-

AuthorSearch Results

-

January 17, 2025 at 1:45 pm #18003

In reply to: Evaluation – Daily Trades

January 17, 2025 at 9:38 am #17989In reply to: Evaluation – Daily Trades

January 14, 2025 at 5:36 pm #17784In reply to: Forex Forum

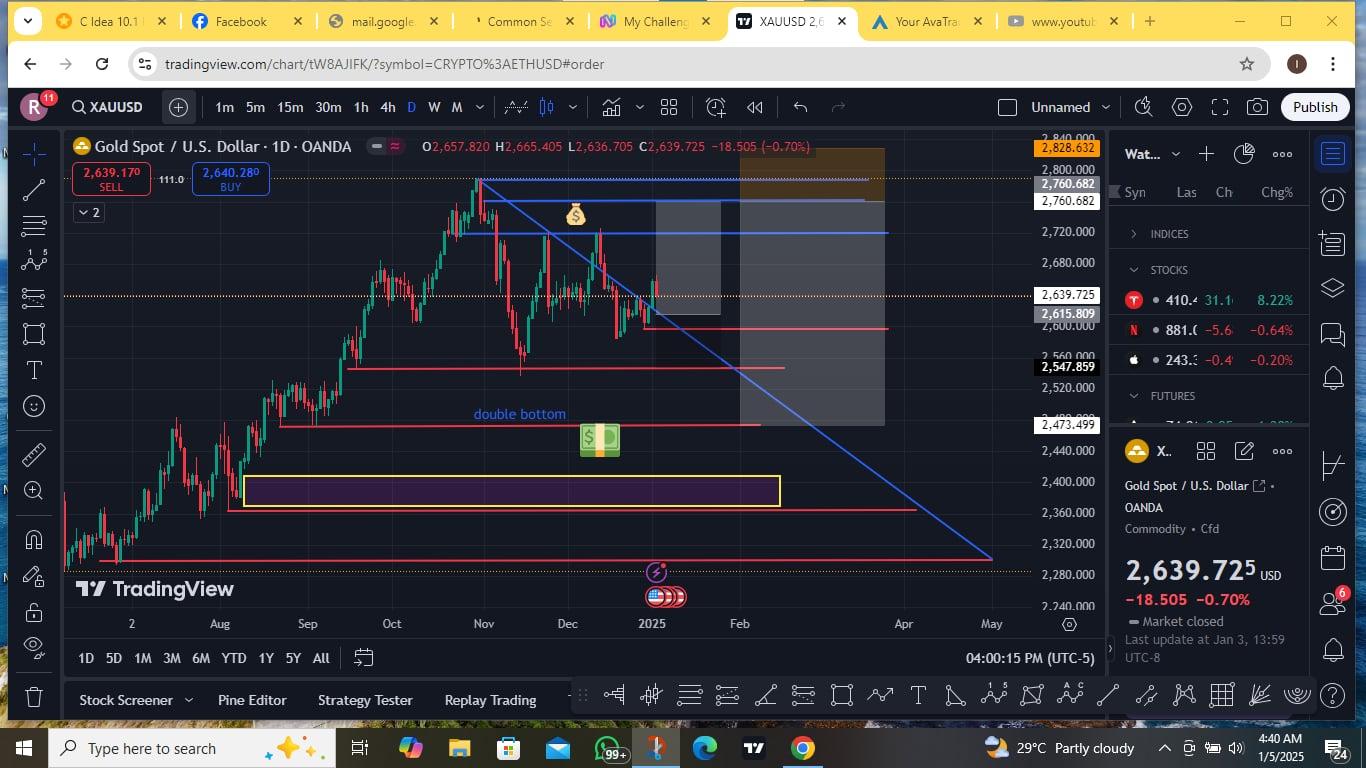

XAUUSD:- My forecast on Gold is below:

There is strong support for Gold @ $2308.00 and stiff resistance @ $3000.40.

The near term flash points are at $2654.20 & $2677.28 respectively.

I expect a lot of profit taking at $3000.40 and a strong collapse from that level at see some buying at $2654. Any short breaches above $3000.40 level can be shorted for humongous returns. At $2308 I expect to see massive buying by central banks around the world. However, if the momentum is stronger at $3000.40 then I’ll redo my analysis and update it accordingly.

GL GT

January 13, 2025 at 12:06 pm #17693In reply to: Evaluation – Daily Trades

AnonymousJanuary 13, 2025 at 9:30 am #17685In reply to: Forex Forum

January 9, 2025 at 9:53 pm #17537In reply to: Forex Forum

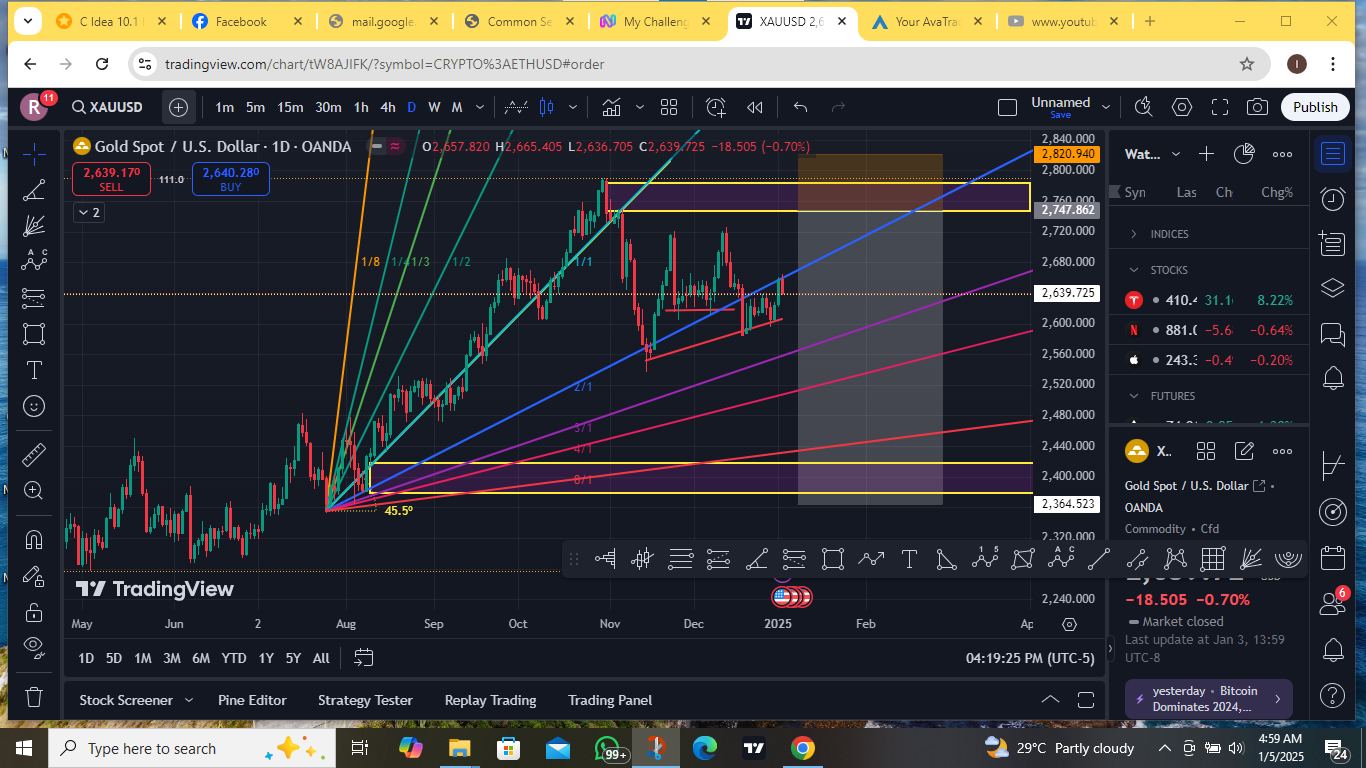

XAUUSD – Gold Daily

Supports : 2660.00, 2640.00 & 2620.00

Resistances : 2680.00, 2695.00 & 2735.00

As proven time and time again , my “Historical” trend lines and angles are working perfectly.

But what does it mean ???

Well, if Gold manages to go over 2735.00 in coming days, we should be seeing new Rally in which case Target is in 3.000 area.

But if not, it is going to be a prolonged correction, lading all the way to 2320.00

January 7, 2025 at 1:28 pm #17267

January 7, 2025 at 1:28 pm #17267In reply to: Forex Forum

January 7, 2025 at 12:04 pm #17264In reply to: Forex Forum

NEWSQUWK US OPEN

US futures gain modestly, USTs contained into data & supply

Good morning USA traders, hope your day is off to a great start! Here are the top 4 things you need to know for today’s market.

4 Things You Need to Know

European bourses are mixed, US futures gain slightly.

USD remains soggy vs. peers, EUR digests CPI metrics, Antipodeans lead.

USTs are contained into data, EGBs lift slightly on HICP, Gilts lag.

A choppy start for crude while spot gold benefits from the broadly softer Dollar.

January 6, 2025 at 10:33 am #17211In reply to: Forex Forum

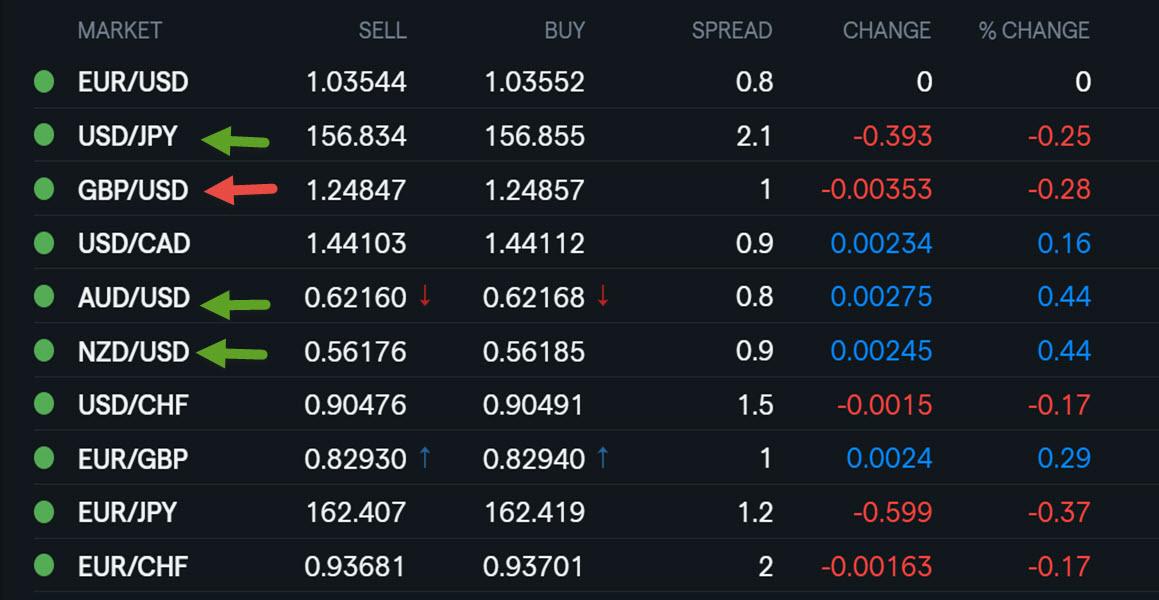

Using my platform as a Heatmap shows the USD lower vs all but the JPY, so you can see what cross flows are helping to drive the price action today.

To suggest anything more than typical start of year trading, EURUSD 1.0375 and/or GBPUSD 1.25+ would need to be regained.

USDJPY 158 remains pivotal as above it opens the door for 1.50.

US stocks up, bond yields up (ust a few bps) , GOLD down

How markets end tge week will be more important than how they start out.

January 5, 2025 at 11:12 pm #17183In reply to: Forex Forum

January 5, 2025 at 9:22 pm #17177In reply to: Common Sense Trading Q&A’s

January 2, 2025 at 9:57 am #16957In reply to: Forex Forum

December 30, 2024 at 11:48 am #16856In reply to: Forex Forum

December 20, 2024 at 4:31 pm #16597In reply to: Forex Forum

December 20, 2024 at 12:08 pm #16559In reply to: Evaluation – Daily Trades

AnonymousDecember 19, 2024 at 9:19 pm #16544In reply to: Forex Forum

All about positions, first before the hawkish Fed and then the not hawkish BOE

Positions getting squeezed

Long GBP (e.g. short EURGBP)

Long BTCUSD/Cryptos

Long Gold

Long Stocks

Less short EURUSD (meaning less ability to absorb selling)

Apparently long JPYMarkets don’t move this way when they get it right

Those who got blown away will pack it in for the holidays

Those who made out okay will bank their winnings and try not to give it back

Bottom line buy USD dips especially if there is a correction earlier in the day like today

Beware of further liquidations if those with vulnerable positions look to square up, which is typical at this time of year, ahead of a thin Xmas week.

December 19, 2024 at 8:03 am #16473In reply to: Evaluation – Daily Trades

Anonymous

After price took out the liquidity on the H4 swing low on Gold, it has broken above that level and it’s rising steadily. I believe there’s a good opportunity for a quick 1 to 2 RR trade here. I’m risking 1% of my account here to make 2%. Risk management is key to success. I believe price will take out that short term swing highDecember 18, 2024 at 7:28 pm #16435In reply to: Evaluation – Daily Trades

AnonymousMy sell idea worked out for Gold, there was a minor support there, building up liquidity as seen on my post earlier, as soon as price took out that zone, I was very confident that we will see massive sells, 35% up on my account in a day, without breaching the 5% drawdown.

I think I would be topping the leaderboards if there were one 😉December 18, 2024 at 6:50 pm #16432In reply to: Evaluation – Daily Trades

AnonymousStraddle trading idea, we have got the highly anticipated FOMC news by 8pm GMT+1, Gold is reacting to a key level on the H4 timeframe, above we have an intermediate swing high that price is very likely to be drawn to, but if that support zone fails, I believe price will go down and sweep the nearest swing low. There will be a lot of volatility, and statistically, straddle trading techniques are the most efficient for extremely volatile price movements

December 17, 2024 at 5:00 am #16359

December 17, 2024 at 5:00 am #16359In reply to: Evaluation – Daily Trades

-

AuthorSearch Results

© 2024 Global View

fan

fan

meeting

meeting