-

AuthorSearch Results

-

January 16, 2025 at 1:27 pm #17904

In reply to: Forex Forum

January 16, 2025 at 11:59 am #17896In reply to: Forex Forum

USDJPY 15 Min Chart – So far, so good

Scroll below for my update pointing out a case for an intra-day low aa long as 155.60 holds

Thia was based on an Amazing Trader pattern and logic… Click to learn more> about this amazing charting algo

January 16, 2025 at 11:41 am #17894In reply to: Forex Forum

NEWSQUAWK US OPEN

European equities lifted by Tech/Luxury updates, JPY bid as BoJ hike bets mount, US Retail Sales due

Good morning USA traders, hope your day is off to a great start! Here are the top 4 things you need to know for today’s market.

4 Things You Need to Know

European bourses opened on a strong footing and remain at highs, with Tech and Luxury among top performers; US futures mixed whilst NQ leads.

USD mixed vs. peers, JPY leads as BoJ hike bets mount after reports noted that BoJ is said to see a good chance of a January rate hike barring a major market rout, following Trump’s inauguration.

Gilts gap lower despite soft GDP, USTs await data and Treasury Secretary nominee Bessent’s confirmation hearing.

Crude takes a breather while base metals cheer risk appetite.

January 16, 2025 at 10:16 am #17886In reply to: Forex Forum

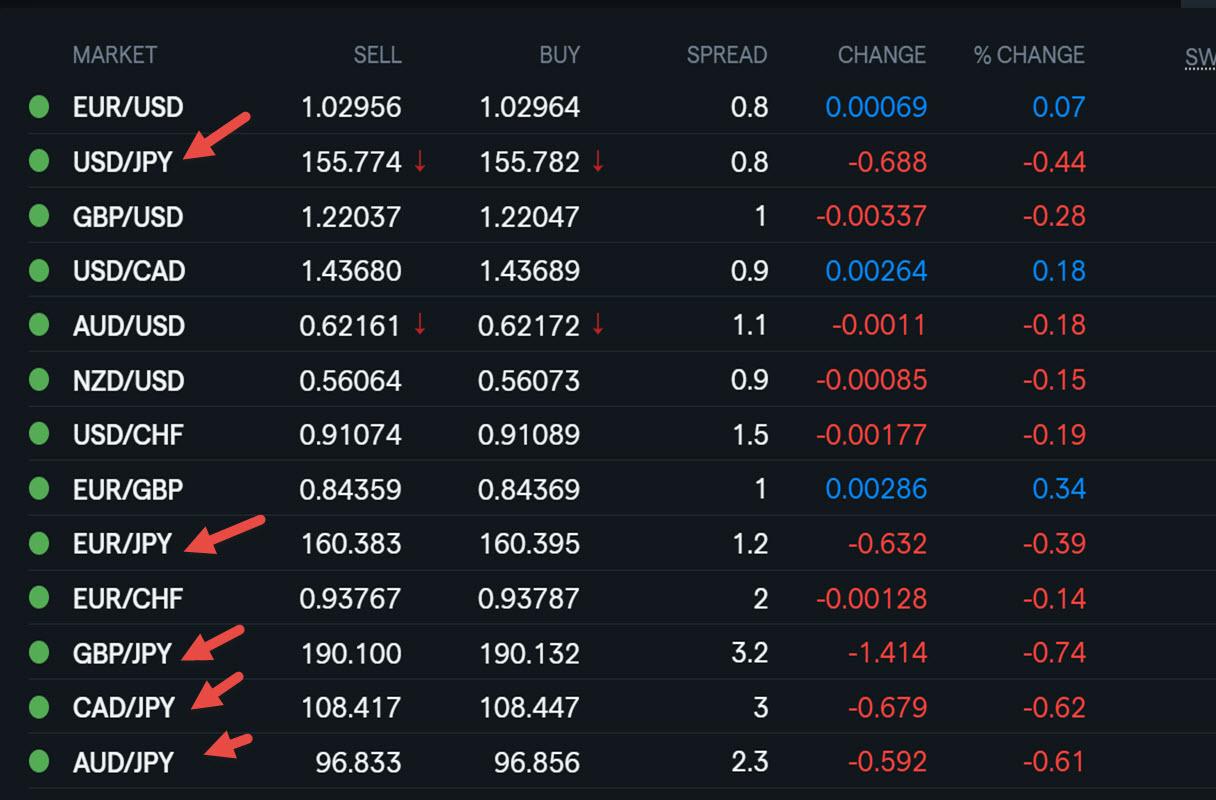

This blog article is worth revisiting as JPY crosses have been a driver today

Markets are like a river flowing downstream constantly looking for the path of least resistance. When it finds a clear path the pace of flow accelerates. This is a way to look at trading…

January 16, 2025 at 9:53 am #17884In reply to: Forex Forum

USDJPY 1 HOUR CHART – BoJ Rate Hike Back on the Table

Selling ahead of the BoJ meeting next week, where a rate hike risk is back on the table, is again weighing on USDJPY and boosting the JPY on its crosses.

This chart, however, shows potential for a bottom today BUT ONLY IF it can stay above 155.60.

Otherwise, using 155-158 as a range puts 156.50 as the midpoint with a sEll bias while below it.

Daily chart shows a void until 153.15 if it stays below 156.

Range so far today: 155.20-156.54

January 16, 2025 at 9:38 am #17883In reply to: Forex Forum

January 15, 2025 at 2:59 pm #17818In reply to: Forex Forum

Let’s put in all in perpective

A 0.1% mOVe in core inflation y/y sparked some big moves, especially in stocks and bonds AND CHANGE IN fED EXPECTATIONS

I will leave this for another discussion so just think of the logic behind the reaction to a small miss in the data.

FWIW EURUSD has so far been unabLe to regaIn 1.0350, USDJPY bounced off my AT support…. buf for now the starch has been taken out of the dollar

And Pres Trump has yet to take office!!

January 15, 2025 at 2:28 pm #17817In reply to: Forex Forum

THe old adage “it’s not the news but the reaction that counts” plaYed true to form today… US 10 year last at 4.663%

USDJPY remains the outperformer, GBPUSD and AUD/NZD 2nd in line.

See earlwr USDJPY poST… TESTING NEXT SUPPORT

EURUSD up with a lag, would need to clear 1.0358 to accelerate the upside.

January 15, 2025 at 11:34 am #17809In reply to: Forex Forum

NEWSQUAWK US OPEN

USD softer ahead of US CPI, Gilts gap higher on cooler UK inflation

Good morning USA traders, hope your day is off to a great start! Here are the top 4 things you need to know for today’s market.

4 Things You Need to Know

Stocks hold modest gains, FTSE 100 outperforms post-CPI; US bank earnings due.

DXY lower ahead of US CPI, GBP resilient in the wake of soft inflation metrics, JPY leads.

Gilts inflated by CPI, JGBs dented by Ueda & USTs await CPI.

Choppy trade in crude while precious metals tilt higher and base metals trade mixed.

January 15, 2025 at 9:58 am #17806In reply to: Forex Forum

January 15, 2025 at 9:48 am #17805In reply to: Forex Forum

USDJPY 4 HOUR CHART – WAITING FOR US CPI AND MORE

Trying to build some downward momentum… if the 156.91 break holds, risk is for 155.94-156.22… if it fails to hold, magnetic 158 remains in focuS

Combination of verbal intervention and selling ahead of the BoJ meeting next week.,,,focus next is on US CPI

January 14, 2025 at 7:58 pm #17793In reply to: Forex Forum

January 14, 2025 at 5:32 pm #17783In reply to: Forex Forum

January 14, 2025 at 4:10 pm #17780In reply to: Forex Forum

January 14, 2025 at 11:54 am #17762In reply to: Forex Forum

NEWSQUAWK US OPEN

Crude under pressure as a Gaza ceasefire nears & stocks grind higher on “gradual” Trump tariff reports

Good morning USA traders, hope your daoy is off to a great start! Here are the top 4 things you need to know for today’s market.

4 Things You Need to Know

Stocks grind higher as sentiment is lifted on reports that the Trump team is looking at gradual tariff hikes month-by-month of 2-5%.

DXY is a touch higher, antipodeans lead, JPY gives back Monday’s gains.

Fixed Income is off best levels ahead of US PPI.Crude under increasing pressure as a Gaza ceasefire looms; based metals mixed, but precious metals eke mild gains.

January 14, 2025 at 10:19 am #17757In reply to: Forex Forum

January 13, 2025 at 12:33 pm #17703In reply to: Forex Forum

January 13, 2025 at 9:30 am #17685In reply to: Forex Forum

January 10, 2025 at 3:37 pm #17587In reply to: Forex Forum

January 10, 2025 at 11:27 am #17562In reply to: Forex Forum

NEWSQUAWK US OPEN

USTs and futures subdued ahead of US NFP; JPY boosted by BoJ source report

Good morning USA traders, hope your day is off to a great start! Here are the top 4 things you need to know for today’s market.

4 Things You Need to Know

European bourses trade choppy, US futures edge lower ahead of the US NFP report.

USD eyes NFP, JPY boosted by BoJ source report, GBP unable to recoup lost ground.

Fixed income a touch lower ahead of US jobs data, Gilts continue to underperform.

Crude soars on geopolitical updates, Industrial commodities bolstered by Chinese commentary

-

AuthorSearch Results

© 2024 Global View