-

AuthorSearch Results

-

March 27, 2025 at 11:12 am #21515

In reply to: Forex Forum

March 27, 2025 at 9:58 am #21513In reply to: Forex Forum

March 27, 2025 at 9:47 am #21512In reply to: Forex Forum

March 26, 2025 at 3:13 pm #21473In reply to: Forex Forum

March 26, 2025 at 2:47 pm #21470In reply to: Forex Forum

USDJPY Daily

Yen has to first take out that 151 – it is EMA 50 acting as a barrier.

Supports: 150.050, 149.300 & 149.050

Resistances: obviously 151.000, 151.250 & 152.450

Pattern wise – it looks good for tomorrows break above 151, as long as the day closes above 150.100

With so much fundamentals in front of us, it is not wise to try to predict so much in advance.

March 26, 2025 at 2:38 pm #21468

March 26, 2025 at 2:38 pm #21468In reply to: Forex Forum

March 26, 2025 at 12:02 pm #21443In reply to: Forex Forum

US OPEN

US futures modestly lower amid tariff reports, GBP lags & EUR/USD attempts to reclaim 1.08

Good morning USA traders, hope your day is off to a great start!

Here are the top 5 things you need to know for today’s market.

5 Things You Need to Know

Tariffs in focus amid reports that Trump could implement copper tariffs in weeks, elsewhere reports that Canada could find some reprieve

European bourses opened firmer but have since slumped, US futures are in the red but only modestly so

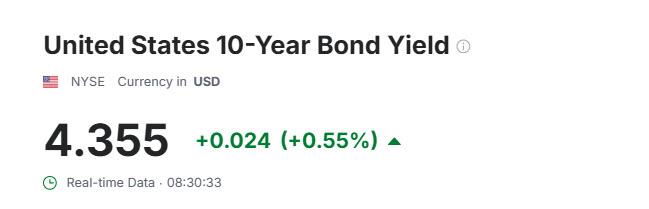

GBP lags after UK CPI, EUR/USD attempts to reclaim 1.08, USD/JPY rebounded overnight but is off highs

Gilts gapped higher on data and extended but have retreated to opening levels into the Spring Statement, USTs softer while Bunds are firmer but only modestly so

Crude continues to inch higher with a handful of factors underpinning, TTF slips as talks continue, Copper soared on tariff updates but has since pulled back

March 26, 2025 at 9:07 am #21434In reply to: Forex Forum

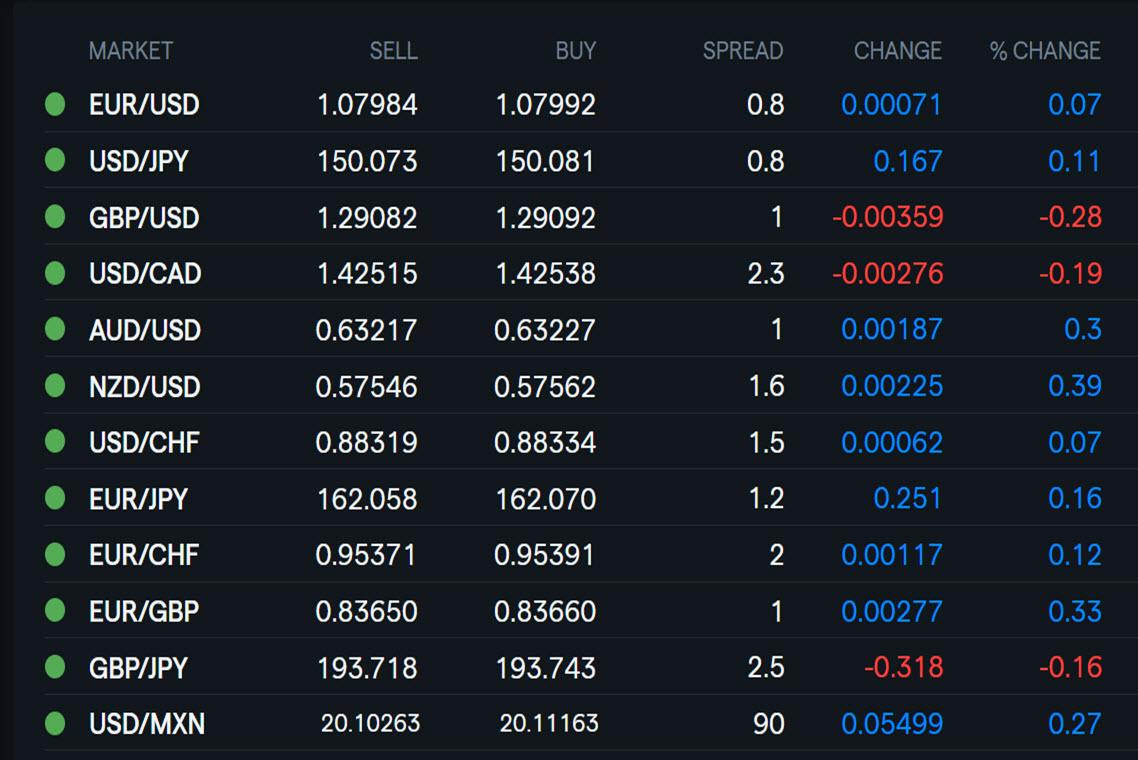

Using my platform as a HEATMAP shows

… uncertain markets looking ahead to quarter end and reciprocal tariff day on April 2

Mixed USD

EURUSD focus still on 1.08 after another test of 1.0777 (2-day double bottom)… support coming fro a firmer EURGBP and lesser extent EURJPY

GBPUSD lower after cooler UK inflation (EURGBP firms)

USDJPY back above 150 after holding above 149.49 yesterday

USDCAD a touch weaker dezpite tariff uncertainty

U.S. stocks a touch weaker

XAUUSD in a wait and see mode

Looking ahead… light US data calendar, awaiting next Trump headline

March 25, 2025 at 10:16 pm #21429In reply to: Forex Forum

USDJPY 4 HOUR – WHY LEVELS MATTER

This chart was posted early on today and see how USDJPY came down just above 149.49 key support (low was 149.53)

This is no coincidence… Levels and patterns formed by the Amazing Trader charting algo matter

If you would like a 30 day free trial, go to the member benefits page in GTA (if not a member sign up, free)

March 25, 2025 at 5:27 pm #21397In reply to: Forex Forum

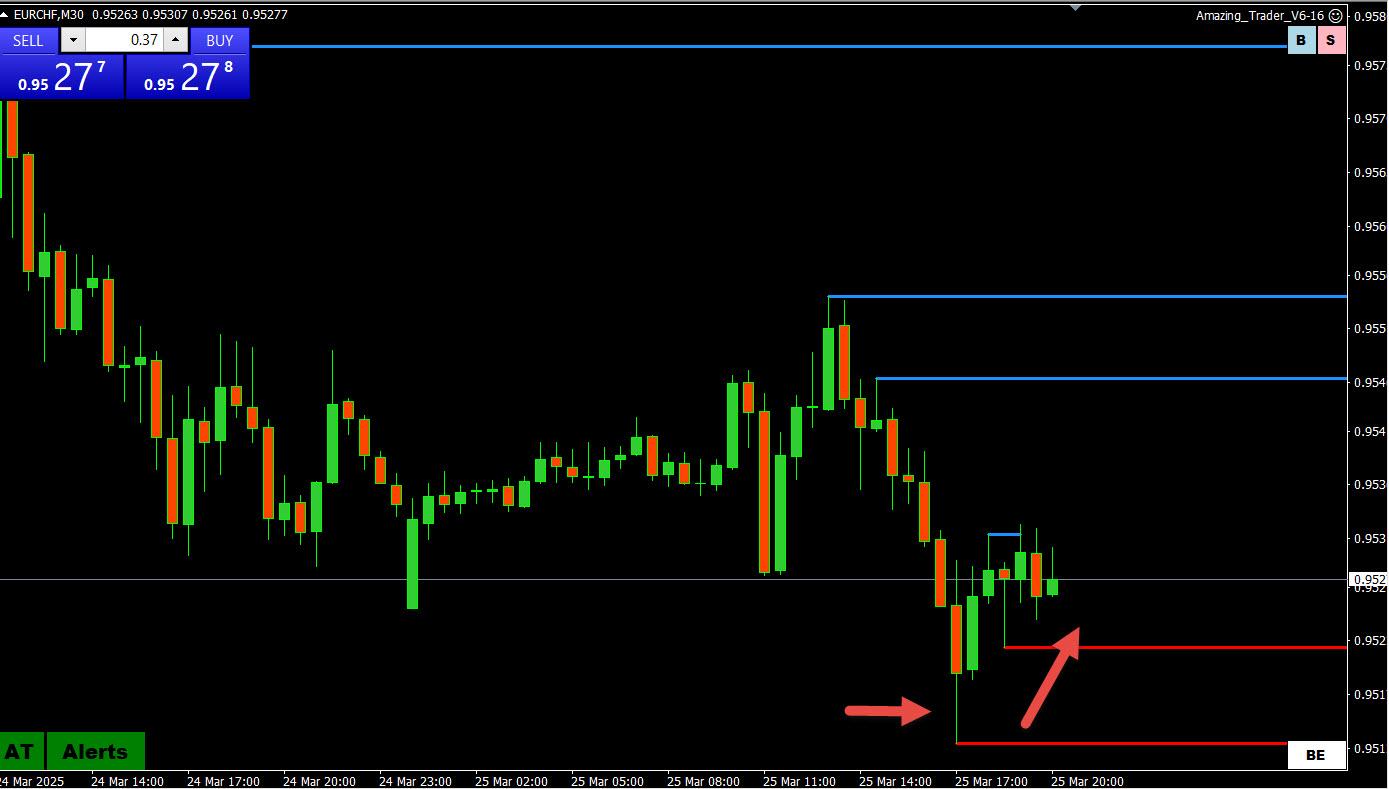

EURJPY 30 MIN – Dominant flow today

Note the price action in EURUSD 1.0810 ( vs. dip to 1.0799) and USDJPY 149.80 (vs 149.53 low) after whatever real money sell order was apparently filled and EURJPY bounced off its low.

As I have also noted, when USFJPY makes a sharp move and another currency lags badly or diverges, it is more often than not the result of an offset from a JPY cross.

Feel free to ask if this is not clear.

March 25, 2025 at 4:12 pm #21396In reply to: Forex Forum

March 25, 2025 at 3:21 pm #21395In reply to: Forex Forum

March 25, 2025 at 2:19 pm #21383In reply to: Forex Forum

March 25, 2025 at 1:51 pm #21376In reply to: Forex Forum

March 25, 2025 at 12:33 pm #21357In reply to: Forex Forum

March 25, 2025 at 11:57 am #21348In reply to: Forex Forum

March 25, 2025 at 10:22 am #21343In reply to: Forex Forum

USDJPY 4 HOUR – Chart tells the story

This is one of those days where this chart tells the whole story

Bid while above 150.18 but upside contained unless 151.30 is taken out.

Back below 150.18 would negate yesterday’s mini breakout and shift the range to 149.50-150.00

150 the clear bias setting level going forward.

March 24, 2025 at 6:13 pm #21320In reply to: Forex Forum

USDJPY Daily

For Monday we have a Bullish Pattern, but USDJPY has to take out 149.650 for any significant move Up.

If successful, opens a road for attack at 151 zone.

Happened – so what next?

Supports: 150.150, 149.650 & 149.150

Resistances: 150.750, 151.000 & 151.350

This is Yen and it can just continue Up, but I expect it to at least pull back till around 150.150 if not a full move to 149.650

March 24, 2025 at 9:26 am #21279

March 24, 2025 at 9:26 am #21279In reply to: Forex Forum

Using my platform as a HEATMAP shows

… week starting out in a risk on mood after Trump’s reciprocal tariff comments… As I have noted, while markets may react to the latest headline actions speak louder than words (April 2 is the reciprocal tariff day).

… the dollar is trading weaker but off earlier lows… exception is USDJPY but remains below 150

EURUSD came close but paused below 1.0860… See What is the trend in Forex Majors for coming week

EZ composite PMIs mixed (manufacturung up a touch (but below 50), Services down a touch (but above 50)… S

March 21, 2025 at 12:57 pm #21233In reply to: Forex Forum

-

AuthorSearch Results

© 2024 Global View