-

AuthorSearch Results

-

February 12, 2025 at 11:48 am #19415

In reply to: Forex Forum

NEWsQUAWK US OPEN

USD and USTs steady ahead of US CPI while crude slips; reports suggest optimism surrounding Middle Eastern talks

Good morning USA traders, hope your day is off to a great start! Here are the top 5 things you need to know for today’s market.

5 Things You Need to Know

US President Trump responded “We’ll see” when asked if reciprocal tariffs are still coming on Wednesday.

European bourses hold an upward tilt pre-US CPI and with tariffs capping optimism; US futures are mixed.

USD steady ahead of CPI, JPY is on the backfoot given the yield environment.

USTs trade steady ahead of CPI, German yields continue their march higher.

Crude slips on inventories which saw a surprise build in headline crude stockpiles, reports suggest there is “some optimism about reaching a solution” on Middle Eastern talks

February 12, 2025 at 10:24 am #19410In reply to: Forex Forum

USDJPY 4 HOUR CHART – Unwinding J{Y crosses lead the way

Short-term trend : Up

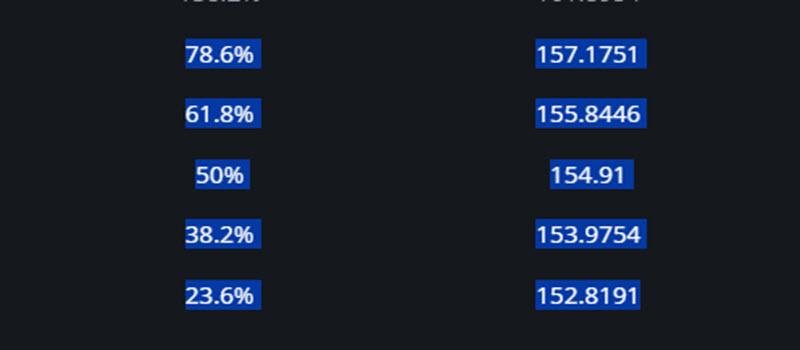

Longer-term trend: Retracement. 153.975 = 38.2% vs 153.88 high so far today

Keeps a bid while above 153.20

Below 152.89 puts 152,00-50 back on the table

Watch JPY crosses, US bond yields after CPI, headlines for any news on reciprocal tariffs

February 12, 2025 at 10:15 am #19409In reply to: Forex Forum

Using my playing as a HEAztMAP

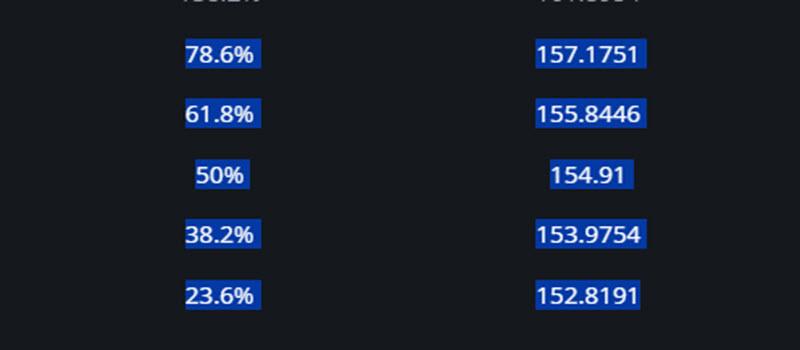

Tug-of-warUSDJPY up

JPY weaker on crosses (EURJPY leading)

USD mixed elsewhere,

EURUSD high 1.0380. vs 1.0385, where it was trading when reciprocal tariffs news hit last Friday

Next up: US CPI … see detailed preview

February 12, 2025 at 7:03 am #19405In reply to: Forex Forum

February 12, 2025 at 12:50 am #19403In reply to: Forex Forum

February 11, 2025 at 9:56 pm #19388In reply to: Forex Forum

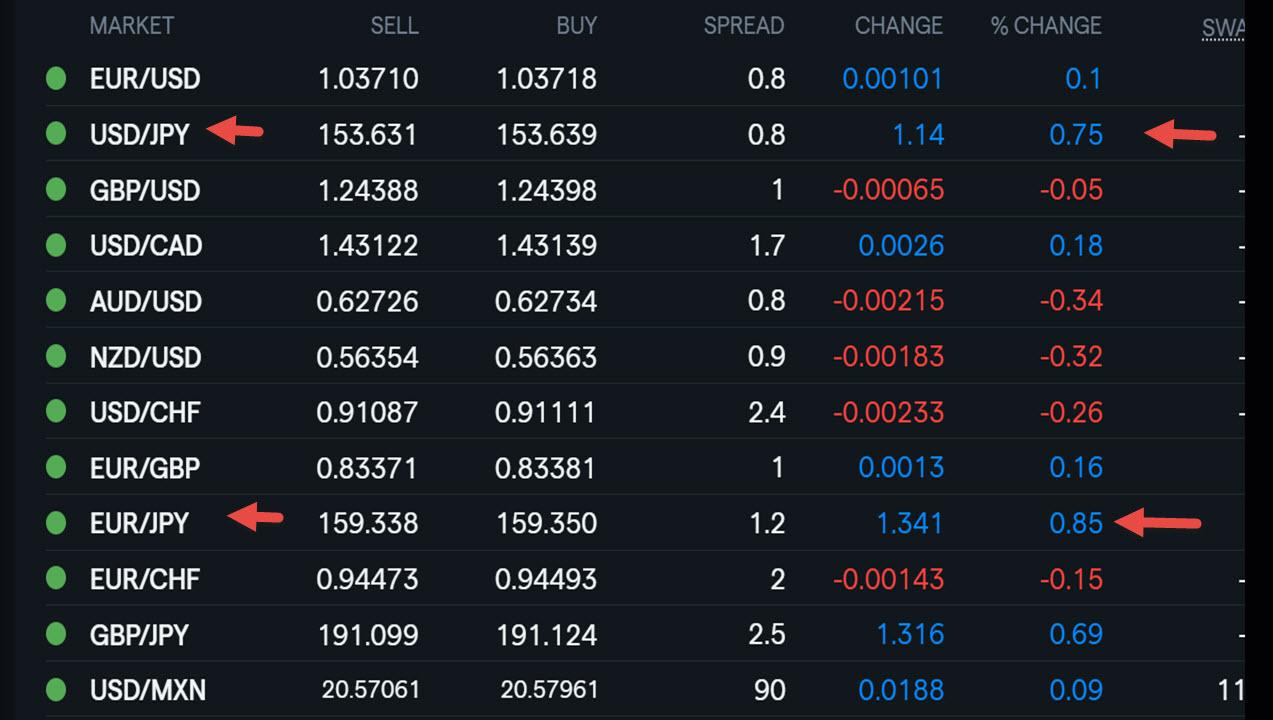

USDJPY 4 HOUR CHART – Momentum mixed

When you see 2 currencies move in opposite directions you can assume there are real money cross currency flows driving the market.

In this case, the USD was down vs all except the JPY…. US bond yields were higher, which could have been a factor behind a softer JPY.

Chart shows omentum currently mixed… would need to break153.20 for it to build.

Otherwise,

152.50+ is needed to make a run at 152.90-153.20

Below 152 neutralizes the upside risk.

February 11, 2025 at 3:20 pm #19368In reply to: Forex Forum

February 11, 2025 at 2:03 pm #19355In reply to: Forex Forum

February 11, 2025 at 11:39 am #19337In reply to: Forex Forum

February 11, 2025 at 5:52 am #19331In reply to: Forex Forum

February 10, 2025 at 11:42 am #19273In reply to: Forex Forum

NEWSQUAWK US OPEN

Trump to announce 25% aluminium and steel tariffs; stocks gain and XAU makes a fresh ATH

Good morning USA traders, hope your day is off to a great start! Here are the top 5 things you need to know for today’s market.

5 Things You Need to Know

US President Trump said he will announce 25% tariffs on all steel and aluminium coming into the US on Monday and unveil reciprocal tariffs on Tuesday or Wednesday which will go into effect almost immediately.

Stocks hold a positive bias despite tariff updates from Trump; NQ outperforms, whilst US steel names surge.

USD is mixed vs. peers as tariff updates dominate newsflow; JPY underperforms.

USTs are flat, Bunds are a touch higher as tariff threat concerns weighs on the EZ outlook.

Gold makes a fresh ATH above USD 2,900/oz on tariff woes, crude sits at session highs.

February 10, 2025 at 11:07 am #19271In reply to: Forex Forum

February 10, 2025 at 10:37 am #19268In reply to: Forex Forum

Using my platform as a HEATMAP

Another week, another set of opening gapd on tariff news.

All gap filled except for USDCAD

Mixed signs of angst over a global trade war

Stocks up and do far shrugging tariff concerns

Gold surging to another record high on global trade war concerns

USDJPY the outperformer… JPY not getting safe haven flows (no sign of concern) vs weaker JPY )reflects global trade war concerns.

February 7, 2025 at 5:24 pm #19216In reply to: Forex Forum

Headline roulette Friday… News algos in overdrive…Dollar pops up on these comments, including vs JPY

Source: Newsquawk.com

February 7, 2025 at 4:42 pm #19206In reply to: Forex Forum

February 7, 2025 at 10:12 am #19168In reply to: Forex Forum

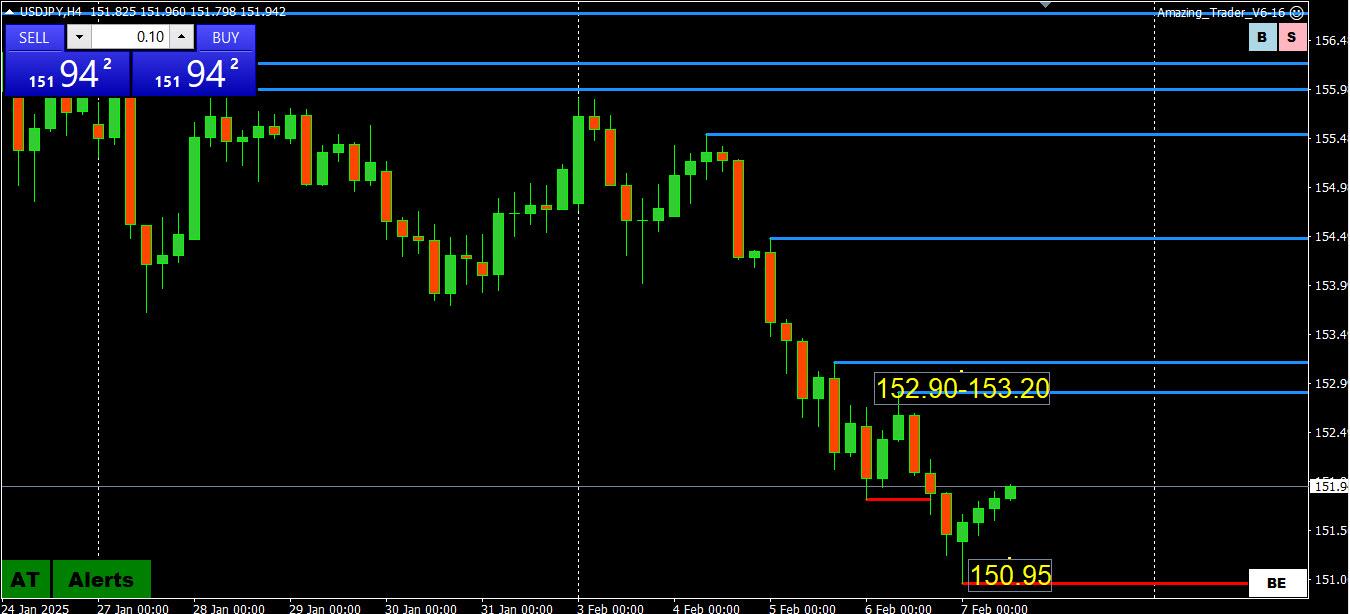

USDJPY 4 HOUR CHART – Watch 152

Keep it simple

Watch 152 as it will be pivotal setting the tone and trading bias,

Support 150.95

Resistance 152.90-153.20, only firmly above it postpones the risk to 150.

Watch US bond yields after the jobs report as the JPY tends to be most sensitive to interest rate moves,

February 7, 2025 at 9:54 am #19166In reply to: Forex Forum

Using my platform as a Heatmap

Given the way markets have reacted to key events and economic data this week all we can say at this point is there will be a reaction to the U.S. jobs report, especially if there is a miss in either direction.

Looking at the Heatmap shows a focus in the JPY… USDJPY finding 150-152, as suggested, a sticky zone.

GBPJPY has bounced back above the key 188.00 level after a brief move below it.

Keep an eye on the U.S. 10-year bond yield post-data and a 4.40%~4.50% range

February 6, 2025 at 8:29 pm #19135In reply to: Forex Forum

USDJPY DAILY CHART – ENTERING THE STICKY ZONE

The break of 153.15 leaves a black hole on the downside with the psychological 150 and 149.35 standing in the way of key support until 148.61.

Only back above 152 would postpone the risk.

This suggests 150-152 has potential to be a sticky zine.

Next up: US January jobs report on Friday. With lower US bond yields a weight on USDJPY, use the 10-year 4.50%

yield as a pivotal level (meaning below 4.50% is a USDJPY negative). .

February 6, 2025 at 6:39 pm #19131In reply to: Forex Forum

February 6, 2025 at 1:36 pm #19117In reply to: Forex Forum

-

AuthorSearch Results

© 2024 Global View