-

AuthorSearch Results

-

February 18, 2025 at 11:52 am #19719

In reply to: Forex Forum

US Open

US equity futures firmer, crude and gold remain underpinned by geopolitics, despite a firmer USD

Good morning USA traders, hope your day is off to a great start! Here are the top 4 things you need to know for today’s market.

4 Things You Need to Know

European bourses are mixed with price action choppy; US futures gain a touch awaiting geopolitical updates as US and Russia begin Ukraine peace talks.

USD is broadly firmer vs. peers, AUD bucks the trend after the RBA delivered a cautious cut.

Gilts underperform on wage data though Bailey has pared some of this, EU joint issuance in focus.

Crude and gold remain underpinned by geopolitics despite the firmer Dollar.

February 18, 2025 at 7:58 am #19711In reply to: Forex Forum

February 17, 2025 at 9:56 pm #19680In reply to: Forex Forum

February 17, 2025 at 1:48 pm #19654In reply to: Forex Forum

February 17, 2025 at 12:03 pm #19645In reply to: Forex Forum

GOLD (XAU/USD) opened at around price 2881 early this morning. It then went long (bullish) to the area of 2906, the highest point it ever got to till this moment. We see a retracement to the area of 2895 after which it went a bit long to its former position. The time is 1pm Nigerian time this Monday afternoon and the mood is good.

The price at 1pm is 2901 now. I forsee a small sell to tje price of 2895 to form a support level before a return to its former buy position. Happy Trading.

Please do not overtrade as it might ship wreck your Account. 2-5% of your Capital is what I recommend. Aword is enough for the wise.

Thanks,

TOPNINE.February 14, 2025 at 8:44 pm #19592In reply to: Forex Forum

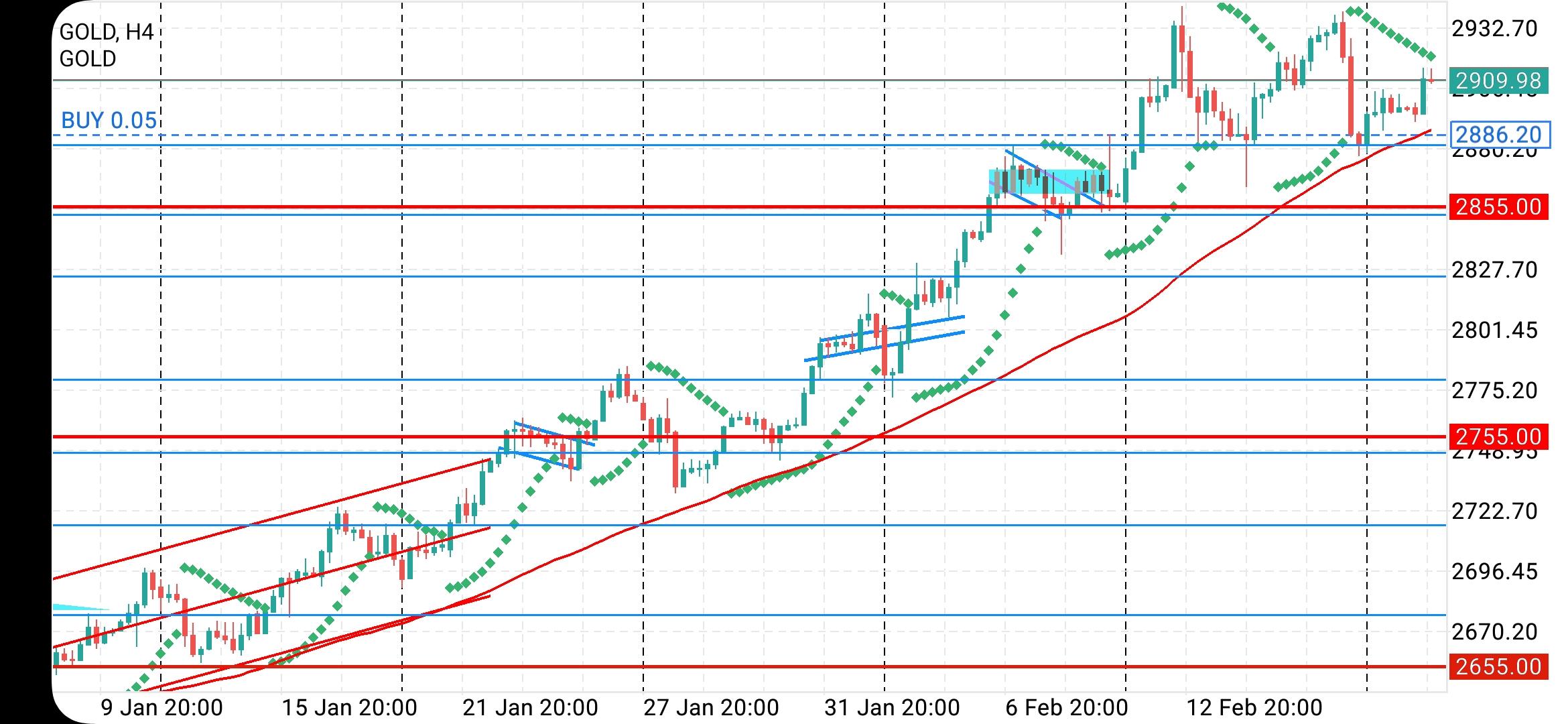

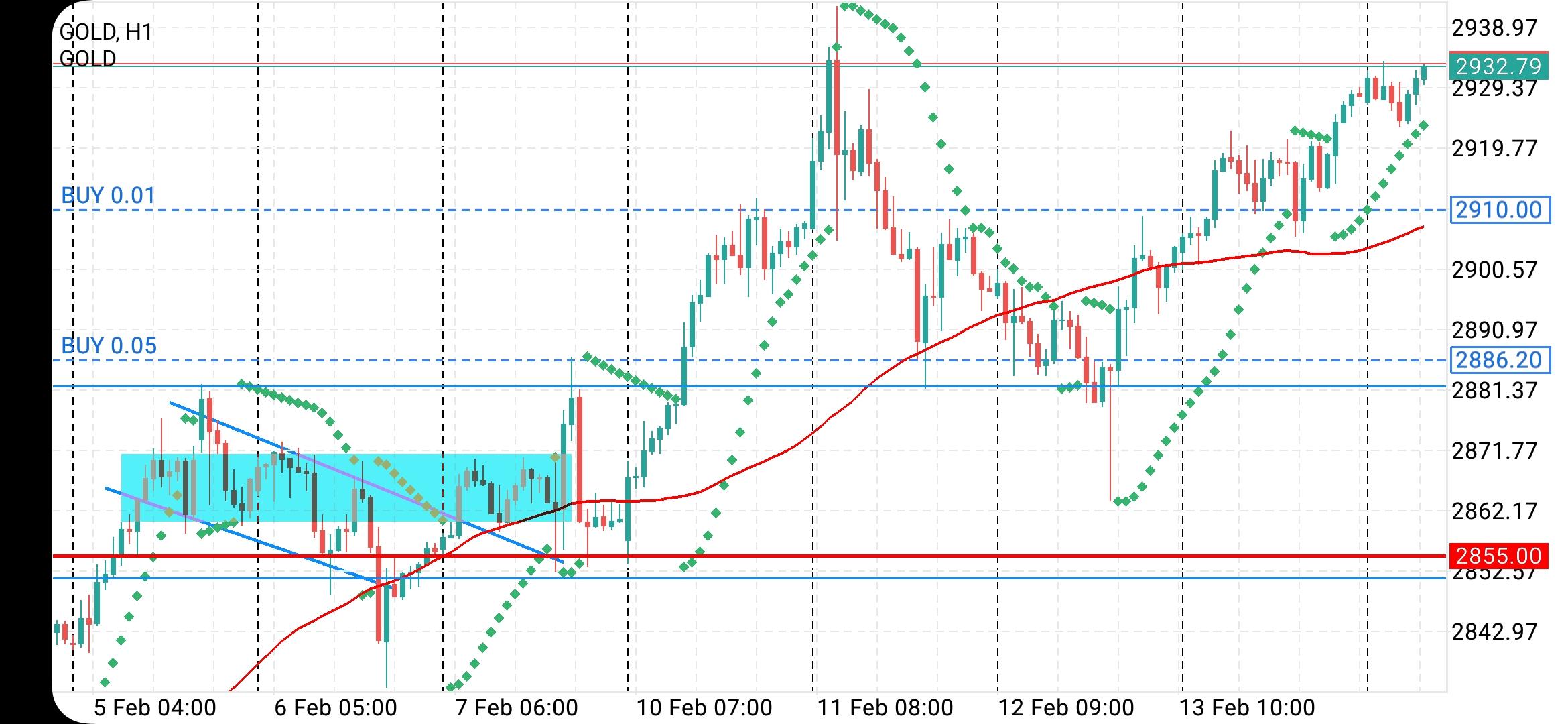

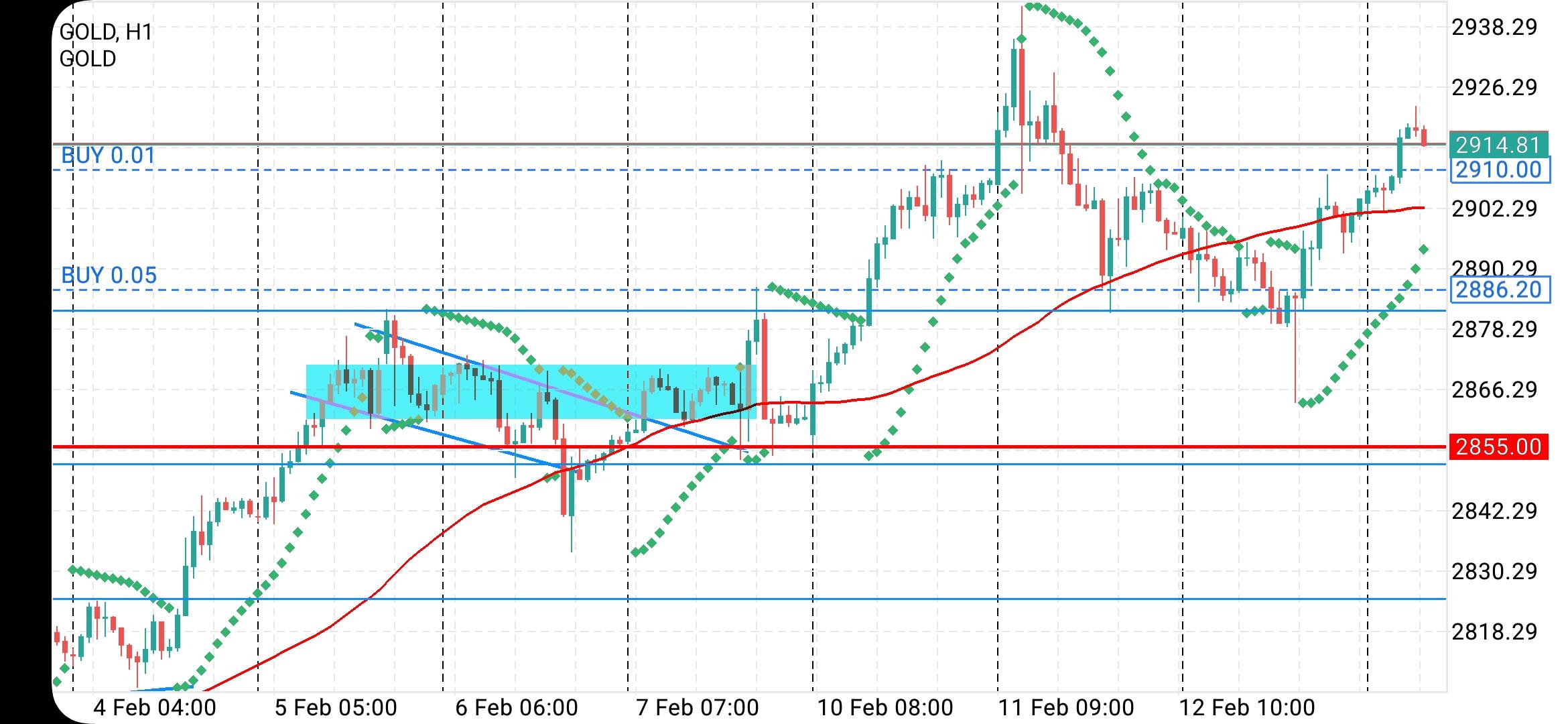

XAUUSD 4 HOUR CHART Logic prevails

There’s an old saying in trading, Markets can remain illogical longer than you can stay solvent.

I thought of this saying as the dollar sold off on easing tariff concerns and hopes for an end to the Ukraine war yet GOLD continued to press higher.’

Well, today logic prevailed after 2942 held for a double top.

Now XAUUSD needs to stay above 2863 as a break would negate the last leg to 2952 and expose a risk if a retracement.

February 14, 2025 at 4:27 pm #19580In reply to: Forex Forum

THE GOLD (XU/USD) has retraced after days of a bullish run. The retracement started at price 2939 this early morning, and has steadily declined ever since then. it is now at price 2895…a long bullish retracement. There was a core retail sales m/m news release at 2:30pm this afternoon.

Market will soon start returning to it’s usual buy bias so Traders should beware not to be stuuck in the sell bias. A word is enough for the wise.

Don’t risk more than 2-5% of your capital on any Trade.

Thanks,

TOPNINE.February 14, 2025 at 6:30 am #19553In reply to: Forex Forum

February 13, 2025 at 10:54 am #19472In reply to: Forex Forum

February 13, 2025 at 6:15 am #19463In reply to: Forex Forum

February 12, 2025 at 9:07 pm #19442In reply to: Forex Forum

XAUUSD – Gold

Is Gold ready for a correction?

Supports: 2885.00, 2865.00 & 2835.00

Resistances: 2910.00, 2940.00 & 2965.00

Time wise – to be able to continue reaching new highs it has to go over previous high in next 4 days.

Pattern wise – it might be ready to go into correction – depending on fundamentals/news in coming days correction can be shallow – till around 2825.00 or a deeper one all the way to 2750.00

February 12, 2025 at 7:56 pm #19437

February 12, 2025 at 7:56 pm #19437In reply to: Forex Forum

I came across a headline yesterday in which the USA is considering a sovereign wealth fund,… well call me late… but just the other day I was considering saying they should have a sovereign wealth fund along the likes of other countries such as Norway and my dear Saudi Arabia etc… But then in order to start that fund the USA wants to offload gold which they purchased at 42 bucks each. Ditching an asset which gives capital appreciation, and superior returns above inflation which stocks have not been able to give. Gold existed ever since the beginning of time even centuries before the USA was even discovered, as a matter of fact that is why they were discovered, it was because of an explorer’s search for Gold and Spices… Trump wants to bail out tiktok and do crypto by dumping money into Moore’s law? He should be negotiating treaties to buy as much gold as can be produced in the world for the next 50 years.

If the FED invests in bond yields then that would fill the void left behind when USAID was dismantled. Bonds are indirect investments into the welfare systems of countries… They got some great non-calleable bond deals going on somewhere in the world. And last I heard on 1 year paper was 6.55%+.

Gold and Bond’s are the only 2 bets for that kind of money.,.. and no other countries know the world like the United States does. What was all that spying done for?

Stock investments are limited by the amount of capital which can be invested in companies. under performance of stocks causes capital erosion which is counter intuitive. Companies won’t last as long as Physical Gold and the countries obviously. eg. India has been around for 5000+ years and which company in the world has been doing business for even 10% of that time?. Additionally, in how many companies in the world can an investor buy 75 billion dollars worth of stock for a 5% stake and be confident that the money is safe,… only maybe 3 or 4 companies if that many.

February 11, 2025 at 9:18 pm #19380In reply to: Forex Forum

XAUUSD 4 HOUR CHART – Is XAUUSD Ready for a Pause

Setup fwa or a pause as indicated here earlier and in my blog article Is XAUUSD Ready for a Pause saw it work out with a low at 2881… which was also around the old record high…. 2852 i the level that needs to hold to prevent a dee[er retracement.

February 11, 2025 at 2:30 pm #19362In reply to: Forex Forum

As I have said many times, There is no reason to guess at a top when something is trading in unchartered waters (i.e. record highs) until charts tell you there is a reason to do so.”

This has especially been the case in GOLD…

February 11, 2025 at 10:27 am #19334In reply to: Forex Forum

Hi all, there is a temporary pull back on the xau/usd (gold), from price 2942 to the present price at 2901. This is a support line as market can pull back up (buy) from here and return to its former buying position. If we are on a sell let’s not sleep there thinking it will continue its bearish movement for long.

Brace up, market might soon start buying again on the Gold. Enter your Trades with caution of 2-5% risk of capital. A word is enough for the wise!

Thanks,

TOPNINE.February 11, 2025 at 5:48 am #19330In reply to: Forex Forum

February 11, 2025 at 5:43 am #19329In reply to: Forex Forum

February 10, 2025 at 8:36 pm #19307In reply to: Forex Forum

XAUUSD – Gold

Supports: 2875.00, 2835.00 & 2810.00

Resistances: 2910.00, 2950.00 & 3030.00

Gold is clearly very bullish and looks to me that two levels are possible targets right now:

3050.00 & 3080.00

Only question is where to buy it right now – well, if it closes tonight just above 2885.00 that would be the first doable level for another leg up tomorrow.

Lower level is 2870.00 – that one would make me smile J

But below those two, better wait and see the reaction around 2810.00

February 10, 2025 at 11:42 am #19273

February 10, 2025 at 11:42 am #19273In reply to: Forex Forum

NEWSQUAWK US OPEN

Trump to announce 25% aluminium and steel tariffs; stocks gain and XAU makes a fresh ATH

Good morning USA traders, hope your day is off to a great start! Here are the top 5 things you need to know for today’s market.

5 Things You Need to Know

US President Trump said he will announce 25% tariffs on all steel and aluminium coming into the US on Monday and unveil reciprocal tariffs on Tuesday or Wednesday which will go into effect almost immediately.

Stocks hold a positive bias despite tariff updates from Trump; NQ outperforms, whilst US steel names surge.

USD is mixed vs. peers as tariff updates dominate newsflow; JPY underperforms.

USTs are flat, Bunds are a touch higher as tariff threat concerns weighs on the EZ outlook.

Gold makes a fresh ATH above USD 2,900/oz on tariff woes, crude sits at session highs.

February 10, 2025 at 10:37 am #19268In reply to: Forex Forum

Using my platform as a HEATMAP

Another week, another set of opening gapd on tariff news.

All gap filled except for USDCAD

Mixed signs of angst over a global trade war

Stocks up and do far shrugging tariff concerns

Gold surging to another record high on global trade war concerns

USDJPY the outperformer… JPY not getting safe haven flows (no sign of concern) vs weaker JPY )reflects global trade war concerns.

-

AuthorSearch Results

© 2024 Global View

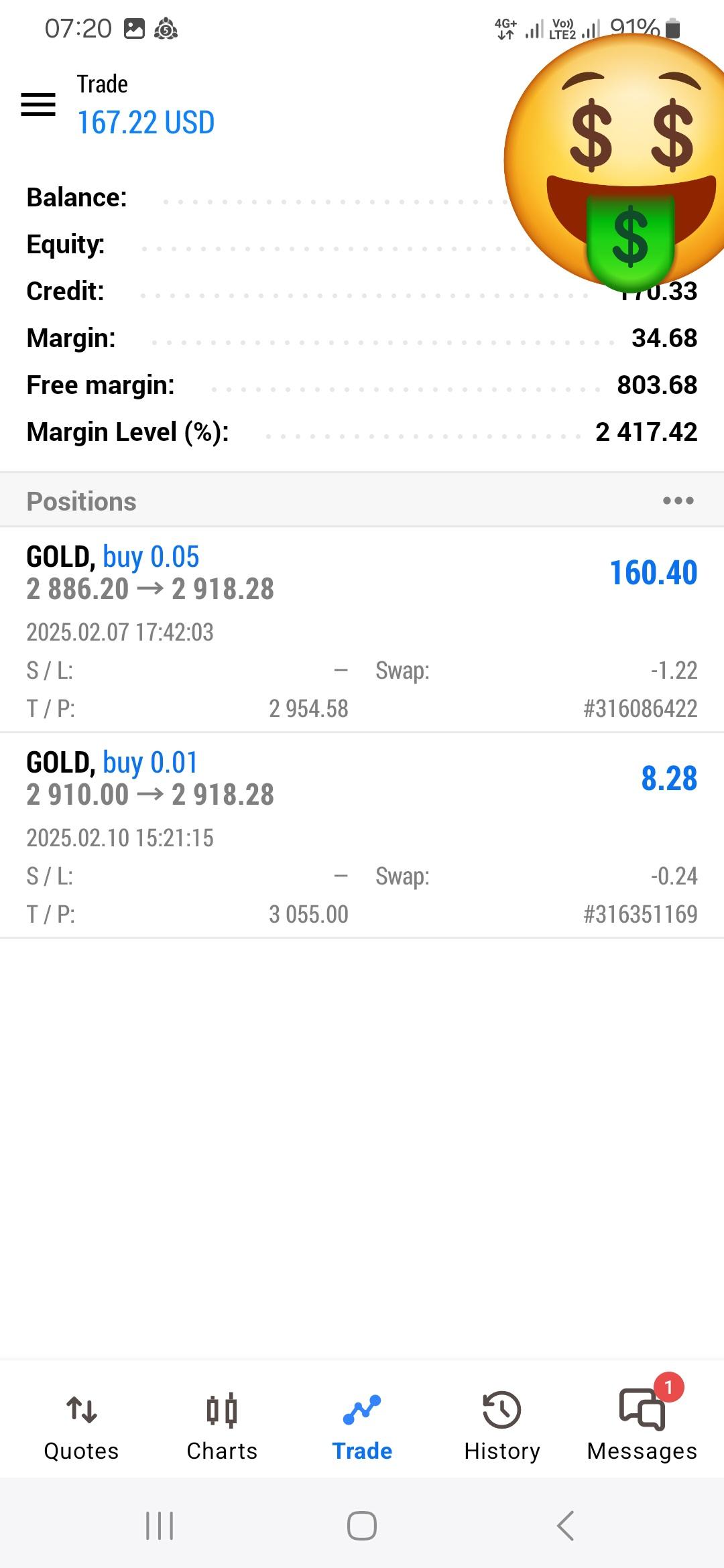

tell gold to hit my tp I want more money 💰 🤑 💸

tell gold to hit my tp I want more money 💰 🤑 💸