-

AuthorSearch Results

-

March 21, 2025 at 12:17 pm #21231

In reply to: Forex Forum

March 21, 2025 at 10:29 am #21227In reply to: Forex Forum

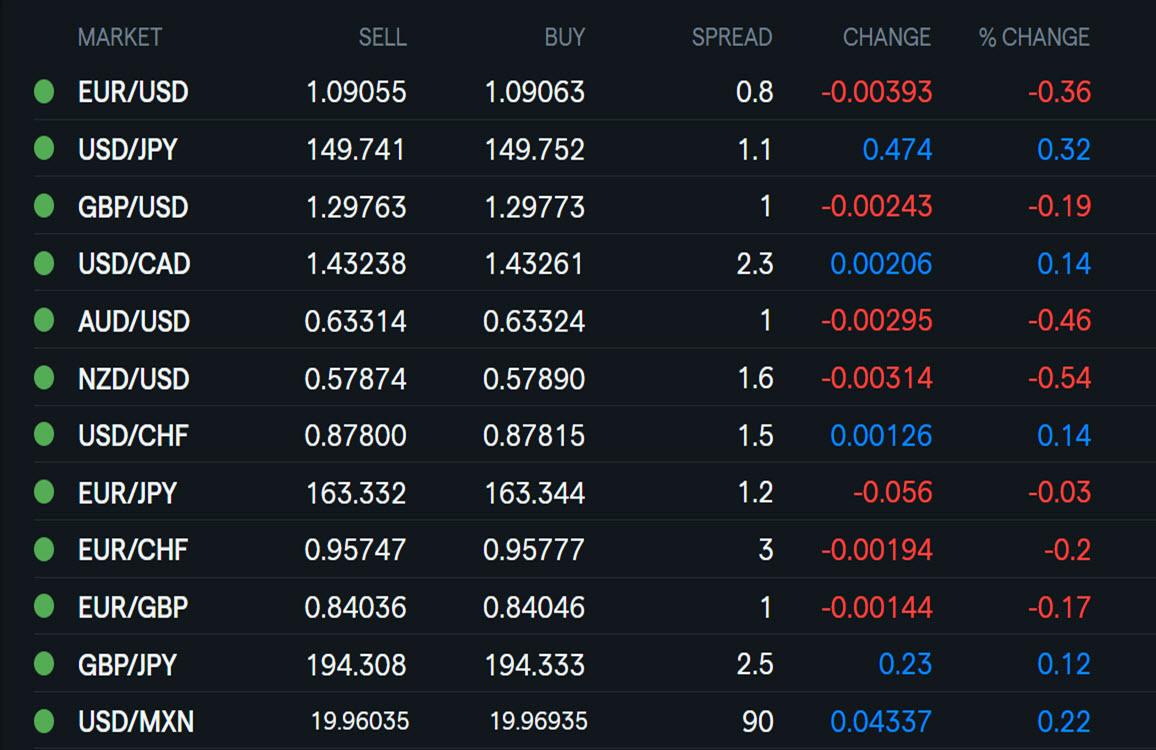

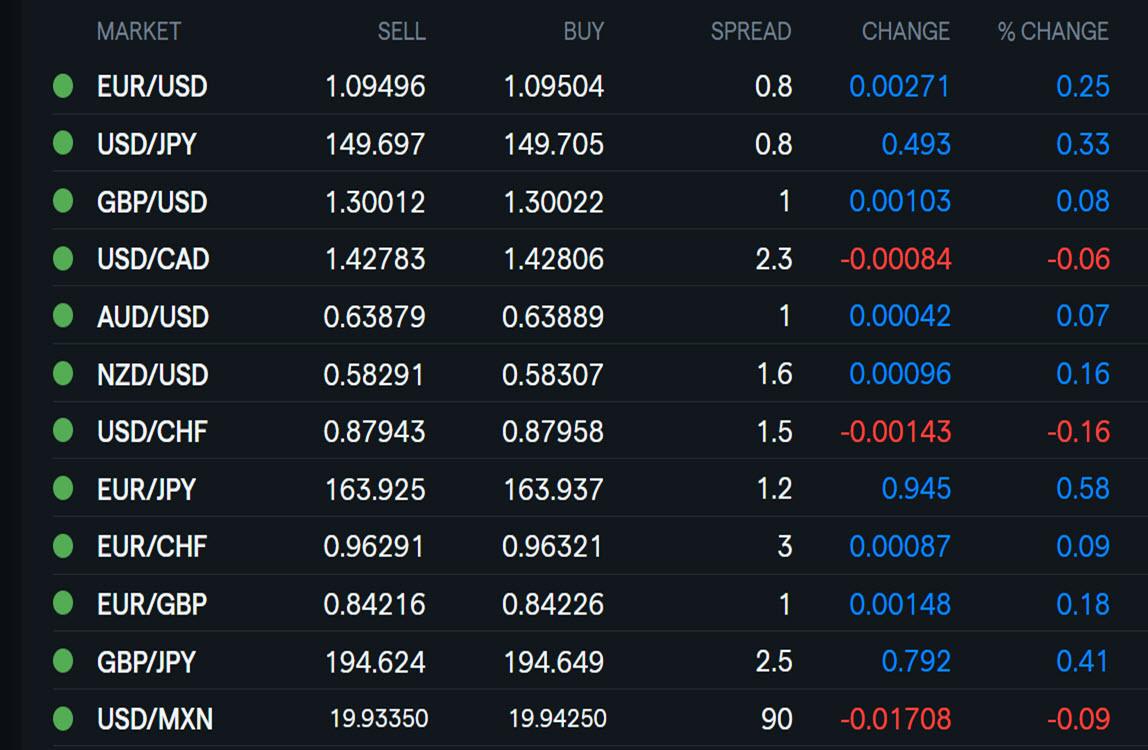

Using my platform as a HEATMAP shows..

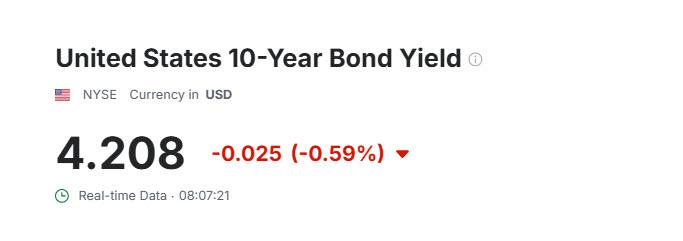

… the dollar trading firmer although except for USDJPY, all are still below Thursday’s highs

Another case where news reports look for some excuse to explain the price action

This time it is the Fed being in no rush to cut rates

EURUSD: Looks like it will break an 8 day pattern around 1.09 (bearish)… needs to stay above 1.0805 to avoid an outside week

Stocks a touch lower, US bond yields. steady, DAX is weaker

XAUUSD: Lower after no new record high today

Light news day

March 20, 2025 at 10:05 pm #21223In reply to: Forex Forum

March 20, 2025 at 10:21 am #21167In reply to: Forex Forum

March 20, 2025 at 9:40 am #21164In reply to: Forex Forum

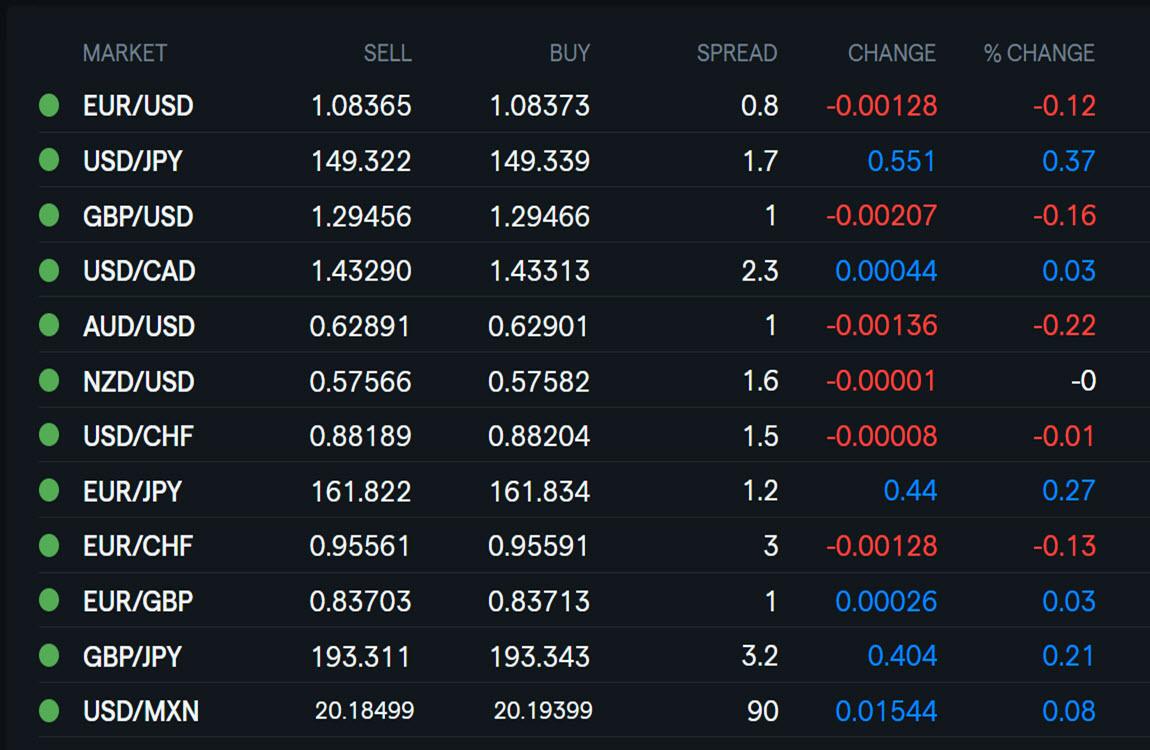

Using my.platform as a HEATMAP shows

Head scratcher day

… the dollar trading firmer in the absence of any news, more than reversing the post-FOMC sell-off (except vs the JPY …about unchanged but USDJPY is off its 148.17 low

All in the aftermath of the FOMC decision where one word (transitory) sparked a reaction: bond yields down, stocks up, dollar down

Today… bond yields still down, stocks giving back some early gains, dollar up

SNB cut rates by 25bps… BOE rate decision is up next

March 19, 2025 at 8:59 pm #21154In reply to: Forex Forum

March 19, 2025 at 7:09 pm #21143In reply to: Forex Forum

March 19, 2025 at 2:30 pm #21118In reply to: Forex Forum

March 19, 2025 at 1:57 pm #21116In reply to: Forex Forum

March 19, 2025 at 1:39 pm #21115In reply to: Forex Forum

March 19, 2025 at 1:00 pm #21108In reply to: Forex Forum

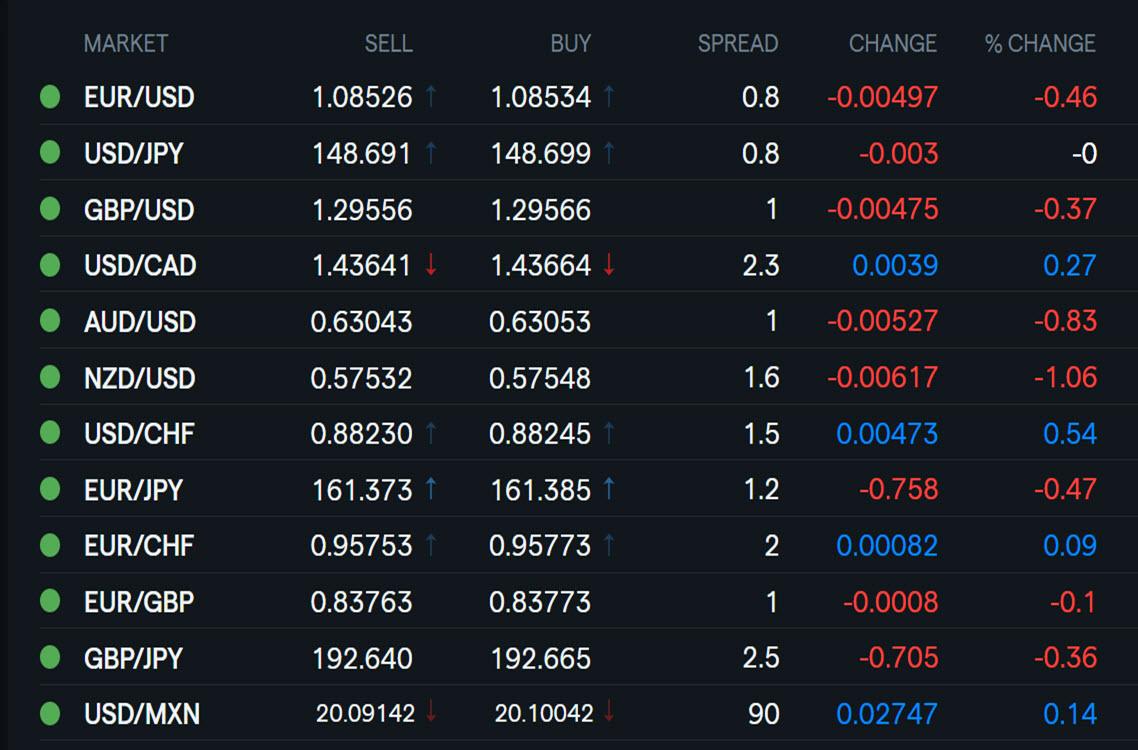

USDJPY

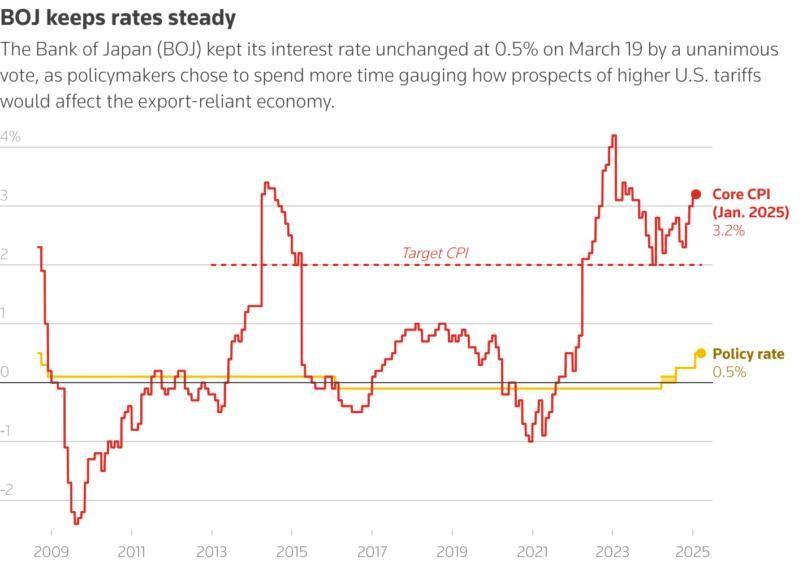

The yen weakened against the dollar, which rose 0.3% to 149.805 in volatile trade as investors mulled the BOJ decision to hold rates steady and comments from Governor Kazuo Ueda

he widely expected BOJ decision underscored policymakers’ preference to spend more time gauging how mounting global economic risks from higher U.S. tariffs could affect Japan’s fragile recovery.

“The decision to leave monetary policy unchanged itself is not a surprise, so its impact on exchange rates is limited. However, the earlier-than-usual timing of the announcement seems to have led financial markets to initially interpret that the BOJ (did not consider) bringing forward a rate hike,” said Hirofumi Suzuki, chief FX strategist at SMBC.

March 19, 2025 at 11:55 am #21103

March 19, 2025 at 11:55 am #21103In reply to: Forex Forum

US OPEN

USD firmer, EUR and GBP hit by JPY-action on Ueda’s press conference, US futures a touch firmer ahead of FOMC

Good morning USA traders, hope your day is off to a great start! Here are the top 5 things you need to know for today’s market.

5 Things You Need to Know

European bourses began the session on the backfoot with the risk tone dented as a few potential factors influenced, US futures modestly firmer pre-Fed

USD firmer, EUR and GBP hit by JPY-action on Ueda’s press conference; BoJ itself was as expected, Ueda began balanced but had some hawkish points in his presser

Fixed income initially benefited on the slip in the risk tone but has since eased off best with USTs now slightly softer into the FOMC

Crude remains pressured after Tuesday’s geopolitical developments while Gas has picked up as strikes on energy infrastructure seemingly continue

Ukraine’s Zelensky to speak with US’ Trump on Wednesday and hopes a ceasefire will eventually be implemented

March 19, 2025 at 11:15 am #21102In reply to: Forex Forum

USDJPY 4 HOUR CHART – Watch 150

Chart showing an upside risk but would need to get through the pivotl/magic150 to expose…

…potential tough levels at 150.18 and 151.30… at risk while above 149.09

Otherwise, expect more chop ahead of the FOMC but only below 149.09 would negate the current risk on the upside

High so far today 150.02

March 19, 2025 at 9:53 am #21099In reply to: Forex Forum

Using my platform as a HEATMAP shows

… the dollar trading firmer

EURUSD back to 1.09 for the 7th day in a row after running stops to a low at 1.0873. Note a failure again to make a serious run above 1.0950 (this time paused below it).

Perhaps some disappointment the Trump-Putin call did not result in a full ceasefire

USDJPY 150 briefly tested (high 150.02) after the BoJ kept policy steady

Turkish lira smashed following arrest of chief political rival

XAUUSD consolidating after surging to another record high yesterday

Looking ahead… Fed day today… see detailed FOMC preview

March 18, 2025 at 1:43 pm #21070In reply to: Forex Forum

March 18, 2025 at 8:44 am #21050In reply to: Forex Forum

Using my platform as a HEATMAP shows

… the dollar trading weaker except vs. a weaker JPY (USDJPY came within spitting distance but backing off after being unable to test 150).

EURUSD break of 1.0947-50 would need to hold to put 1.10 on the radar.

Middle East heating up, supporting oil and gold but little signs of stress elsewhere.

XAUUSD extends record high above 3005.

US stocks steady and seeing if they can build on a 2- day rally

Looking ahead,

Trump-Putin call today

entral bank meeting deluge starts on Wednesday

March 17, 2025 at 10:25 pm #21047In reply to: Forex Forum

USDJPY 4 HOUR CHART – Reacting to risk on

What has the weaker JPY been telling us?

No BoJ rate hike this week?

Foreshadowed a shift out of a risk off mood?

Chart shows 149.32 stands in the way of key levels… 150.18 and 151.30

While 150+ should be tough, only back below 148.00-25 would shift the risk the other way.

March 17, 2025 at 2:45 pm #21008In reply to: Forex Forum

March 17, 2025 at 1:38 pm #21001In reply to: Forex Forum

March 17, 2025 at 9:52 am #20986In reply to: Forex Forum

Using my platform as a HEATMAP shows

A cautious start to what will be an event filled week with the dollar trading a touch sotter except vs a steady JPY..

XAUUSD is higher below 3000.

Trump to talk with Putin on Tuesday in ending the Ukraine-Russia war.

U.S. Retail Sales due…See a detailed preview.

-

AuthorSearch Results

© 2024 Global View