you can see by this weekly chart, there is a large black hole on the downside, leaving the focus on the pivotal 148 level to set the tone and dictate whether it can make a run at 146.50 and 145.00 or not..

As I have noted, when you see a big move in USDJPY, especially when it diverges with what others are trading vs the USD, it generally involves a real money cross flow.

Intra=day range: 147.70-149.33

March 6, 2025 at 9:51 am #20493In reply to: Forex Forum

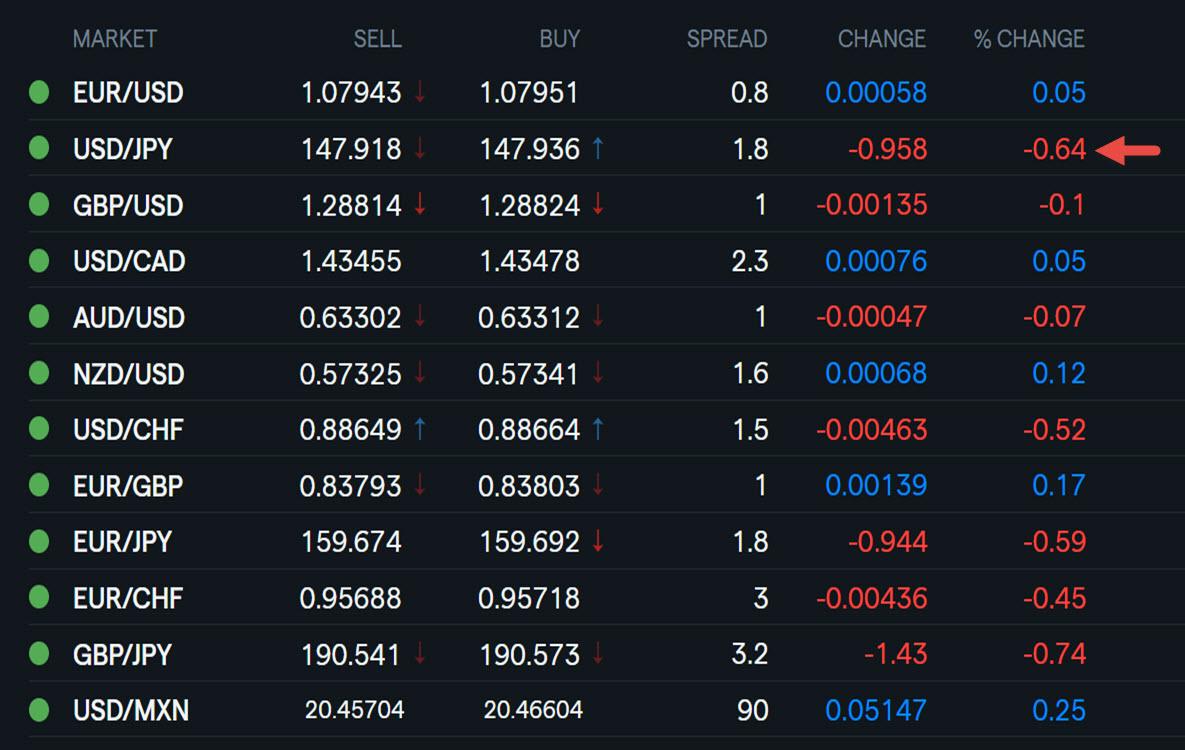

Using my platform as a HEATMAP shows

The dollar traded softer overnight before some caution set in ahead of the ECB decision. Most currencies are currently showing only modest changes except the JPY, which has been the outperformer (extended low below 148).

Key focus is on the bond market where higher German yields are pulling other country yields higher as well.

Pivotal levels to watch end in 8: EURUSD 1.08, USDJPY 148.

Light U.S. calendar (weekly jobless claims) ahead of the key .S. jobs report on Friday

US stocks currently down, bond yields up…not a good comination

Keep on eye on headlines, specifically tariff replayed

March 5, 2025 at 10:10 am #20453In reply to: Forex Forum

March 5, 2025 at 9:30 am #20444In reply to: Forex Forum

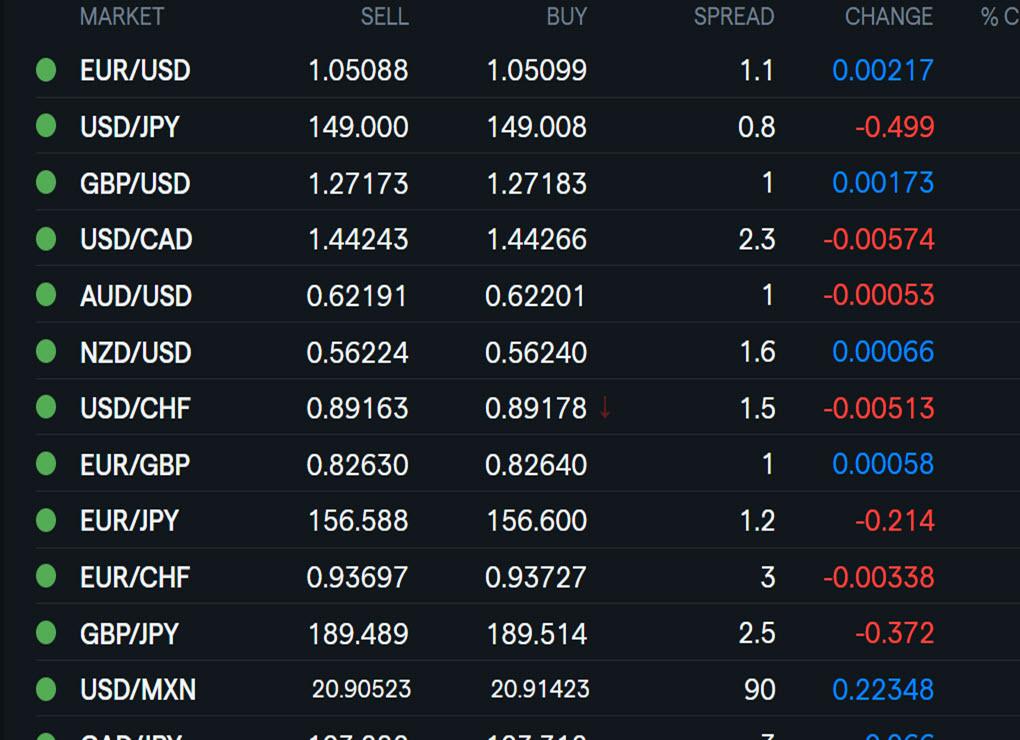

Using my platform as a HEATMAP shoes

The dollar trading weaker, led by the EURUSD, which is in a breakout mode.\

EUR firmer on crosses as well.

USDJPY failed to hold a move above 150.

German bond yields are sharply higher after deal to ease debt restraints (otherwise known as the debt brake)

DAX is up sharply as well.

Zelensky kisses up to Trump by showing a willingness to negotiate a peace deal.

Trump’s address to Congress unveiled no new policies.

.Trade war still on but CAD and MXN rebound suggest caution and hope it may be a negotiating tactic

Date calendar: US ADP employment and ISM services PMI.

March 4, 2025 at 9:42 pm #20435In reply to: Forex Forum

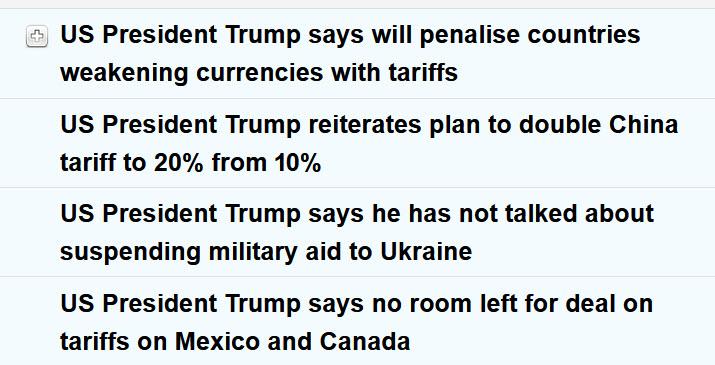

Thisa was a trigger for the risk on reaction USDCAD AND USDMXN drop AND usadjpy pop towards

March 4, 2025 at 7:27 pm #20420

March 4, 2025 at 7:27 pm #20420In reply to: Forex Forum

March 4, 2025 at 11:44 am #20397In reply to: Forex Forum

March 4, 2025 at 10:37 am #20393In reply to: Forex Forum

USDJPY 4 HOUR CHART – Reversal of fortune

At this time yesterday USDJPY was bid out of weaker JPY crosses, a sharp contrast to where it ia currently trading.

You can see by this chart why the recent 148.56 low is a key level (low so far today 148.60).

Looking ahead, unless 150+, is regained, risk will be pointed down

As JP pointed out, keep an eye on US bond yields.

March 4, 2025 at 10:12 am #20390In reply to: Forex Forum

Using my platform as a HEATMAP shoes

The dollar trading generally softer but off its lows in what I call T-Day (aka Tariff Day)

EURUSD above 1.05 but upside paused below a key 1.0528-34 zone/

USDJPY is weaker but so far paused just above its recent 148.56 low,

USDCAD is lower despite Trudeau retaliating with a 25% tariff on U.S. imports

USDMXN is firmer

XAUUSD is firmer

BTCUSD lower as Trump strategic reserve pop continues to fizzled out

Key highlight: President Trump’s’ address to a joint session of Congress at 9PM EST

Expect Ukraine, DOGE and tariffs to be discussed,.

March 3, 2025 at 11:35 pm #20385In reply to: Forex Forum

March 3, 2025 at 11:35 pm #20384In reply to: Forex Forum

March 3, 2025 at 8:31 pm #20354In reply to: Forex Forum

Trump tanks CAD, MXN, stocks,… bomd yields fall… JPY the MAIN beneficiary of risk off

March 3, 2025 at 4:47 pm #20344

March 3, 2025 at 4:47 pm #20344In reply to: Forex Forum

March 3, 2025 at 3:08 pm #20341In reply to: Forex Forum

March 3, 2025 at 12:16 pm #20325In reply to: Forex Forum

March 3, 2025 at 10:48 am #20320In reply to: Forex Forum

USDJPY 1 HOUR – 150-151

Tested just outside both sides of 150-151 with JPY crosses (weaker) keeping it above 150.

The key level is on the upside as there is about a 1 JPY void (151.94) above it.

While within 150-151, pivotal 150.50 seta the tine.

As I have noted, when you see two currencies moving in opposite directions (e.g. EURJPY) it indicates real money cross currency flows.

-

AuthorSearch Results

© 2024 Global View