-

AuthorSearch Results

-

February 10, 2025 at 5:10 am #19267

In reply to: Forex Forum

February 8, 2025 at 6:16 pm #19225In reply to: Forex Forum

XAUUSD: I checked out gold and the targets are wayyyy out… I don’t wanna post them and cause wild global panic… There may be some corrections along the way but the trend on gold is simply just too strong…

2025 is a geopolitical year. Hence all I can say for now is hang on to your gold… It’s pretty likely that we can range at this level, which is a good opportunity to keep adding like as in a SIP…

However on a global long term outlook the targets are way wayyyy out and higher than the markets can imagine… And I just won’t say it simply out of concern that it might cause markets to go cowabunga.

And believe me when I say BTC is a mouse when compared to Gold, as Gold will surpass the wildest Bitcoin prediction with lot more room left for it to soar…. wayyy out like I say…

In the PF in the early years I had a discussion with BC and my call on gold was 5000 (from those early days) when gold was at USD$200, before that I called 1000+,… now 20 years later gold is closer to USD$3000, and in those days I was told that I was talking my book… lol…

February 7, 2025 at 9:32 am #19165In reply to: Forex Forum

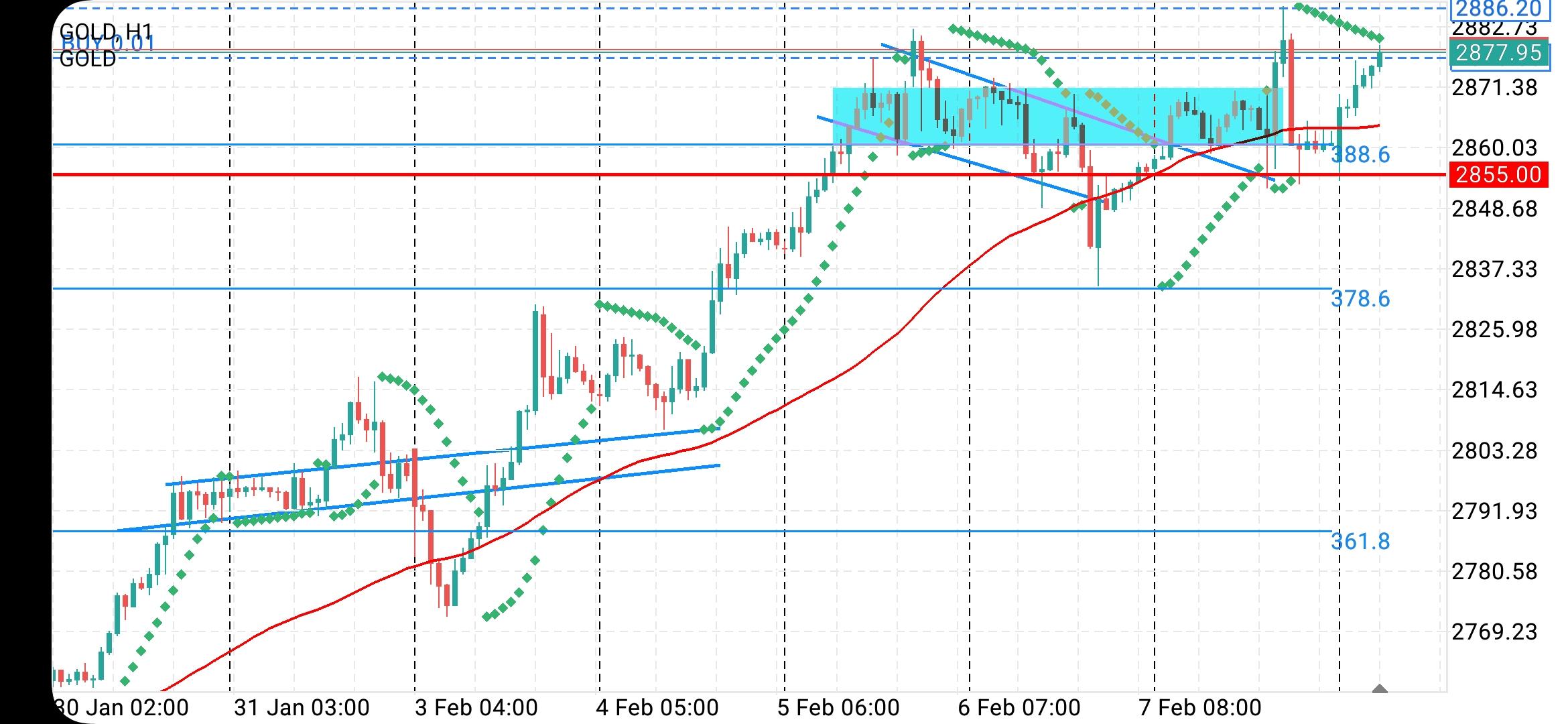

Gold (xau/usd) seems to be on a continuous buying bias. It has been like this since forever and now reinforced with the Trump’s administration. The currency pair picked up from a low at price 2858.61 which was the lowest point it got to so far today. From then it has been a steady buying bias uptil 2870, the highest price it has reached today.

I see a buy bias on the gold and a continuation in same direction it has gone since 1996. This Metal is indeed a bullish one. Let us all tread softly. Today is NFP (Non Farm Payroll) day by exactly 2:30pm Nigerian time.

Don’t risk more than 2-5% of your capital to preserve your capital.A word is enough for the wise. I come in peace.

Thanks,

TOPNINE.February 6, 2025 at 10:09 am #19104In reply to: Forex Forum

Using my planform as a HEATMAP

Dollar is trading firmerm except vs JPY… but well within this week’s wide ranges

USDJPY back above 152 after brief dip below this pivotal level

GBPUSD softer ahead of expected BOE rate cut (note GBPJPY, EURGBP)

Bond yields are higher after plunging yesterday

Stocks are trading slightly firmer

Gold has backed off from yesterday’s record 2882 high… indicator of tariff sentiment?

February 5, 2025 at 11:39 pm #19100In reply to: Forex Forum

It feels like markets have begun trading in anticipation of Trump’s tariffs since August. Signals are mixed (i.e. gold up, bond yields down, dollar well of its highs, stocks uncertain) as to whether Trump’s tariffs will turn out to be a Nothing Burger.

Will Trump’s Tariffs Turn into a Nothing Burger?

https://global-test.financialmarkets.media/will-trumps-tariffs-turn-into-a-nothing-burger/February 5, 2025 at 5:25 pm #19058

https://global-test.financialmarkets.media/will-trumps-tariffs-turn-into-a-nothing-burger/February 5, 2025 at 5:25 pm #19058In reply to: Forex Forum

JP// Re: Your proposal and IF I don’t object… This is the most I will do for now…

I have always said/done everything with kindness, freedom, transparently and honestly…

You wanna make money then gold offers opportunities… I have posted Gold forecasts, if you like them then you may trade them at your leisure and at your own risk.

No offense meant to you or anyone for that matter.

GL GT

February 5, 2025 at 5:16 pm #19057In reply to: Forex Forum

XAUUSD:- TARGET @ $3000.40.

My model has sounded the alarm and other targets have cropped up flashing for Gold since the past few days and I will post them in a few days time probably over the weekend however until then USD$$3000.40 should be okay.

Word of caution is that once at $$3000.40 then we need to check if momentum is sufficient to push it higher… that is until I post the updated levels.

Additionally, it does not mean that my posting updated levels nullifies 3000.40, as my levels become important when prices come closer towards them, irrespective whether in a few days of time or come back down towards it in market corrections further down the line.

GL GT

February 5, 2025 at 11:29 am #19027In reply to: Forex Forum

NEWSQUAWK US OPEN

USD lower and Bonds gain ahead of ISM Services, NQ hit as China mulls a probe into AAPL, GOOGL -7% post-earnings

Good morning USA traders, hope your day is off to a great start! Here are the top 5 things you need to know for today’s market.

5 Things You Need to Know

European bourses mostly lower; NQ underperforms with GOOGL -7% & AMD -8% post-earnings, AAPL -2.5% as China mulls a probe on its App Store.

EU prepares to target US big tech if US President Trump pursues tariffs against the EU, according to FT.

Dollar dragged lower again, JPY is boosted by wage data, EUR/USD above 1.04.

Bonds bid as AAPL reports hit sentiment and into Bessent’s first Quarterly Refunding.

Gold continues to print record highs on lingering uncertainty; crude on the backfoot despite the firmer Dollar.

February 5, 2025 at 9:56 am #19022In reply to: Forex Forum

Using my platform as a HEATMAP

USD is down across the board, led by the JPY (breaka below 153.70 and 153.14)

Outside week in USDCAD but still above 1.4260

Outside week in USDMXN by just one pip (double bottom around 20.29-30)

EURUSD completes 61.8% retracement at 1.0410 (high 1.0417), next res 1.0434

Gold continues its march into record high territory

Trade war with China heats up, EU threaten retaliation against tech

US stocks slip

US 10 year currently below 4.50%

February 4, 2025 at 4:45 pm #19005In reply to: Forex Forum

This an all buy time for GOLD (XAU/USD) as it is not relenting in its continuous buying power. This week Friday 7th February 2025 is NFP (Non farm payroll ) release date and market is set to be volatile that day. Even days before we will see abnormal market behaviour. We saw a gap of 50-100 pips in some currency pairs upon Market opening this week.

This is testament to the volatility we are about to experience this week and beyond. The gold went on the lowest at price 2806 this morning and ever since went on a buy. It has ever since been buying and it got to a high of 2845. I see market reching around 2853 and beyond today. The upward movement does not seem to want to wane so soon. I see a continued buying power of the gold.As i said earlier gold has been buying since 1996, go and check your hourly chart on the gold to confirm this.

However, let us tread with caution and let’s place minimal trades with strong SL and TP. Don’t Trade more than 2-5% of your capital. A word is enough for the wise.

Thanks

TOPNINE.February 3, 2025 at 2:44 pm #18947In reply to: Forex Forum

February 3, 2025 at 2:16 pm #18945In reply to: Forex Forum

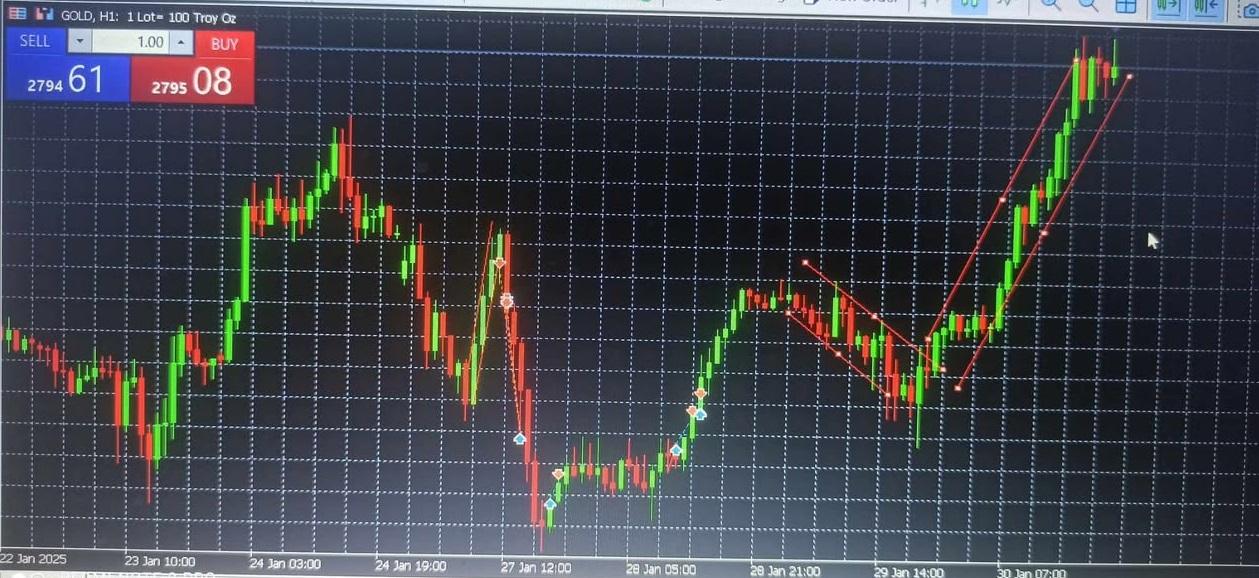

It seems to be a buy bias for the xau/usd (GOLD) pair. as it has conssistently climbed upwards since whenever. I just looked at the monthly chart of the Gold and I discovered that it has actually been climbing since 1996. This is an upward move of almost 30 years.

The market opened overnight at 2785 and immediately went on a sell. Hours later it retraced and went long from the lowest point at 2772. It has consistently gone long from then till now at 2814. My analysis is that it will still pull up to the price area of 2818 at least. This has to be because of the strong buy candle on the 15′ chart ,further confirmed on the 30′ these 2 are strong to determine what happens on the hourly chart.

We are gonna be in for a long buy bias on the Metal Gold this week. Gold might buy all the wat with little retracements.

REMEBER THIS IS NFP WEEK. Tread carefully, do not overtrade. A little 2-5% of your capital is good risk Management.Thanks,

TOPNINE.February 3, 2025 at 12:34 am #18918In reply to: Forex Forum

January 31, 2025 at 7:10 pm #18844In reply to: Forex Forum

US500 4 HOUR CHART – What’s the ugly word?

Just when it looked like US500 was setting up for a run at the record high, tariff news cut it short.

Now it is dependent on 6000-20 holding to keep the bid in what was looking like a goldilocks market => tame bond yields, growing but not overheating economy. Watch bonds now that ugly word, tariffs, is likely to become a reality rather than a threat.

January 31, 2025 at 5:51 pm #18837In reply to: Evaluation – Daily Trades

January 31, 2025 at 3:28 pm #18824In reply to: Forex Forum

January 31, 2025 at 3:05 pm #18822In reply to: Forex Forum

January 31, 2025 at 2:28 pm #18814In reply to: Evaluation – Daily Trades

January 30, 2025 at 8:09 pm #18764In reply to: Forex Forum

January 30, 2025 at 6:09 pm #18762In reply to: Forex Forum

This is perfectly 7pm Nigerian time, and the gold (xau/usd) has just spoken. This is another buy. Looking at the hourly chart. the candles are well set for a buy. the just formed candle is heading long while the candle that formed an hour before then (5pm) closed at 2788. Now as I said, the direction of the last candle dictates where the trend is going.

The 7pm candle was a buy candle and suggests continuing buy bias. I think the gold will hit 2797 at least before retracing. It has begun going long as i speak so a few pips is good and I will be exiting at 2797. Do not be greedy. A little pip at a time is good. Don’t risk more than 2-5% of your capital at a time. I will see you soon. This is my analysis.

Thanks,

TOPNINE. -

AuthorSearch Results

© 2024 Global View