-

AuthorSearch Results

-

April 1, 2025 at 10:39 am #21783

In reply to: Forex Forum

April 1, 2025 at 9:09 am #21777In reply to: Forex Forum

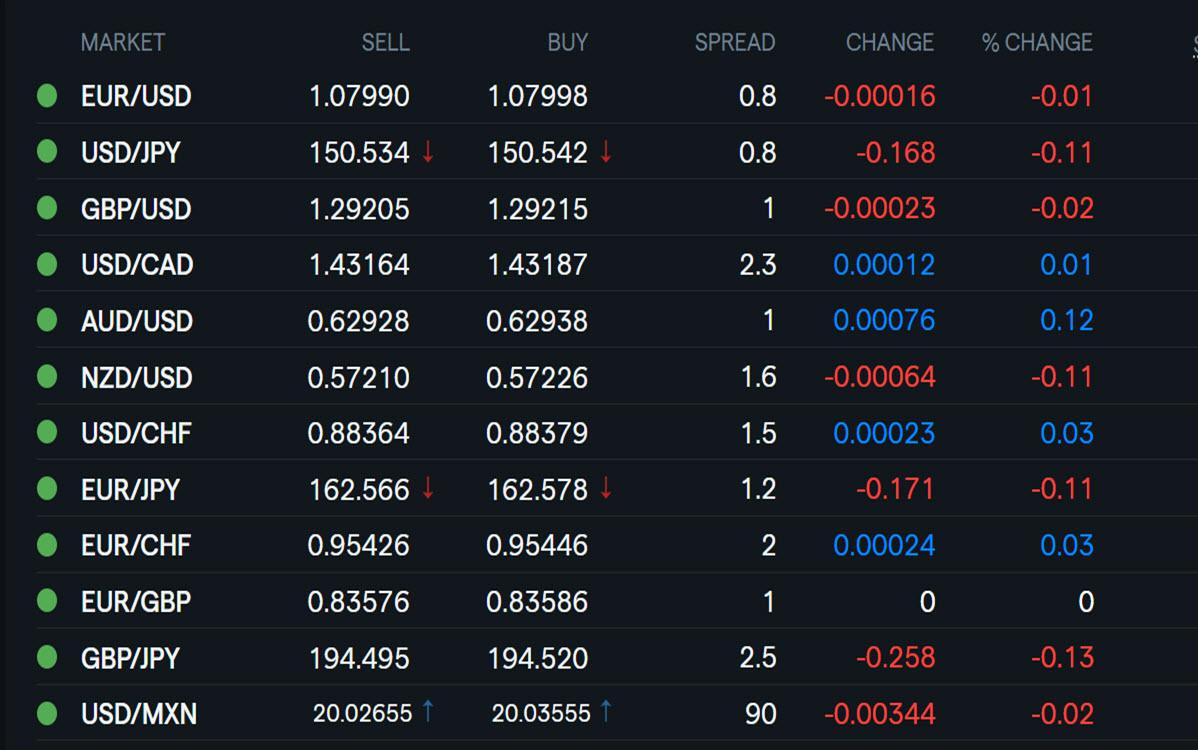

Using my platform as a HEATMAP shows

… a calm before the Liberation Day storm

Dollar more or less steady and cautious

EURUSD 1.08 has traded for 8th day in a row

USDJPY backed away from 150 but still well above yedterday’s 148.70 low

U.S. bond yields lower (10 year 4.18%)

U.S. stocks cautious

Gold sets another record high

Looking ahead, US ISM PMI

April 1, 2025 at 8:44 am #21774In reply to: Forex Forum

DAX – ger30

DAX opened with a gap to the upside.

Facing resistance at 22.500, with another one at 22.700

Unless some miracle happens it should fail and go for 21.750

Even if it is meant to continue being bullish, it has to take some time in yoyo-ing , and to form a new base for continuation of the uptrend.

I am mostly interested to see how 21.750 will act.

March 31, 2025 at 5:13 pm #21757

March 31, 2025 at 5:13 pm #21757In reply to: Forex Forum

March 31, 2025 at 10:57 am #21695In reply to: Forex Forum

US OPEN

Pronounced risk off into ‘Liberation Day’, though crude remains underpinned on US-Iran relations

Good morning USA traders, hope your day is off to a great start! Here are the top 6 things you need to know for today’s market.

6 Things You Need to Know

US President Trump is said to be pushing senior advisers to go bigger on tariff policy as they prepare for ‘Liberation Day’ on April 2nd; reportedly revived the idea of a flat universal tariff single rate on most imports.

European bourses and US futures in the red given the above and into month & quarter end, Euro Stoxx 50 -1.5%, ES -1.0%; NQ -1.3% with NVDA pressured.

DXY has been on either side of the unchanged mark throughout the morning, EUR and GBP flat/slightly softer while USD/JPY hit a 148.71 low as the Nikkei 225 entered correction territory.

Fixed benchmarks bid on the broad risk tone, German State CPIs sparked a fleeing move lower into the mainland figure, JGBs slipped as the BoJ cut its bond purchase amounts.

Crude firmer as geopolitical tensions outweigh the macro tone following reports around Trump on Iran, XAU at a fresh record high, base metals dented.

US President Trump threatened to bomb Iran if a nuclear deal can’t be reached, while he also warned of secondary tariffs on Russian oil.

March 31, 2025 at 9:40 am #21689In reply to: Forex Forum

USDJPY DAILY CHART – Safe haven

JPY getting the safe haven flows, helped by a fall in US bond yields )10 YEAR 4.20%) In a risk off start to the week.

Trendline broken at 149.80 following the failure to reach 151.30

Key support at 148.15… only below it (and then 148) would shift the focus from 150.

Intra-day range: 148.70-149.74

Conspiracy theory says, if I was the MoF/BoJ I would be on alert to prevent a meltdown if the downside starts to accelerate.

March 31, 2025 at 9:14 am #21685In reply to: Forex Forum

Using my platform as a HEATMAP shows

Risk off… stocks down, bonds up, gold soars…and..

… dollar mixed.. JPY up on safe haven flows… AUD, CAD, NZD down.. EUR and GBP not far from unchanged

What caught my eye in EURUSD was a failure at 1.0850 (high 1.0849)

Looking ahead: German CPI, Chicago PMI… month/quarter end

… April 2 reciprocal tariffsMarch 28, 2025 at 3:53 pm #21636In reply to: Forex Forum

March 28, 2025 at 2:35 pm #21627In reply to: Forex Forum

March 28, 2025 at 11:34 am #21607In reply to: Forex Forum

US OPEN

US futures approach PCE in the red following the overnight tone and further risk aversion from earthquakes in Myanmar; Carney to speak with Trump today

Good morning USA traders, hope your day is off to a great start! Here are the top 6 things you need to know for today’s market.

6 Things You Need to Know

European bourses and US futures approach PCE in the red following the overnight tone and further risk aversion from earthquakes in Myanmar

Canadian PM to speak with Trump today; EU has mentioned Apple, Meta and PayPal as part of any potential tariff response

DXY attempts to claw back Thursday’s pressure and is firmer vs peers ex-JPY, which is the best performer after Tokyo CPI

A firmer start for fixed benchmark ahead of US PCE and any tariff/trade developments, no move to the morning’s prelim. HICP figures

Crude choppy, precious metals underpinned by the tone while base metals are lower

Geopolitics in focus amid updates on Panama, Ukraine minerals deal and further damage to the Sudzha station

March 28, 2025 at 11:30 am #21605In reply to: Forex Forum

March 28, 2025 at 10:25 am #21597In reply to: Forex Forum

March 28, 2025 at 9:22 am #21593In reply to: Forex Forum

Using my platform as a HEATMAP shows

.. the dollar trading firmer except vs. the JPY, a reversal of what wax seen at this time yesterday as mood turns to risk off (and an unchanged GBPISD… weaker EURGBP)

What caught me eye:

USDJPY came within 10 pips of 151.30 and then went into retreat

EURUSD printed 1.08 (6th day in a row) but no higher

XAUUSD at a new record high

Tame EZ flash CPI

UK retaik salea beat

Looking ahead

Key data focus will be on US PCE

Monday is month/quarter end

Wednesday is reciprocal tariff day

Spring forward for clocks this weekend

March 27, 2025 at 7:14 pm #21561In reply to: Forex Forum

USDJPY DAILY – Key resistance cited

Chart: Positive but faces a key resistance at 151.30, which stays at risk while above 150.50-60.

Note weak JPY crosses (e.g. firmer GBPJPY) adding to USDJPY demand’

I have not seen any specific news to account for the weaker JPY, which reminded me that March 31 is Japanese fiscal yearend.

I remember when this was a key time for FX and stocks but have not heard much talk about it in recent years. So, no clue whether this has been a factor but something to keep an eye on once March 31 passes.

March 27, 2025 at 2:56 pm #21537In reply to: Forex Forum

March 27, 2025 at 1:09 pm #21528In reply to: Forex Forum

March 27, 2025 at 1:03 pm #21526In reply to: Forex Forum

March 27, 2025 at 12:44 pm #21522In reply to: Forex Forum

March 27, 2025 at 12:18 pm #21518In reply to: Forex Forum

I was just asked how do you know there is a real money sell order in the JPY?

My reply:; It’s like a tug-of-war with the USD caught in the middle

When yiou see 2 currenies move in oppodite directions vs the USD, (e.g. buying EUR and GBP, selling JPY)you can assume there is “real money” buy or sell order in the cross.

March 27, 2025 at 11:57 am #21516In reply to: Forex Forum

US OPEN

European bourses hit on auto tariff rhetoric, DXY mixed vs peers while EGBs & USTs diverge

Good morning USA traders, hope your day is off to a great start!

Here are the top 6 things you need to know for today’s market.t

6 Things You Need to Know

The US is to impose 25% tariffs on all cars made outside of the US effective on April 2nd

Trump reiterated that reciprocal tariffs are also set for next week but stated they will be lenient

Updates which weigh on European equities with Auto names lagging, US futures mixed/firmer

DXY mixed with GBP outperforming in an attempted recovery from Wednesday’s action while JPY lags

EGBs and USTs diverge as they focus on growth and inflationary implications of the latest rhetoric respectively

Crude benchmarks lower, TTF choppy, XAU gains and base metals slip

-

AuthorSearch Results

© 2024 Global View