-

AuthorSearch Results

-

January 26, 2025 at 7:37 pm #18440

In reply to: Forex Forum

January 24, 2025 at 3:43 pm #18370In reply to: Forex Forum

January 24, 2025 at 1:16 pm #18345In reply to: Forex Forum

USDJPY 1 HOUR CHAPT – Key level cited

As I noted earlier, support below 155 caught my eye but the extent of the bounce is a surprise. Key level is 156.75, then a void of key levels until above 158 (not a forecast but an observation).

IN any case, upside will be contained unless 156.75 is firmly taken out.

January 24, 2025 at 9:57 am #18339In reply to: Forex Forum

Using my platform as a HEATMAP shows

A weaker USD but unless EURUSD can establish 1.05+ moves will lose steam. What also caught my eye ia USDJPY back above 155 after again failing to hold on another trade below it following the expected BoJ rate hike,

With all the talk about Trump comments about lower interest rates, 10-year yield is close to unchanged..

January 23, 2025 at 8:53 pm #18321In reply to: Forex Forum

January 23, 2025 at 2:04 pm #18284In reply to: Forex Forum

January 23, 2025 at 10:35 am #18264In reply to: Forex Forum

January 22, 2025 at 8:18 pm #18238In reply to: Forex Forum

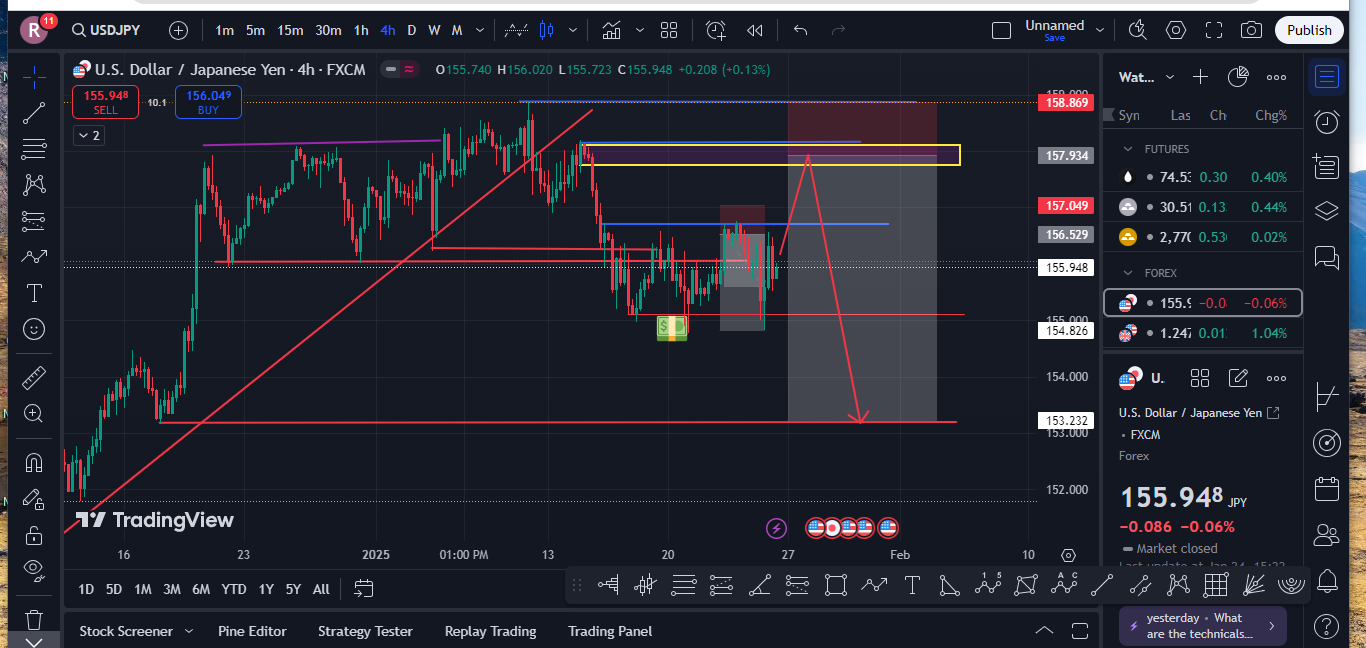

USDJPY 4 HOUR CHART – Waiting!

The wait is on for the BoJ’s expected rate hike and price action suggests it is already baked in the cake.

If you take 155-158 as a range then 156.50 will set the tone ahead of the BoJ.

Note the JPY was the underperformer Wednesday, both vs the dollar and on its crosses, most notably EURJPY..

January 22, 2025 at 3:57 pm #18228In reply to: Forex Forum

A driving flow today remains EURJPY, which is close to testing the 162.89 level cited earlier.

Unlike earlier, though, market is following the path of least resistance by pushing USDJPY higher as EURUSD lags. EURUSD lag is also coming from a firmer EURGBP, which is weighing on GBPUSD (after completing a 38,2% retracement earlier.

January 22, 2025 at 2:41 pm #18220In reply to: Forex Forum

January 22, 2025 at 1:08 pm #18213In reply to: Forex Forum

EURJPY 4 HOUR CHART – TESTS RESISTANCE

Credit again to The Amazing Trader for highlighting this key resistance, which was the start of the move down to the 159.65 low.

Even if you do not trade EURJPY, it pays to keep an eye on it when you sewe the JPY move in the opposite direction of the EUR vs the dollar. ‘

The high in EURJPY coincided with the top in EURUSD at 1,0457.

January 22, 2025 at 12:06 pm #18210In reply to: Forex Forum

A bit of a tug-of-war with USDJPY firming, JPY weaker on key crosses.

Not to pat myserlf on the back so I will give credit to The Amazing Trader for highlighting the EURUSD 1.0457 level.(scroll to see chart)

January 22, 2025 at 10:23 am #18200In reply to: Forex Forum

Using my platform as a HEATMAP shows

The dollar is trading a touch softer except vs the JPY despite the BoJ likely to raise rates this week and the BOE and ECB likely to cut.’ One clue may have been another Trump taro\iff threat was ignored.

So, looking for a reason for the recent softer USD, I came across this in a Reuters article..

The dollar looks stretched on positioning, sentiment and valuation metrics – hedge funds last week held the biggest net long dollar position in nine years; ‘long dollar’ is one of investors’ most crowded trades, according to Bank of America’s latest fund manager survey; and Citi analysts reckon the currency is overvalued by 3%.

January 20, 2025 at 10:14 am #18083In reply to: Forex Forum

Using my platform as a HEATMAP shows

A market on hold waiting for the inauguration of President Trump and a slew of executive orders to follow.

For the FX market, the focus will be on anything related to tariffs but I have not seen any talk of it in the press.

The heatmap, meanwhile, shows the EURUSD as an outperformer with the GBP and JPY lagging out of respective EUR crosses.

The main action has been in cryptos with BTCUSD surging higher to a new record high (marginally so far). The $Trump memecoin has been the talk of the press but I will leave my opinion on something that has no intrinsic value for another time.

Otherwise US markets are closed today, liquidity is thin and it is now just a wait until the new Trump era begins.

January 17, 2025 at 2:52 pm #18015In reply to: Forex Forum

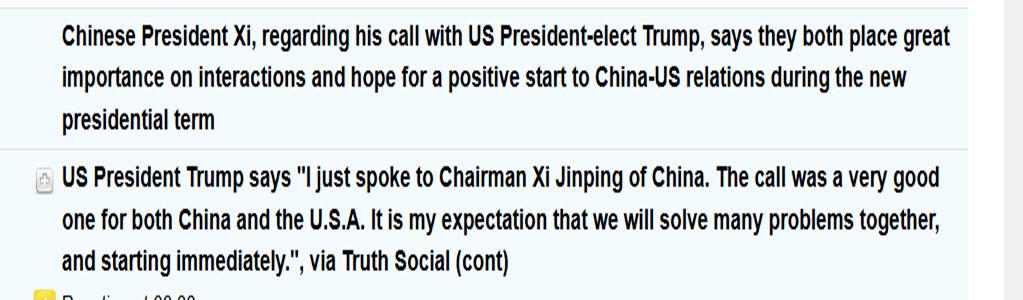

Dollar coming off highs /slipping (except USDJPY (HIGHER AS BOND YIELDS TICK UP)) after concilatory remarks from Trump and Xi

Source:

January 17, 2025 at 11:23 am #17998In reply to: Forex Forum

NEWSQUAWK US OPEN

Stocks edge higher, JGBs lag on further BoJ sources, UK Retail sales weigh on GBP

Good morning USA traders, hope your day is off to a great start! Here are the top 4 things you need to know for today’s market.

4 Things You Need to Know

European bourses grind higher, US futures modestly in the green.USD marginally firmer, JPY softer and GBP knocked lower by disappointing retail sales.

JGBs lag slightly on further BoJ reports, Gilts gapped higher on Retail Sales.

Mixed trade in the base metal complex but crude stays firm.

January 17, 2025 at 10:58 am #17996In reply to: Forex Forum

USDJPY 4 HOUR CHART – Tests 155

The main action remains in USDJPY and JPY crosses

155 remains the pivotal level on the downside (low 154.97) and a break of 156.35 would be needed to postpone the risk.

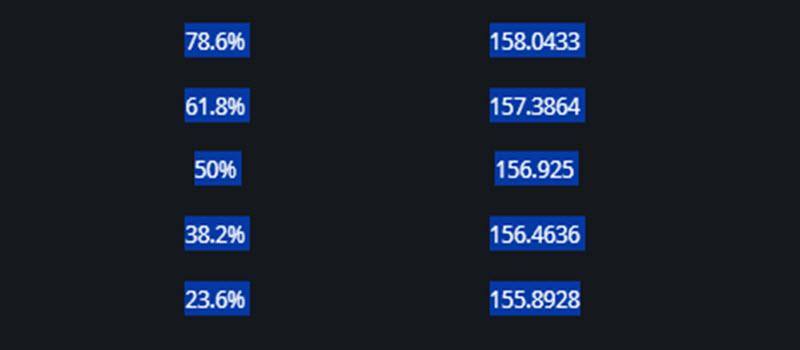

For FIBO lovers, here are retracement levels for 158/88-154.97 using our Fibonacci Calculator

January 17, 2025 at 10:33 am #17993

January 17, 2025 at 10:33 am #17993In reply to: Forex Forum

Using my platform as a HEATMAP shows

A market that appears to be on hold ahead of Monday’s US holiday and the inauguration of President Trump and a s;ew of executive orders.

Bpnd yields remain soft after yesterday’s dip

USD is off earlier highs and USDJPY Bbounced from a 154.97 low

Right now it feels like a Friday market will dominate unless any key levels are taken out.

January 16, 2025 at 9:08 pm #17948In reply to: Forex Forum

January 16, 2025 at 8:10 pm #17945In reply to: Evaluation – Daily Trades

-

AuthorSearch Results

© 2024 Global View