-

AuthorSearch Results

-

March 14, 2025 at 3:20 pm #20924

In reply to: Forex Forum

March 14, 2025 at 12:00 pm #20902In reply to: Forex Forum

US OPEN<

Spot Gold makes a fresh record high above USD 3000/oz & sentiment lifts ahead of Trump Executive Orders and UoM

Good morning USA traders, hope your day is off to a great start! Here are the top 4 things you need to know for today’s market.

4 Things You Need to Know

Stocks gain with sentiment lifted after a strong Chinese session overnight and after the recent market turmoil.

USD mixed vs. peers, GBP soft post-GDP, JPY weighed on by Rengo data, which showed average wage hike less than demands.

Gilts gap higher on soft growth data while JGBs lift on Rengo.

Spot gold makes a fresh record high above USD 3,000/oz; crude oil and base metals benefit from the risk tone.

March 14, 2025 at 10:31 am #20897In reply to: Forex Forum

As I have noted, when you see a sharp mkve in USDFJPY while others either lag or diverge, look for the offset currency.

IN this case, it appears to have been in AUD and NZD ad well as into EUR although a firmer EURGBP may be giving EURUSD some support.

Life in a mutti-currency centric (as opposed to a dollar-centric) trading world..

March 14, 2025 at 9:19 am #20893In reply to: Forex Forum

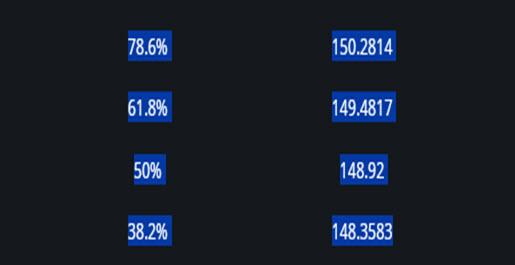

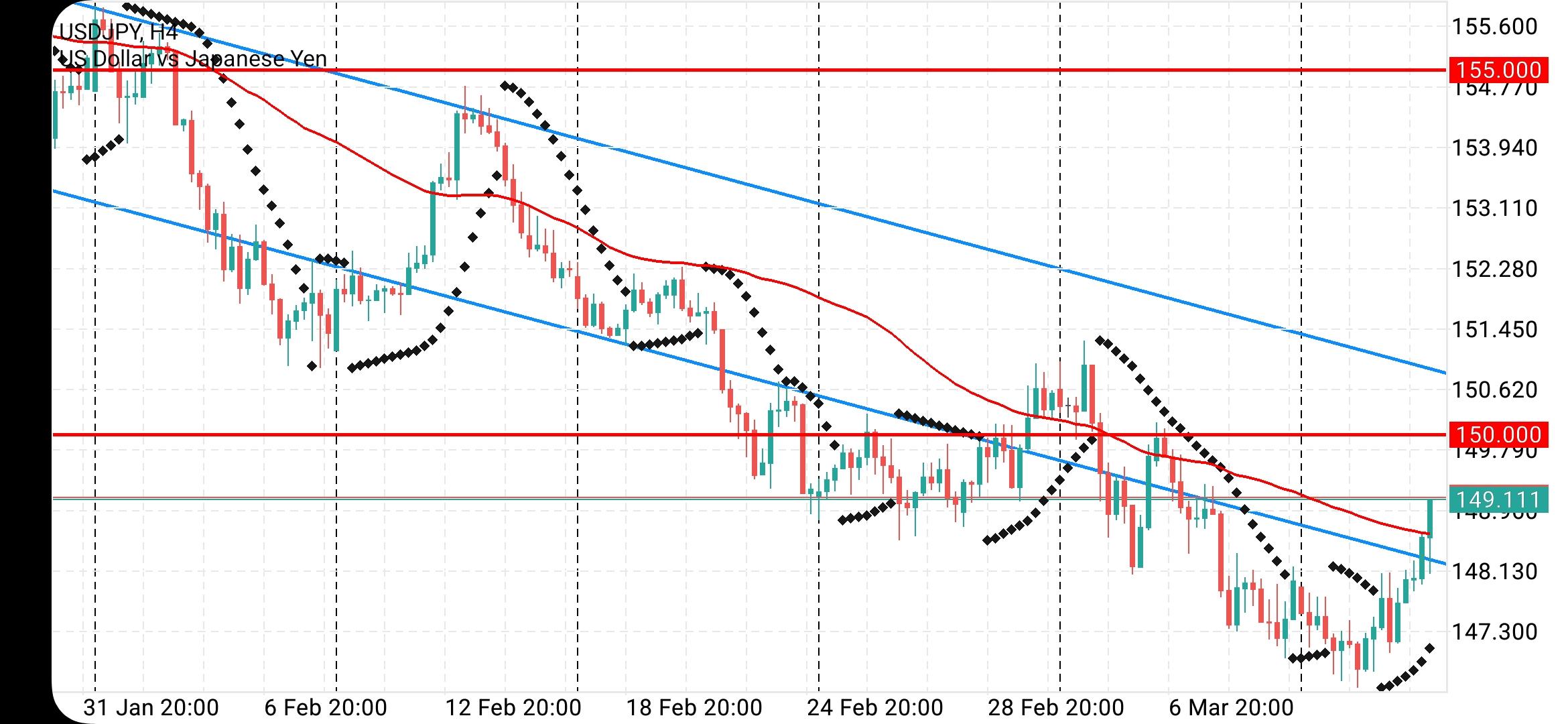

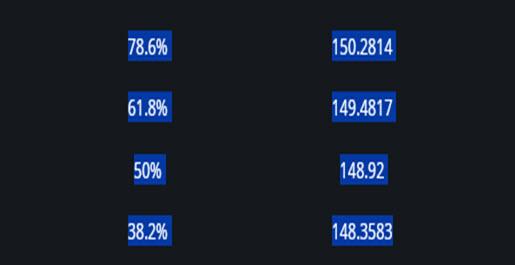

USDJPY 4 HOUR CHART – Following stocks

Main mover today but faces resistance at this week’s 149.19 high and 149.33, which block the pivotal 150 level.

It has been pretty much one-way since 147.85 so only minor levels withing 148-149.

Otherwise watch any reaction to Trump tariff headlines and how stocks trade (note day is still young)

March 14, 2025 at 8:59 am #20891In reply to: Forex Forum

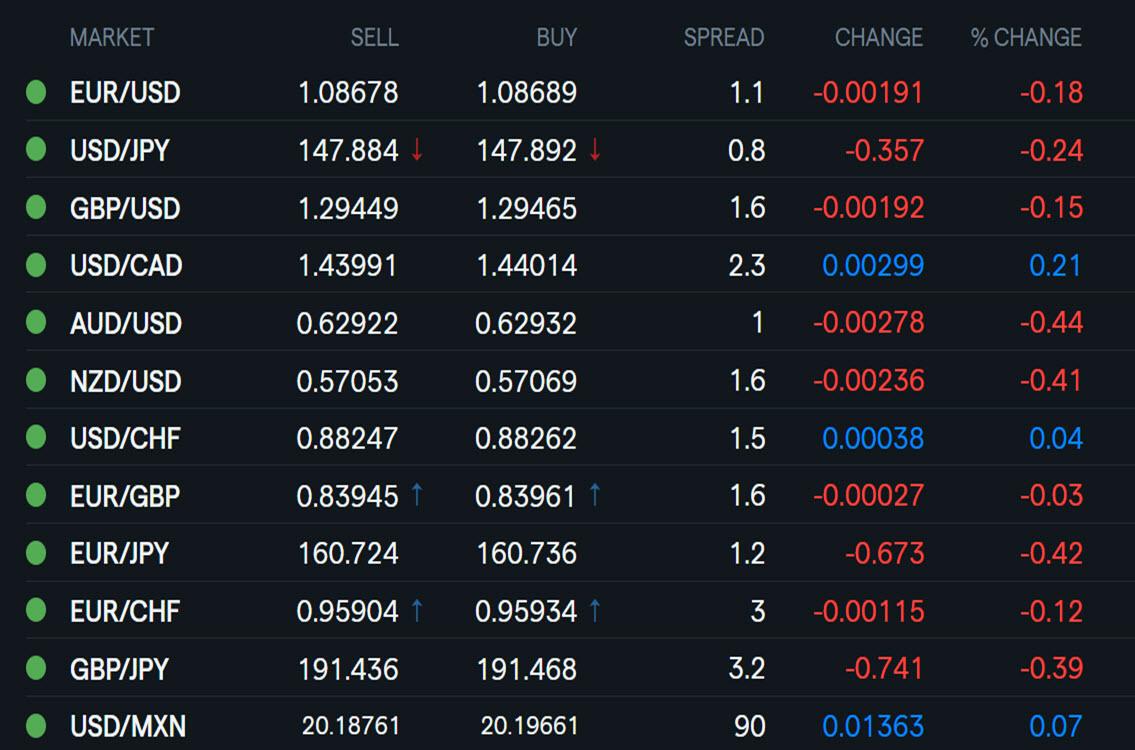

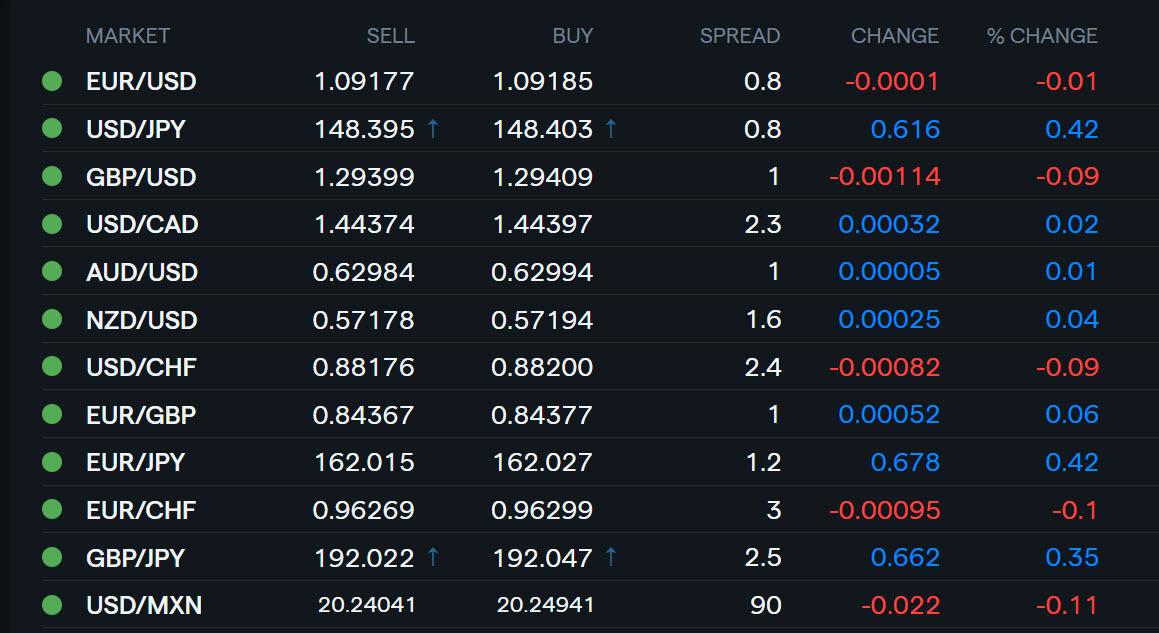

Using my platform as a HEATMAP shows

TGIF after another Trump tariff headline roulette driven week

USDJPY seems to be following firmer stocks while the dollar is mixed elsewhere

Gold continues shine and within spitting distance of 3000

Looking ahead

Another headline news watch

University of Michigan Consumer Sentiment

March 13, 2025 at 9:26 am #20829In reply to: Forex Forum

March 13, 2025 at 7:39 am #20821In reply to: Forex Forum

Using my platform as a HEATMAP shows

A reversal of fortune from this time yesterday

JPY firmer, both vs the dollar (USDJPY back below 148) and on its crosses (note EURJPY weaker) as mood turns back to risk off.

Dollar a touch firmer elsewhere. EURUSD so far failed to trade 1.09+ after 2 days testing above it Commodity currencies trading weaker.

Looking ahead

US PPI and Weekly jobless claims

G7 foreign ministers meet in Quebec amid rising trade/tariff tensions

Looming U.S. shutdown at 12:01 AM Saturday unless there is an agreement to extend funding the government

March 12, 2025 at 3:56 pm #20799In reply to: Forex Forum

With stocks bouncing from the lows, bond yields following, the FX market is not sure whAT PATH TO FOLLOW while USDJPY remains well of the 149+ high but still up on the day above 148.

EURUSD is back to about unchanged on the day in what seems to be setting up to be an FX range afternoon with the focus mainly on US rquities.

March 12, 2025 at 2:22 pm #20794In reply to: Forex Forum

March 12, 2025 at 1:04 pm #20784In reply to: Forex Forum

March 12, 2025 at 12:09 pm #20776In reply to: Forex Forum

US OPEN

US equity futures higher & USD incrementally gains ahead of US CPI; JPY modestly lags

Good morning USA traders, hope your day is off to a great start! Here are the top 4 things you need to know for today’s market.

4 Things You Need to Know

· European bourses are in the green as sentiment in the complex improves; US futures are also higher with the NQ slightly outperforming.

· USD is a little firmer ahead of US CPI data, JPY lags peers.

· Bonds are bearish overall amid supply, inflation updates & German fiscal developments.

· Oil and base metals firmer, gold trades sideways ahead of US CPI.

March 12, 2025 at 10:24 am #20770In reply to: Forex Forum

Thinking out loud— looking for reasons to explain the weaker JPY

Will the BoJ hold back on raising rated Given the chaos and uncertainty in global markets.

Aldo, March 31 is the end of the Japanese fiscal year, which used to be seen as an FX factor but I have not seem it talked about in recent years.

March 12, 2025 at 9:32 am #20768In reply to: Forex Forum

March 12, 2025 at 9:27 am #20767In reply to: Forex Forum

USDJPY 4 HOUR CHART – Back above 148

It is hard to fight real money flows that seem to be driven by JPY crosses, such ad EURJPY, which is building on yesterday’s breakout above 161.27 and helping to pull USDJPY above 148.

While damage is not fatal (i.e. it would need to move above 151.30 for an outside week), the solid move through 148.00-40 has broken the downward momentum

So, expect support if 148+ holds bit would need to get through 150.00-20 to suggest anything more than a retracement.

Watch the risk on/off mood as the former seems to be a factor today.

–

March 12, 2025 at 9:10 am #20766In reply to: Forex Forum

Using my platform as a HEATMAP shows

The dollar around unchanged except vs. a weaker JPY, which is also dowm on its crosses

Will have to see if this foreshadows a better showing for stocks, which are currently up, as it faces headwinds from….

— 25% steel and aluminum tariffs taking effect today

— Risk of retaliation (e.g. EU to Impose $28 bln in counter tariffs on US goods)

In the U.S. news programs have been leading with reports on the sharp falls in stocks

Looking ahead (see detailed previews)

US CPI, Bank of Canada rate decision

March 11, 2025 at 4:27 pm #20747In reply to: Forex Forum

Posted in our blog

The stars seem to be lining up for a weaker USDJPY but the move down has not been a straight line..

March 11, 2025 at 2:51 pm #20742In reply to: Forex Forum

March 11, 2025 at 2:12 pm #20740In reply to: Forex Forum

March 11, 2025 at 1:48 pm #20739In reply to: Forex Forum

March 11, 2025 at 1:34 pm #20738In reply to: Forex Forum

-

AuthorSearch Results

© 2024 Global View