-

AuthorSearch Results

-

January 30, 2025 at 1:52 pm #18736

In reply to: Evaluation – Daily Trades

January 30, 2025 at 12:09 pm #18728In reply to: Forex Forum

NEWSQUAWK US OPEN

USTs bid and RTY outperforms post-FOMC, Big Tech results mixed; TSLA +2.5%, META +1.3%, MSFT -3.7%

Good morning USA traders, hope your day is off to a great start!

Here are the top 5 things you need to know for today’s market.

5 Things You Need to Know

European bourses hold an upward bias into the ECB; RTY outperforms post-FOMC.

Big-Tech results were mixed; META +2.4%, MSFT -3.5%, TSLA +1.7%

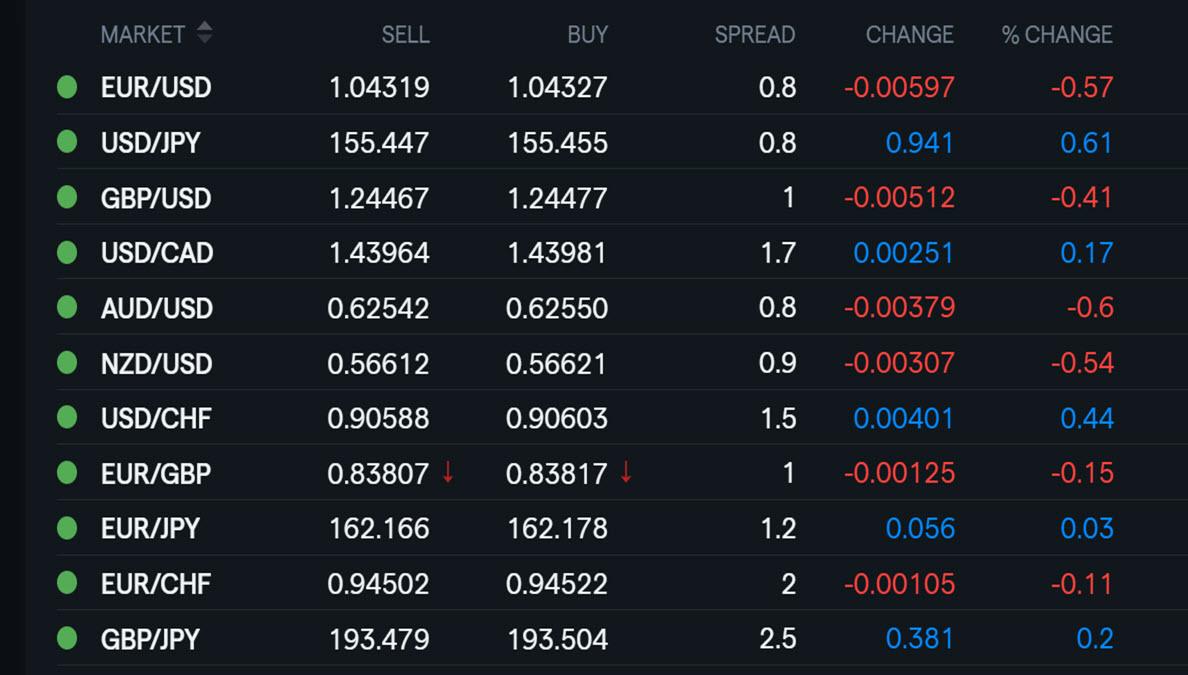

USD steady post-FOMC, EUR eyes ECB 25bps rate cut; USD/JPY below 154.50.

Powell props up bonds, weaker-than-expected EZ GDP spurred little reaction in Bunds ahead of the ECB.

Crude slips on tariffs and growth fears, base metals edge a little higher despite China being on holiday

January 30, 2025 at 9:59 am #18710In reply to: Forex Forum

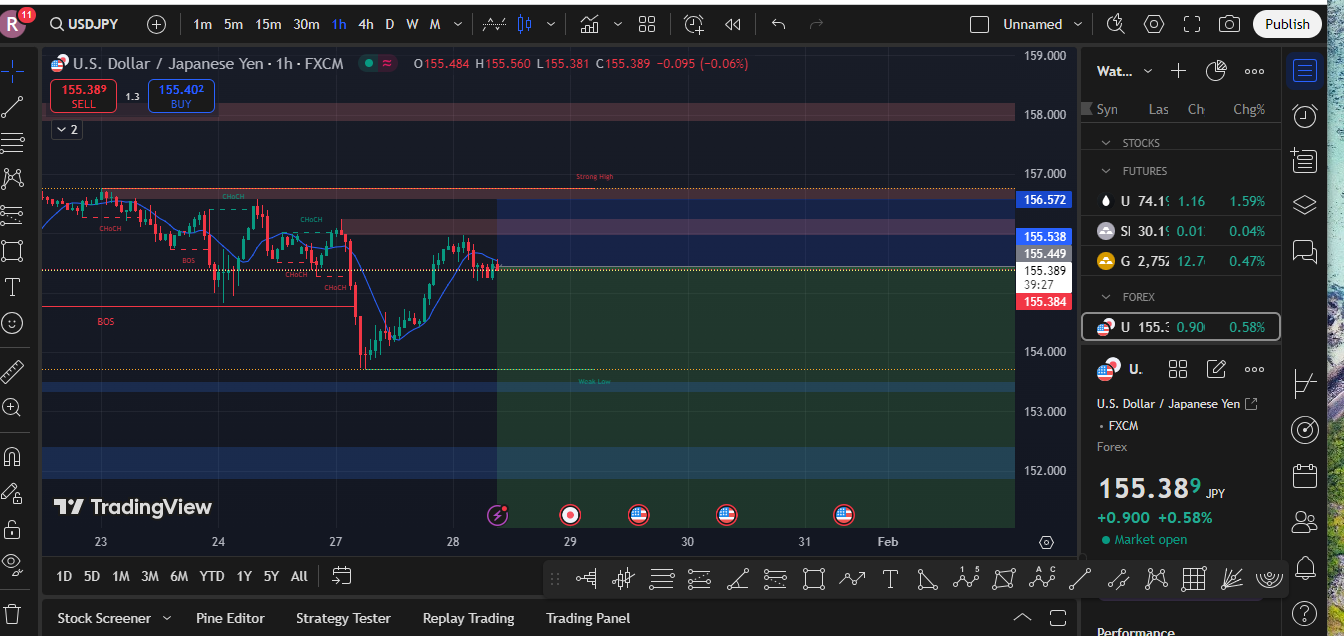

USDJPY 4 HOUR CHART – Watch bond yields

Posted yesterday after the Fed rate announcement…

FX is following US bond yields… back to square one after post Fed pop as Powell walks about hawkish part of statement.

Keep this one simple:

Chart is bearish bit as you can see very choppy.

Bearish while below 155 but..

Only below 153.70 would break the current range

January 30, 2025 at 9:40 am #18707In reply to: Forex Forum

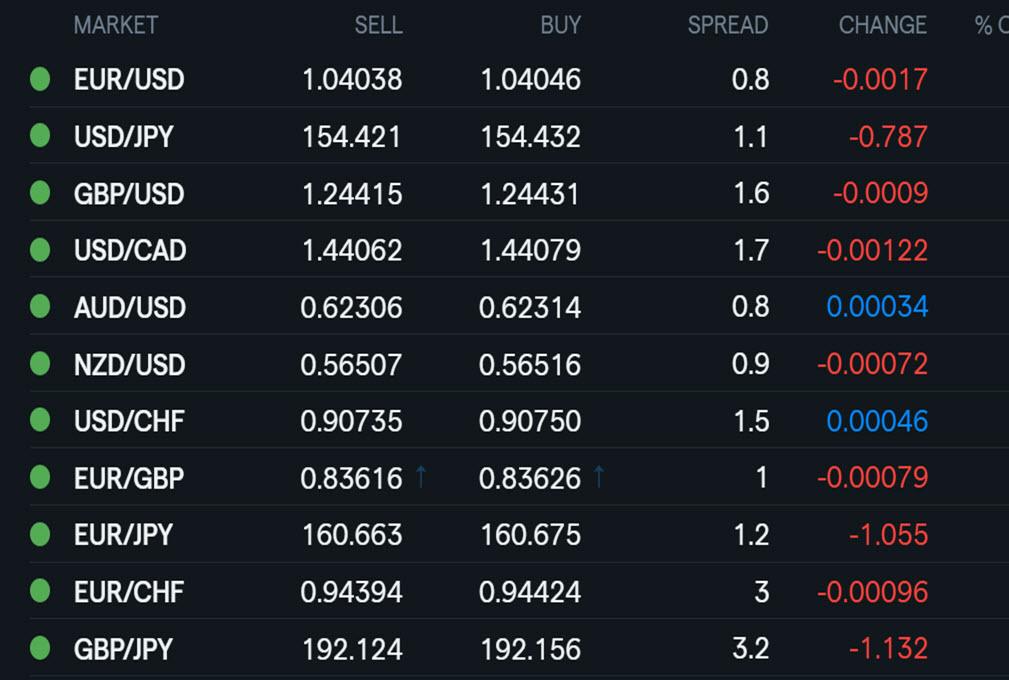

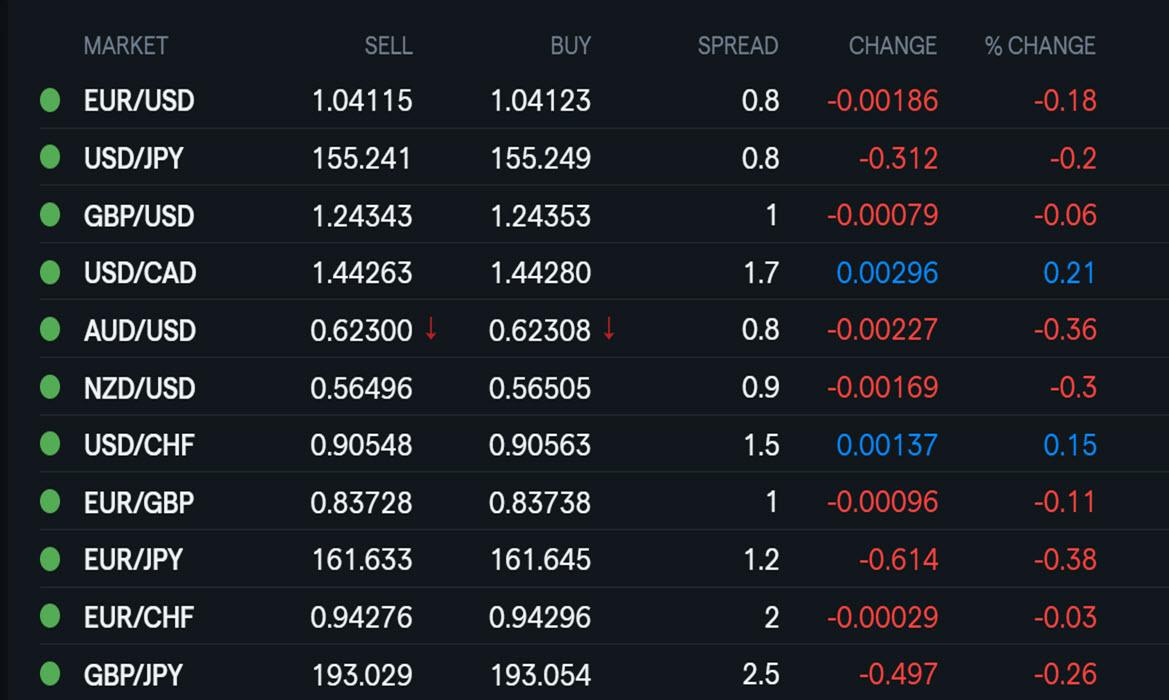

Using my platform as a HEATMAP shows

JPY outperforming… look no father than US interest rates, which peaked at 4.59% for the 10-year after the Fed announcement, then slipped back and were last quoted at 4.506^

Next up is the ECB decision, the 3rd in the CB trifecta, where a 25bps cur is widely expected, leaving the focus on the forward guidance. Given the lack of strong reactions to the other CB decisions yesterday, it is hard to predict one here.

EURUSD a touch softer, levels to watch

1.0371/92 – 1.0444/57

January 29, 2025 at 5:22 pm #18655In reply to: Forex Forum

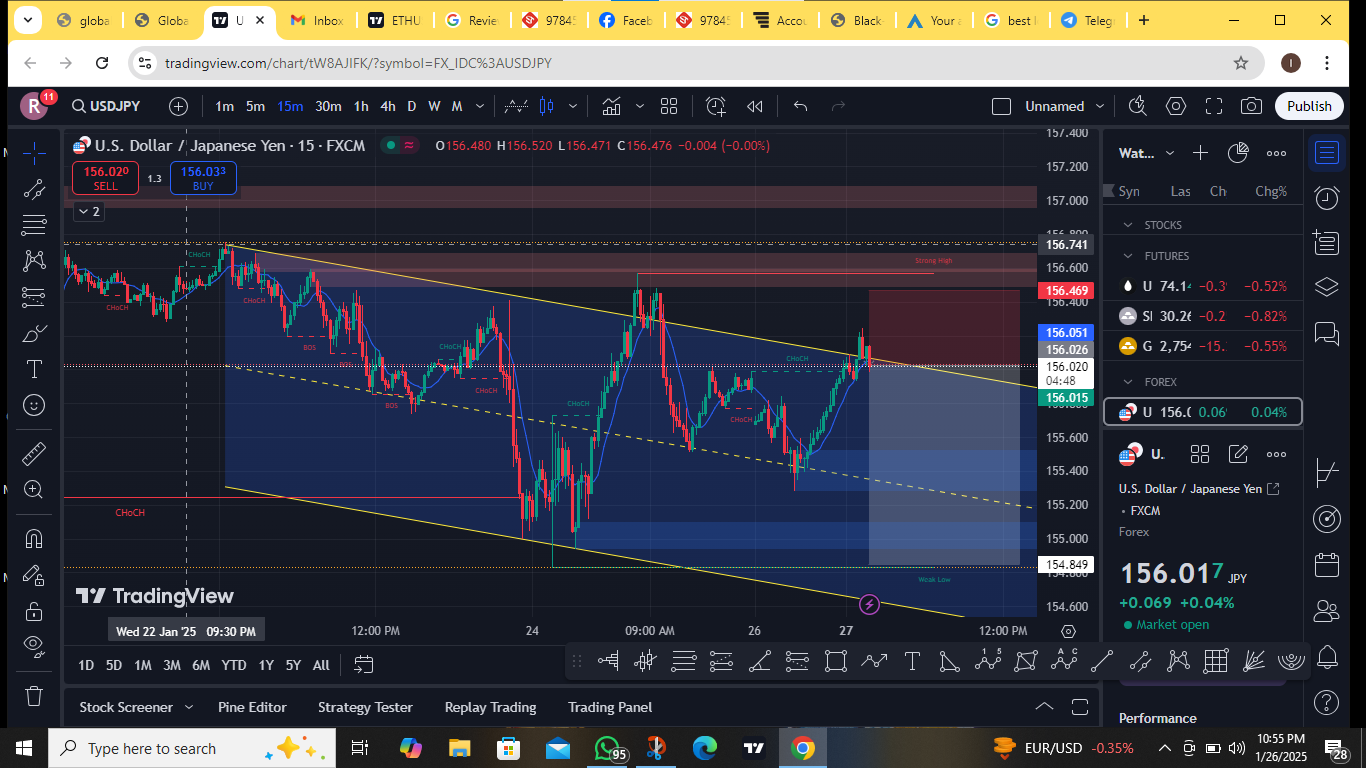

This is 6pm nigerian time and the weather is good. Market is not as volatile as it was between 3:15 and 3:45 pm when some news came out and Market was volatile. The usd/jpy has consolidated and is ready for an upward move. This may not be a long move based on my analysis.

The usd/jpy is st price 155.120 as we speak. It rose to an all high today at 155.524 before declining to 154.915, the lowest point as at today.

Based on technical Analysis on Price Action. On the 1 hour candle, we see the latest being a BUY candle, with the former candle which formed at 5pm , being a sell candle. The candles are of similar length, which may signify further movement in the later candle (the buy candle that formed at 6pm)Therefore I have taken a buy bias with expectation of price rising to around 155.378 before I close it off in marginal profit.

Let’s see where market go now.Thanks,

TOPNINEJanuary 29, 2025 at 9:54 am #18610In reply to: Forex Forum

Using my platform as a HEATMAP shows

USD Is firmer (except vs JPY but USDJPY Is still above 155)) ahead of the FOMC (and BOC) rate decisions despite lower bond yields as market is showing little fear of the Fed.

USDCAD is firmer ahead of a widely expected BoN 25bps rate cut.

AUDUSD hit after CPI raised expectations of Feb rate cut.

January 28, 2025 at 4:04 pm #18570In reply to: Forex Forum

EURUSD failed to test 1.0444 let alone 1.0450/57 but downside contained after a pauwe above 1.0411.

USDJPY trading well above 155 on the pop in stocks

XAUUSD above 2650 after finding support in my 2725-35 zone but still just consolidating.

NASDAQ The UP 1.1%

Now the wait is on for CB meetings or next Trump tweet.

January 28, 2025 at 2:50 pm #18567In reply to: Forex Forum

January 28, 2025 at 2:36 pm #18566In reply to: Forex Forum

Uncertainties around U.S. policies could slow global economic growth modestly in 2025, according to major brokerages. They expect U.S. President Donald Trump’s likely plan to raise tariffs to fuel volatility in global markets, raising inflationary pressures, which could limit major central from easing their monetary policy.

Following are the forecasts from some top banks on economic growth, inflation and the performance of major asset classes in 2025.

Forecasts for stocks, currencies and bonds:

Brokerage S&P 500 target U.S. 10-year yield EUR/USD USD/JPY USD/CNY

January 28, 2025 at 2:23 pm #18563

January 28, 2025 at 2:23 pm #18563In reply to: Evaluation – Daily Trades

January 28, 2025 at 12:10 pm #18551In reply to: Forex Forum

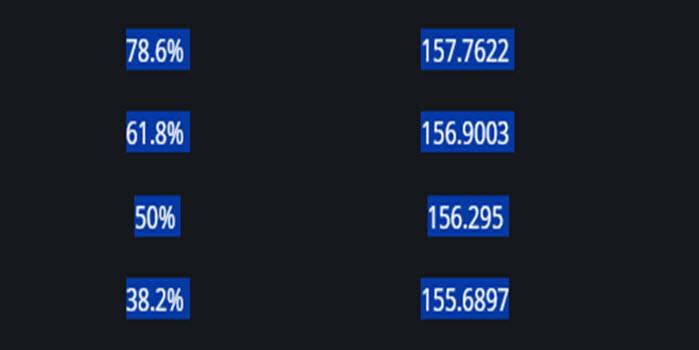

USDJPY 4 HOUR CHART – Key levels

Bounce from 153.73 would need to break the trendline + 156.25 to suggest the low is on for now.

Otherwise, keep an eye on 155 to set its tone (while within 154=156) and the risk tone as set by US equities.

FIBOS for 158.86 => 153.73 using our Fibonacci Calculator

January 28, 2025 at 10:12 am #18538

January 28, 2025 at 10:12 am #18538In reply to: Forex Forum

Using my platform as a HEATMAP shows

The day after an earthquake wher the damage was not as bad as initially thought but wary of aftershocks,

The dollar trading firmer after:reacting to Treasury Secretary Bessent’s tariff remarks (reaction to news is what matters)

Panic selling in equities at this time yesterday easing

USDJPY back above -155

EURUSD backing away from 1.05

Focus should shift to respective monetary policy meetings (BoC, Fed, ECB)

January 27, 2025 at 8:40 pm #18527In reply to: Forex Forum

January 27, 2025 at 4:37 pm #18507In reply to: Forex Forum

GBP/JPY AT EXACTLY 5:30PM NIGERIAN TIME SHOWS A DOWNWARD SLOPE BIAS. THERE WAS A DESCENDING GAP WHICH I TOOK ADVANTAGE OF FOR A FEW PIPS. MARKET PRICE WAS AT 192.37 AS AT THEN THEN I WENT IN FOR A FEW PIPS, WITH THE PLAN TO EXIT AT PRICE 152.25

THIS IS A GOOD MONDAY EVENING TO TRADE THE MARKET AS MARKET IS TRENDING BEAUTIFULLY. I HOPE TO CATCH A FEW PIPS HERE BEFORE MARKET RETRACES AND GOES THE OTHER WAY.

January 27, 2025 at 11:59 am #18491In reply to: Forex Forum

Newsquawk US Open

NQ down 5% & NVDA -11% pre-mkt as Chinese startup DeepSeek threatens US AI dominance

Good morning USA traders, hope your day is off to a great start! Here are the top 6 things you need to know for today’s market.

6 Things You Need to Know

Risk sentiment hit by DeepSeek threatening US AI dominance, NQ -4.8% & ES -2.7%; NVDA -13.5% in premarket trade

European bourses are also mostly in the red, Tech lags with ASML -10.6% while Energy names are hit on this and numerous other factors

Additionally, disappointing Chinese PMI data overnight, Trump’s tariff announcement on Colombia and reports around MXN & CAD also weigh on the risk tone.

DXY is at session lows with 107.00 coming into view, havens lead with USD/JPY probing 154.00 to the downside.

Fixed benchmarks benefit from the above and partially on better-than-expected German Ifo; Central Banks coming into focus

Crude is now modestly in the green, as the USD provides support and offsets initial bearish action on the above and Saudi/US discussing lower prices; Metals lower across the board

January 27, 2025 at 11:23 am #18487In reply to: Forex Forum

USD/JPY IS ON A DESCENDING TREND AND IS CURRENTLY AT PRICE 153.8, I FORESEE A FURTHER DESCEND BECAUSE OF THE LAST 15 MINUTE CANDLE WHICH IS A SELL CANDLE AND A CONTINUATION PATTERN ON PRICE ACTION…I INTEND EXITING THE MARKET AT PRICE 153.6 WHICH IS A GOOD PLACE TO EXIT WITH A FEW PIPS IN PROFITS . THANKS

January 27, 2025 at 10:40 am #18477In reply to: Forex Forum

January 27, 2025 at 10:33 am #18473In reply to: Forex Forum

January 27, 2025 at 10:24 am #18472In reply to: Forex Forum

Using my platform as a HEATMAP

While the first trade war has been averted, it is a risk off start to the week

Stocks off sharply => bond yields down shar[;y =: JPY (and CHF) outperforming… Catalyst: Popularity of China’s discount AI, DeepSeek, which has hit the high valuation AI stocka

BTCUSD smashed lower as well.

January 27, 2025 at 7:05 am #18457In reply to: Evaluation – Daily Trades

-

AuthorSearch Results

© 2024 Global View