-

AuthorSearch Results

-

February 6, 2025 at 1:25 pm #19116

In reply to: Forex Forum

February 6, 2025 at 10:32 am #19105In reply to: Forex Forum

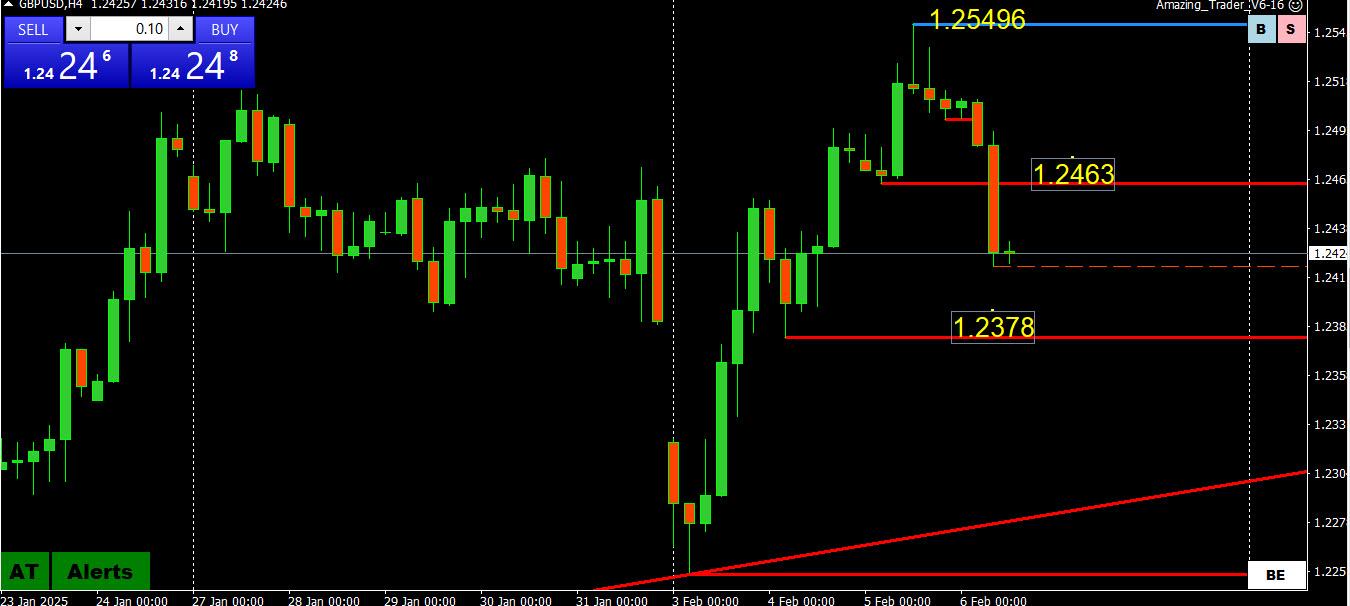

GBPUSD 4 HOUR CHART – Waiting for the BOE

My only question is why was GBPUSD bid at this time yesterday with a rate cut looming today.

What caught my eye at this time was the Power of 50 level after a high at 1.25496, so there is a method to my madness.

Note, a clue of a vulnerable GBPUSD, as I pointed out yesterday was GBP weakness vs the EUR and JPY, evident again today.

Back to charts

Move below 1.2463 breaks the upward momentum… back above this level would put 1.25 in play again.

Below 1.2378 would shift the risk back to this week’s low.

Re the BOE, a rate cut is widely expected and will not be a surprise.

February 6, 2025 at 10:09 am #19104In reply to: Forex Forum

Using my planform as a HEATMAP

Dollar is trading firmerm except vs JPY… but well within this week’s wide ranges

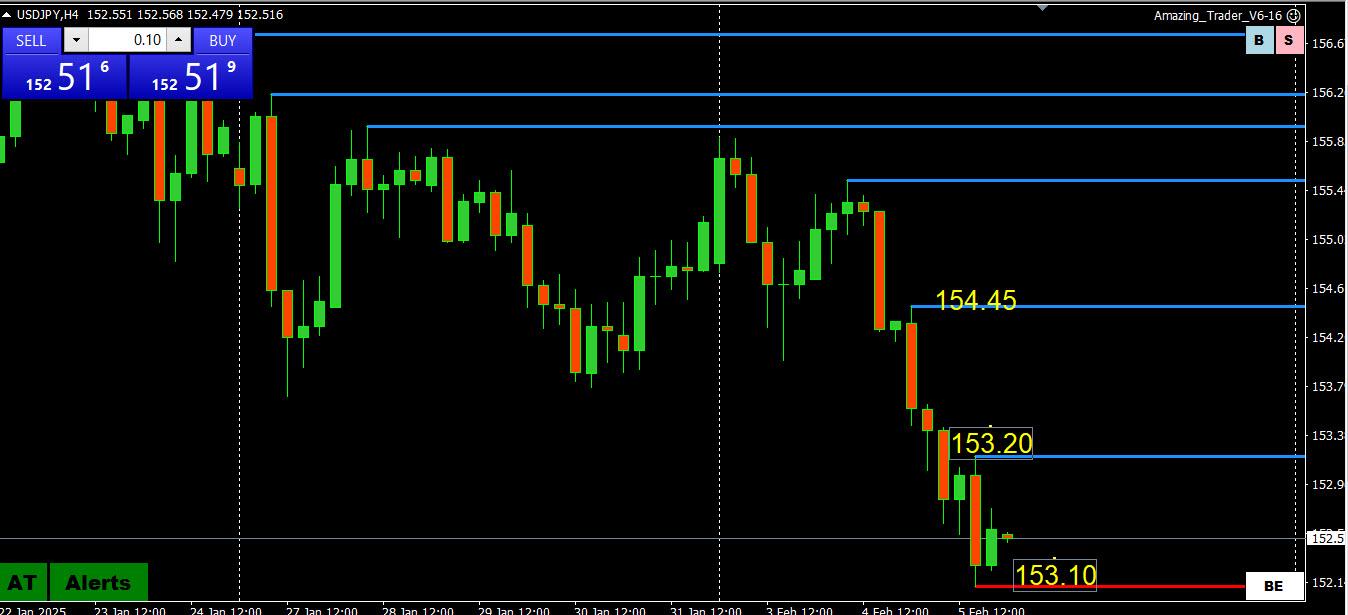

USDJPY back above 152 after brief dip below this pivotal level

GBPUSD softer ahead of expected BOE rate cut (note GBPJPY, EURGBP)

Bond yields are higher after plunging yesterday

Stocks are trading slightly firmer

Gold has backed off from yesterday’s record 2882 high… indicator of tariff sentiment?

February 5, 2025 at 11:32 pm #19099In reply to: Forex Forum

February 5, 2025 at 3:05 pm #19048In reply to: Forex Forum

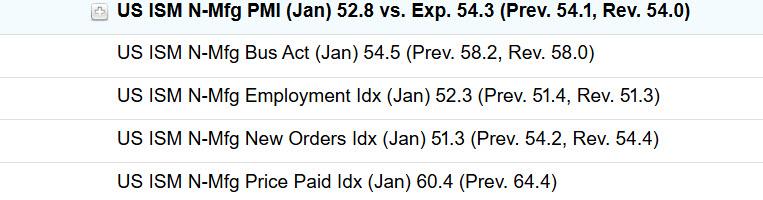

Big downside miss in ISM Services PMI..Bond yields down… USDJPY showing biggest FX reaction…

Source: Newsquawk.com

February 5, 2025 at 12:15 pm #19033In reply to: Forex Forum

Yen Hourly

USDJPY 1 hour

On the 1 hour chart, we can see that we have a minor downward trendline adding confluence to the resistance zone. This should technically strengthen the resistance and give the sellers more conviction to step in there targeting new lows.

The buyers, on the other hand, will look for a break above the resistance and the trendline to position for a pullback into the 155.00 handle. The red lines define the average daily range for today.

February 5, 2025 at 11:29 am #19027

February 5, 2025 at 11:29 am #19027In reply to: Forex Forum

NEWSQUAWK US OPEN

USD lower and Bonds gain ahead of ISM Services, NQ hit as China mulls a probe into AAPL, GOOGL -7% post-earnings

Good morning USA traders, hope your day is off to a great start! Here are the top 5 things you need to know for today’s market.

5 Things You Need to Know

European bourses mostly lower; NQ underperforms with GOOGL -7% & AMD -8% post-earnings, AAPL -2.5% as China mulls a probe on its App Store.

EU prepares to target US big tech if US President Trump pursues tariffs against the EU, according to FT.

Dollar dragged lower again, JPY is boosted by wage data, EUR/USD above 1.04.

Bonds bid as AAPL reports hit sentiment and into Bessent’s first Quarterly Refunding.

Gold continues to print record highs on lingering uncertainty; crude on the backfoot despite the firmer Dollar.

February 5, 2025 at 10:07 am #19023In reply to: Forex Forum

February 5, 2025 at 9:56 am #19022In reply to: Forex Forum

Using my platform as a HEATMAP

USD is down across the board, led by the JPY (breaka below 153.70 and 153.14)

Outside week in USDCAD but still above 1.4260

Outside week in USDMXN by just one pip (double bottom around 20.29-30)

EURUSD completes 61.8% retracement at 1.0410 (high 1.0417), next res 1.0434

Gold continues its march into record high territory

Trade war with China heats up, EU threaten retaliation against tech

US stocks slip

US 10 year currently below 4.50%

February 5, 2025 at 12:49 am #19018In reply to: Forex Forum

February 4, 2025 at 5:55 pm #19006In reply to: Forex Forum

February 4, 2025 at 11:57 am #18990In reply to: Forex Forum

NEWSQUAWK US IOEN

US equity futures modestly lower, Crude softer, Bonds and USD await tariff updates

Good morning USA traders, hope your day is off to a great start! Here are the top 5 things you need to know for today’s market.

5 Things You Need to Know

New 10% tariffs on China exports to the US have taken effect; China is to levy countermeasures on some US imported products with 15% tariffs on coal and LNG, as well as 10% tariff on oil, agricultural machines and some autos from the US.

European bourses trade tentatively, Tech buoyed by strength in Infineon; US futures are modestly lower.

DXY is flat, JPY underperforms, unwinding the prior day’s strength, and Antipodeans lag.

Bonds pullback but remain above Monday’s lows as we await tariff updates from US/China.

Crude softer amid Canada/Mexico tariff delays and China tariff retaliation.

February 3, 2025 at 12:03 pm #18938In reply to: Forex Forum

NEWSQUAWK US OPEN

USD surges and stocks dip after post-Trump actions; RTY underperforms

Good morning USA traders, hope your day is off to a great start! Here are the top 5 things you need to know for today’s market.

5 Things You Need to Know

Trump signed a tariff order that confirms 25% tariffs on Mexico and Canada (with the exception of 10% on Canadian energy products) and 10% additional tariffs on top of existing levies for China.

Canada has announced retaliatory action, Mexico is expected to announce its measures later today, China is to challenge tariffs at the WTO.

European bourses sink as markets react to Trump tariffs and threatens the EU; RTY underperforms.

USD surges and Bonds gain post-Trump tariff actions, JPY bolstered by safe-haven appeal, EUR/USD sits on a 1.02 handle.

Crude firmer, precious metals subdued, but base metals slip on tariffs and Chinese PMI miss.

February 3, 2025 at 11:30 am #18933In reply to: Forex Forum

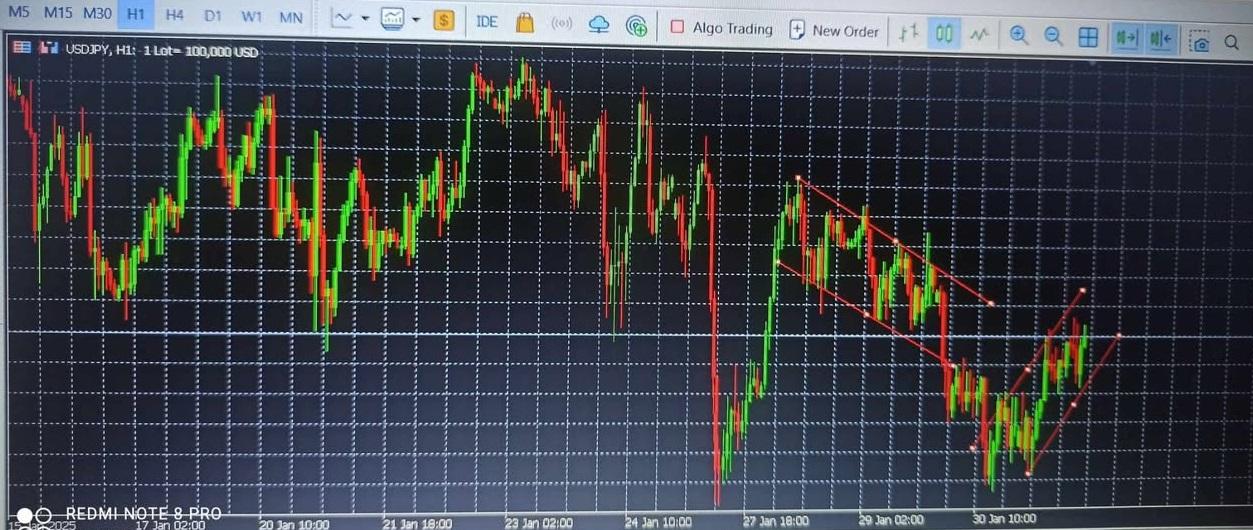

USDJPY 1 hour

1 hour chart, we can see that we have a minor upward trendline defining the current bullish momentum. The buyers will likely continue to lean on the trendline to push into new highs, while the sellers will want to see the price breaking lower to start targeting new lows. The red lines define the average daily range for today.

February 3, 2025 at 10:55 am #18928

February 3, 2025 at 10:55 am #18928In reply to: Forex Forum

February 3, 2025 at 10:12 am #18922In reply to: Forex Forum

Using my platform as a HEATMAP shows

Tariffs -> Gaps => USD up, stocks down, bond yields down s

Those currencies of countries most affected, directly or indirectly, by Trump’s tariffs hit the hardest (red arrows)

JPY the outperformer, GBP second (weaker but not as much as EUR) as UK seems not to be on the tariff hit list

Watch for headlines as Trudeau (Canada) and Sheinbaum (Mexico) are due to speak with Trump today. Note tariffs go into effect on Tuesday.

January 31, 2025 at 4:20 pm #18831In reply to: Forex Forum

This is about 5pm Nigerian time and the USD/JPY is looking good for a buy. The market went to the lowest point at 154.504which is a support area as there was a previous low at that level a few hours ago. Market has risen ever since and is at 154.813 currently. Identical candles in opposite directions are seen forming at the hourly chart.

This fortells a continuation pattern of a buy. New candles usually follow the last candle and head in same direction.

This is what is currently occuring now and price is going towards 155.040 for a few pips before i relax and see if i will find another opportunity to re enter the market.

As i ussally say, don’t overtrade. Just go in for a 2:1 risk / reward ratio and dont trade more than 2-5% of your Account. Slow and steady wins the race, be careful.

Thanks,

TOPNINE.January 31, 2025 at 11:21 am #18802In reply to: Forex Forum

Newsquawk US Open

DXY mixed ahead of PCE, NQ bid with AAPL +3.5% pre-market, Bunds outperform on soft state CPIs

Good morning USA traders, hope your day is off to a great start! Here are the top 4 things you need to know for today’s market.

4 Things You Need to Know

European bourses gain, NQ outperforms with AAPL +3.5% in the pre-market after strong growth in services segment.

USD mixed vs. peers ahead of core PCE; JPY underperforms.

Fixed benchmarks bounce on cool German State CPIs, which has led to outperformance in Bunds.

Crude pares initial premia awaiting updates from Trump regarding tariffs on Canada/Mexico oil.

January 31, 2025 at 11:21 am #18801In reply to: Forex Forum

Newsquawk US Open

DXY mixed ahead of PCE, NQ bid with AAPL +3.5% pre-market, Bunds outperform on soft state CPIs

Good morning USA traders, hope your day is off to a great start! Here are the top 4 things you need to know for today’s market.

4 Things You Need to Know

European bourses gain, NQ outperforms with AAPL +3.5% in the pre-market after strong growth in services segment.

USD mixed vs. peers ahead of core PCE; JPY underperforms.

Fixed benchmarks bounce on cool German State CPIs, which has led to outperformance in Bunds.

Crude pares initial premia awaiting updates from Trump regarding tariffs on Canada/Mexico oil.

Try Newsquawk for 7 Days Free

January 30, 2025 at 4:08 pm #18753In reply to: Trading Tip of The Week

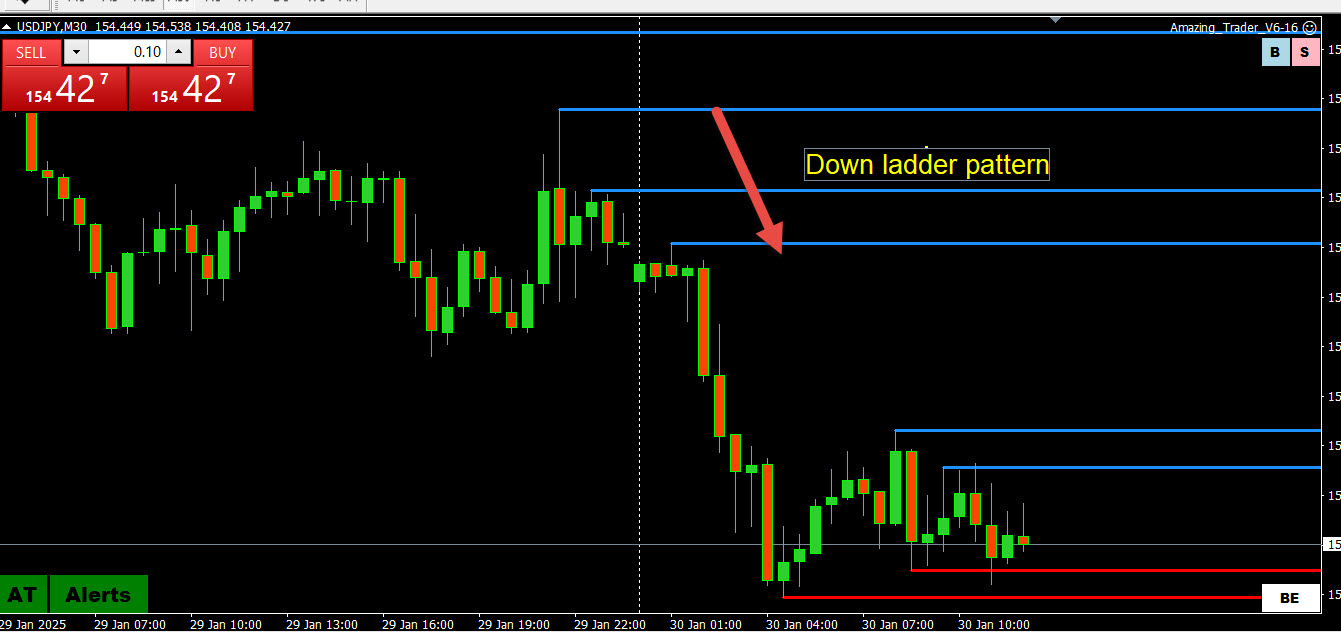

Trading Tip 7: Why You Should Drill Down on Your Charts

As I have noted many times, identifying the side to trade is more than half the battle in putting on successful trades. In this regard, one way to do this is by drilling down on your charts as I will explain in the following:

The term “drilling down” means starting at longer time frame charts and then moving down to shorter time frames to find opportunities to trade on what I call the “strong side” of the market.

In this article I will show how I drill down using my Amazing Trader (AT) charting algo

The process is designed to look for confirmation of a trend or episode on multiple time frames, and then find an AT ladder pattern to trade. Note, an AT ladder pattern is characterized by rising red lines (uptrend) or falling blue lines (downtrend)

Down AT Ladder Pattern: USDJPY 30 minite chart

Drilling down time frames:

Daily => 4 hour => 1 hour => 30 minute > 15 minute => 5 minute depending on what time frame you prefer to trade.

If you see AT ladders building in the same direction on say daily, 4 hour and 1 hour charts, you can assume there is an imbalance tilted in that direction

What the means for trading is that the institutional type traders who trade larger size and use longer term time frames will be looking to buy dips (ladder up) or sell blips (ladder down).

What this means for you is when multiple longer-term time frames confirm each other (I.e. AT ladders pointed in the same direction), you can identify the side to trade from, which is where big money traders are looking to do the same.

You then drill down time frames until you see an AT ladder pattern on the time frame you prefer to trade (e.g. 30, 15, 5 minute) and employ the ladder strategy to trade (explained in detail when you subscribe).

Here is an illustration from a video I created awhile ago with insights that have stood the test of time.

NOTE, you don’t trade blindly as you need to be aware of any levels, especially on longer term time frame charts, that would dampen or reverse the current episode.

Get more tips like this when you Join GTA – for FREE – CLICK HERE

-

AuthorSearch Results

© 2024 Global View